Silicon Valley Bank collapses in the second-largest bank failure in US history

The Fed's aggressive rate hikes and balance sheet reduction have caused a historic bank failure — fashioning a real-time ad for Bitcoin self custody.

Dear readers,

Something finally broke. As the Fed’s aggressive tightening campaign wears on, the lagged transmission into tighter financial conditions has made a loud, destructive entrance in the form of the second-largest bank failure in United States history.

Silicon Valley Bank, the 18th largest bank in the nation, collapsed yesterday—with it, we learn how last year’s record selloff in US Treasuries has created billions of dollars worth of unrealized losses within the banking sector and gain yet another example that in a system of fractional reserve banking, there are no depositors, only lenders.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

Receive $10 off when you use promo code ‘BITCOINLAYER’

Silicon Valley Bank was the 18th largest bank in the United States yesterday before it collapsed. On Tuesday, the bank announced a sizeable $1.8 billion loss from the sale of US Treasuries and MBS securities, both of which are highly rate-sensitive and were the victims of 2022’s aggressive rate hikes. That same day, the bank’s holding company announced a capital raise; in response to the news of the loss and subsequent raise, investors started walking towards the exits, eventually snowballing into a mad dash for safety. Despite being in sound financial condition the day before, SVB faced a bank run. The fear among depositors reached a fever pitch, with a total deposit call on Wednesday of $42 billion—about a quarter of its $173 billion deposit base:

With a reported $212 billion in assets as of the fourth quarter of 2022, Silicon Valley Bank’s collapse is the second-largest bank failure in US history, second to Washington Mutual, which fell in 2008 failure at $300 billion in assets.

Its colossal size is made more surprising by the unexpected nature of the failure, and the seemingly instant speed with which solvency turned into insolvency and FDIC takeover. So, how did that happen?

Gargantuan interest rate risk, and no hedges in place

Holding high-quality collateral and maintaining an ample supply of it were hallmarks of the post-2008 bank regulatory overhaul—for their unmatched safety and deep liquidity, US Treasuries are the collateral of choice for financial institutions. A key consideration when holding assets of any kind is duration risk, or how an asset’s value will change as interest rates change. Long-duration assets offer asymmetric returns during falling interest rate regimes, but when rates rise sharply as was the case throughout 2022, the losses can be astronomical.

US Treasuries are no exception. The long end of the curve got hammered last year, suffering its worst total return losses in over 50 years—not great news for these financial institutions that are now stuffed to the gills with this pristine collateral. The collateral is still pristine, but the price is far from par.

As for Silicon Valley Bank, it certainly falls into the stuffed-to-the-gills category, with a large $120 billion securities portfolio relative to its balance sheet, $91 billion of which was comprised of long-duration assets like long-end US Treasuries and commercial mortgage-backed securities:

Over $90 billion of these securities were a combination of long-end US Treasuries and residential MBS. According to SVB, these hold-to-maturity securities had a duration of 6.2 years, meaning that for every 1% move higher in interest rates, it was losing $5.66 billion. Given that rates rose 450 basis points last year, Silicon Valley Bank lost a staggering $25.47 billion mark-to-market on interest rate risk alone.

Post-GFC reserve requirements outline that banks must hold a significant portion of their assets in safe collateral like US Treasuries. It’s not that SVB wasn’t well capitalized, it was well-capitalized with long-duration US Treasuries, which had one of their worst years ever in 2022. Eating those losses created the need to raise equity, which triggered the bank run that ultimately led to its swift collapse and takeover by the FDIC.

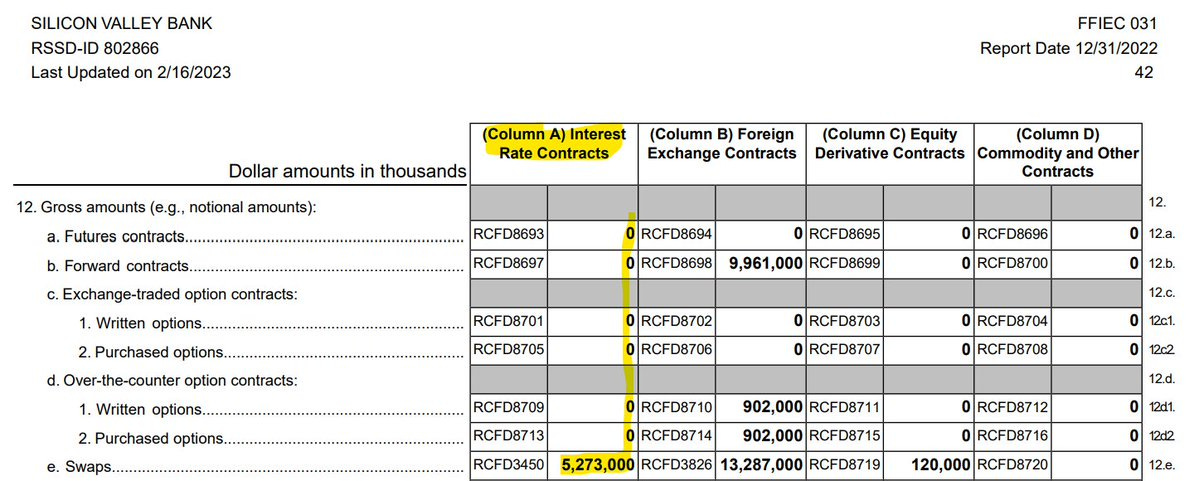

Despite the $120 billion in securities and $91 billion in long-duration Treasuries and MBS, Silicon Valley Bank had virtually no hedges in place for interest rate risk. No futures, no forward rate agreements, no interest rate swaps, and no swaptions—a baffling display of poor risk management:

