Good morning Readers! Welcome to TBL Weekly #117 — grab a coffee, and let’s dive in.

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.

Weekly Monitor

Weekly Analysis

Rates are up over 0.75% since the Fed cut rates in September—formally known as a rate shock.

The reason could be:

Election outcome

Inflation reignites

Other

We can’t know for sure today, but this coming week’s results should provide us with at least part of the answer. What we do know is that Treasury markets have seen a tremendous temporary readjustment, one that should have implications on others, including stocks and bitcoin.

Even looking only at bitcoin, the price action over the past few days has us all a little dizzy. Our dominant theme here at The Bitcoin Layer has been bond volatility—our studies tell us that its variance is the primary motivator for the direction of stocks, which most of the time matters a lot for bitcoin. In short, elevated bond volatility suppresses money creation, which dampens the appetite for financial assets. Here is the shock:

Treasury 10-year yields are now approaching 4.4% as bond volatility continues to surge. We are experiencing the largest increases of the year:

October has seen the highest monthly growth rates in bond volatility, from a minimum value of 90 in late September to 133 today. Given higher volatility, our TBL liquidity measure experienced a huge drop starting October, which is now, barely, being reflected in the S&P 500. We have achieved a near 50% correlation with our measurement, which is why it has become a foundation for our framework:

Interestingly, bitcoin outperformed amongst its risk peers, closing the week higher, but succumbing to volatile weekend price action.

Don’t forget the Fed meets on Thursday

In tradition with a history of the Fed altering its schedule to accommodate for elections, the FOMC will release its decision on Thursday this week. It will cut rates by another 25 basis points, bringing this cycle’s total cut to 0.75%. The Fed is likely to signal that the labor market remains a concern and that appropriate recalibration of the policy rate is necessary, but that inflation remains a risk; so, further decreases will need to be balanced with the upside risk to inflation. We will look for a strong signal on whether another cut is imminent, but the rates market suggests that might not be the case. Data is all over the place, and frankly, nobody knows what to think until the noise around January’s balance of power in Washington quiets down.

Why, one might ask, is the election so important for rates? Thirty-six trillion dollars in public debt and a bipartisan voracious appetite for deficits mean any outcome might bring more Treasury-money creation. How exactly spending will happen does depend on who wins. The Fed is waiting, just like the rest of the market is, to measure the fiscal impact on the economy, which should partially dictate monetary policy, a phenomenon known as fiscal dominance.

It feels strange to admit that the FOMC meeting this coming week almost fails to register on important market events, but here we are. A suspect labor market, which we’ll cover below, is enough to justify a 25 basis-point cut. Perhaps we’ll finally get some long-awaited information on QT, something we’ve long awaited at TBL. A flurry of dislocation in the relative yields between Treasuries and interest rate swaps (swaps), known as “swap spreads” indicate to some professionals that there is strain in the Treasury market that will bring the Fed back into play. This is certainly some inside baseball (go Dodgers!) on the Fed’s balance sheet, but a blowout in swap spreads that precludes an end to QT is exactly the type of development that we aim to bring you. Fed balance sheet expansion is bullish for bitcoin because it supports the liquidity of the system, when liquidity is measured by the asset base of banks and central banks.

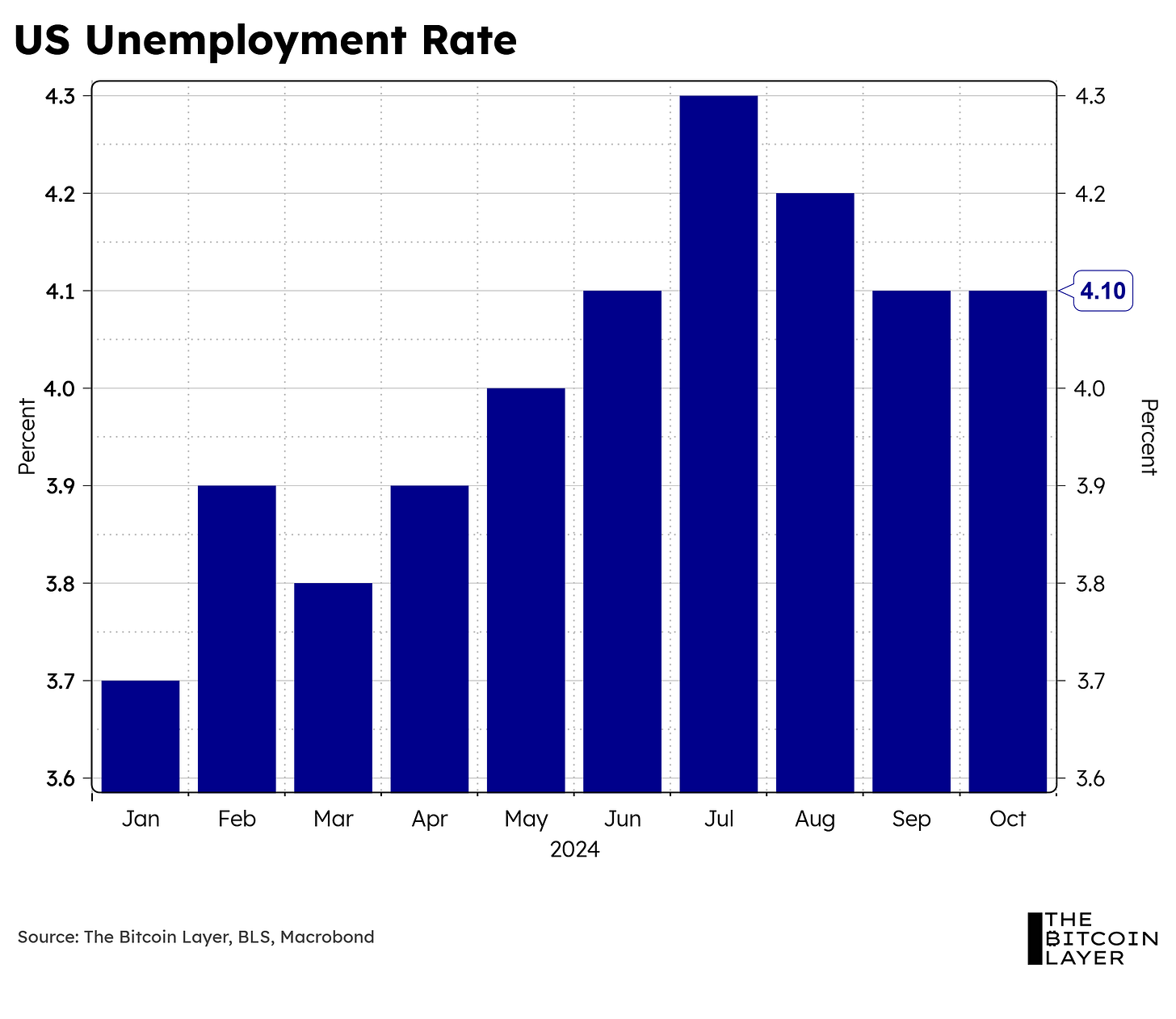

Shaky at best labor market:

In July and August, we had our two highest unemployment prints of the year, which pushed Treasury yields to yearly lows. By the time September came around, the Fed followed bond market sentiment and adjusted its unemployment projection upward to 4.4%, alongside a 50 basis-point cut.

Friday’s unemployment rate stayed flat on a rounded basis, but the internals of the jobs report were poor. They justify the weakening labor market approach at the Fed, and we are also seeing weakness confirmed in other places, such as JOLTS. Openings and quits continue to plunge. This is unhealthy for the job seeker:

We had a large drop in job openings to 7.44M from the previous month’s print of 7.86M. At TBL, an important metric that we look at is Job Quits, which continue to fall precipitously from their 2022 highs of 4.52M. To us, this showcases a lack of willingness from employees to switch jobs given market conditions.

Another interesting print this week was NFP:

The final job print came in at 12K, not to mention downward revisions to previous months’ prints…which makes you wonder whether October’s print will remain positive or if it will be revised down to negative territory. We are now facing negative job growth, which would confirm data we are seeing at the ISM subindex level. Here, it is worth noting how recent prints are massively skewed by recent hurricane events, but the overall pattern of downward revisions is not new.

Let’s now do a surface-level check on inflation:

Another interesting number to note was the Average Hourly Earnings print:

Wage growth remains solid, at 0.4% on a rounded basis. Interestingly, this higher AHE was accompanied by an increase in the Fed’s favorite measure of inflation:

Inflation, including wage inflation specifically, don’t appear to be slowing at all.

Let’s now look at the Economy:

We also got GDP this week, which came in lower-than-expected at 2.8% QoQ (Annualized).

ISM manufacturing remains in recessionary territory:

Most importantly, we see the divergence of the labor market and the inflation situation within ISM manufacturing—spiking prices, but people are losing their jobs:

A weak labor situation keeps the Fed cutting cycle in play, while higher prices allows for higher bond yields to restrict financial markets. All of this indecisiveness within the data itself is causing volatility and uncertainty, but we must say that with a full understanding that bitcoin, stocks, and gold are all basically at their all-time highs despite a rate shock.

Next week, we’ll likely find out the next US President, some indication on the path of monetary policy, and almost certainly large market moves one way or the other. We promise to be documenting and analyzing every step of the way. While we’ve made our prediction and even demonstrated some bias over the past weeks, what is most important to us as Americans is the civic process outlined in our great Constitution.

In case you missed it: TBL on YouTube

Beyond the Headlines: How to Really Understand Financial Markets.

In this video, Nik shares his journey from a confused college student to a professional analyst, revealing how discovering Zero Hedge in 2010 transformed his approach to financial information. As a money market practitioner, Nik discusses his use of primary sources with tools like Macrobond as his foundation, while also relying on trusted outlets like The Wall Street Journal, Bloomberg, and Zero Hedge for stories. Through the methods and insights that shape his research at The Bitcoin Layer, Nik aims to helps viewers and readers cut through mainstream narratives to find real market signals.

Here are some of the key insights:

Primary source analysis is crucial for accurate market understanding, with emphasis on direct examination of market prices, economic data releases, and central bank statements, helping investors avoid the biases often present in secondary news coverage.

The Wall Street Journal stands out for its reliable U.S. economic and Federal Reserve coverage, while Bloomberg offers premium factual reporting and data services, though its news subscription is more accessible than the full Terminal service.

Zero Hedge serves as an alternative voice in financial media, providing valuable counter-narratives to mainstream perspectives, though Nik advises selective use of their content, particularly their market recaps, while being mindful of their potential biases and pay-to-publish model.

Professional tools like Macrobond provide comprehensive economic data access for deeper market analysis, supporting independent financial research efforts such as those conducted at The Bitcoin Layer.

The combination of primary sources, reliable news outlets, alternative perspectives, and professional tools creates a well-rounded approach to market analysis and financial research, enabling more informed decision-making.

Bitcoin Hits $73,000: The Hidden Money Printer Fueling All-Time Highs

In this episode, Nik examines the powerful forces pushing Bitcoin toward new highs, revealing how government spending sets off new money creation that flows directly into assets. Starting with a breakdown of Bitcoin’s recent breakout and technical setup, he then explores the global backdrop, including China’s $1 trillion stimulus and shifts in U.S. fiscal policy. Using a balance sheet approach, Nik illustrates how Treasury issuance, bank purchases, and government payments lead to new deposits and net worth expansion — a process fueling assets without Fed involvement. This analysis reveals why Bitcoin, as a finite asset, stands to benefit in a world of accelerating government-driven liquidity.

Here are some of the key insights:

Bitcoin has broken out of its March consolidation phase and entered a "price discovery" phase, coinciding with significant government spending initiatives from both the U.S. and China, including China's $1 trillion bond issuance and potential increased U.S. spending under a possible Trump return.

The mechanics of government spending create new money in the system, as illustrated when Treasury debt issuance leads to payments to contractors like Raytheon, who then deposit funds in banks like Citibank, ultimately increasing banking system liquidity and driving up asset prices.

Both U.S. and Chinese fiscal policies are contributing to global liquidity expansion, with China injecting funds through bonds and U.S. prospects of higher deficits through increased spending or tax cuts.

Bitcoin's price movement is responding to these broader economic trends rather than specific political developments, serving as a hedge against the global "borrow and spend" approach that contributes to inflation.

As fiat currency purchasing power faces pressure from these monetary policies, Bitcoin is positioned as the "true expression" of these economic realities, transcending political considerations to reflect fundamental monetary dynamics.

Countdown to Election: Treasury Moves and Rising Rates Poised to Shape 2024 Markets

In this episode, Nik Bhatia and Matt Dines unveil the high-stakes dynamics of U.S. Treasury issuance and its immediate ripple effects on markets, set against the backdrop of the upcoming election. They examine the latest borrowing projections, the strategic role of short-term bill issuance, and how rising bond volatility could signal market risks. Comparing the U.S. and UK debt strategies, they analyze the debt ceiling’s potential to disrupt credit markets and consider how a Trump return or GOP Congress could reshape Treasury strategies. Closing with insights on the Federal Reserve’s stance, they chart the course for an economy on the brink of transformation.

Here are some of the key insights:

The U.S. Treasury is strategically focusing on short-term bill issuance over long-term debt to manage over $1 trillion in new debt while suppressing long-term rates, though this approach reveals a dependency on short-term markets that may struggle with sustained higher rates.

Political outcomes could significantly impact fiscal policy, with a Trump victory potentially leading to increased tariffs, tax cuts, and higher spending, while a divided government might result in extended debt ceiling negotiations, with both scenarios affecting Treasury management under new leadership.

The UK's experience with heavy long-term debt issuance serves as a cautionary tale, demonstrating why the U.S. Treasury prefers maintaining short-term flexibility rather than committing to long-term debt obligations.

Markets are closely monitoring Federal Reserve policy updates regarding quantitative tightening (QT), as any shifts could signal changes in monetary easing and significantly impact market sentiment.

High bond volatility persists as markets anticipate potential economic changes and rate adjustments, creating additional challenges for the Treasury's debt issuance strategy across different maturities.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we discussed US trade policy with China and what the IMF thinks about it (especially given the strong emphasis on tariffs by a Trump re-election). We also looked at the continued struggles in commercial real estate.

Check out TBL Thinks here:

What TBL Pro Is Reading

Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Read more by going TBL Pro.

Exclusive content: access to the weekly "Mean, Median, Mode" risk report

More in-depth analysis not available in free content

Timely information for assisting in investment decisions

Monthly Q&A sessions with the team

Community access to a network of like-minded Bitcoin investors

Full access to our proprietary metric TBL Liquidity

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

With today’s macro landscape, many people are worried about whether they’re saving enough for retirement. Now you can grow your retirement savings using tax-advantaged bitcoin in an Unchained IRA! The Unchained IRA is the only solution that allows you to hold the keys to real bitcoin in a standard IRA.

Right now, get started with no setup fees and no account fee for the first year. You can roll over old IRAs or 401(k)s into traditional or Roth bitcoin IRAs while keeping control of keys. With Unchained, you get the power of key control combined with the long-term potential of Bitcoin, making it the ideal choice for those looking to protect and grow their retirement savings.

Don’t wait to take control of your financial future. Set up an Unchained IRA today at unchained.com/tbl and experience true ownership of your retirement.