Personal Savings Almost Drained & Small Banks' Future Is Uncertain: TBL Weekly #73

In just 3 short months, we'll see how resilient the US really is.

Welcome to TBL Weekly #73—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good morning everybody, happy Saturday.

Our headline in today’s Saturday morning newsletter isn’t meant to spark fear or feign sensationalism—we’re just using cycles as our guide and taking these two pieces of data for what they are.

In case you missed our Tuesday piece on bitcoin’s sublime setup heading into next spring, go check that out as it is a prequel of sorts to what we’re analyzing today. The flip side to bitcoin’s tailwinds—illiquid supply and ETF approvals—is the macro backdrop; specifically, the cushion of excess savings and emergency lending that has kept consumers and banks alive comes to an end at the same time these bitcoin tailwinds reach their zenith: the end of Q1 next year.

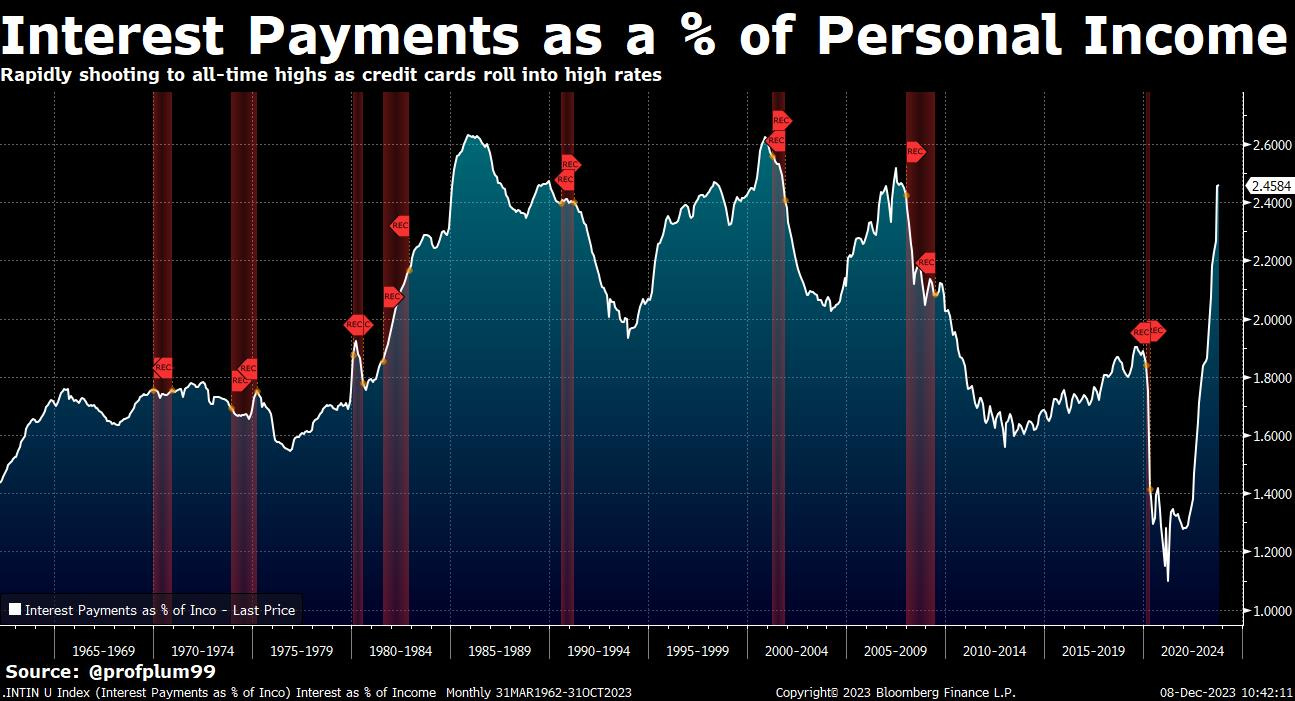

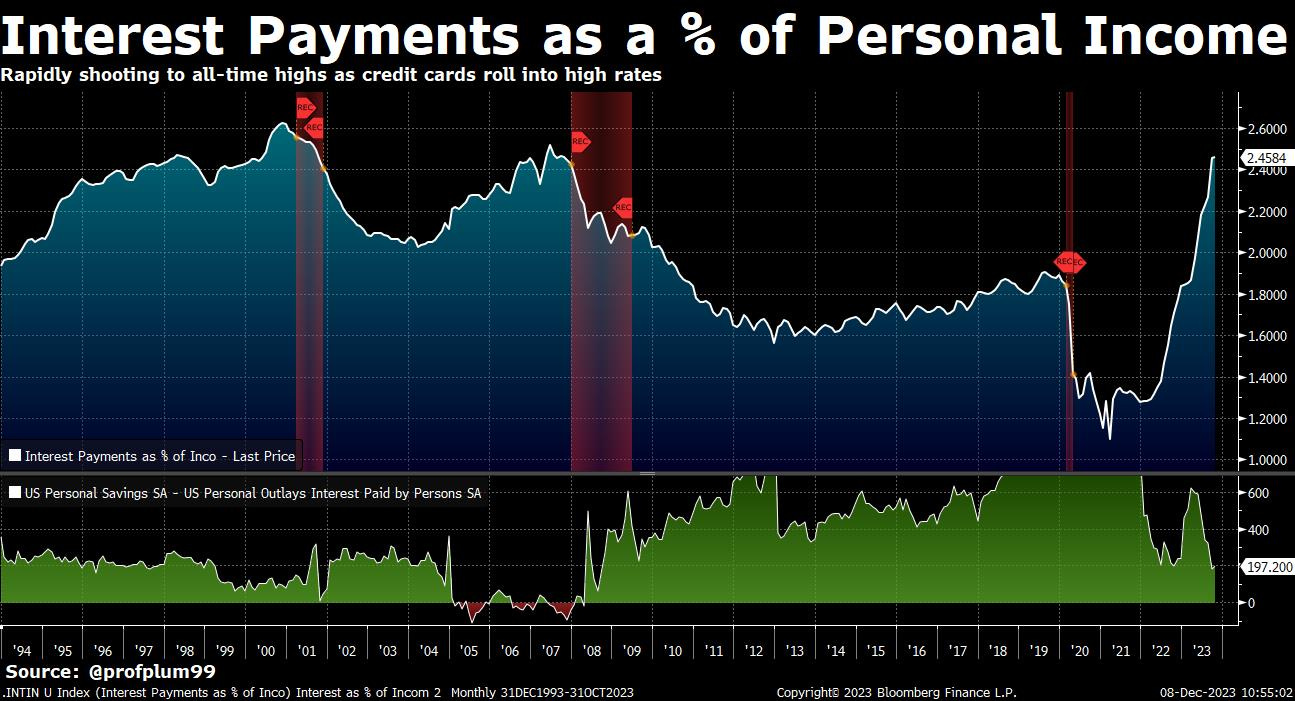

Personal interest payments as a percentage of personal income have rocketed from all-time lows to nearly all-time highs in just two years, as credit cards roll off of teaser rates and new mortgages are written anchored to much higher rates. Note the velocity of this move compared to every other move throughout history: it is staggering how quickly interest payments have usurped personal income for US consumers this cycle—from 1.1% in late 2020 to 2.4% today:

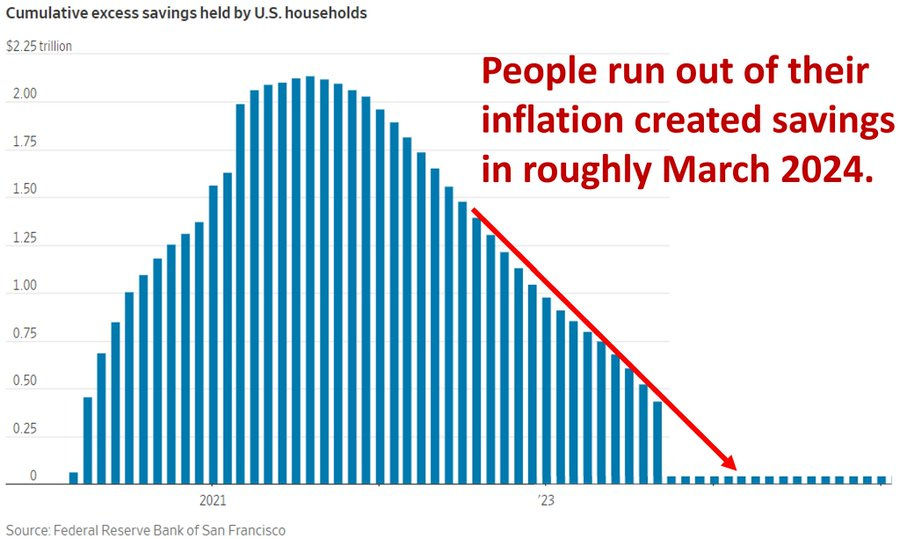

People are tapping into their excess savings, gained from fiscal stimulus and asset price inflation, to cope with rising prices interest payments on revolving and non-revolving loans. At this rate, excess savings are slated to run out by next March:

The personal-savings cushion relative to interest payments has deflated from $600+ billion to $197 billion in just 9 months and will be depleted in another 3; interest payments will overtake personal savings at that point. This also happened prior to the 2008 financial crisis.

Come March, we get to see how resilient the US consumer really is:

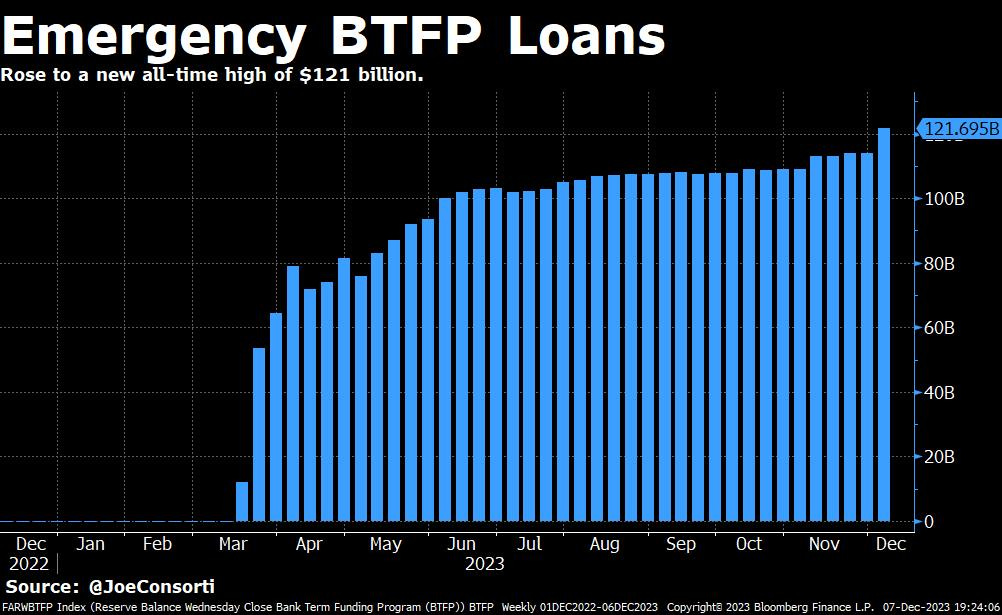

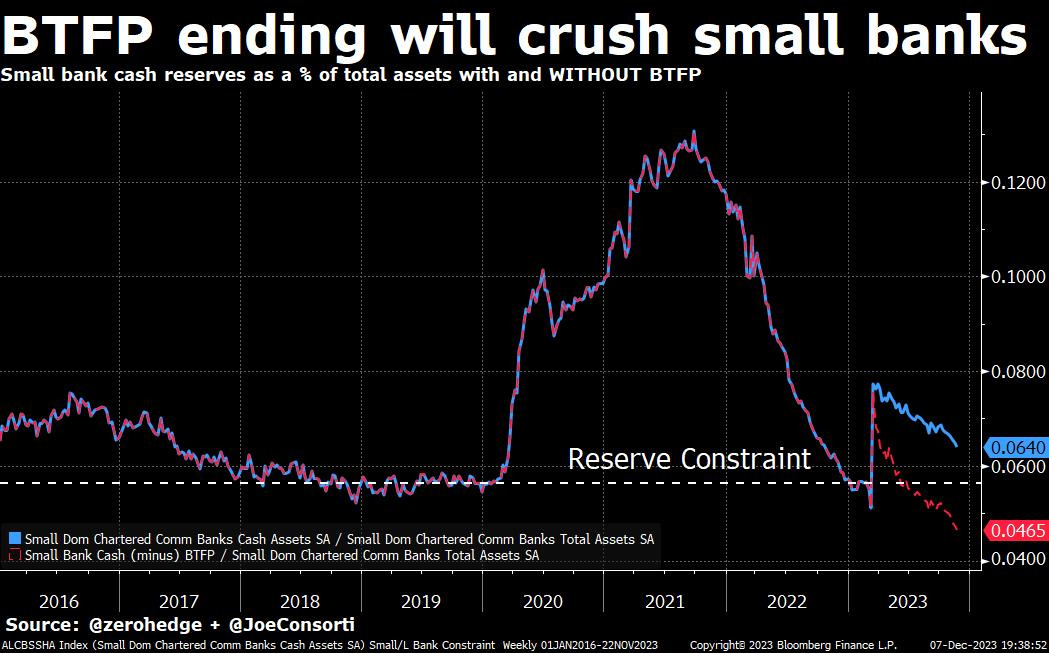

Emergency loans from the Fed's BTFP facility rose by $9 billion this week to a total of $121.69 billion in outstanding loans.

BTFP is set to expire in almost exactly 3 months; odds are, given how reliant small banks' cash reserves are on it, this temporary facility created by the Fed becomes permanent:

This probable move to make BTFP a permanent landing fixture will (for most banks) eliminate the left tail risk of a fire sale in the US Treasury market. In the event of a sharp spike in yields and devaluation of banks' bond holdings, they can recoup them at the Fed instead of selling.

More importantly, the likelihood of BTFP becoming permanent brings a sobering reality about globalism and monetary alchemy: the Fed cannot allow a prolonged recession to occur due to bank failures because it would make the US less desirable on the world stage for new capital allocators. Thus, it has and will continue to engineer facilities that stave off the failure of financial institutions, while allowing the bubble of toxic capital misallocation to build.

If BTFP is allowed to expire on March 11, 2024, small banks go under as loans from the facility are called in, pushing small banks’ reserves below their constraint level that has caused cash shortages and failures in 2019 and 2022:

The Fed had to reverse course and infuse the banks with liquidity both times.

Does that mean lending will never slow, even in the face of high rates and bad borrowers? If US Treasury losses can be written off and restored to full value, who’s to say that the Fed won’t make the same facility for bad consumer and business credit given that it accomplishes the same goal: no prolonged recession?

Outcome? Prolonged credit cycles, forever. A more rip-roaring boom and more devastating bust, each time with more price inflation that outpaces wages and leaves people destitute while the unelected elite in the Eccles Building throw wine parties.

Continuing to go down this path of delaying and preventing financial institutions from failing to stave off recession fundamentally changes the dynamics of markets because it fully eliminates the right tail risk of too much monetary tightening. If there’s no deflationary impulse, there’s no price discovery, and the party rages forever. The coffers are pillaged and the citizenry is left wondering where their livelihood went.

Do you want to go down that path? We certainly do not. Your solutions are to wait and pray the US returns to monetary and fiscal austerity, or to recognize the end of the game that’s being played and insulate yourself from it with productive capital and scarce assets.

