Question Everything. Learn Something. Answer Nothing. TBL Weekly #163

Dear Readers,

We’d like to believe that we, bitcoiners, pride ourselves on being Mavericks. Not afraid to be the contrarians, willing to play the devil’s advocate on just about anything. Our demographic consists of a wide range of experts: from critical thinkers well-versed in Keynesian and Austrian economic schools of thought, all the way to astrophysicists. You could call us philosophers. We “Question Everything. Learn Something. Answer Nothing.” A quote from Euripides, a Greek Tragedian.

The one thing that binds all bitcoiners together is our understanding of money. Or, better put, our epiphanic realization of our lack of understanding of it. But we study money and learn more about it every day.

It is within that ever-receding pocket of monetary ignorance in which The Bitcoin Layer lives. In other words, our purpose here at TBL is to try our best to educate others on the intricacies built within today’s complex financial system.

Upon some long weekend readings, it dawned on us that, although many like to talk about the Federal Reserve, not a lot of people know who actually runs the Fed. What is the makeup of this highly talked-about institution?

We are going to make an educated guess and say that the majority of Americans know the President and his administration, but not a lot know monetary policy makers, arguably just as important.

So, in today’s article, we will get to know the ‘admin’ of the Central Bank of the United States. And, as we approach December, we will take a closer look at the two sides of the Fed’s dual mandate: employment and inflation.

So, without further ado, let’s dive in!

Bitcoin forces long-term thinking.

With that perspective, custody isn’t an afterthought — it’s a structural choice. The goal is resilience: maintain control, remove single points of failure, and stay aligned with the monetary principles that brought you to bitcoin.

Unchained is the leader in collaborative multisig custody and bitcoin-native financial services, securing over $12 billion in bitcoin for more than 12,000 clients — roughly 1 out of every 200 bitcoin sits in an Unchained vault.

The model is simple:

You hold two keys.

Unchained holds one.

This shared-custody framework blends institutional-grade security with the sovereignty of individual key ownership.

From that foundation, Unchained offers services for long-term bitcoin strategies: trade directly from your vault, access dollar liquidity through bitcoin-collateralized commercial loans, open a bitcoin IRA while holding your keys, or create business and trust accounts for multi-generational planning.

For elevated private-client service, Unchained Signature provides a dedicated account manager, discounted trading, exclusive events, and more.

If you’re building a durable bitcoin position and want a custody partner designed for that responsibility, visit unchained.com and use code TBL10 for 10% off your new bitcoin multisig vault.

Secure your Bitcoin this holiday. 21% off all Blockstream Jade devices.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

The Central Bank of the US

The Federal Reserve System has three entities:

1. The Board of Governors

An independent government agency that oversees the operations of the Reserve Banks across the US. There are seven board members nominated by the President:

Jerome Powell, Chair

Philip Jefferson, Vice Chair

Michelle Bowman, Vice Chair

Michael Barr

Lisa Cook

Stephen Miran

Christopher Waller

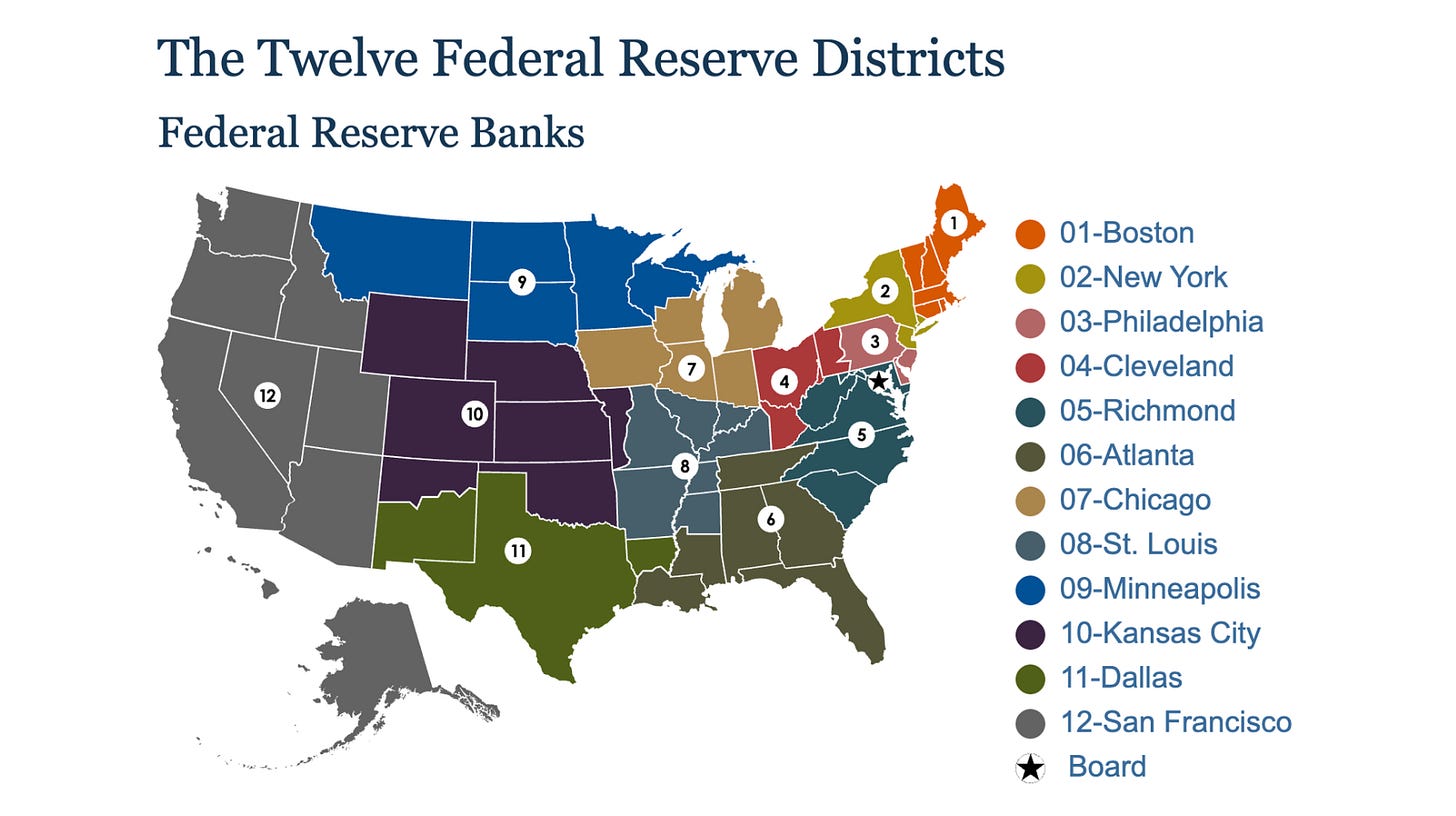

2. The Reserve Banks

There are 12 Reserve Banks across the US, each one covering its own individual region (chart below):

Here is where each region is headquartered, alongside its President:

Boston: Susan M. Collins

New York: John Williams

Philadelphia: Anna Paulson

Cleveland: Beth Hammack

Richmond: Thomas Barkin

Atlanta: Raphael Bostic

Chicago: Austan Goolsbee

St. Louis: Alberto Musalem

Minneapolis: Neel Kashkari

Kansas City: Jeffery Schmid

Dallas: Lorie Logan

San Francisco: Mary Daly

3. The Federal Open Market Committee (FOMC)

Lastly, the FOMC, which combines both of the aforementioned entities, and whose members vote on things like the target range of the Federal Funds rate. This committee is made up of 12 individuals: