Red October On The Horizon: TBL Weekly #61

A blazing red sun is on the horizon, it portends the inevitable.

Red sky at night, sailor’s delight. Red sky in morning, sailor’s warning.

This old sailor’s adage illustrates how one event at two separate times of day can elicit two very different responses.

A red sky in the evening means high pressure and stable air is flowing from the west, portending good weather the following morning.

A red sky in the morning means that good weather is past and a low-pressure, high-moisture atmosphere is flowing in and bringing torrential rain along with it.

The calm before the storm.

Red skies are ahead folks, and it’s the crack of dawn.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

In the Federal Reserve’s Sept '23 Beige Book the word ‘recession’ was used 15 separate times—compared to just 3 in July. Language from monetary policymakers has moved from early-cycle to patently late-cycle terminology, a signpost that a meatier economic contraction is upon us.

A contraction is a reduction—in the case of markets, a reduction in economic activity. So where are we seeing it?

America’s largest private employer is cutting costs. Walmart, with its 2.3 million workers, has begun cost-cutting measures with new workers being paid less than 3 months prior.

Retailers are tightening their belts due to higher input costs and a weary outlook for consumers heading into the Q4 holiday shopping season. Not only have borrowing and input costs risen, but consumers are weak thanks to the same higher rates impacting corporates. One person’s spending is another’s income, and both are cyclically pushing each other down at the moment:

Labor market weakness is inarguably manifesting. Last week we saw JOLTS job openings decline, employment gains fall, and unemployment unexpectedly rise to 3.8%—pair that with the Walmart news, and it’s looking bleak for economic activity. Again, a weak consumer doesn't help stimulate things.

Personal savings as a % of disposable income is at a near all-time low of 3.5% while revolving credit card debt continues exploding on an absolute basis and relative to income.

Consumers are packing on debt while burning through personal savings to fund expenditures. Charge-offs are skyrocketing as well, meaning that a lot of this debt growth is bad debt that consumers don’t intend to pay down:

Consumers are already at the end of their rope, and with federal student loan payments accruing interest and set to resume on October 1st (no delinquency until 2024), they will reduce their spending substantially. Borrowers are scrambling to pay down their balances before payments resume with $1 billion in student loan payments per day at its peak earlier this week:

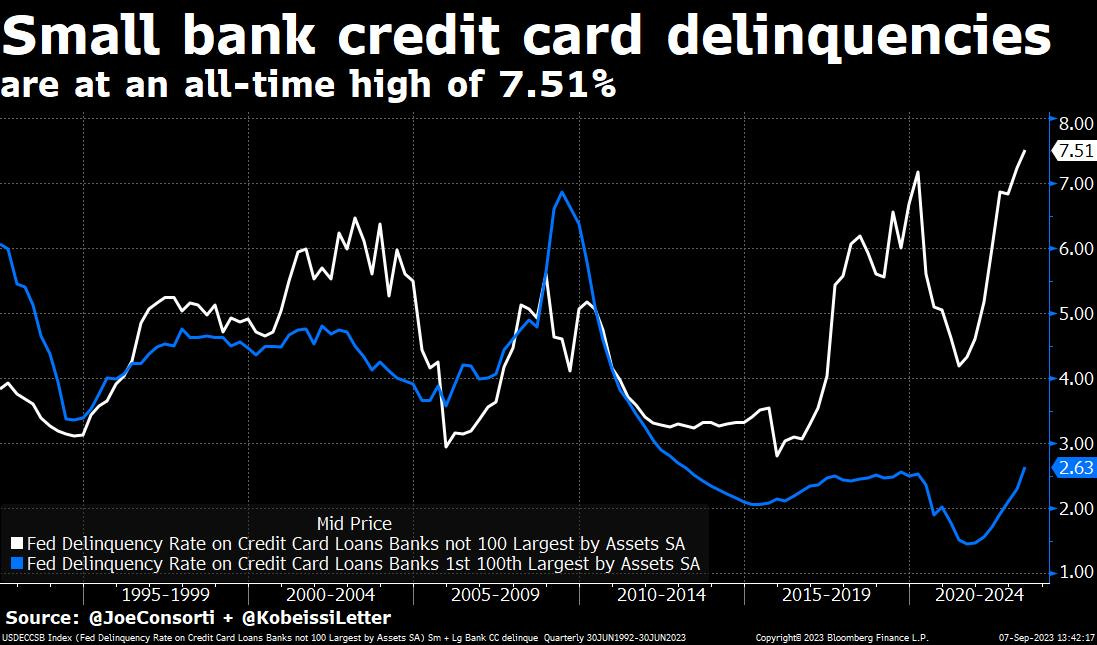

In light of withering savings and rapid credit expansion that consumers aren’t intending to pay (remember, charge-offs exploding), credit card delinquencies are at multi-decade highs. Some 7.51% of credit card payments due to small banks are delinquent, while the problem is much less pronounced for large banks at 2.63% delinquency. Remember how small banks are also the ones acutely impacted by the rapid deposit flight of 2023 and now-toxic commercial real estate exposure? Here’s some more impairment for them:

Regional banks are teetering on the brink and we’re not even in recession yet.

Following the October 1st student loan payment resumption, a government shutdown is on track for October 2nd when the new budget year begins.

A deadlock in the House and Senate is preventing a funding bill (SIGH) from being passed, threatening a shutdown of certain federal agencies.

On TOP of that, a FEMA and FCC Nationwide Emergency Alert Test is scheduled for two days later on October 4th. Pair that with possible new COVID lockdowns that are being trial ballooned, and you suddenly have a 5-factor convergence of stress tests all across sectors relevant to US financial markets, all happening at the very start of October.

Coincidence, or deliberate?

Who’s to say.

With the San Francisco Fed’s Head of Bank Supervision departing on, you guessed it, October 1st, the first few days are set to be the most turbulent that markets have felt in some time. Taking the very, very low VIX, general absence of fear, and liquidity coming back online from the summer holiday here in the US into account, and one may be fearful that those first few days of October could be make or break for US financial markets in that they mark the turn of the cycle, or yet another false alarm.

The other question that remains to be seen is that when the cycle turns, how devastating will it be? Where will unemployment peak? Will it be a violent deleveraging? The longer the ball is held underwater via rates being held where they are, the higher the eventual cannon-shot out of the water in the form of unemployment could ostensibly be.

Unemployment and inflation is the tradeoff, and in hiking up the cost of capital to slay inflation, the Fed has drowned banks in the process:

That is precisely where we are in the cycle—where the realities of losses incurred by US financial institutions due to interest rate risk during the Fed’s hiking campaign come to the fore, even if the inflation battle isn’t slain.

Unrealized losses at US banks have increased to $558.4 billion thanks to higher interest rates and mortgage rates devaluing the banks’ debt holdings. This gaping hole in the US’ financial plumbing resulted from inflation, higher market rates, and of course, Fed hikes:

The Big 4 US banks hold some ~$200 billion of these interest rate-risk losses:

Financial stability is the Fed’s #1 mandate.

Forget what they tell you about full employment and stable prices, instead, watch what they do. In 2008, the Fed dropped both mandates at the first sign of financial armageddon in favor of financial stability, i.e. bailouts, rather than face the music and let the fragile players get flushed so that a new foundation to be built. They will do the same thing today. In fact, they already have.

Emergency loans from the Fed's BTFP facility are sitting at $107.855 billion, so the Fed is covering almost 20% of the losses it helped create in the US Treasury market with its own rate hikes. The Fed has its hands on both sides of the scale, and its monetary alchemy is only working to exacerbate the problem of not allowing dead financial institutions to die. We are in for a surprise, and not the good kind, at some point down the line:

Bailouts are, as always, the inevitability and the bull case. Unfortunately for those not close to the monetary spigot, there’s nothing new under the sun.

What else is the Fed seeing that warranted their 15-time usage of ‘recession’ in the latest Beige Book? We just had the busiest August for corporate bankruptcy filings on record, soaring 54% from last year’s total amount of filings:

The number of US businesses filing for Chapter 11 bankruptcy protection this year is the highest since 2012, and we still have 3 months until the year is over:

For these businesses, it’s a game of restructure, extend, and pretend. A 4-week moving average shows the disconcerting accelerating pace of bankruptcy filings:

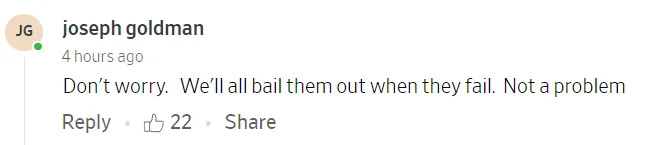

US bankruptcy courts recorded six new, large filings last week while the pile of distressed debt grew by $3.1 billion—the first uptick after 6 weeks of decline:

Zooming out, you’ll note the level of distressed debt climbing to elevated levels:

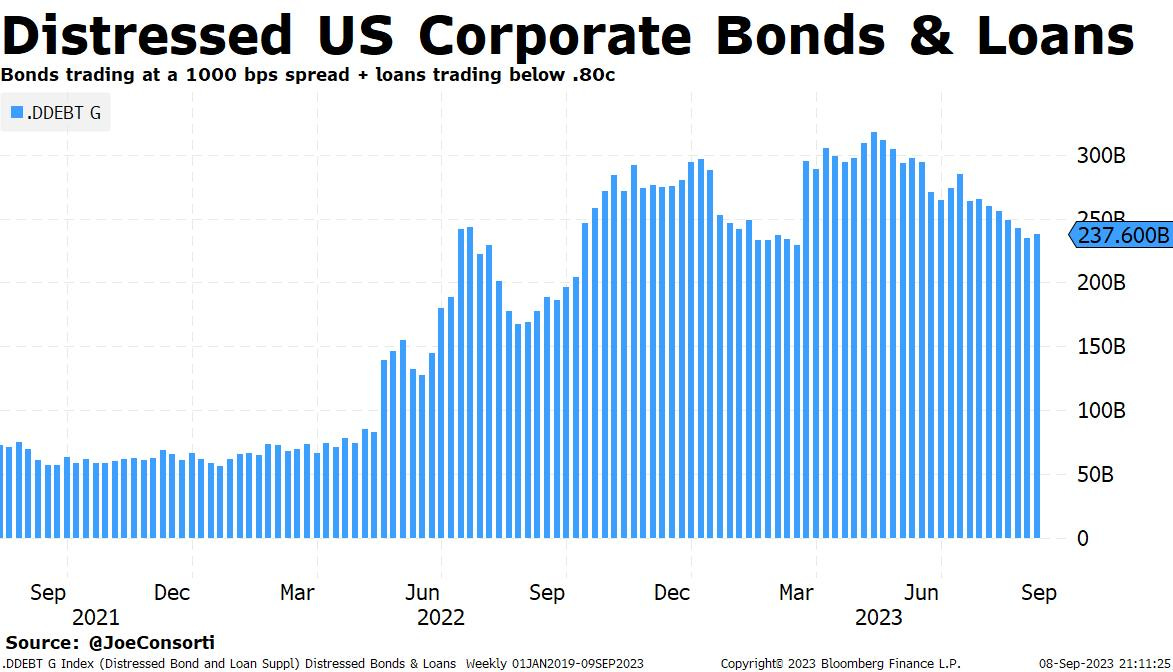

The year 2023 has been the biggest bank run in a very long time. US banks have lost roughly $633.85 billion in deposits since January. Deposit flight leads to credit contraction, which in our credit-based economy means economic contraction. Not great for the US economy, the signs continue to worsen:

PMI surveys from the top to bottom of supply chains are sour, consumer sentiment is dour, and maturing corporate credit is in its final hour.

We are close, closer than at any point previously. It may not be today, may not be tomorrow, but there’s a red sun on the horizon. It’s not about timing when or foreseeing where, but rather assessing the relevant macro data and the basket of risks as it evolves to make the most probabilistic calls and predictions.

It’s morning in markets, and a blazing red sun stretches over the horizon climbing straight into the air.

A colossal ball of fire that portends the inevitable.

I leave you with the sea shanty sung in delirium as the crewmembers hunted the great white shark in Jaws, 1975, to distract themselves from the inevitable:

Show me the way to go home,

I'm tired and I want to go to bed.

I had a little drink about an hour ago,

And it’s gone right to my head.

Wherever I may roam,

On land or sea or foam.

You can always hear me singing this song,

Show me the way to go home.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Saturday

In this episode, Joe is joined by the inimitable Joe Carlasare, partner at Amundsen Davis & TBL Legal Correspondent. Joe breaks down Grayscale's victory over the SEC, what this means for GBTC and other spot bitcoin ETF applicants, the timetable for when these may be approved, the SEC's plan of delaying until the final deadline for each applicant, the trouble brewing in the SEC v Binance case, and his outlook for bitcoin as we head into a volatile Q4.

Check out—Bitcoin ETF Just BEAT The SEC, What's Next?

Tuesday

Dr. Jeff Ross, Founder & CEO of Vailshire Capital Management LLC, releases a monthly portfolio and markets update for his clients. Thanks to him, we’re privileged to distribute his excellent work to you, our alpha-hungry TBL readers.

Check out—Liquidity Is Dropping Fast & The Fed Risks Market Havoc: September 2023 Update

Wednesday

Nik summarizes the latest developments in financial markets and the global economy. He discusses the strong readings in the US services sector that is challenged by terrible mortgage applications and a weakening consumer. Also covered are Europe's ugly recession and China's property sector defaults which both bring the danger of dollar strength.

Check out—Dollar Strength Bringing DANGER To Markets: Here's Why.

Thursday

When in Austin recently visiting with bitcoiners, we once again came across an argument that we’ve already written about this year. It goes: the Fed is raising rates not to fight inflation, but as a conspiracy to take back the power of dollar creation away from European banks and into the hands of American onshore banks. Remarkably, the institutional investors who are proponents of this theory are not only hesitant but reluctant to come on our channel for an interview discussion because of the fear of being labeled a conspiracy theorist. This dynamic led us to examine this argument a little further, as there are many who deeply believe that US banks are on the verge of handing European banks a striking defeat. We don’t see it as so.

Check out—Fed conspiracy to kill Eurodollar banks?

Friday

TBL Africa correspondent Noelyne Sumba is joined by Hermann Vivier, a multifaceted personality and surf coach, educator, teacher, and organizer of Bitcoin Ekasi. Discover how the circular economy is taking shape around Bitcoin in South Africa, and gain valuable insights into the country's democracy and governance. Hermann also shares his inspiring journey of making a positive impact by extending a helping hand to the townships of South Africa.

Check out—South Africa's Circular BITCOIN Economy | Hermann Vivier

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL and receive $5 free when you buy $100 in Bitcoin.