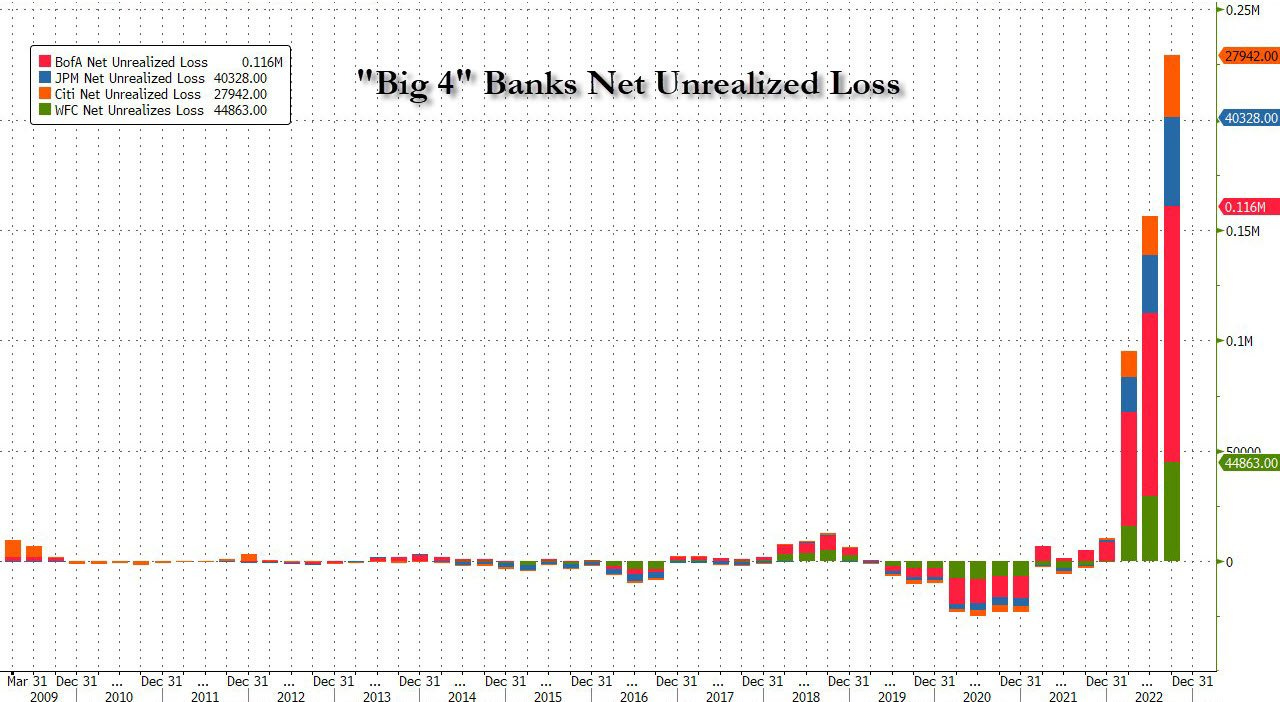

Long-duration assets were hammered last year, and now the financial institutions that have made them a staple on their balance sheets are holding enormous mark-to-market unrealized losses on their books. Tech-exposed banks like Silicon Valley Bank whose assets are poorly diversified are bleeding, but they're not the only ones:

Not only are banks contending with billion-dollar mark-to-market losses from duration risk, but they also face an exodus of depositors. In the VC space, from which SVB derives much of its deposit base, business has slowed down to a crawl. This deposit crunch was especially exacerbated for SVB because of this. When it comes down to deciding between deposit accounts yielding 0.05% or front-end Treasuries yielding 4% or more, it’s no contest; the flight to safety for higher-yielding instruments has played a factor in this deposit exodus and will continue until banks raise their deposit rates to stem the bleeding.

We are now entering the ‘Downturn’ phase of the credit cycle. This can be categorized by rising funding stress, rapidly failing asset prices, and ultimately defaults as borrowers are no longer able to repay lenders.

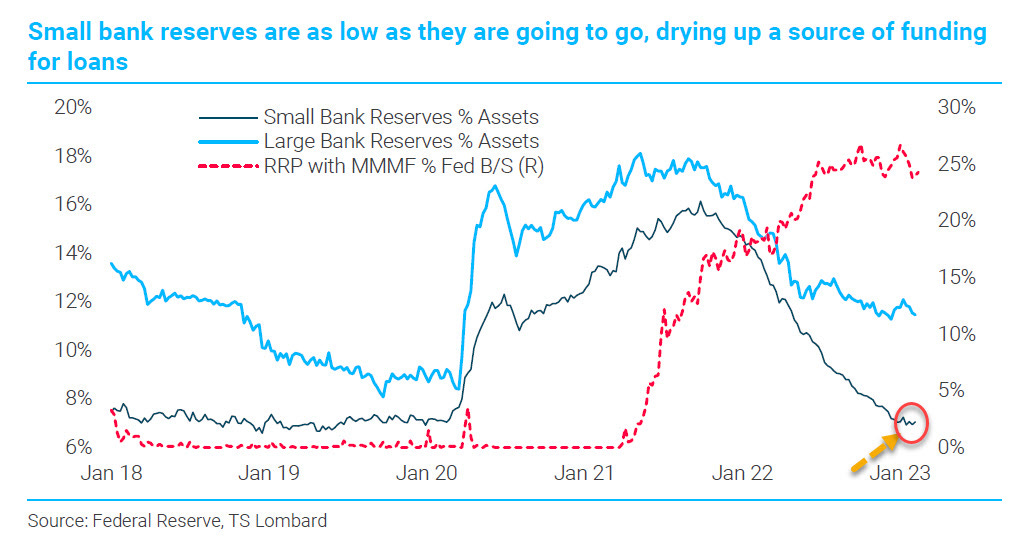

Quantitative Tightening is winding down bank reserves at a snail’s pace for large banks, but at an exceedingly fast pace for smaller banks. Small banks’ reserves have dried up to a level where funding stress is emerging and new deals aren’t being made with smaller banks that don’t have this critical interbank liquidity to service it:

Other distressed and at-risk banks include —

Silvergate Bank, a prominent crypto-adjacent bank which has already begun voluntary liquidation.

Signature Bank, another crypto-friendly bank that provides the 24/7 Signet blockchain-USD settlement service.

First Republic Bank & Western Alliance Bank, two other large regional banks which have accumulated large unrealized losses and face the same basket of risks as SVB—both fell more than 14% on Friday and are being heavily shorted.

Regional banks across the board are fickle, and any losses from exposure to SVB or its impacted counterparties will be tougher to stomach for these banks with smaller balance sheets.

As if turmoil in legacy finance wasn’t enough, the contagion has already seeped into the stablecoin ecosystem. The issuer of the second-most liquid USD stablecoin USDC, Circle, unveiled it had 8.25% of its USDC reserves locked at Silicon Valley Bank—this $3.3 billion locked at the bank far exceeds the FDIC-insured limit of $250,000 per depositor. Unless Circle is able to recover the remaining reserves via a Fed-led bailout or some other means, it will have an 8.25% shortfall in reserves, losing its 1:1 asset backing and falling to a technical value of ~91.75¢ rather than $1.00 per USDC.

Following the news, Binance and Coinbase have announced a pause on conversions from USDC to dollars, causing USDC to break its peg and move as low as 97 cents:

UPDATE: USDC is trading as low as ~90¢. Danger zone!

Buyout, bailout, or let it fail?

In a callback for the ages, bankers and venture capitalists alike have begun crying foul at the Fed for their heinous crimes against financials, demanding a bailout for SVB and an immediate end to rate hikes and QT. Unfortunately for the upset billionaires, the FDIC only insures $250,000 per depositor, and over 97% of SVB’s depositors had well more than that limit—all of which is uninsured and in limbo as to whether it will ever be recovered. So will there be a Fed-led effort to cover those uninsured depositors and stave off a potential cascade of deleveraging between the loan counterparties of SVB?

It might, but it might not. You’ve got to remember, high-duration, low-yielding junk venture capital companies are the very type of thing the Fed would prefer to have destroyed in its fight against inflation. The Fed is fighting ZIRP-enabled excess, and Silicon Valley is at the pinnacle of poor capital allocation and cheaply-financed excess.

If the Fed were to bail out SVB, it would not be to save VC projects or the bank itself, but rather to prevent the ripple effects that could be wrought if certain key counterparties, i.e. major financial institutions, lose billions that they were owed by the now-shuttered bank. If SVB defaulting creates a wave of domino insolvencies that impact other regional banks all the way up to the Big 4, the Fed may establish an emergency facility—a practice not unfamiliar to the Fed—to put a pin in it before it spirals into a cascade of bank failures. The Fed may also step in and organize a leveraged buyout, like what happened when the Fed sweetened the pot for JP Morgan to buy Bear Stearns. A pause to rate hikes to allow the market to digest may be prudent—the Fed has broken something, the question is whether or not it views Silicon Valley Bank’s solvency as integral to the proper functioning of the banking sector.

The 14 years of ZIRP are over and done with. Powell is sending an abundantly clear message that the US dollar will have a positive real price for the foreseeable future, and those who can’t stomach non-zero rates are simply taken back behind the shed.

