S&P 500 All-Time High Monthly Close, All Eyes on August Labor Report: TBL Weekly #108

Rate cuts are right around the corner, now it's on the labor market to stay intact

Welcome to TBL Weekly #108—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Good morning TBL Readers, happy Saturday ☕

Labor Day weekend is here, and Tuesday will be a return to the desk for most of Wall Street who spent their summer relaxing on a beach somewhere with no screens or charts in sight.

As “sell in May and go away” gives way to more active management in the fall, let’s take a look at where markets are at as we head into the final month of Q3.

First things first: this week was filled with strong economic data all across the board.

GDP for Q2 was revised up from 2.8% to 3.0%

Personal Consumption for Q2 was revised up from 2.2% to 2.9%

Personal Income in July accelerated from 0.2% to 0.3%

Personal Spending in July accelerated from 0.3% to 0.5%

Core PCE remained flat at 0.2% MoM and 2.6% YoY, missing expectations

GDP was revised higher. Consumer-focused data strengthened. Core PCE is stagnant.

For the Fed, this was a full week of economic data that strengthened its conviction that now is the perfect time to cut. Disinflation has been persistent and is now stagnant and declining near its long-run targets, economic growth is still very strong, and consumers are remaining resilient.

Next Thursday’s labor report should seal the deal on a 25-bps maintenance rate cut if it confirms that the labor market is slowing moderately. The expectation is for UNR to fall from 4.3% to 4.2%, for 165k job gains to NFP, and for average hourly earnings to rise. If next week’s labor report comes in as expected, market expectations for the Fed’s September FOMC move are locked in at a 25 basis point cut:

Markets love certainty—it’s one of the reasons that Jerome Powell has managed to steer the US economic ship so effectively this time around, something he was on the way to doing in 2019 before a COVID-sized iceberg sank his chances.

Jerome Powell literally said that he won’t accept any further cooling in the labor market. If next week’s August labor report is cooler than expected, markets may price in a larger 50-bps rate cut based on Powell’s no-tolerance comments, which would likely spook markets. A miss next week and an increase in Fed rate cut expectations would go alongside it, which would mean this cutting cycle narrative goes from maintenance rate cuts administered by a Fed in control to emergency rate cuts administered by a Fed that is losing control.

Markets love one and hate the other—just look at the 12.9% gain in the S&P 500 during the 2019 cutting cycle compared to the 33% crash after COVID cuts:

The risk of persistent inflation is gone and the risk of recession is here and rising. The Fed has plenty of room to respond, and they’ll be quick to do it if we see UNR print anything hotter than 4.2% or 4.3% next Friday:

Continuing jobless claims also stayed flat at ~1.864 million last week, an encouraging sign that next week’s unemployment rate will be similarly muted, likely falling in-line with expectations and giving the Fed all the confidence it needs to cut rates in its planned 25-bps increments and nothing more.

Switching over to rates, yields have corrected higher as of late after touching local bottoms. Tens will probably get back closer to 4% before the rally resumes as growth and inflation moderate, and the Fed cuts rates down to the currently priced level of 3.5%. A good unemployment report next week will likely be a good short-term catalyst for 10s to continue the current move higher:

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your crypto assets and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

The S&P 500 has logged its highest monthly close of all time, which has been the case for most of the months this year. It has been an undeniable bull market, and rate cuts on the way will support the current looseness of financial conditions and let the bull market continue to rage on, ceteris paribus:

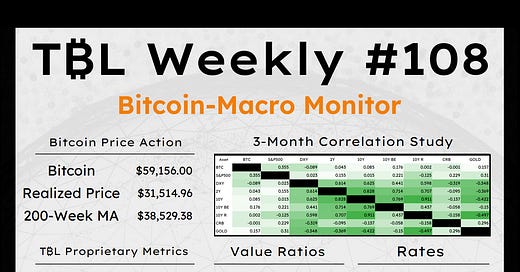

Bitcoin has been extremely rangebound in choppy consolidation for the entire summer, bouncing off of and most recently underneath the $60,000 level. We expect monetary easing after more than 2 years of tightening to be a catalyst that will help drive BTC back to and through new all-time highs, but that move will have to wait until momentum arrives above $70,000. We can’t see any yet:

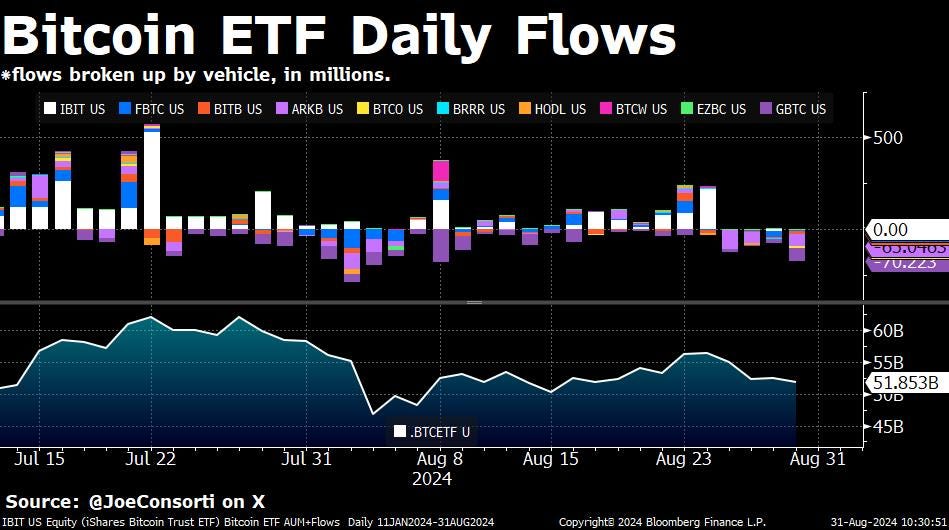

If you’re afraid of the Fed cutting rates, Larry Fink and his clients at BlackRock certainly aren’t. Inflows into the IBIT spot bitcoin ETF persisted last week despite nonexistent price action, with BlackRock scooping up over $200 million in BTC by Friday. ETF investors are looking ahead at what’s to come with monetary policy and the return to action after the May-September slump:

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Next Week with Nik

In the week ahead, we receive all the relevant data needed before the next Fed decision. While all eyes, including our own, will be on Friday’s unemployment report, Tuesday’s and Thursday’s ISM releases will also inform us as to what’s happening under the hood of the economy. Remember that two forces are battling—expectations of a hard landing rise, while the spot economy remains robust. That robustness should keep the recession trade and 3% Treasury yields at a distance, unless the data mandates it. And that is precisely what investors are looking for: data that spells doom.

ISM manufacturing, especially the employment subcomponent, is crucial to our outlook, as is its cousins within ISM services on Thursday. Wednesday brings us JOLTS, another opportunity to capture any labor market weakness. Friday the unemployment rate is expected to come back at 4.2%, but variance should send yields higher and risk lower if we see 4.1% and the opposite if we see 4.3% or higher. Our current expectation is that the economy is strong enough to put off recession worries until perhaps 2025 at this point, disrupting the imminent recession narrative and thereby the associated trades.

What we’ll watch for the rest of the year is how the Fed’s balance sheet is managed, and if there is some catalyst to get balance sheet growth back into the mix, especially with deficit growth expected to remain strong. Somebody is going to have to finance all of this debt, but TBL readers also understand that all of the debt, despite ultimately finding a buyer, must be digested. That requires primary dealers, and eventually, central banks with their best John Stockton impression. Got bitcoin? Actually, you probably already do. We hope.

If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik is joined by financial markets trader Craig Shapiro to discuss the monumental shift in tone from Fed Chair Jerome Powell at last week's Jackson Hole central banker conference. Craig Shares with us a snapshot of his portfolio and describes the changes he made after hearing Powell's dovish rhetoric. Watch to find out how he has positioned around the dollar, gold, and bitcoin.

Check out—Rate Cuts Are Here: Here's What My Portfolio Looks Like

With the Fed’s clear stance on unemployment after Jackson Hole last week, investors eagerly await more employment data for further signs of cooling in the labor market. We have not only expanded our Bitcoin section with some additional on-chain data, but we also added some new information in our Return Analysis section in this week’s edition of Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. Don’t forget to register for our next Virtual Q&A, scheduled for Thursday, September 19th—link for September’s Zoom and August’s recording are below.

Tuesday

In this video, Joe gives an update on the slow and painful death of Ethereum. He walks through the ETH/BTC pair dropping below the critical 0.05 level, and explains that the downside target is zero over the next several years. With the narratives of ETH all dried up, it and other "crypto" are dying on the vine. The cherry on top is a $100-million sale of ETH from the Ethereum Foundation, a vote from the creators themselves that this is an asset on life support with a value prop that has been completely overtaken by Bitcoin.

Check out—The Slow & Painful Death of Ethereum

Thursday

Our new and evolving TBL Liquidity has fascinated you—we can tell by your follow up questions, inquiries, and suggestions. First and foremost, it demonstrates accuracy, bringing us to the theme of today’s letter: math. TBL Pros are math people, and nothing demonstrates this more than today’s reader-inspired breakdown. With so many constructs to liquidity—he easily and quickly rattles off fifteen—how do we weigh each? It also could be the most prized question we’ve ever received from a reader, considering it correctly pinpoints our 2024 research theme of multifaceted liquidity and simultaneously challenges the mathematical weighting of each seemingly relevant contributing metric. Bravo, Orfeo!

In this episode, Nik is joined by Amboss founder Jesse Shrader to discuss his Lightning Network company and the evolution of bitcoin's second layer. Jesse presents fascinating statistics about the usage of LN, discusses how node operators manage payment channels, and explains LN's tradeoffs & relationship with bitcoin's blockchain. Nik and Jesse unveil how the evolution of LN contributes to bitcoin as a global monetary network.

Check out—Lightning Network: The Economics of Bitcoin's Global Payment Rails

Friday

In this episode, Nik brings us a timely global macro update on Treasury yields, the dollar, and what might happen in financial markets in September. He breaks down the latest path of global central bank rates, including his expectation for rate cuts at every meeting this year. Finally, Nik analyzes the bitcoin consolidation and dives into the math behind TBL Liquidity, our new metric for market signal.

Check out—Global Macro Update: How Soon Is A Recession Coming?

It’s Thinking Time! This week we cover unemployment in Asia, the demise of the business district, and Hilton’s expansion plans in China.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.