Options 101

"Implied volatility is opportunity—not risk."

It’s time to dive into the basic understanding of options. You probably heard Michael Saylor saying that volatility is vitality. Volatility is also a fundamental part of pricing options. This letter is intended to provide a comprehensive introduction into trading options. To make it easier to grasp, we will use real world examples and even implement our own targets to provide fictional trade on paper that we can track over time. Please be aware that this is not financial advice, but for educational purposes only.

Stop treating bitcoin like any other asset. It’s time to build a long-term strategy and declare your financial independence. Unchained’s Financial Freedom Bundle is designed to help serious bitcoin holders secure their future by taking control of their generational wealth.

Request the bundle to get:

A premium bitcoin coffee table book, Foundations

A digital copy of our 2025 hardware wallet guide

An invite to an exclusive July macro strategy session with Tuur Demeester

First 100 to request a bundle receive a physical copy of Foundations.

The Financial Freedom Report is a weekly newsletter from the Human Rights Foundation (HRF) that tracks how authoritarian regimes weaponize money to control their populations and suppress dissent. It also spotlights how freedom technologies like Bitcoin are helping everyday people reclaim their financial independence and freedom.

A one-of-a-kind newsletter connecting the dots between financial repression, geopolitics, and emerging tech.

Smart macro analysts don’t just watch the Fed. They watch the world.

Blockstream Jade Plus is the easiest, most secure way to protect your Bitcoin—perfect for beginners and pros alike. With a sleek design, simple setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes.

Seamlessly pair with the Blockstream app on mobile or desktop for smooth onboarding. As your stack grows, Jade Plus grows with you—unlock features like the air-gapped JadeLink Storage Device or QR Mode for cable-free transactions using the built-in camera.

Want more security? Jade Plus supports multisig wallets with apps like Blockstream, Electrum, Sparrow, and Specter.

Protect your Bitcoin, sleep better, stack harder. Use code: TBL for 10% off.

Optionality

The most important part to understand about option trading is that it’s about probabilities. The future is uncertain in markets. Options are financial instruments to own optionality or to provide optionality to others. And as you probably know, there’s no such thing as a free lunch. So if you want to own optionality you have to pay for it. And you’re paying to the one providing you that optionality.

What do we mean with optionality? It’s the right to buy or sell an asset at a certain price at a certain time. We’ll repeat this sentence more often throughout this letter, because this is the essence of options trading.

Let’s define key concepts:

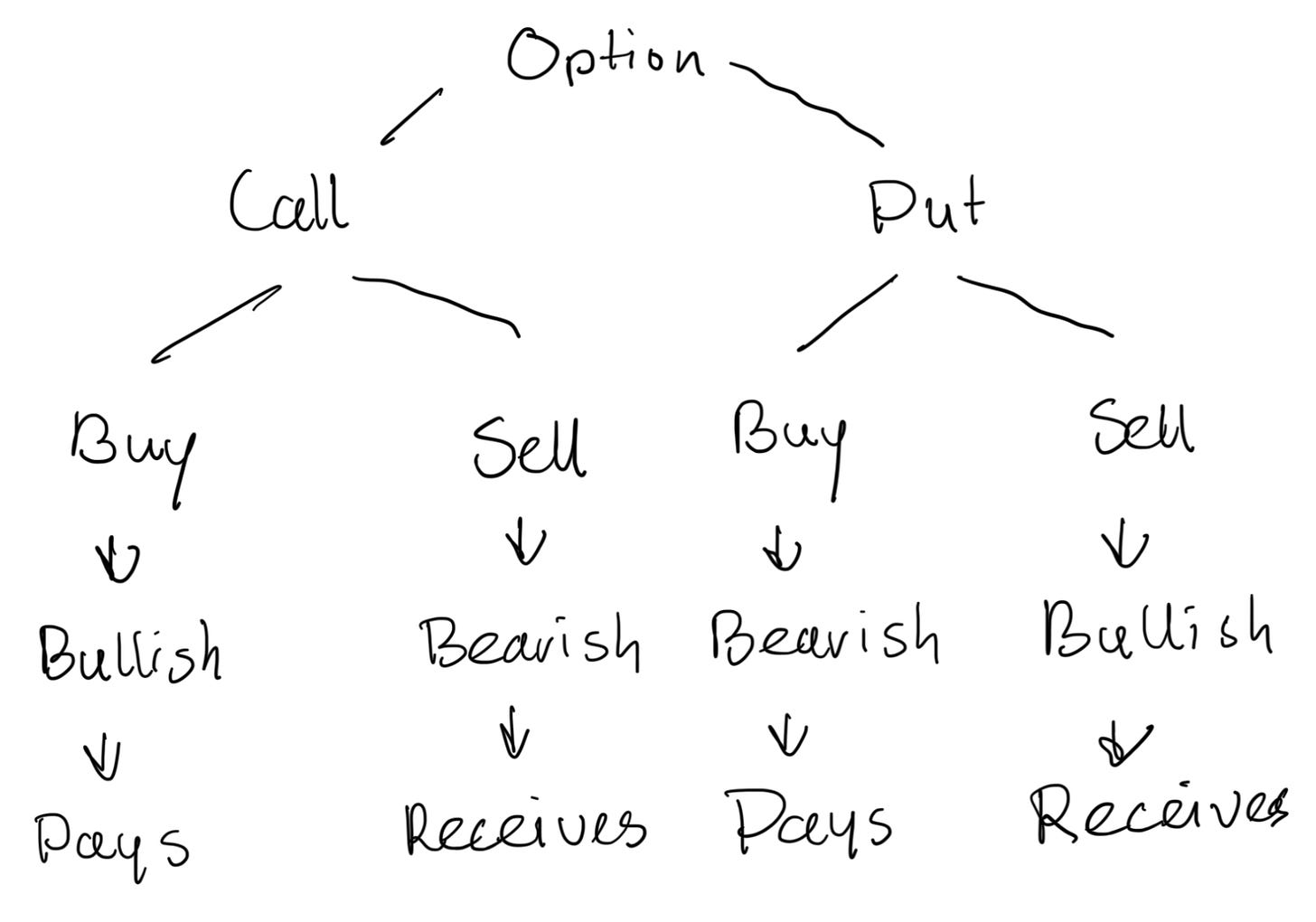

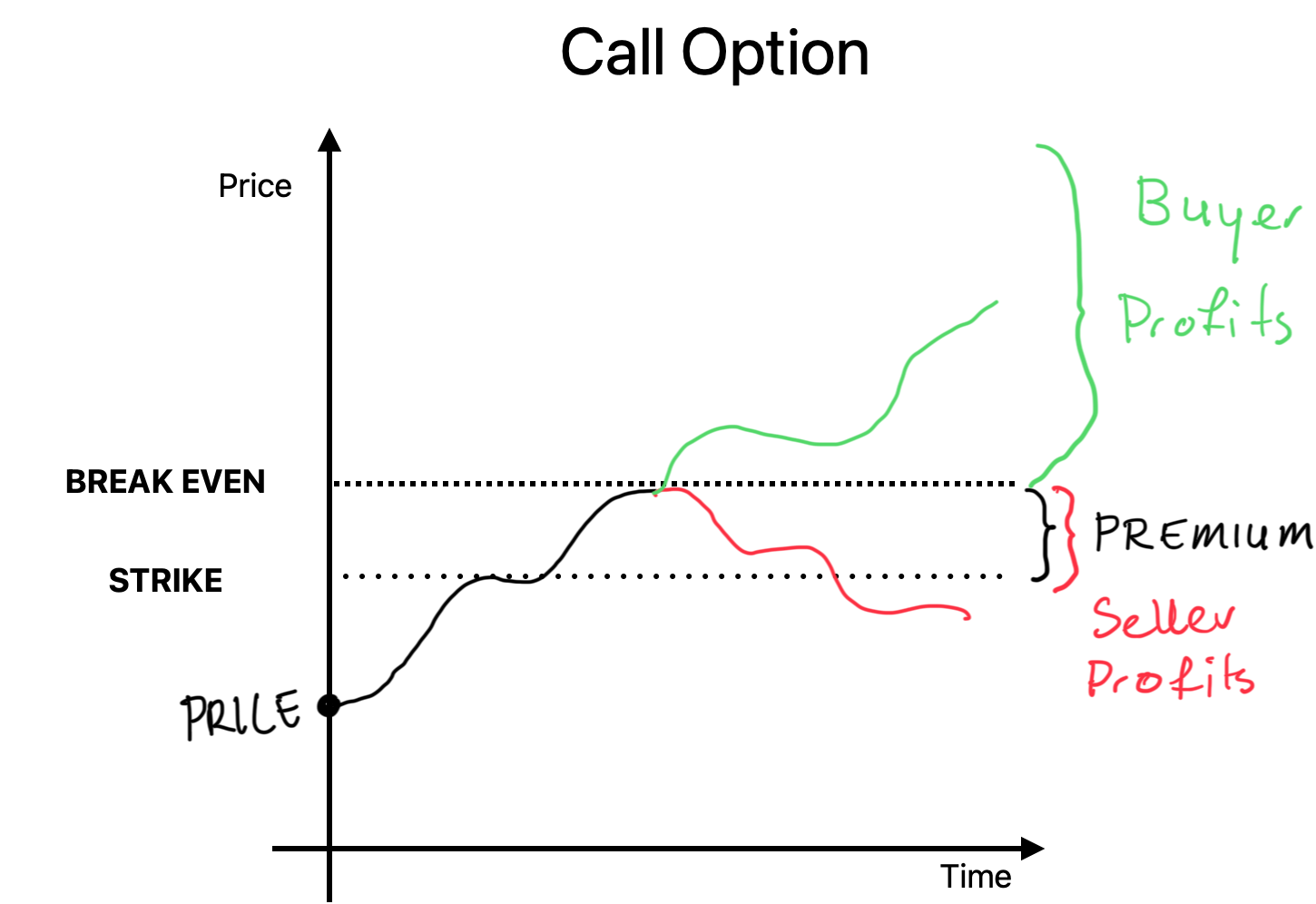

Call Option: A buyer of a call option, owns the right to buy bitcoin at the strike price on expiry. For this right, the buyer pays a premium to the seller. The seller has an obligation to sell the asset to the buyer at the strike price on expiry. The seller receives the premium from the buyer in exchange for that obligation.

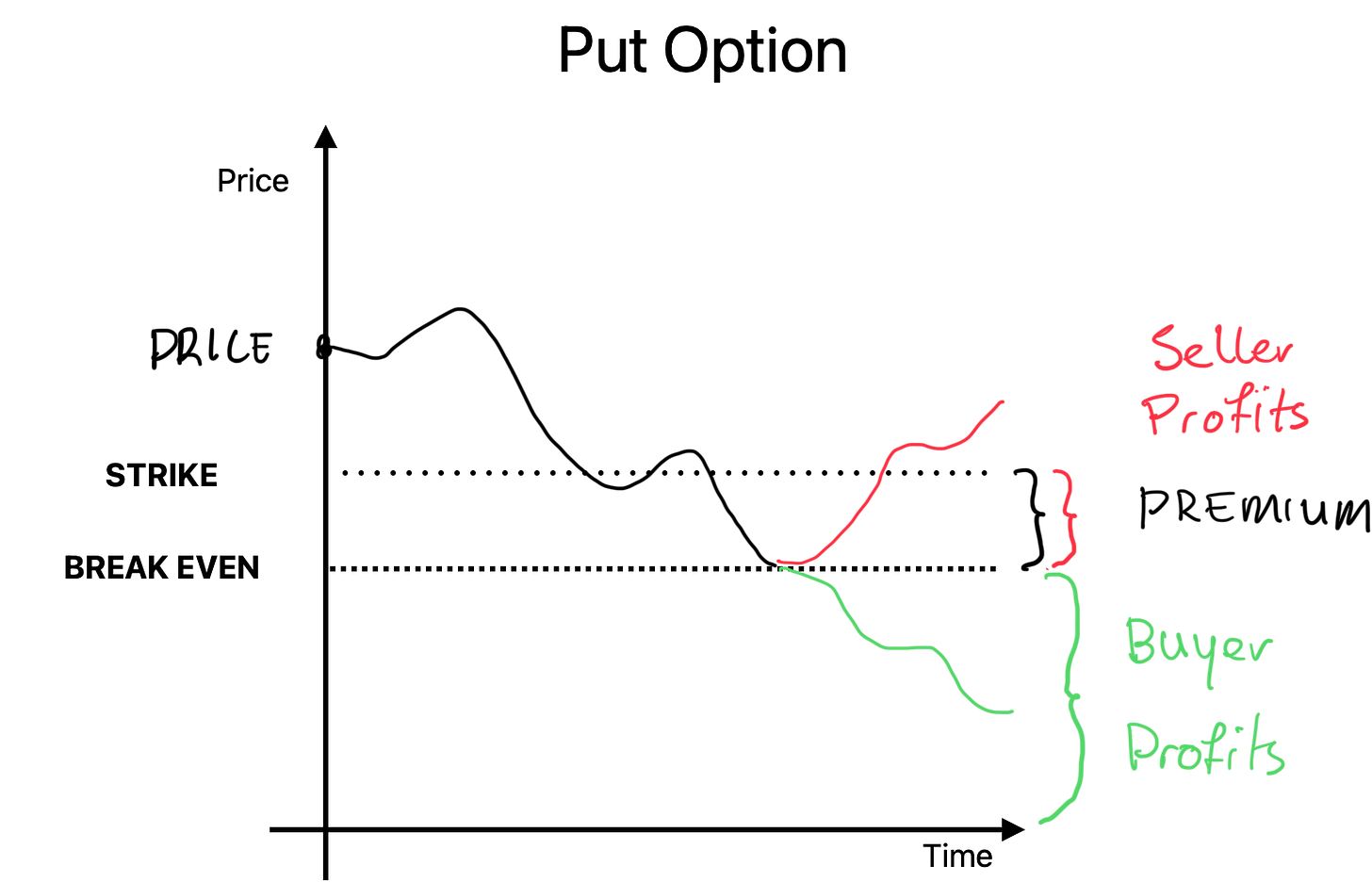

Put Option: A buyer of a put option, owns the right to sell bitcoin at the strike price on expiry. For this right, the buyer pays a premium to the seller. The seller has an obligation to buy the asset from the buyer at the strike price on expiry. The seller receives the premium from the buyer in exchange for that obligation.

Call option

Basically, if somebody buys a call option, he expects bitcoin to increase in price significantly before expiration. We use the word significantly on purpose, because it has a statistical implication. That means that most of the time the price of bitcoin won’t increase that much, but sometimes it does. And if you buy a call you’re expecting that this uncommon rise in price will happen during the remaining days until expiration. People selling the call are willing to take that bet in exchange for a premium as compensation for the risk involved.

The risk for selling a call option is in theory unlimited. The price of bitcoin could rise, in theory, from $100,000 towards $500,000 in only a few months. If you’ve sold a call with a strike price of $100,000 and it’s exercised by the buyer of the call at $500,000, you’re on the hook for $400,000. That is a big risk, but also has a very small chance of happening. And that’s exactly what option trading is all about, probabilities.

And this is also where strategies come into play. The seller of the call option could have covered that risk with buying the underlying asset. Because what happens if this scenario with very low probability actually does happen, the appreciation of the asset covers the dollar amount of his obligation. He has to sell 1 bitcoin at $100,000. If you don’t have that bitcoin, you better have enough cash laying around. But if you do have 1 bitcoin, it won’t be the best trade he ever did, but he does have the money to meet his obligations. This strategy covers the risk of the seller, hence the name “Covered Call”.

Put option

The same goes for a put option. The buyer of the put option expects a probable price correction and wants to hedge against downside risk — or outright profit from the depreciation of the asset. The buyer has the right, but not the obligation, to sell the asset at the strike price.

If he buys a put with a strike price of $100,000 and the price of bitcoin drops to $60,000, he has the right to sell bitcoin to the seller of the put at $100,000 — and can then buy back bitcoin at the market price of $60,000. That gives him a revenue of $40,000. However, he did pay a premium for this right, so that amount needs to be deducted from the revenue, along with any trading fees. Still, it gives him a nice profit at the bottom line.

Put options can also provide countless strategies, used alone or in combination with call options. For example, Metaplanet is raising cash and selling put options at a lower price than the current market level. The reason they do this is because they expect the market to pull back a bit. In this case, they collect premiums as long as their strike price hasn’t been reached yet. And when their strike prices eventually are met, they need to buy the bitcoin — which was their intention in the first place.