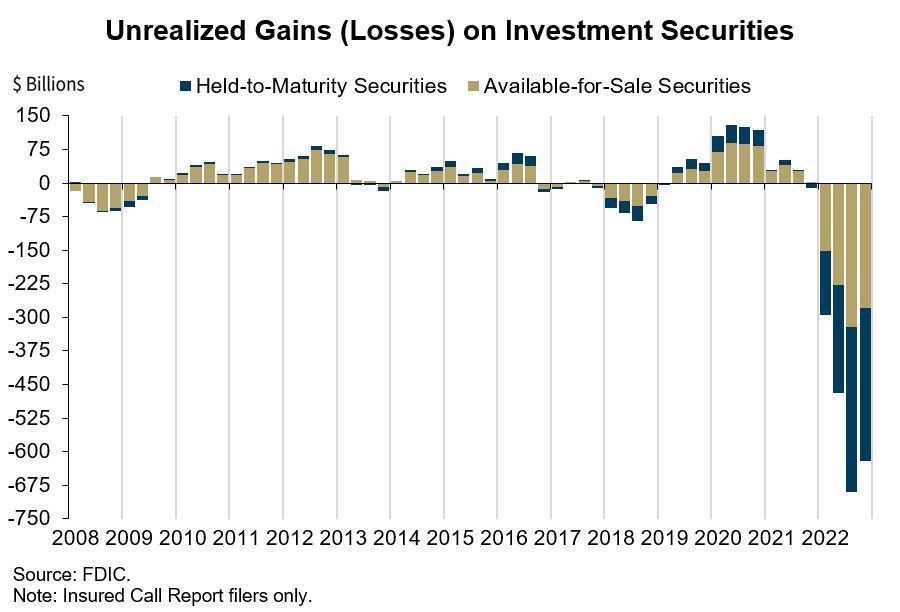

All told, the FDIC estimates there are roughly $600 billion in unrealized losses within the banking sector—what happens if depositors continue their exodus from banks, forcing them to realize these losses to redeem deposits?

The FDIC will only insure $250,000 per depositor, and its deposit insurance fund is only $128.2 billion in size; a fraction of the estimated unrealized losses currently held on bank balance sheets. Should these bank failures beget further bank failures, what is an ample now may soon be rapidly depleting—after all, the FDIC’s single reserve is smaller than the total amount of uninsured deposits left behind at SVB:

If it ever needs additional funds, the FDIC can borrow up to $500 billion from the US Treasury, an eyewatering figure and one that is wildly unnecessary at this moment in time.

Should confidence in institutions continue falling and triggering successive bank runs that drain the FDIC’s available resources, not unlike 2008, what options are left on the table other than the Fed resuming asset purchases from distressed banks, another round of Quantitative Easing? Well, there aren’t many. A targeted relief program doesn't seem too farfetched—the Bank of England was quick to respond overnight to its flash gilt crisis last September, and the Fed is well aware that acting quickly with its available tools is a necessity if its a choice between QE and plunging into another financial crisis. That said, we’re far off from using the words ‘financial’ and ‘crisis’ in the same sentence given how isolated SVB’s failure is (for now), but we will be on the lookout for any signs that the Fed is putting together an emergency facility of any kind, and for any rumblings of a buyout of SVB’s assets from another bank.

Bitcoin enables real wealth storage with ZERO counterparty risk

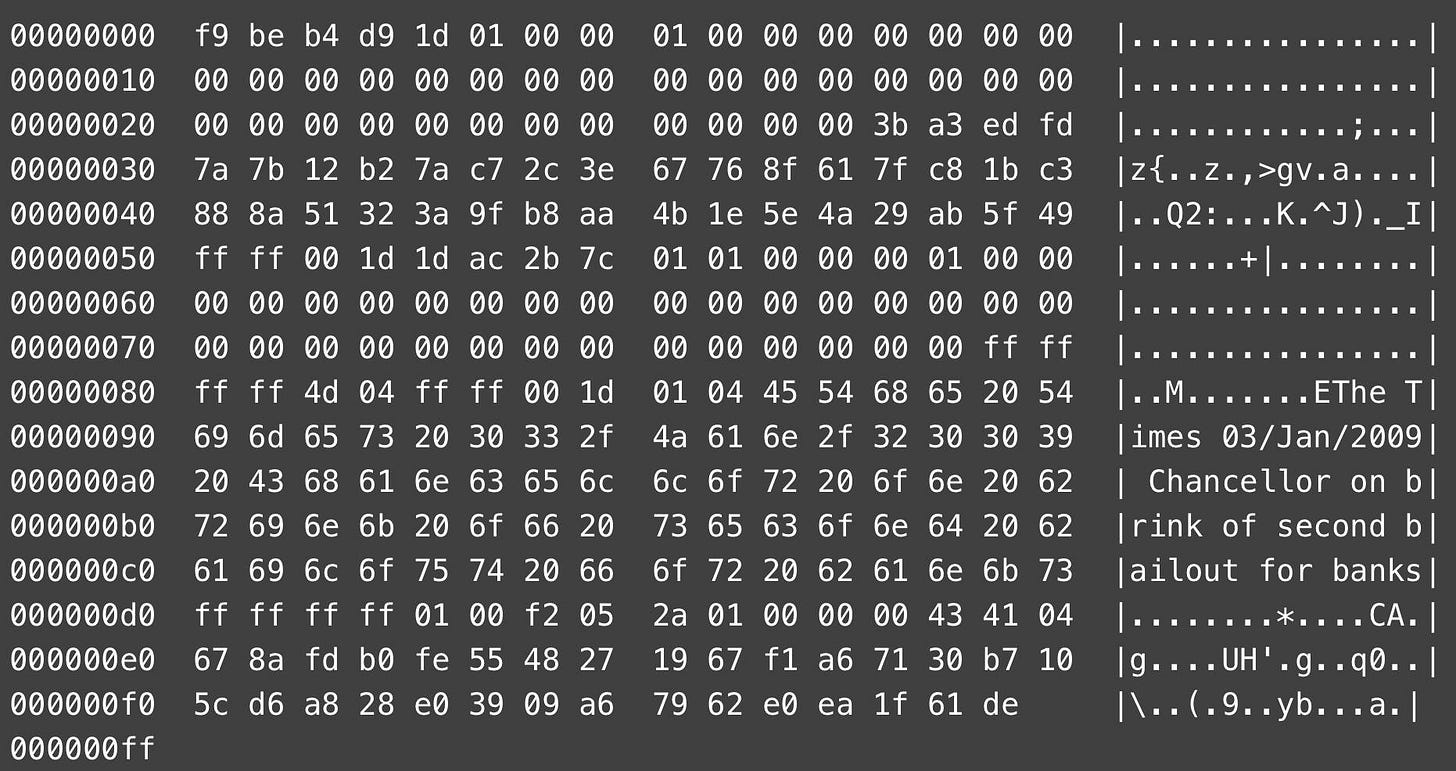

Depositors are creditors in a fractional reserve banking system—in other words, you’re lending the bank your money, not depositing it there. This reality has been made abundantly clear once again and was the bedrock upon which bitcoin was created. In the fresh aftermath of the Great Financial Crisis, an article from The Times titled ‘Chancellor on brink of second bailout for banks’ was inscribed into bitcoin’s genesis block on January 3rd, 2009.

Averting counterparty exposure is inherent to Bitcoin’s very DNA:

Two major US banks have failed in the past three days—one was the largest single bank failure since 2009, with several counterparties looking fragile and a wave of contagion and involuntary defaults set to potentially vaporize billions.

It's never been more apparent: money deposited in a bank is not your money.

Bitcoin enables you to circumvent banks and take direct ownership of your wealth. Solutions for storing your bitcoin in a sovereign manner, out of the grasp of centralized institutions, share the same exponential growth profile of bitcoin—each passing year, intuitive and user-friendly devices are brought to market and propel the mass adoption of bitcoin further along.

In 2023, there isn’t a device more seamless than the Passport by Foundation Devices. Not only does it have a familiar form factor, but its modern display and user interface make it understandable right out of the box—it’s a device you practically already know how to use. Not to mention it’s directly interoperable with your phone, so you’re circumventing the need to spend hours setting up a wallet on your computer, all without sacrificing on security.

Cold-storage Bitcoin solutions like Passport are proliferating with each passing day. As we’re about to witness the aftermath of the least expected bank failure ever, one many believed couldn’t happen in a post-2008 world, the importance of actually owning your wealth is abundantly clear, and bitcoin is the only way to do it.

Until next time,

Nik & Joe

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

Receive $10 off when you use promo code ‘BITCOINLAYER’

The Bitcoin Layer does not provide investment advice

Really good summary Joe! Crazy to see my day job (banking) and passion (bitcoin) colliding violently once again.

Is passport open source?