Prices Never Fall

Dismantling the United States' Inflation-Propaganda Complex

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

"The problem isn't inflation. It's prices."

The title of this Vox article is deliberately misleading and confusing to the average reader, as inflation usually refers to the rate of change in prices.

Journalists, economists, and the sitting President of the United States use this and other intentional misnomers like the ever-popular "inflation is falling" to fool uninvolved Americans that prices are normalizing leading into an election year.

Why do they do this?

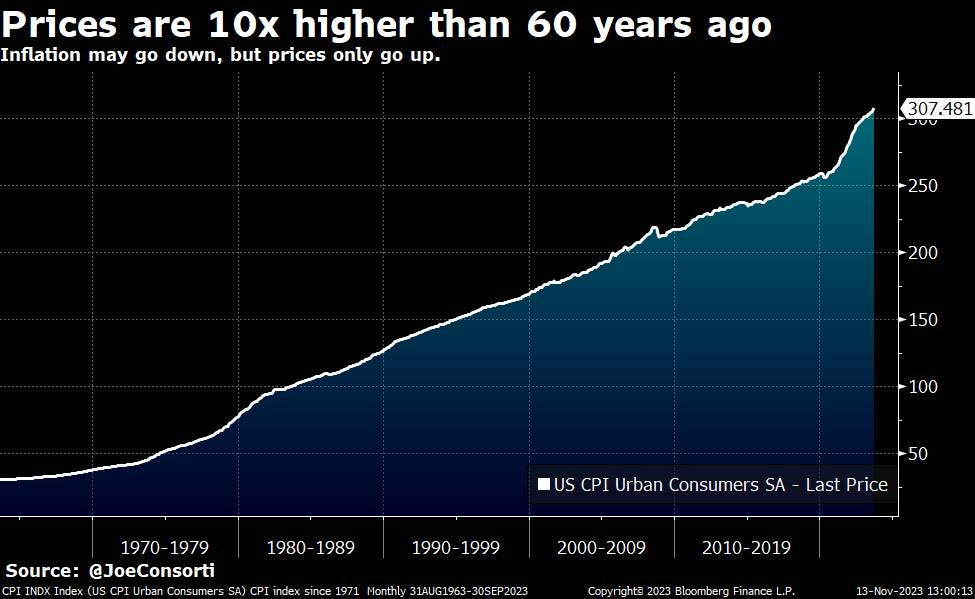

It’s simple: prices never fall.

First, let's unpack modern economists' disingenuous reasons for why they believe price inflation is necessary.

Modern economics as taught in the West is usually from the Keynesian School, which posits that "aggregate demand" is at the center of economic well-being, and that "aggregate demand" can be stimulated by a steady rate of money printing and the resulting price increases.

The gist of their thinking is: more dollars printed → more spending → more "aggregate demand" → more production to meet that demand.

Except, this presupposes that people only buy things in anticipation of them becoming more expensive. When's the last time you heard of a single mother holding off on feeding her kids until the cost of baby formula went down? You've never heard of that happening, because it doesn't happen. Maybe the mother waits for a sale to buy more baby formula than she usually does, or stocks up when she has a coupon, but she's not going to stop feeding her kids in anticipation that food prices will fall.

The reality is that falling prices don't deter people from buying things, but the economists who run the country believe that if not for the price of baby formula compounding at 2% per annum, babies simply would not eat.

They essentially jeer at you with condescension and say "Prices rising in perpetuity is good for you, actually" as you can barely make ends meet for your family of four at your dual full-time jobs.

Now, let's dig into why the propaganda machine from the US government, intelligence, and media complex has shifted into hyperdrive to mislead you about price inflation. There are 2 reasons:

1) Convincing the American populace that prices "just naturally" rise by 2%+ per annum keeps them from coming after every representative in Washington.

2) Financial repression is accelerating, in the form of perpetual price inflation allowing the US government to diminish the value of its debt by passing its cost onto its citizenry.

Let's unpack each.

#1 - Propaganda, Justifying The Fed's Own Existence

The Vox article in question goes on to say that "Deflation probably isn’t in the cards (and the rub is we don’t want it to be)" — when she says "we" she means the Federal Reserve and US Treasury.

Price deflation, wherein the price level decreases across the US economy, would be an absolute Godsend for Americans. The cost of living has persistently risen as quality of life withers due to wages not keeping up—a sustained period of prices falling would be much-needed breathing room for the American people, and be a welcome change in an unending regime of sticker-checking and forced frugality.

But the powers that be will never let it happen.

Why?

The Federal Reserve Bank of the United States' directives are twofold: full employment and stable prices—however, the economy is just as cyclical with or without a central bank.

The Federal Reserve adjusts its policy interest rates up & down, making borrowing more and less expensive, to steer economic activity. The problem is, with a ship as big as the US and by extension the global economy, it can't be effectively "steered" by one entity. Picture a field mouse trying to remotely steer all of the ocean's shipping vessels at once—the vessels would be thrown off course since each has its own needs and direction. This is the net effect that the Fed has on the US and global economy.

