PUBLIC: Hidden Leverage Reveals The Gargantuan Size of FX Swap Markets

So it turns out that offshore banks and nonbanks hold ~3x more dollar debt than anybody knew about. You thought FTX were the only ones who played with leverage?

Dear readers,

We’ve long been readers of the research produced by the Bank of International Settlements (BIS). It is considered the central bank of central banks—a coordination mechanism, of sorts. The BIS publishes on topics that illuminate how our monetary system truly works, and it has just landed another serious punch.

It’s been unveiled that a whopping $65 trillion of hidden dollar debt exists at offshore banks and non-banks in the form of FX swaps, a revelation that an already gargantuan market is much larger than was previously known.

Global dollar shortages put all of that unearthed leverage at risk. Is it what Dr. Powell ordered?

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself.

Create a node in less than 2 minutes, just visit voltage.cloud

Today’s Topics

Offshore banks are stuffed to the gills with more US dollar leverage than expected.

As contracts mature on a <1-week basis, the risk of sudden funding shortfalls arises.

Who you gonna call? The lender of only resort.

Offshore banks stuffed to the gills with more US dollar leverage than expected

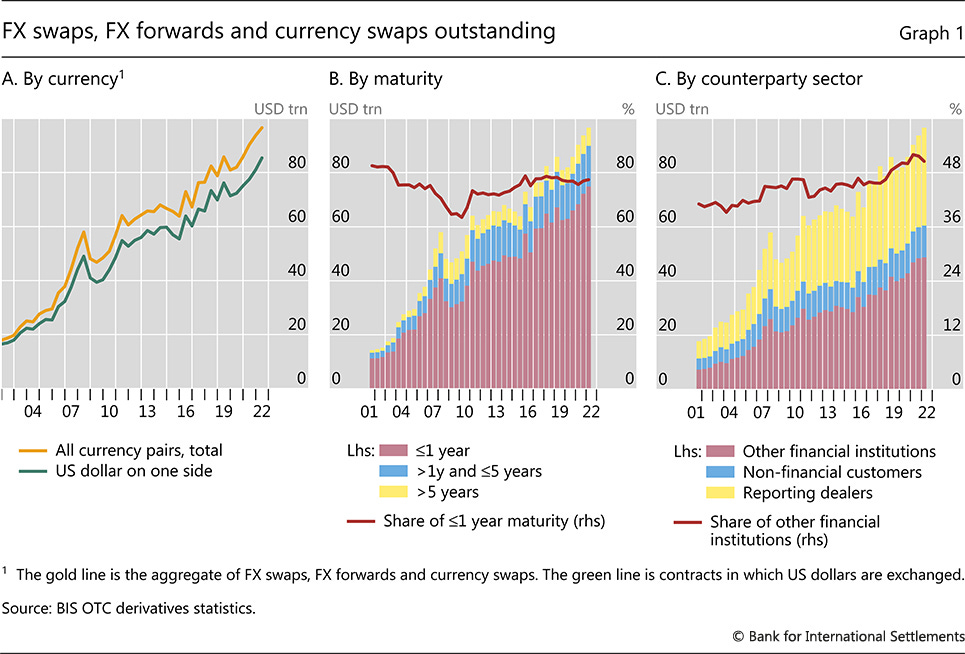

A report released by the BIS, Dollar debt in FX swaps and forwards: huge, missing and growing, unveiled a large and growing amount of off-balance sheet debt in the FX swap market, one of the deepest and most liquid markets for short-term dollar funding in the world.

There are two primary types of secured money markets:

Overnight Repurchase Agreements (Repo) - a Treasury-collateralized overnight borrowing market

FX Swap Market - a currency-collateralized borrowing market; participants here usually borrow dollars and post their home currency as collateral

FX swaps are derivatives used by banks and non-bank financial firms for short-term funding and hedging their portfolio’s FX risk on a rolling basis.

Most FX swaps have the US dollar on one side and have very short maturities; this makes FX swaps vulnerable to dollar funding squeezes. We saw this in 2008 and 2020 when market fear and a dollar shortage led to money markets seizing up. The Fed ultimately stepped in with liquidity facilities to get global borrowing flowing again.