Next Week

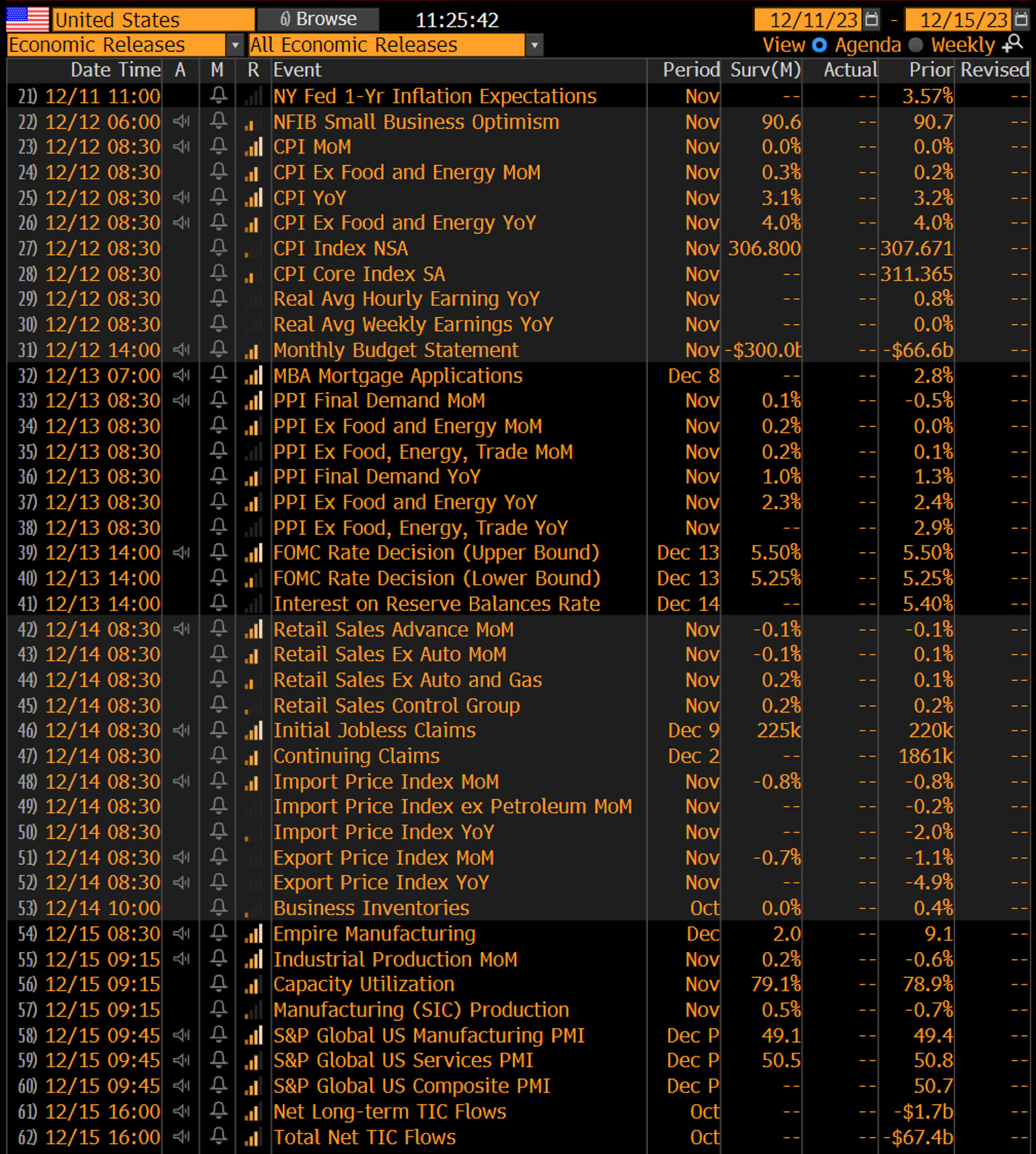

In the week ahead, we look to CPI on Tuesday which is expected to remain flat month-over-month, accompanied by a steadily decelerating yearly growth rate from 3.2% to 3.1%, though a downside surprise would not be out of the ordinary considering the derisking impulse as Treasuries rally. Wednesday brings our final FOMC rate decision of the year—we’ll be most interested to hear if Powell is really excited to keep mentioning rate hikes while his face is unable to hide that rate cuts are next. No doubt, he’ll try to deliver hawkish language, especially with stocks at their highs for the year. Will Powell’s tie be Christmas-themed?

Next week will also be a large Treasury issuance week—we’ll watch how the duration dump impacts risk assets.

Retail sales are expected to decline marginally this month, and we’ll see how accurate that is come Thursday, with the trio of Empire Manufacturing, Industrial Production, and the S&P PMI survey prelim for December on Friday to further elucidate us as to the pace of the economic slowdown:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, we are joined by Lyn Alden, founder of Lyn Alden Investment Strategy. In a sweeping discussion of bitcoin and global macroeconomics, Lyn walks us through why bitcoin is a solution to the monetary problems of the day. She explains her bitcoin thesis, why it has moved to the center of her framework, fiscal dominance in the US, the Fed's balance sheet, and much more.

Check out—Bitcoin Fixes Broken Money with Lyn Alden

Tuesday

Bitcoin is up 57% over the past two months since rumors of imminent spot bitcoin ETF approval began swirling. Up 172% from its cycle bottom this time last year, it crossed $42,000 on Sunday in a dominant move that feels like we never left these levels in the first place.

Check out—Bitcoin Never Left

Thursday

There are times for research, and then there are times for bold predictions. As we are neither a trading service nor a prediction engine, staying away from sweeping claims is our preferred modus operandi. Regular readers are also familiar that I never hold back from calling out certain shifts in the market. With the Fed pause now about to stretch over half a year, Fed cuts are coming much sooner, and much more sneakily, than most realize. Let’s do some forecasting.

Check out—ECB cuts by March, Fed by June

Friday

In this episode, Nik provides us with a global markets update, including a discussion about bitcoin's recent move above $40,000. He covers falling yields, rate cuts coming from the ECB and Fed in 2024, falling RRP, and a deep dive into various definitions for the word 'liquidity.' Finally, Nik looks at bitcoin's price action and some on-chain valuation metrics.

Check out—Understanding Liquidity & Bitcoin Bull Markets

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.