SBF Feigns Ignorance After Defrauding Customers Of Billions: TBL Weekly #68

Just when you thought there wasn't enough humor in markets, Sam Bankman-Fried acts out an episode of Seinfeld in the courtroom.

Welcome to TBL Weekly #68—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Let’s kick things off with a little bit of light humor.

The trial of Sam Bankman-Fried, soon to be Sam Bankman-Jailed, is underway in New York City—and yesterday, Sam dropped this gem of a remark:

That’s right, the biggest financial fraudster since Bernie Madoff is feigning ignorance about fraudulently misappropriating customers’ funds to manipulate markets, donate to politicians, and purchase expensive estates for himself and his family. Could he be telling the truth? Was he a patsy? An aloof CEO playing the front to the real criminal? Probably not, but who knows.

Even though he has to defend himself, making what he said almost an inevitability, it is so gratifying to finally see it in real-time. We are witnessing one big blame game in which it’s nobody’s fault—a fascinating window into the lack of integrity in the “crypto” world. We expect nothing less from a den of thieves.

As SBF flails like a cockroach in court, bitcoin has exploded above all of its moving averages and touched $35,000 for the first time in 17 months. Admit it, you let out a sigh of relief, a sigh of “at long last” as bitcoin finally escaped the tumult of the 6-month crab market and almost 2-year downtrend. People are frontrunning the flows of a spot ETF whose sun is peaking up over the horizon. All that’s left is filibustering and running out the clock from the SEC, and then it’ll be here. Only a matter of time now:

Shifting gears to markets, the week was jam-packed with strong headline economic data, with the expected rot underneath the surface.

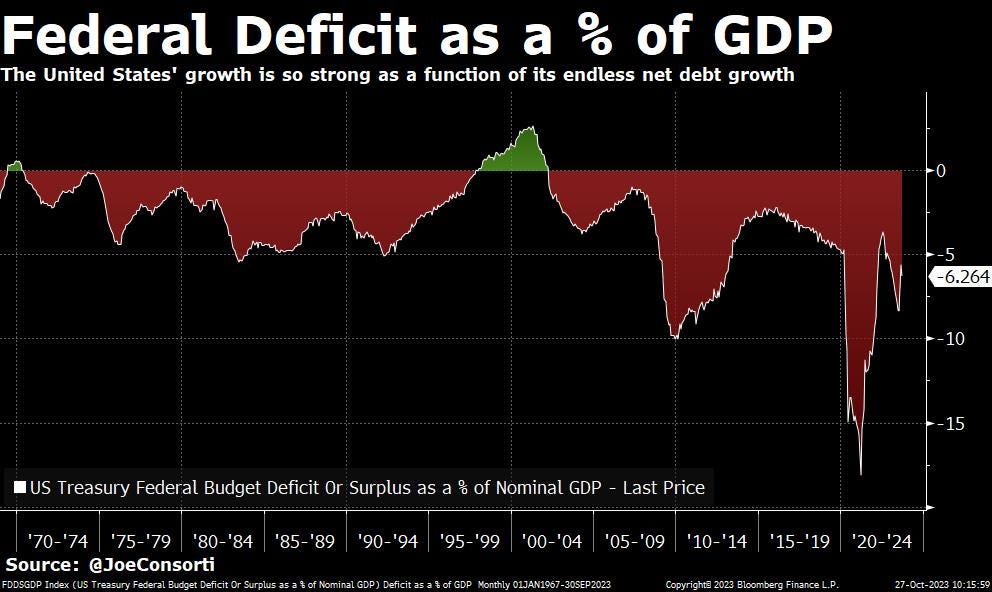

GDP topped 4% but is continually negative relative to our fiscal deficit. For the past four decades, the United States hasn’t made more than it has spent; despite this, headline growth metrics always tout the strength, resilience, and growth of economic activity while always disregarding the debt-fueled manner that we used to achieve it.

As for the Fed, Powell will continue marching forward as GDP remains nominally positive and unemployment continues to build pressure underwater. As perpetual fiscal deficits get deeper and the people who perpetrate them don’t care because they won’t be here in 20 years, it is more important than ever to illustrate that the US is playing a lazy, dangerous game for the young people who will have to deal with this down the line:

Personal income rose 0.3% in the month of September while personal spending eclipsed it and rose 0.7%—symptomatic of the buy-now-pay-later paradigm that has subsumed the American collective conscience. Does historically low unemployment matter if people are funding their lives on a perpetually expanding revolving line of credit? We don’t think so:

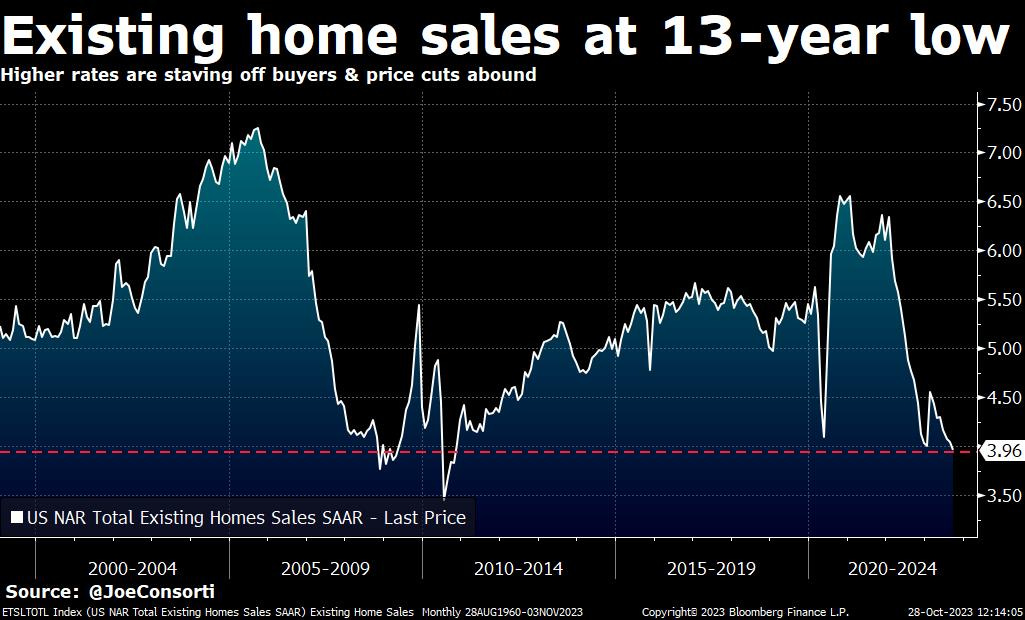

Existing home sales are at a 13-year low as the highest mortgage rates in decades are locking new buyers out and keeping homeowners from moving:

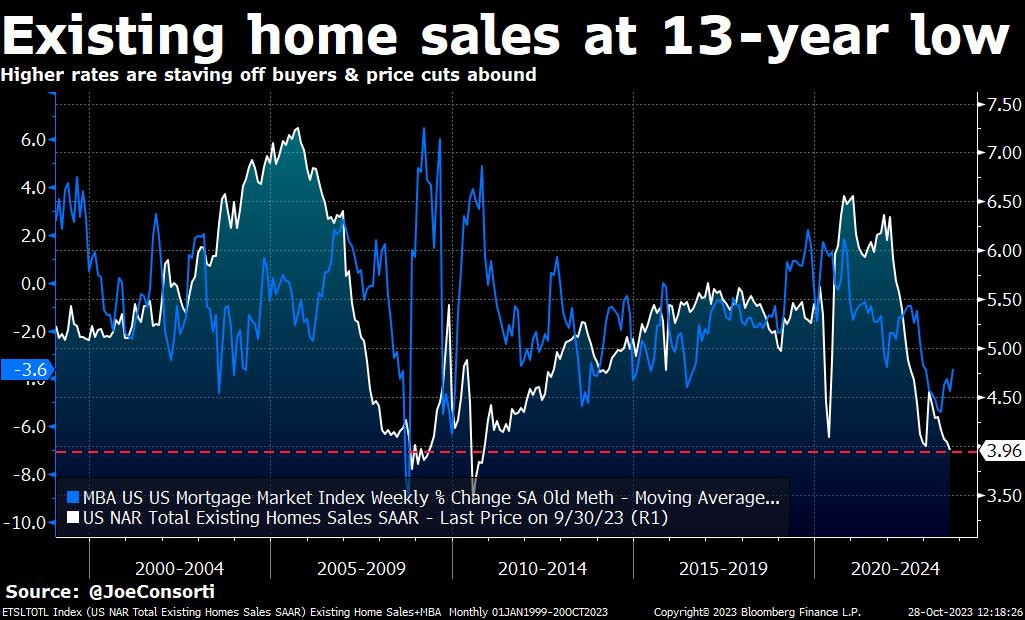

Overlaying a moving average of MBA Mortgage Applications (Blue) on top of existing home sales, and it’s obvious that a negative trend in borrower demand is correlating strongly with falling sales—new mortgage applicants continue to stumble and fall, as 8% national average 30-year mortgage rates are doing their thing:

M2 US dollar money supply just logged its 10th straight month of contraction at -3.6% in September. The longest period of money supply contraction since 1933 continues to get longer:

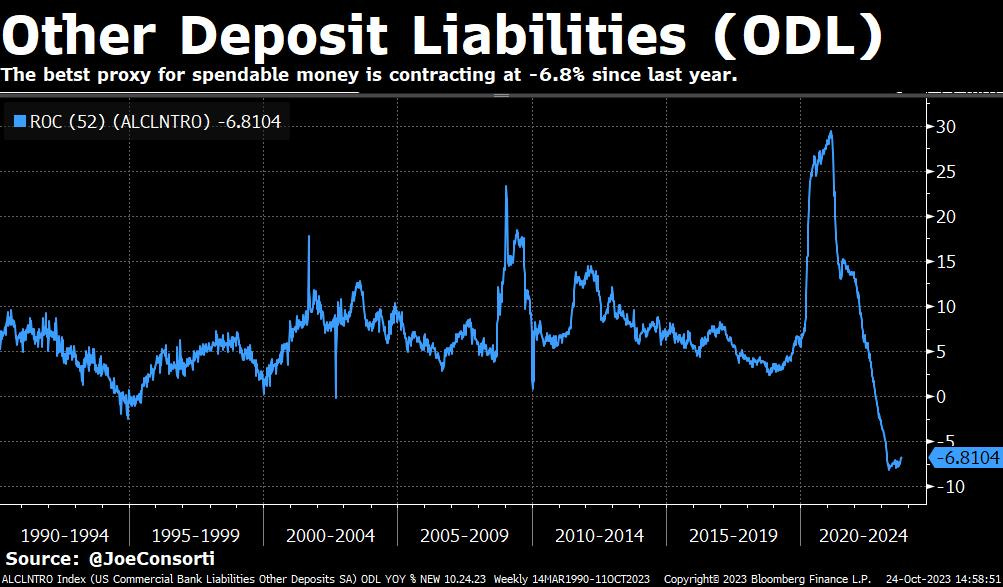

Spendable money, as measured by Other Deposit Liabilities (ODL), has contracted by 6.8% since last year, another huge boon for disinflation:

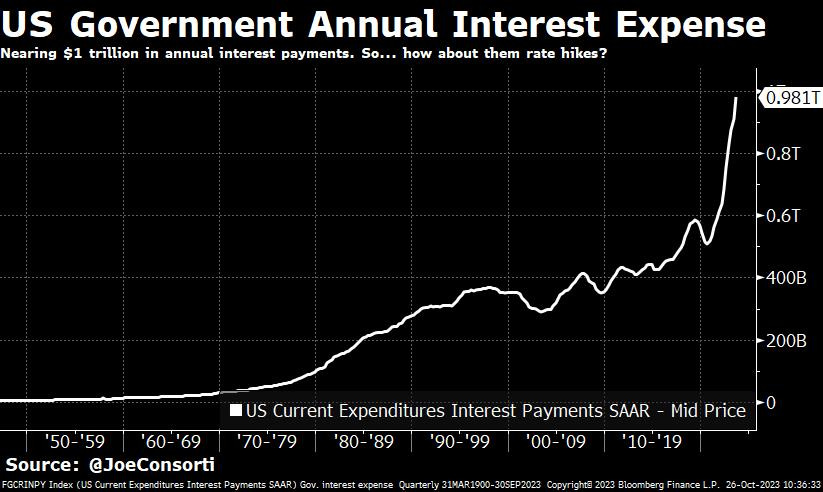

The US' annual interest expense just hit $981 billion and will be over $1 trillion any second now.

As the Fed hikes its policy rates to try and reign in consumer demand, it nominally bankrupts the US government in the process. As tax receipts weaken, interest payments will be increasingly funded with more debt issuance—primarily with bills on the front end maturing 12 months and sooner, a staple for Treasury funding needs.

This train has no brakes.

The people in charge don’t intend to cut back on fiscal spending or downsize the government. Solutions only come in the form of creating new and unique ways to steal from the American people explicitly with taxes and tacitly with new money creation—thank God for bitcoin:

Next Week

In the week ahead, economic data arrives every day to round out October and begin the holiday season.

We get August’s home price data on Tuesday which will help us make heads or tails of the slowdown in US housing, a proxy for the wider slowdown in the US economy. On Wednesday we receive a slew of data—from PMIs to mortgage applications and employment change data, but the most important yet most expected data of all is the FOMC rate decision, where the Fed is expected to stay put at 5.5% for the month of October.

We also have our eye on more employment data releasing on Thursday and Friday, with more preliminary and final PMI data on Friday to round out one of the busiest economic data weeks in recent memory. There’s surely going to be plenty of action next week as traders look to trade around the outcome of each of these data releases—buckle up! You know we’ll be covering it every step of the way, and don’t miss our LIVE coverage of Wednesday’s FOMC meeting on X.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

Be honest. Be completely honest. You had fun last night. And when bitcoin prices hit their highest level in almost two years, there’s no shame in your game. As news that Blackrock’s bitcoin ETF ticker has been readied by the custodial authorities hit the tape, bitcoin’s embedded rocket fuel met traders’ matches Monday evening. We weren’t fully distracted by the dramatic albeit typical price action, however, as Treasuries show us signs of a bottom, stocks continue to lose steam, and the Fed gets backed into a corner by the rates market. You won’t want to miss this crucial chart pack, including a screaming rates signal hiding in plain sight.

Check out—Bitcoin up 100% in 2023

Wednesday

In this episode, Nik provides an update across bitcoin and financial markets, including bitcoin's strong price increase over the past week. He discusses bitcoin outpacing Ethereum as of late, compares bitcoin's returns to other asset classes, and explains the risks facing bitcoin amidst the optimism surrounding an ETF approval.

Check out—Bitcoin Up 100% IN 2023 On ETF Hopes

Thursday

On Wednesday during trading hours, we found ourselves shouting at our Bloomberg Terminal screens at several stock tickers throughout the day. While, in a vacuum, this may be a one-way ticket to the local psych ward, we were simply in awe of the awful day that many key regional bank names, consumer-facing lenders, and stock indices were experiencing. Isolated sector weakness is nothing special—but stratified weakness across the stock market typically lines up with a significant turning point in the market cycle.

Let’s break it all down and unpack the implications in 5-minutes or less.

Check out—Stocks Are Slipping As Rate Hikes Do Their Magic: 5-Minute Market Rundown

Friday

Do you think the US economy is growing at 4.9% quarterly? I've got a bridge to sell you. In this video, Joe debunks the headline data regarding a strong and resilient US economy and unpacks the unsustainable fiscal path that has fueled this disingenuous data for several decades.

Check out—The US Economy Is (Not) Growing & Resilient

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.