Banks are no strangers to using derivatives well in excess of their assets. Take a look at the notional amounts of derivatives contracts that are ~10x the size of assets held at the top 25 commercial banks:

A significant amount of derivatives activity in dollars occurs offshore, off-balance sheet, and unreported, making it difficult to calculate the scale and location of debt in the system.

That’s the fly in the ointment detailed in the BIS report: significant amounts of unreported leverage in the FX swaps market. Banks and non-banks outside the US hold ~$65 trillion of dollar debt off-balance sheet, more than triple the $20 trillion reported on their balance sheets. Much more off-balance sheet liabilities than previously estimated:

In other words: banks and non-banks outside of the US have layers of hidden debt, unseen by standard debt statistics. The FX swap market was presumed to be gargantuan, but this new estimate that includes previously undocumented leverage means the notional size of these derivatives is much larger than initially thought. The dark and scattered nature of this debt makes it tough to anticipate the scale of dollar funding needs, making it near-impossible for the Fed to model for sudden dysfunction in these markets.

This is a funding issue for banks and non-bank financial firms

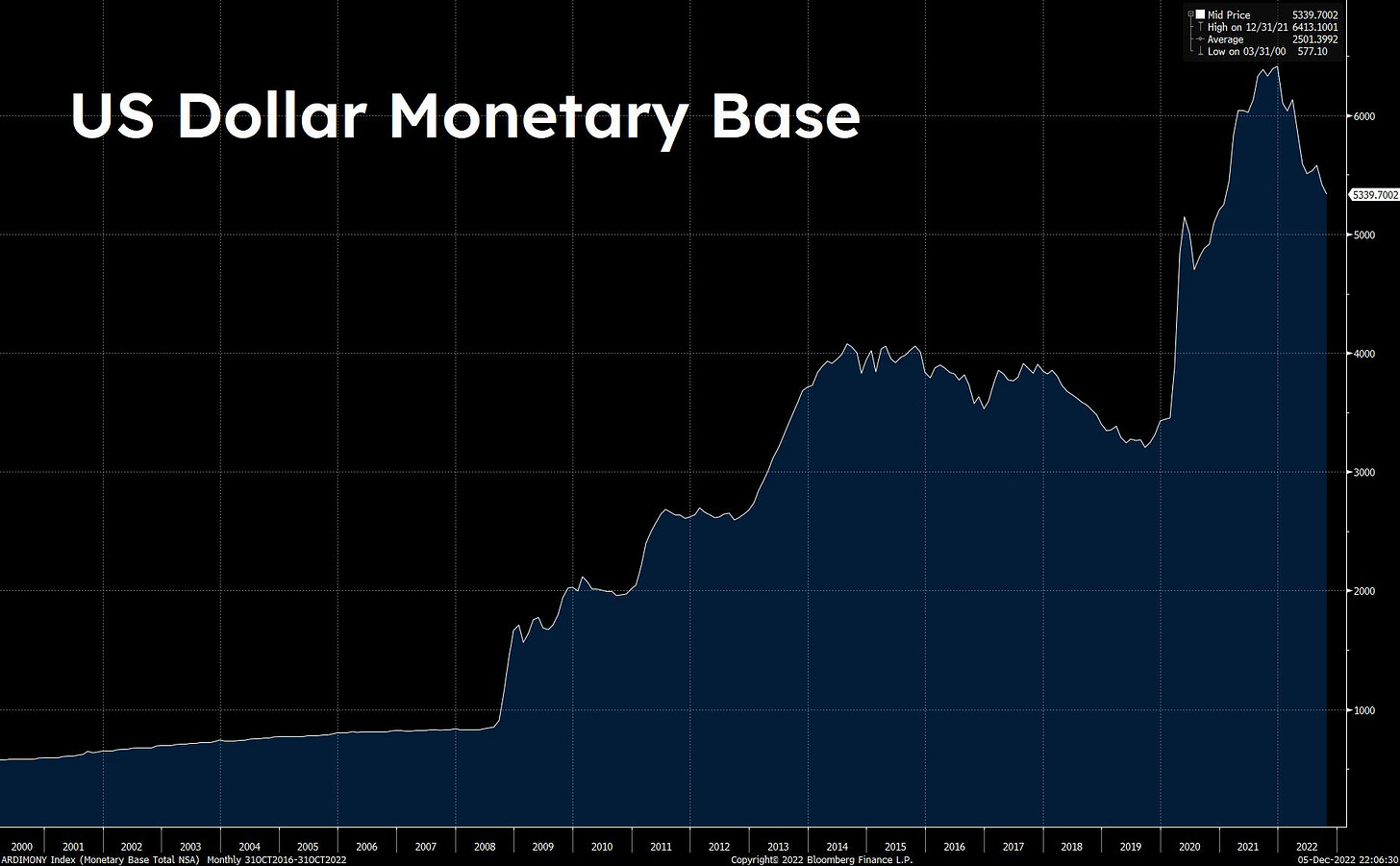

As the Fed tightens policy and pushes short-term dollar rates higher, funding stress will emerge in the larger-than-presumed FX swaps market for banks and non-banks that use it for funding and hedging purposes. The global dollar supply is contracting while the amount of capital in FX swaps looms:

The short maturity of the standard FX swap leaves financial institutions vulnerable to dollar funding squeezes. As contracts mature on a short-term basis, usually overnight or in less than one week, this leaves the market exposed to sudden funding shortfalls—in a rising rate environment, the risk of these shortfalls should rise as well.

In the middle graph below, note how FX swaps and forwards maturing within one year accounted for ~80% of outstanding FX swaps in June 2022, but the paper states that almost all of that matures in one week or less:

During 2008 and 2020, dollar borrowers were forced to pay exceedingly high rates, if they could borrow at all. This financial plumbing became clogged, and the Fed stepped in to backstop these dollar obligations with little or no knowledge about who owed the debt—it did so largely via central bank FX swap lines, in which the Fed lends to the ECB, for example, so that the ECB can lend money to BNP Paribas and Deutsche Bank, for example.

Is a deleveraging in FX swaps what Powell wants? Who knows how he operates his chessboard, but aggressively tightening at a time when banks are bloated with derivatives might lead to unintended collateral damage:

For now, this is a potential funding issue on the horizon and nothing more. FX swaps are a liquid and actively traded money market that provide critical overnight funding and hedging for financial institutions; there is more leverage in the system than previously estimated, but nothing screams “imminent illiquidity” given the size and activity of this market. That said, the FX swap market was a flashpoint in 2008 and again in 2020. If the Fed’s not careful with its aggressive stance in the face of record-high debt loads, the FX swap market may be a negative catalyst again in 2023.

If the going gets rough, the Fed is the global lender of last resort

The Fed is aware of dollar debt globally—the size and rate at which it can be serviced are taken into account as it plans its policy. The Fed may be aware of hidden offshore dollar debt, but it probably wasn’t aware that off-balance sheet liabilities in the FX swaps market were this size. It may have unknowingly already clogged the flow of this critical dollar financial plumbing more than it thinks it has—ironically, we have no way of knowing until a liquidity crisis occurs.

When it comes to creating new liquidity facilities, the Fed is an expert. It set up swap lines with all major central banks in the aftermath of the 2008 financial crisis, formerly temporary facilities that have now been made a US monetary policy tool:

These swap lines prevent financial plumbing from getting clogged when foreign banks stop lending to one another amidst a desperate need for dollars. It unclogs by providing dollars in exchange for foreign currency collateral—a liquidity injection. It unclogged the world’s financial plumbing (short-term money markets) by flooding it with new dollars and unintentionally cemented itself as the world’s central bank, a lender of only resort, in 2008. Created as temporary facilities more than a decade ago, these swap lines are still chugging along today.

