Stuck In The Middle With You

Clowns to the left of me, Jokers to the right

This week, we are doing a core Bitcoin market update instead of the broader market risk report, which many of you know as Mean Median Mode. Before we dive into the charts, it’s important to state that the current price action of bitcoin is challenging. The challenge isn’t in analysing the data. The big challenge is the difference between the current price action and the broader fundamentals. Nik really brought the heat this week with his letter about Japanese government bond yields, a rate check between the US and Japan, and a lower DXY.

The cracks in the foundations of money are becoming harder to ignore. Persistent deficits, rising debt, and central bank behavior are quietly reshaping how investors think about preservation and risk.

On January 28 at 1PM CST, James Lavish joins Unchained for a live conversation on currency debasement, why traditional portfolio assumptions are being tested, and how gold and bitcoin fit into a changing monetary landscape.

The discussion will cover:

Why debasement is structural, not cyclical

How inflation and financial repression challenge familiar portfolios

Why gold tends to move first—and bitcoin often moves further

Wednesday, January 28 at 1PM CST — online, free to attend. Register now and get early access to the report:

❌ DON’T WRITE YOUR SEED ON PAPER 📝

Why? Because securing your generational wealth on paper is risky.

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why.

This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Use code TBL to take 15% off your purchase.

We are seeing gold skyrocket with another parabolic move up, hinting at changes in the current world order, which Nik also made a great video on. With all of this going on, bitcoin got pushed back into the range where it had been trading since November 2025 and still hasn’t managed to reclaim some important levels, so it remains in a downtrend.

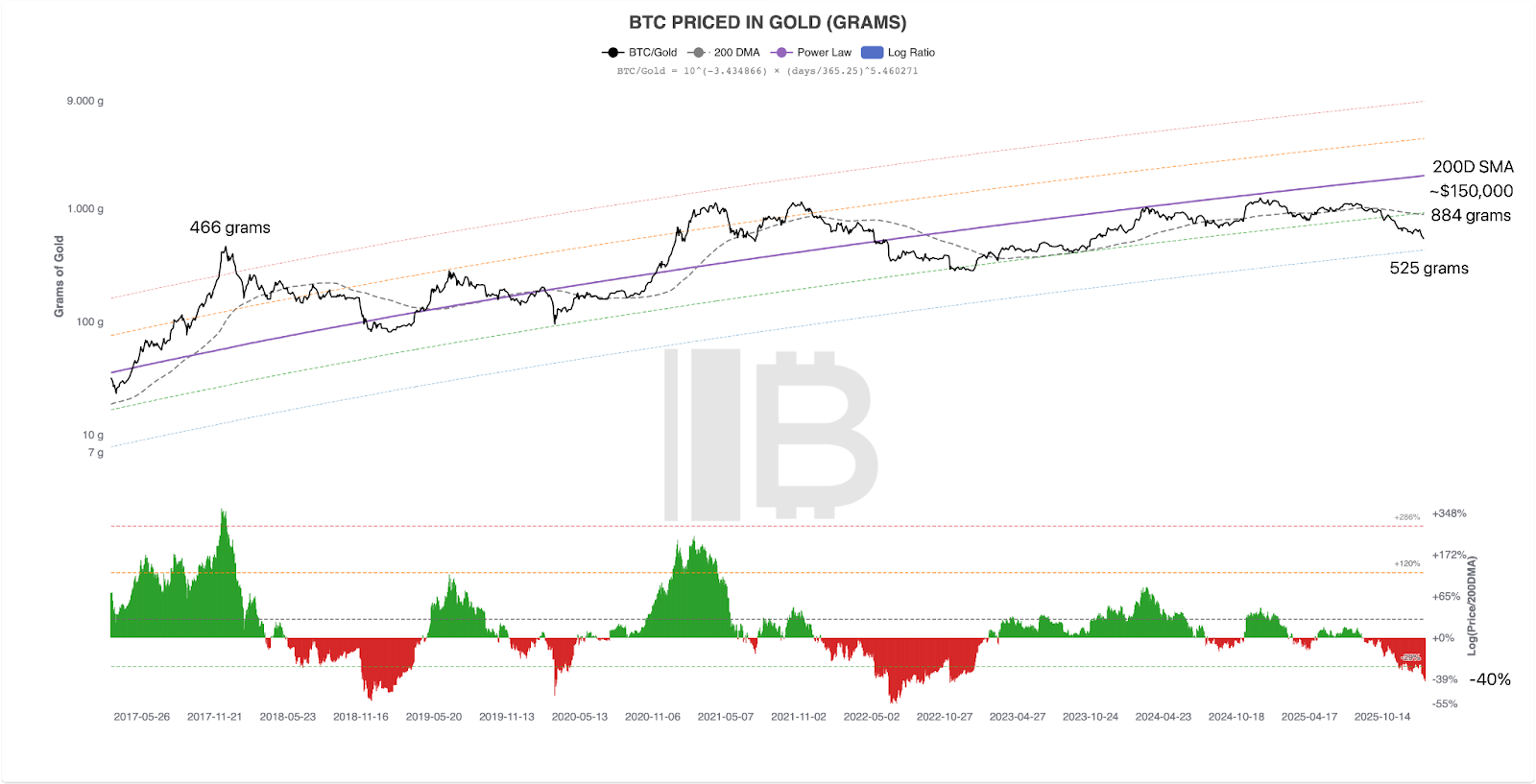

The chart below of bitcoin priced in grams of gold tells the entire story. At the top in late 2017 bitcoin reached a high of 466 grams. It is currently trading at 525 grams. Because this chart is on a log scale, the difference of 60 grams is so small that if you were to draw a line between both, you are basically on the same level as we were more than eight years ago.

Mr. Musk would say, “Let that sink in.” Granted, back then bitcoin was way overbought, almost 350% above its 200-day moving average and above the 2 standard deviation band of the power trend. Currently, the price of bitcoin in terms of gold is trading around 40% below the 200-day moving average. Nik tweeted out that sentiment feels like post-FTX bear vibes, and this data agrees with that take. So it would be fair to say bitcoin is oversold versus gold.

Because price is relatively low, that doesn’t mean it is the bottom per se. It has been worse, and it could become worse. But the gravity for mean reversion is to the upside. That could play out in multiple ways. Gold could come down, which would cause the price to revert to the mean without bitcoin really needing to rally. Or gold is searching for a new equilibrium at these highs, and bitcoin would really need to play catch-up. Or the path forward could be a combination of both.