They want you to think it's normal and necessary that a devastating recession every 4-6 years is normal, and that prices rising by 2% per annum is a natural, inexplicable phenomenon.

The Fed wants you to believe these things because it justifies its own existence. Its first mandate of 'full employment' would occur cyclically but is accelerated by the Fed's own boom and bust cycle which throws people out of work.

Its second mandate of 'stable prices' can only be achieved by manipulating interest rates for the world's largest capital market, making ‘stable’ a moving target that the Fed uses as self-justification for all its actions—sending prices up and down and up and down and patting themselves on the back when it causes a recession, put people out of work, allowing prices to level off because people cut back on spending.

The Fed makes prices rise so that it can then make them rise slower for a transient time. Never mind that it achieves this by making people lose their jobs, FOMC members then position themselves as heroes, despite creating the problem in the first place.

It's like an arsonist-fireman putting out the fire that he caused.

You'd immediately fire him for creating the very problems he then goes on to solve... unless he had the power of mass media and the information complex to convince you that the blame rests on his faulty water hose and the low-quality wood that greedy wood companies use to build homes. It is in this same way that the American populace blames "billionaires" and "corporations" for price inflation while the Federal Reserve amplifies a boom & bust business cycle which always ends in money printing and consequent price increases.

The best the Fed can do is half-heartedly attempt to conflate inflation (the rate of change of price increases) "falling" with prices falling. Most of the electorate will accept this misnomer without much thought—the reality is more than a half-century of non-stop price increases. Don't be fooled.

Price inflation MUST be viewed by the general populace as a natural phenomenon, or caused by greedy billionaires—otherwise, they'd potentially hold accountable the institution that exists to engineer it: the Federal Reserve Bank of the United States.

#2 - Financial Repression

The propaganda machine is in overdrive right now with "it's actually not that bad" headlines for a larger reason: the US fiscal train is coming off the tracks.

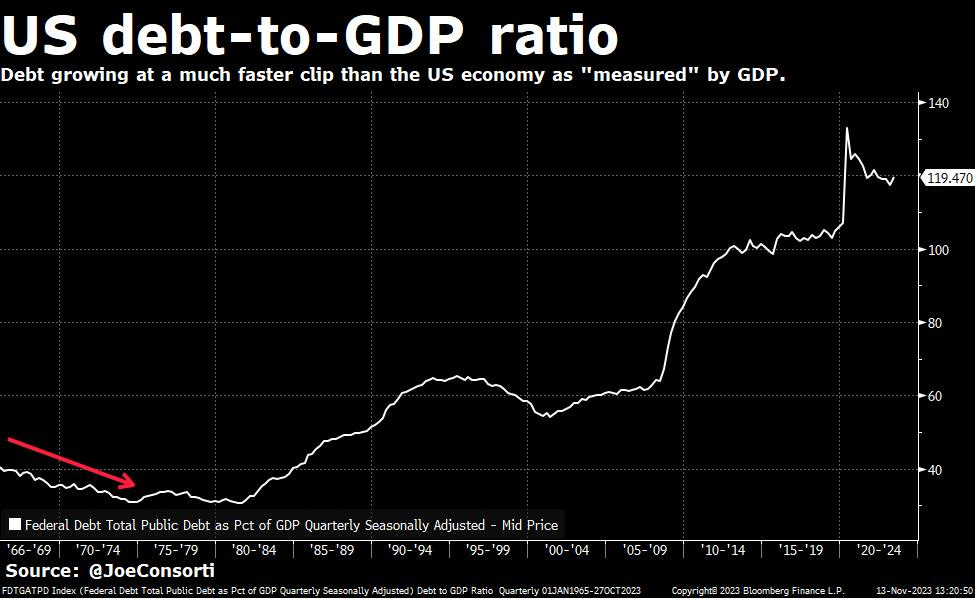

The US has a near all-time high debt-to-GDP ratio of 119% (high was 132%) which is projected to reach 200% by 2050.

The adult way to resolve this would be to cut back on fiscal spending, so productivity growth can catch up to government debt issuance. We are, however, led by bought-and-paid-for politicians, so austerity has never been in the cards because it would affect government contracts, one at a time. Politicians that suggest austerity are never elected, because someone always benefits when money is spent by the government.

The other solution is financial repression. This is what the US government in collaboration with the Treasury and Fed has chosen for more than 50 years now.

Debt growth is seriously outpacing economic growth, and it is increasingly made up of unproductive debt. The Fed's manipulation of interest rates distorts the price of borrowing, often far too low for many cohorts, allowing for unproductive, low-quality borrowing to proliferate.

Our productivity rose faster than debt growth following World War II, as shown by the debt-to-GDP ratio declining—then curiously right when the Federal Reserve detached from the gold standard, debt growth greatly exceeded economic growth.