While we’re not at a point when banks halt lending with one another, high amounts of increasingly expensive debt may eventually lead to the Fed being tapped to unclog the money markets once more. The patented Powell Plunger may soon make an appearance:

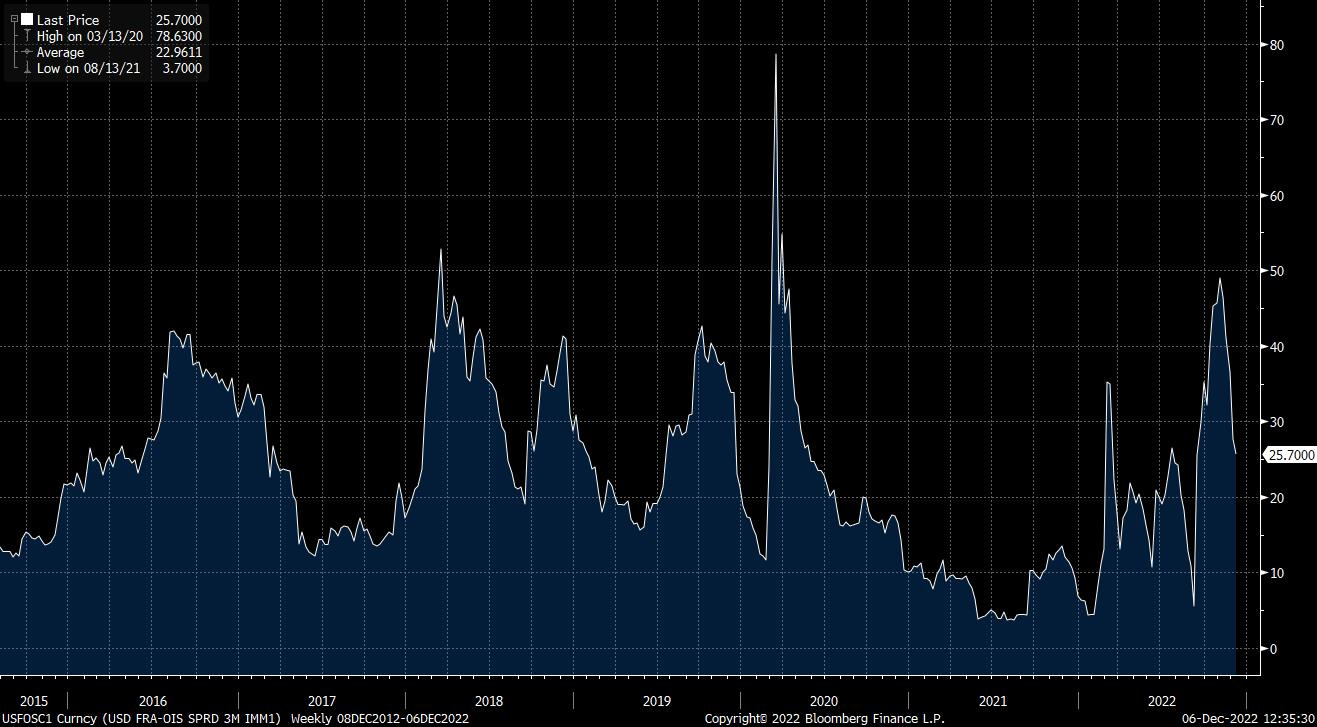

For now, banks and dollar funding are doing alright. Take a look at LIBOR-OIS, a proxy for interbank lending stress—it has come down from its yearly high, indicating lending is flowing smoothly throughout the financial markets:

Another market that we will be more closely monitoring to gauge relative financial tightness is cross-currency basis swaps. The FX swap market is larger and much more opaque than previously thought, so monitoring cross-currency basis swaps to see when these markets are experiencing outsized stress should be a useful tool for our macro framework as we approach the pinnacle of Fed tightening.

No amount of scary headlines will waver the Fed's tightening mission, but a systemically disruptive liquidity squeeze will. While we haven’t experienced one yet, the highly-leveraged and short-dated nature of the FX swaps market can create one suddenly.

Until next time,

Nik & Joe

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud