Soft landing? Yeah, about that...

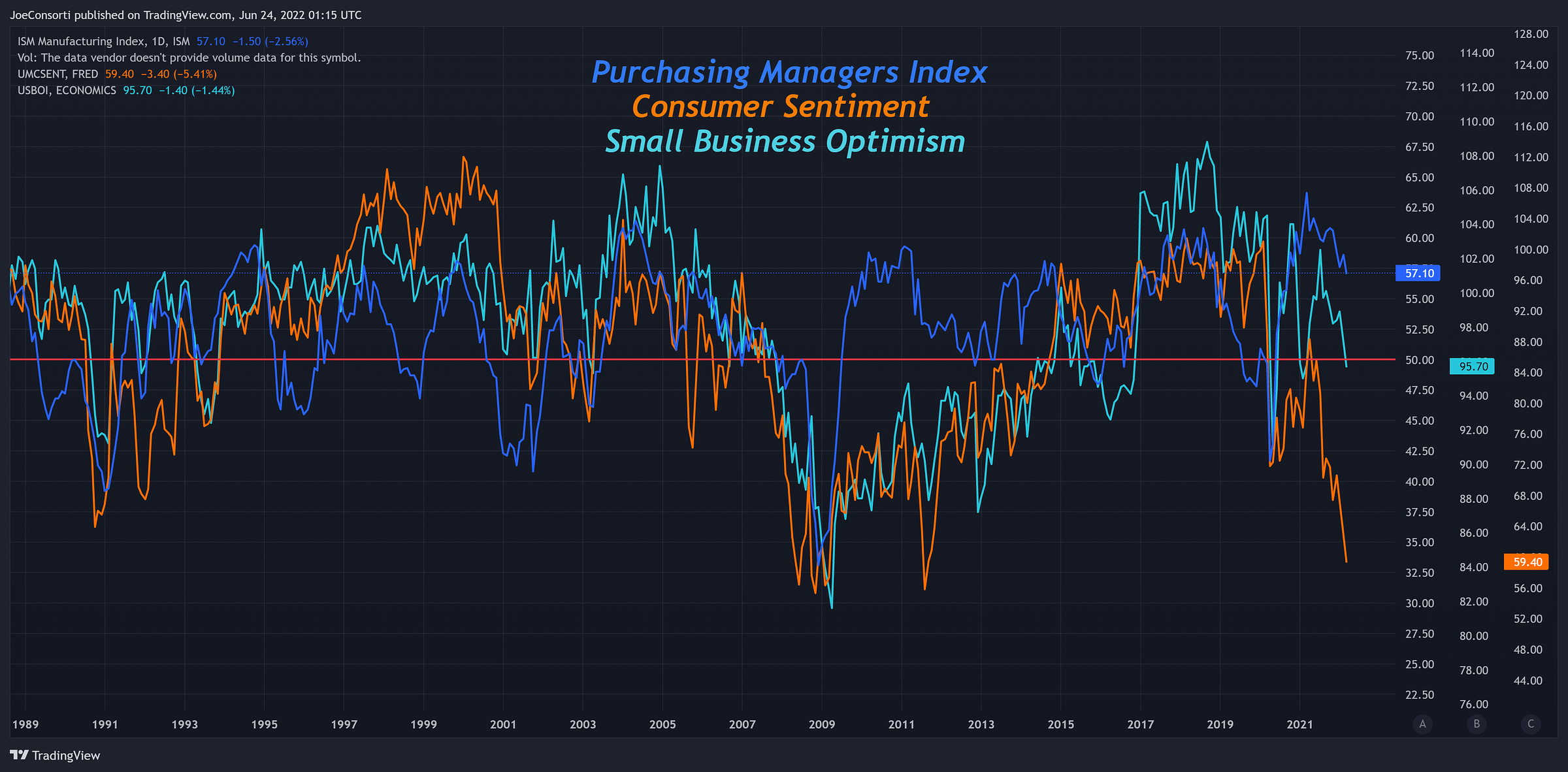

After a dismal PMI release, it's obvious the real economy is quickly slowing.

Dear managers,

How are you doing? No, literally, this is the question posed to managers and upper-level executives on a monthly basis across all sectors of the economy to gauge the health of their businesses.

PMI (Purchasing Managers’ Index) survey data is a window into the real economy. It’s the clearest signal of the health and direction of business activity, based on sentiment of managers, executives, and bosses.

Yesterday, we had a dismal PMI print—let’s cover it and examine how the real economy is feeling the heat.

Soft landing? No. Brace for impact.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself. Create a node in less than 2 minutes, just visit voltage.cloud.

Yesterday, the S&P Global US PMI came in well below expectations for both manufacturing and service sectors.

Quick PMI explainer: A survey is sent out to purchasing managers at hundreds of firms across the economy. Questions follow this type of format:

Did you hire more people or less people last month?

Did you have more or less new orders this month versus last month?

If the answers are positive, readings come back above 50. If the answers are negative, readings come back below 50. Said otherwise, a PMI survey above 50 indicates expansion, while below 50 indicates contraction. There are PMI surveys from different data providers, across various sectors, all around the world. Yesterday’s data was an indication that the economy is slowing significantly, even though ISM Manufacturing, a data series with decades of mirroring GDP, readings remain firmly in expansionary territory.

Less important is the 57 current reading on ISM Manufacturing than the decline from levels above 60 last year and a clear sign of an end to the current business cycle.

We bring in two more surveys that have strong historical correlation with GDP and PMI data, consumer sentiment and small business optimism. Both readings are showing an end to the business cycle, which will eventually play out in PMI, ISM Manufacturing, and GDP:

The Consumer Sentiment index is a monthly survey conducted by the University of Michigan that considers personal financial situation, as well as participants’ views on the economy.

The Small Business Optimism index is a composite of ten questions answered by small businesses to determine their health and outlook.

Much of the decline in survey data is reflecting the real-world impact of tightening financial conditions by way of a stronger dollar, wider credit spreads, higher Treasury yields (and Fed Funds rate), and negative consequences related to the wealth effect and falling equity markets.

There are thousands of economic indicators out there, but at The Bitcoin Layer we rely heavily on PMIs to indicate our current position within the business cycle.

Expansions happen after easy monetary policy is achieved. Recessions happen after tight monetary policy is achieved. Right now, we are in the middle of tightening, so it should be our baseline expectation that the economy is going to contract. Not a surprise. You can count on us to keep our eye on our favorite economic indicators to confirm the recession thesis. If the business cycle drives returns, identifying our place in the cycle might be your best possible alpha. Narrator: historically, it is. Stick with us for more on our economic framework and why a cycle-driven approach to asset allocation is historically a sound approach to investing across decades.

Until next time,

Nik & Joe

This post was sponsored by Voltage, provider of enterprise-grade Bitcoin infrastructure.