Detaching money from physical reality when the US de-pegged the dollar from gold is when the show of endless fiscal spending supported by the Federal Reserve's 50-year campaign of artificially lowering interest rates began. And here we are today: the burden has been passed entirely to Americans and other holders of the US dollar.

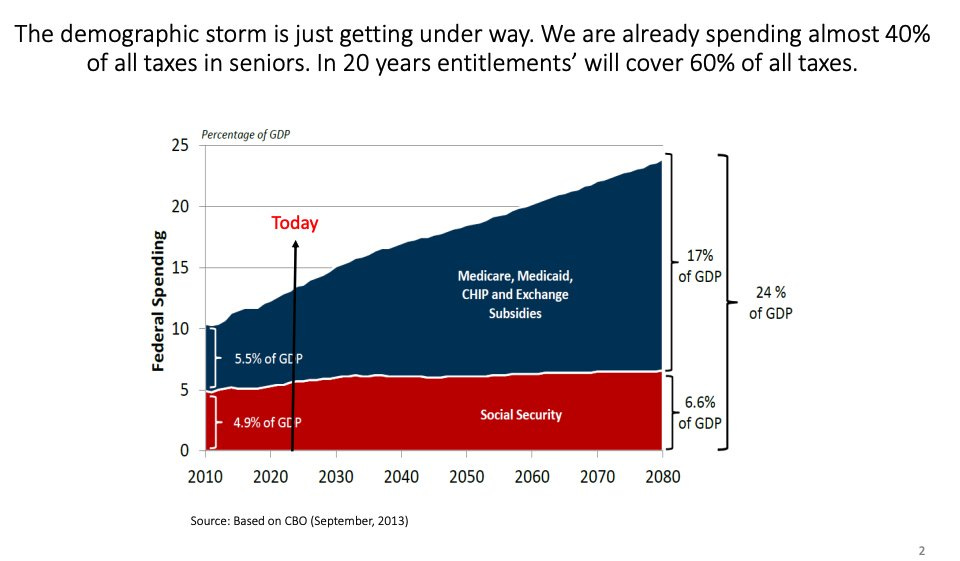

One of the sole societal "benefits" out of this perpetual wealth devaluation that many look forward to is Social Security—but even this hallmark of endless debt issuance and fiscal spending is set to run out by 2034.

New changes have been proposed to "fix" this, like removing the limit on taxable income (not kidding), increasing payroll taxes by 25%, reducing benefits, and lifting the full retirement age.

In other words, the Ponzi scheme is slated to run dry, and not everybody will be able to receive their earnings.

The only people who benefit from the Ponzi scheme are the ones in charge, but the burden of loss continues to be entirely borne by you.

Negative real interest rates are the US government's escape hatch.

Financial repression, in the form of letting price inflation run hotter than nominal interest rates on government debt and perpetual credit expansion, is accelerating to address this problem of rising debt-to-GDP.

Letting inflation run hotter than nominal government bond yields erodes the real value of government debt so the government has an easier time paying it down.

Not only this, but the Fed pinning rates near zero let them borrow at a low rate for over a decade. This will have to be done again soon, considering the US' annual interest expense is slated to pass $1 trillion in Q4 of this year, and will reach $2 trillion in the next decade if rates stay where they are.

Given the magnitude of government debt markets, the Fed also developed another tool inspired by Japan in Quantitative Easing: large-scale asset purchases from banks, giving them a cash transfusion with money created out of thin air to stimulate economic activity.

US politicians and Federal Reserve members have not and will not choose to simply spend less money because it's more difficult, and it won't win them election or re-election. Said differently—the US government is broke so it's mortgaging your livelihood to pay it down, and it won't change any of the spending habits that created this mess in the first place.

Financial repression is their only option.

This is why the propaganda machine is shifting into hyperdrive, such as the Vox article that inspired this post and the remarks from the highest-ranking government officials which echo the same deliberately misleading misnomers.

The mission is to make Americans point the finger at each other instead of pointing it at them.

Americans are pillaged of their wealth and livelihoods in the process and your politicians spend more time vilifying you than they do sympathizing with your plight of their own making.

The Vox article ends with this: "the disorienting nature of what’s happened in the economy over the past few years will likely fade. Post-pandemic prices will eventually feel normal, and post-pandemic wages should make those prices more feasible — or at least not significantly less feasible than they were before. Sooner or later, sticker shock will feel a little less shocking."

This is not normal, it never will be.

The Fed creates the problem it pretends to exist to solve, only to create it again once it has done too much, with the US government rinsing the proverbial blood from its hands by siphoning millions of dollars into media diatribes pointing the fingers at greedy businesses, billionaires, poor people, or all three.

Don't ignore your intuition: it doesn't feel normal for prices to rise in perpetuity because it isn't normal. Don't let the skepticism for your institutions fade like they want it to.

Ignore the propaganda. Prices will never fall. That's by design.

Point the finger at the Fed.

Until next time,

The Bitcoin Layer

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.