Welcome to TBL Weekly #79—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

On Wednesday, the market was shocked that New York Community Bancorp had suffered an almost quarter-billion dollar loss in the fourth quarter and would be raising its loan loss provision to $552 million. NYCB bought Signature Bank last March when it was failing, and has since inherited its toxic credit and CRE assets. Its stock plunged almost 50% over three days, bringing a minor tremor to the KBW regional bank index as it did:

Real estate risks and toxic corporate credit exposure are creeping their way into the market as the value of properties is written down and corporate refinancing risk rears its head with rates 2-3x higher than outstanding debt was issued at.

Last year, the problem with banks was duration, with banks holding too many long-dated Treasuries that became impaired by the Fed’s fast rate hikes. This year, US commercial banks have a credit problem, with commercial real estate exposure turning into a hot potato as office buildings continue being written down across major metropolitan areas. Office vacancy rates are approaching 25% while small and mid-size banks hold almost 70% of outstanding loans on all commercial real estate, hence the fear that the same banks who were in trouble last year will soon fall into dire impairment once again, but for a different reason.

The key difference between last year and this year is that there is no bailout facility where the Fed can lend money against bad assets. Unlike the Fed’s discount window and BTFP, in which US Treasury collateral is required for emergency rescue measures, there is no facility where the Fed accepts office buildings or loans against them as collateral for rescue.

While the Fed is only thinking about the low-income owner burdened by inflation right now, it is likely not looking at the banks’ rising credit issues. As per Nik’s post on Thursday and his video linked below, we believe the Fed will botch it for this very reason, inevitably cutting rates after it is too late.

Lending has already slowed down to a crawl at US commercial banks, with no new commercial bank loans have been created on net since mid-December:

Deposits are stable and rising, up roughly $190 billion in nine months. We have seen how this can change on a dime though, especially in the age of social media where bank fears can spread faster than wildfire and deposits can be called with the tap of a finger:

However, we did just witness the largest deposit outflow from large banks since last March, perhaps a measure by some to derisk as BTFP expiration rolls around:

As cash reserves fall, this liquidity struggle only gets worse, particularly for small banks which have a lower cushion to absorb runs on deposits. With BTFP ending soon and the slowdown in lending signaling banks may be battering down the hatches, we wouldn’t put it past the Fed to attempt a new rescue facility for new collateral types if CRE continues underperforming and corporate credit risks are material:

Yesterday we received an outwardly booming jobs report that means mostly nothing. Nonfarm payrolls came in 117,000 payrolls higher than the expectation, locking in more than 350,000 payroll additions in January—a 4-sigma beat. This is, as all Januarys are, post-Christmas season window dressing via the seasonal adjustment, which accounts for temporary jobs lost after the Christmas season. What’s more, 10 of the last 12 months’ nonfarm payroll reports have been revised down after the fact, and we expect this one to be no different. This release serves to highlight just how absurd the data will be as we get closer to November:

Rates did pare back cut and recession expectations after the beat, with 2s rising 16 basis points and 10s rising 14 basis points on the day:

It was a great week for the magnificent seven as almost all met or beat earnings expectations, however, stock indices are being led almost entirely by gains in these mega-cap stocks in the tech sector. Don’t equate booming tech stocks with a strong economy, as politicians are disgustingly quick to do. According to Gordon Johnson on X, the 384 out of 1946 companies that make up the Russel 2000 which have reported earnings so far experienced a 53% drop in QoQ earnings growth.

The Atlanta Fed’s GDPNow estimate is another indicator used to tout the economy’s resilience, despite it not being a great forward discounting mechanism. It rose from 3% to 4.2% on Thursday, driven by a sharp rise in personal consumption expenditures, indicating a still-hot consumer after the Christmas season. Again, this tends to be a rear-view way of viewing the US economy, that can and will change on a dime when recession eventually looms:

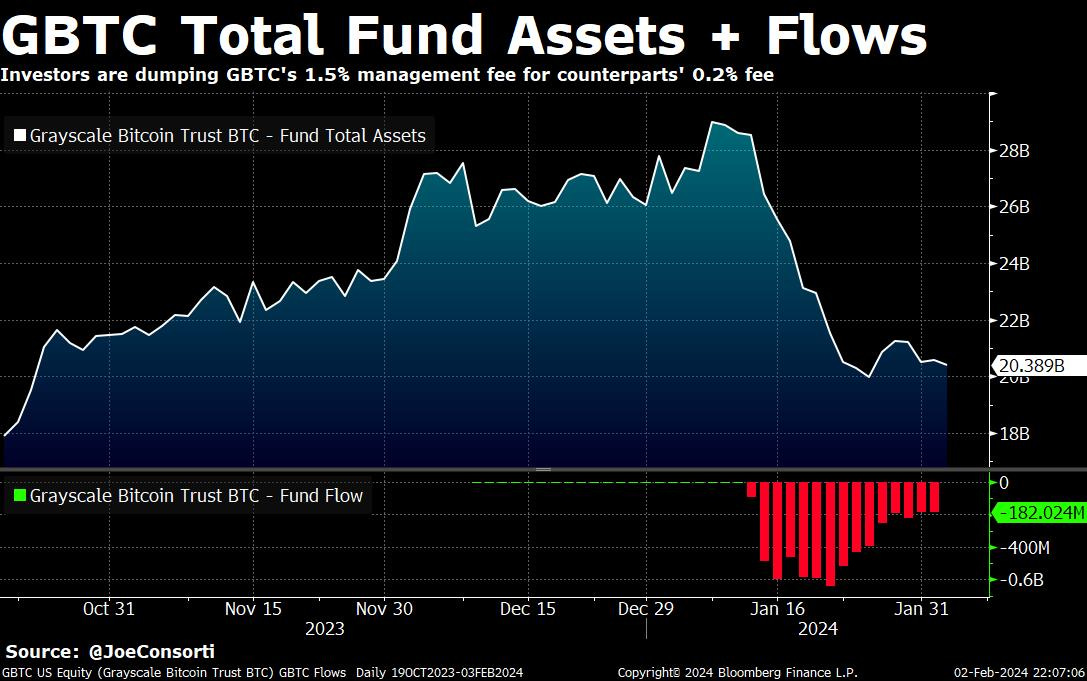

Switching over to bitcoin ETFs, Grayscale continues to dominate the competition, with its total assets under management sitting above $20 billion. Including GBTC, the total AUM of all spot bitcoin ETFs now exceeds $27 billion:

GBTC outflows continue but have stabilized at just under $200 million in net outflows every day, the value of the fund offset by the commensurate rise in bitcoin’s price:

Miners have enjoyed extremely profitable conditions since November as bitcoin’s price has experienced extreme pre and post-ETF gains, and demand for blockspace has driven fees to the moon. With an upward difficulty adjustment slated to happen just over 7 days from now, expect some less profitable miners who have enjoyed a free ride of sorts for a few months now to be culled from the network:

We understand that with stocks at all-time highs and rates pricing in cuts based on a recession nowhere in sight, markets can be confusing these days. Historical correlations have been shattered as market participants across asset classes cannot agree on the Fed’s reaction function and remain baffled as to how the economy has weathered its monetary tightening storm thus far. Also, remember that it’s an election year—as the US Treasury does what it can to ensure recession is staved off until after November, don’t expect anything to make sense according to historical analogs.

Next Week

In the week ahead, data will be relatively light compared to last week’s FOMC onslaught. Still, we’ll have ISM services, the Fed’s quarterly SLOOS survey on bank lending, and some notable Treasury auctions. On the economy, we saw ISM manufacturing put in a strong January and could see services follow suit. Jobless claims, especially continuing claims, surprised to the upside last week. This statistic will be material as we march forward this year—in reality, there is no better real-time metric of the employment situation than how many people are filing for unemployment assistance:

On Wednesday and Thursday, Treasury will auction 10s and 30s, which will both settle into the market the following week on Thursday, February 15th. While the impact to money markets and repo will have to wait until then, next week will give us another sense of just how much appetite there is for a healthy supply of Treasuries deeply inverted to the policy rate. According to our rough technical analysis, 10s have room up to 4.33% before the trend shifts bearish—until then, Treasuries still have that rate-cut momentum behind them.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

With the first FOMC meeting of 2024 set for tomorrow to close out January, let’s take a look at what the market expects, how the Fed and Treasury are bracing for it, and how assets and the economy will respond in the months to come.

Check out—'Twas The Night Before Fed Day

Wednesday

In this episode, Nik breaks down the eventful week in macro, central banking, and financial markets. He begins by answering a viewer's question about the interaction between the Fed and the US Treasury, recaps the FOMC's decision to make no changes to policy, and describes why the Fed might be late to recognize trouble in financial plumbing. He ends with a discussion on where The Bitcoin Layer's name comes from and why an allocation to bitcoin is essential in today's dollar system.

Check out—Fed Update: No March Cut, No QT Change

Thursday

FOMC meetings always tend to bring a touch of the dramatic, but this time, Jerome Powell’s press conference triggered a greater realization. While for most of his microphone handling, Powell deftly maneuvered around every question with a convincing answer on why the economy, labor market, inflation, and rates are all essentially exactly where he wants them. But reading through the lines, because the Fed is hyper-focused on inflation and disinflation to guide the next policy move, it failed to start planning for a problem that is sure to reappear: QT is unsustainable. When Powell said the committee would start discussion on plans for QT in March, I knew right then that this was going to be another Fed botch job. You’re going to want a front seat and some bitcoin.

Check out—The Fed is going to botch this

Friday

In this episode, Nik offers a second look at this week's FOMC meeting and breaks down the strong jobs numbers from Friday morning. He begins with why the 353,000 jobs gained in January is not necessarily significant, discusses what is happening in money markets with assets under management now over $6 trillion for the first time, and finishes with some analysis on bitcoin ETF flows and a major milestone for BlackRock.

Check out—HOT Job Numbers & Bitcoin ETF Milestone

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

When do you think DXY will come back down ??? We need it for Bitcoin /Crypto to rally