The risk is that bitcoin doesn’t pull back and instead rips higher, leaving Metaplanet unable to add more bitcoin to their balance sheet. But when selling puts, they need to make sure they have the cash available for when bitcoin does go down and the right they’ve sold gets exercised. If you have the full amount of cash to cover your obligations, you’re managing the entire risk. This strategy is called selling “cash-secured puts.”

Option Valuation

As an investor, you need to come up with your own expectations of the market. What do you think is most likely to happen? And in which timeframe will this occur? Options are instruments that can help you optimize your positioning for what you think is about to happen.

But you also need to take into consideration that premiums can be relatively cheap or relatively expensive. So let’s first explore what determines the value of an option — and thus, where the premium is at.

An option’s value is the result of a mathematical model that weighs multiple market variables. The most widely used model, especially for European-style options, is the Black-Scholes model, which calculates the option’s fair value based on several key inputs.

The most obvious determinant is the difference between the strike price and the associated future price of the underlying asset.

Implied volatility (IV) is another major driver — higher IV means a greater expected range of movement, which increases the potential for the option to end up in the money.

Beyond that, the time to expiration plays a big role: the more time an option has, the more opportunity it has to become profitable, and therefore, the more valuable it is.

Lastly, factors like interest rates can also impact value, especially in longer-dated options. Understanding how these elements interact gives traders a much clearer view of whether an option is overpriced, underpriced, or fairly valued.

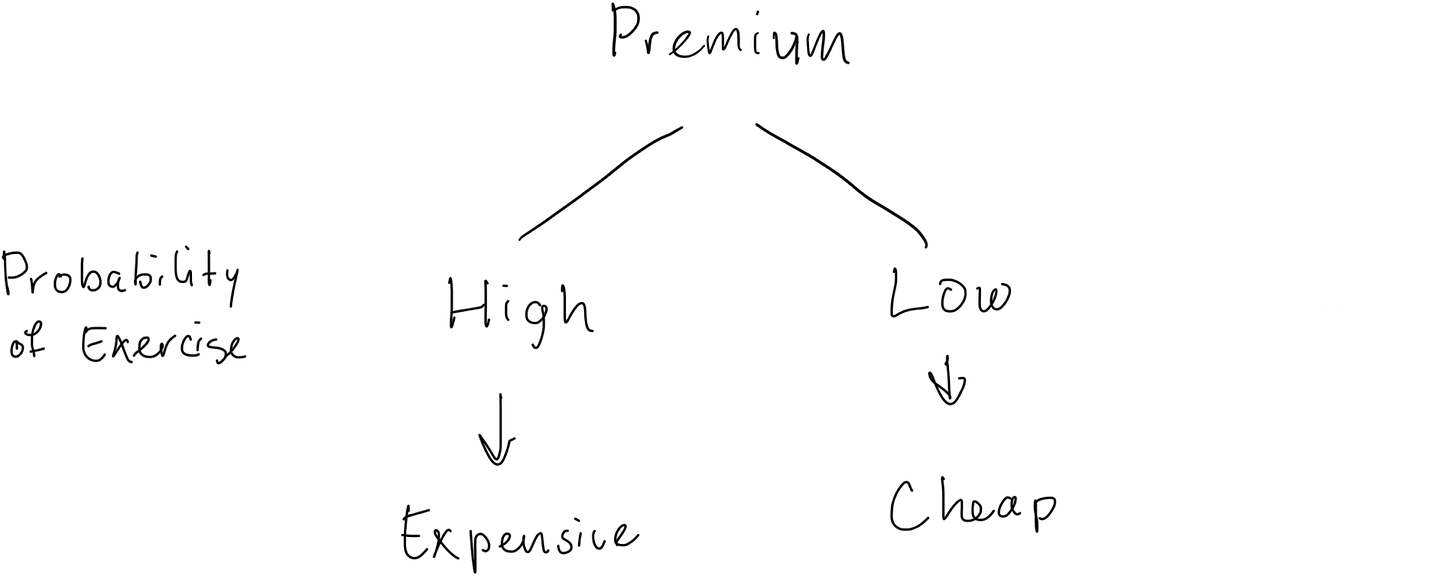

While these are the components that determine an option’s value and the associated premium, the most important takeaway is this: the premium is determined by the probability that the option will be exercised.

Know your Greeks

These components are expressed using Greek letters. The “Greeks” come down to clarity, tradition, and mathematical convention.