Reports of the dollar's death have been greatly exaggerated

The US dollar is deeply entrenched in global financial plumbing. For now, the notion of China or Russia imminently dethroning it is a far cry from reality.

Dear readers,

We invoke Mark Twain's infamous reaction to the false report of his death in our title today because the longstanding narrative of the US dollar's imminent demise is just as inaccurate.

An excerpt from this NYT article on the Monday following Nixon’s departure from the gold standard colors the consensus view of the dollar’s collapse, some 50 years ago:

Arthur M. Okun, Chairman of the Council of Economic Advisers under President Johnson said he could not say by what degree other currencies would rise in value relative to the dollar, but he was certain that they would rise.

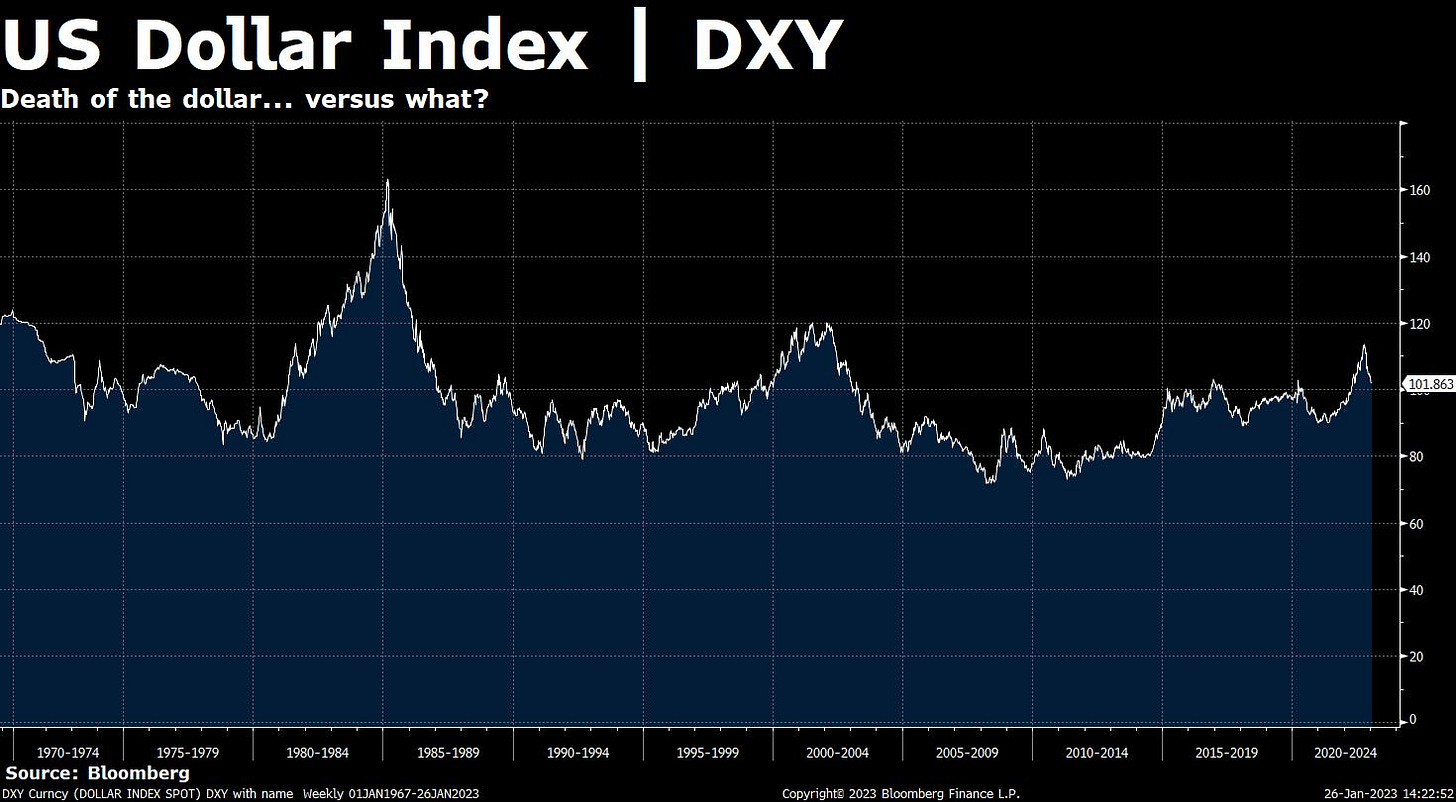

The dollar has been dying over and over again since the post-Bretton Woods era of the global monetary order began in 1971, with the dollar being allowed to fluctuate freely against gold, and with that, the global currency regime undergoing a 51-year period of price discovery. Yet half a century later, the dollar remains king in the universe of currencies.

The United States dollar is globally entrenched to the nth degree—it helms the deepest and most liquid fixed-income market in the world, which provides securities that receive a healthy, structural bid from every capital allocator with dollars on their balance sheet, sovereign and non-sovereign. Lending is collateralized by these securities, foreign nations and their businesses purchase them, and world interest rates bend at their whim.

Uprooting this critical financial infrastructure would prove lengthy, costly, disruptive, and impractical, not to mention there is no clear reason for another national currency to displace the US dollar as the world’s primary reserve currency.

Inflation, money printing, and endless deficit spending aside, the US dollar works for what it was intended to do: lubricate global trade and financial markets with deep enough liquidity.

With all of this in mind, today we beg the question: will the real dollar replacement please stand up? We were moved to write this piece off the back of Michael Pettis' recent Twitter thread outlining the misguided idea of a collapsing dollar:

Dedollarization? Actually, more like redollarization.

We can gauge the appetite for dedollarization by observing foreign holdings of US Treasuries across countries’ foreign exchange reserves. FX reserves are assets denominated in another currency that are held by a central bank. They’re utilized for several things—namely, FX defense in the event of currency devaluation and global trade.

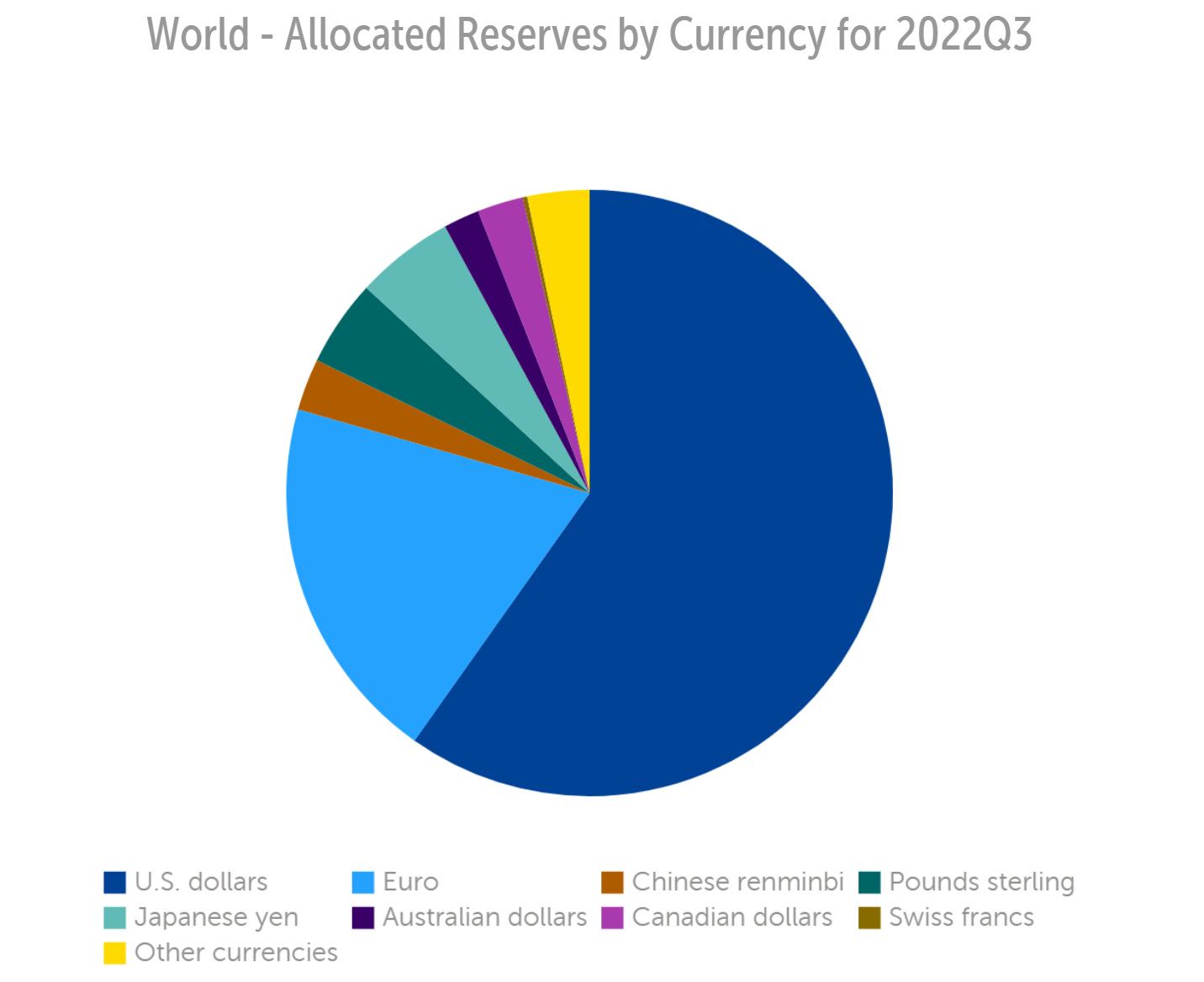

The US dollar and dollar assets such as US Treasuries compose the majority of global FX reserves because most global trade is conducted in US dollars. FX reserves are used to back liabilities on the balance sheets of global central banks, making US Treasuries the deepest, most liquid market for collateral in the world. They, along with other US dollar instruments, are integral to global financial plumbing:

Russia is one of two major adversarial nations working to circumnavigate US dollar hegemony—wanting to break from needing to use the US dollar for international trade. In 2018, it sold virtually all of its US Treasuries and has been steadily accumulating gold in lieu of them:

In hindsight, this was a wise decision, as it cushioned the blow that Russia sustained from the economic sanctions imposed by Western nations, whereby it was cut off from the SWIFT interbank settlement network, and its FX reserves held abroad were seized. That’s a total of $594.6 billion in assets, completely frozen by the West:

However, they still have 16.4% of their FX reserves in dollar-denominated assets as of the most recent data set from the Central Bank of Russia:

That’s right, despite owning virtually no USTs, Russia still holds 16.4% of its portfolio, some ~$97.4 billion, in dollars and corporate dollar-denominated bonds. In Russia’s pursuit to insulate itself from the power wielded by the US through selling its US Treasuries, it quickly realized that in order to sell what it produces and purchase what it needs, dollars are an absolute necessity. It’s a tall order to stop using the world’s primary settlement currency when you’re the only one abstaining from it—therein lies the problem for other nations who are attempting to do the same.

China’s central bank has the world’s largest foreign exchange reserve at a staggering $3.127 trillion, compared to the US at $247 billion. A substantial amount of liquid assets on hand is required to be one of the world’s largest centers for global trade:

Despite China’s slew of initiatives to break free from dollar hegemony, a substantial portion of those assets need to be, you guessed it, dollar-denominated. Still, China has managed to reduce its UST holdings from $1.2 trillion in 2018 to ~$870 billion today, as it continues building out a coalition of inter-dependent nations that trade in the Chinese yuan (also called renminbi), and gradually wane off of Western trade:

Eventually, China falls into much of the same trap that Russia has. Regardless of whether you’d like to deal in dollars, if you’re going to grow as a nation, you need to be utilizing the currency that is embedded throughout all of global finance. China’s position as the largest holder of FX reserves unintuitively makes it all the more reliant on the US dollar and its staying power for international trade. As emerging markets ignore the yuan-denominated dream of Beijing and continue accumulating Treasuries being sold by Russia and China, these two dollar adversaries are backing themselves into a worse position economically, narrowing their options for global trade.

Loose fiscal and monetary policy in the United States hasn’t created an exorbitant loss of faith in the dollar and mass exodus from the dollar capital markets. To the contrary, there has been no dedollarization. This is reflected in the world currency composition of FX reserves:

All of Russia and China’s net selling of US Treasuries and other dollar-denominated assets has been met with a welcome bid from other major sovereigns and emerging markets who are aware of the unspoken rules of the game. Here’s a simpler visual of the same data—the proportion of FX reserves that are US dollars is practically flat across the past 25 years:

The dedollarization trend has swiftly reversed into redollarization.

China and Saudi Arabia’s everpresent trade surpluses year after year do not matter. Other nations will buy goods, services, and commodities from suppliers, regardless of domicile, in US dollars, which means nations must hold US dollars and be an active participant in the dollar capital markets to play the game. Whether we like it or not, we live in US dollar hegemony.

Proponents of the dollar's demise point most recently to Xi Jinping’s visits to Saudi Arabia, and talks of purchasing oil and paying for it with the renminbi.

With China being the world’s largest oil importer, this seems like the most substantial news of the 21st century—and while it’s not nothing, the notion of imminent displacement of the petrodollar is misplaced. Both nations run current account surpluses and would continue purchasing securities from the United States and other current-account-deficit countries for the global balance of payments to balance.

Proponents of dedollarization will also point to Russia’s move to accept yuan for oil as cannon fodder for the petroyuan, but this is disingenuous as it was less likely voluntary and more likely bred out of a state of necessity. As all of the Western world ceased purchase of Russian crude following its invasion of Ukraine—this means Russia is not at all in the driver’s seat in this trade deal. It just needed to sell its oil, and China was willing to purchase it at a discount. The move to accept yuan for oil was out of economic necessity; it should not be taken as a sign of the shifting tide towards the yuan as a US dollar replacement. In reality, the yuan accounts for a measly 2.88% of global FX reserves, which is not deep and liquid enough to settle a fraction of global trade that the US dollar settles every single day. Nations simply won’t drop everything and shift gears into another currency that is barely liquid to sustain daily global trade volumes without wild volatility. Not to mention, the yuan is not a fully convertible currency—it doesn’t trade freely as the Chinese government restricts yuan activity.

The dollar replacement Mexican standoff

Adversarial relationships between countries that want to take the dollar’s place are a major hurdle when making the case for a “new” world reserve currency.

The BRICS alliance between Brazil, Russia, India, China, and South Africa is the cited attempt at a coalition trying to bring about a new monetary order—for now, this seems like a premature conclusion to draw. In its present form, BRICS is an ant-farm-like form of globalization, created by China to test the global appetite among similarly-minded nations in growth mode, hypothesizing how far from the USD they can stray without detracting from their economic futures. This is a several-country Mexican standoff, where there is no clear strategy for an individual country to achieve victory over USD in the absence of cooperation.

Every major international currency throughout history has been issued by a political democracy of some kind—a basket of currencies backed by commodities, in our view, is not a suitable replacement using history as our judge. Nor are the ruble and renminbi, due to their issuers’ stringent capital controls. Note that The Bitcoin Layer views bitcoin as a sensible alternative that will achieve adoption as an international settlement rail over the next decades—over $8 trillion was processed by the bitcoin network in 2022.

Any dollar replacement must also be large and liquid enough that its daily fluctuations during trade settlement are not disruptive to the issuing nation's economic activity, else the issuing nation will begin to back away from the role. Today, the US dollar is the only currency that fits the bill: relaxed capital controls, a persistent current account deficit, and a large-enough liquidity profile to weather volatility storms while keeping critical financial plumbing intact.

The dollar is entrenched, and as the world decentralizes it will become more, not less entrenched. Due to the adversarial dynamic we describe, no nation will accept another's small and relatively illiquid currency because it narrows the options available in US dollar financial markets. The dollar remains the default, as it’s likely perceived as neutral in a decentralizing world. Additionally, the notion that a group of countries, all of whom have different interests, can displace the dollar's position is a stretch. A unique set of circumstances, unlikely to be replicated again, has created its hegemonic position in the spaghetti of global finance. The dollar is here to stay.

Liquidity is what makes a world reserve currency viable

Both Russia and China are purchasing gold for their reserves to bolster the perception of their currencies and attract capital into their financial markets—but they are barking up the wrong tree. An efficient medium of exchange does not have to be the world’s greatest store of value—the dollar fluctuates wildly within a range relative to other currencies, and its spot as the world’s main medium of exchange is unchanged.

What matters most is liquidity—China’s renminbi has none of that. Its measly 2.37% of global trade settlement pales in comparison to the 40% of global payments settled by the US dollar:

The dollar is king expressly because it attracted global liquidity at the Bretton Woods agreement, which came after the great global monetary reset that was World War II. No amount of gold backing or non-dollar trade networks will change the reality of the dollar’s unmatched depth of liquidity—unless we experience the complete abandonment of all existing financial plumbing, it’s here to stay. The dollar genie is not only out of the bottle, it’s spent the last 79 years developing a complex global network that relies upon it for daily functioning—this simply can’t be displaced by unplugging the USD cartridge and replacing it with the CNY one.

Where the dollar has achieved the most liquid market for collateral in the world, the CNY and RUB appear in less than 4% of global FX reserves. Where the United States’ open capital account attracts all the world’s talent, China’s closed capital account and Russia’s minimal growth prospects aren’t roping in the same capital allocators. The hamster wheel of dollar dominance keeps spinning for now.

Until next time,

Nik & Joe

The Bitcoin Layer does not provide investment advice.

Good note, absolutely agree. I'd be interested to know where you get your figure of US$8 trillion transacted over the Bitcoin network in 2022. We've been measuring the data at ByteTree.com since 2014 and have the number at around US$1.3 trillion...