Rapid-fire Macro Reorientation

Everything you need to catch up on the current state of markets heading into year's end.

Dear readers,

Turbulence in markets looks to continue into year’s end, and our aim is to keep you informed during times of volatility and confusion. So, it’s time for some rapid-fire reorientation on the big-picture state of markets.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself.

Create a node in less than 2 minutes, just visit voltage.cloud

Today’s Topics

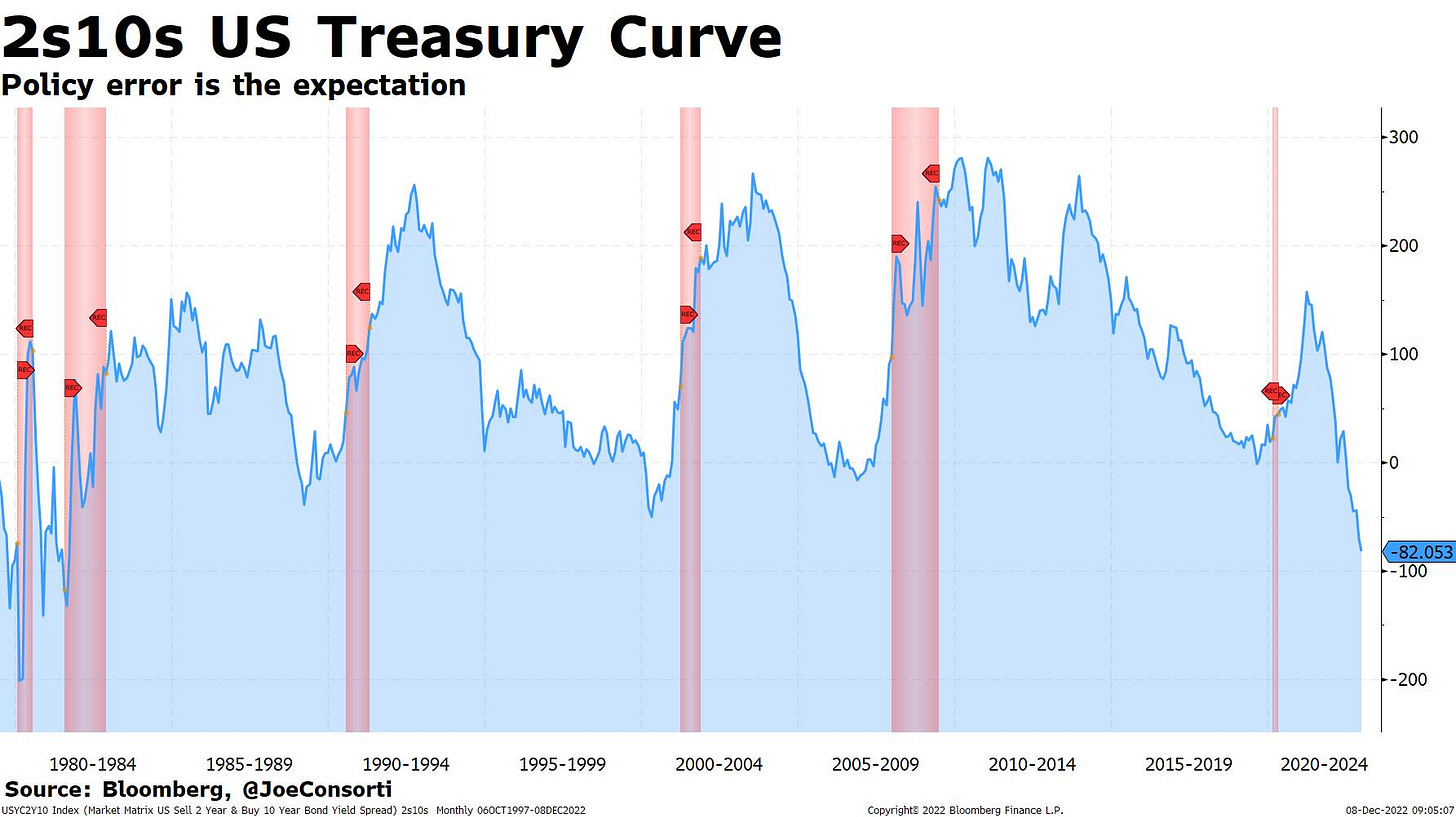

Record-deep inversions point to a market-anticipated economic slowdown.

The Fed’s mission is to hold higher for longer—in times of high inflation, risk assets bottom only after rate cuts.

It’s a pivotal week for market confirmation, with both CPI and an FOMC meeting.

Market pricing in an ever-deeper economic slowdown

Record-deep inversions along the US Treasury curve signal weakening investor sentiment about recession probability.

The 2s10s curve is inverted by 82 basis points. The shorter-dated 2s yield is 82 basis points higher than the 10s yield, which usually demands a higher yield due to its longer duration but has fallen below 2s as buyers pile into longer-duration Treasuries: