Dear Readers,

This past week, we had to take an existential step back to better understand the signal we provide. We want to capitalize on all the work we’ve been doing with TBL Liquidity:

During one of our regular morning calls at TBL this week, Nik expressed the need for a more accurate signal from our TBL Liquidity Cycle, which builds on something we wrote about last Friday:

“Troughs have a range, which makes them hard to detect [...].”

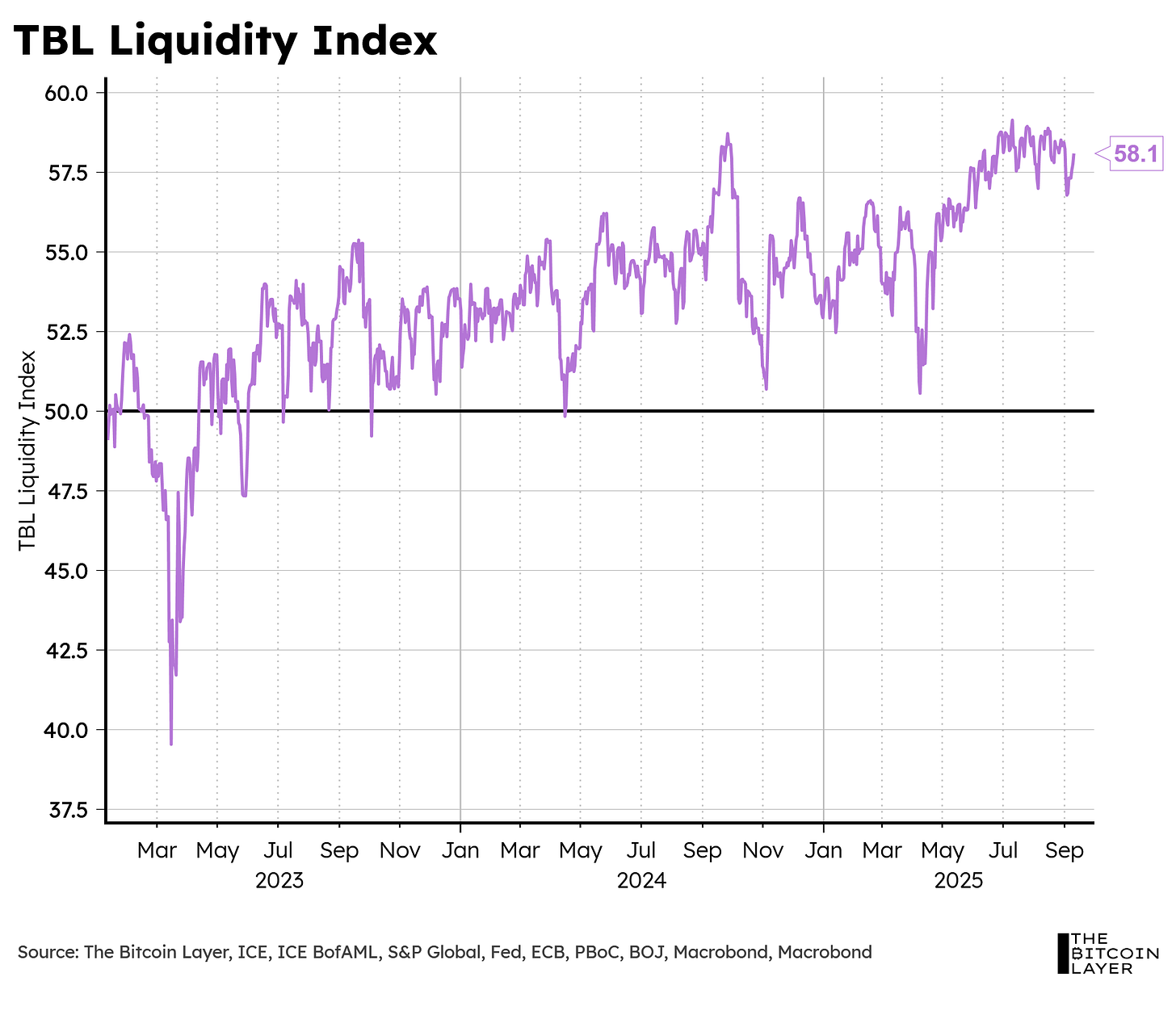

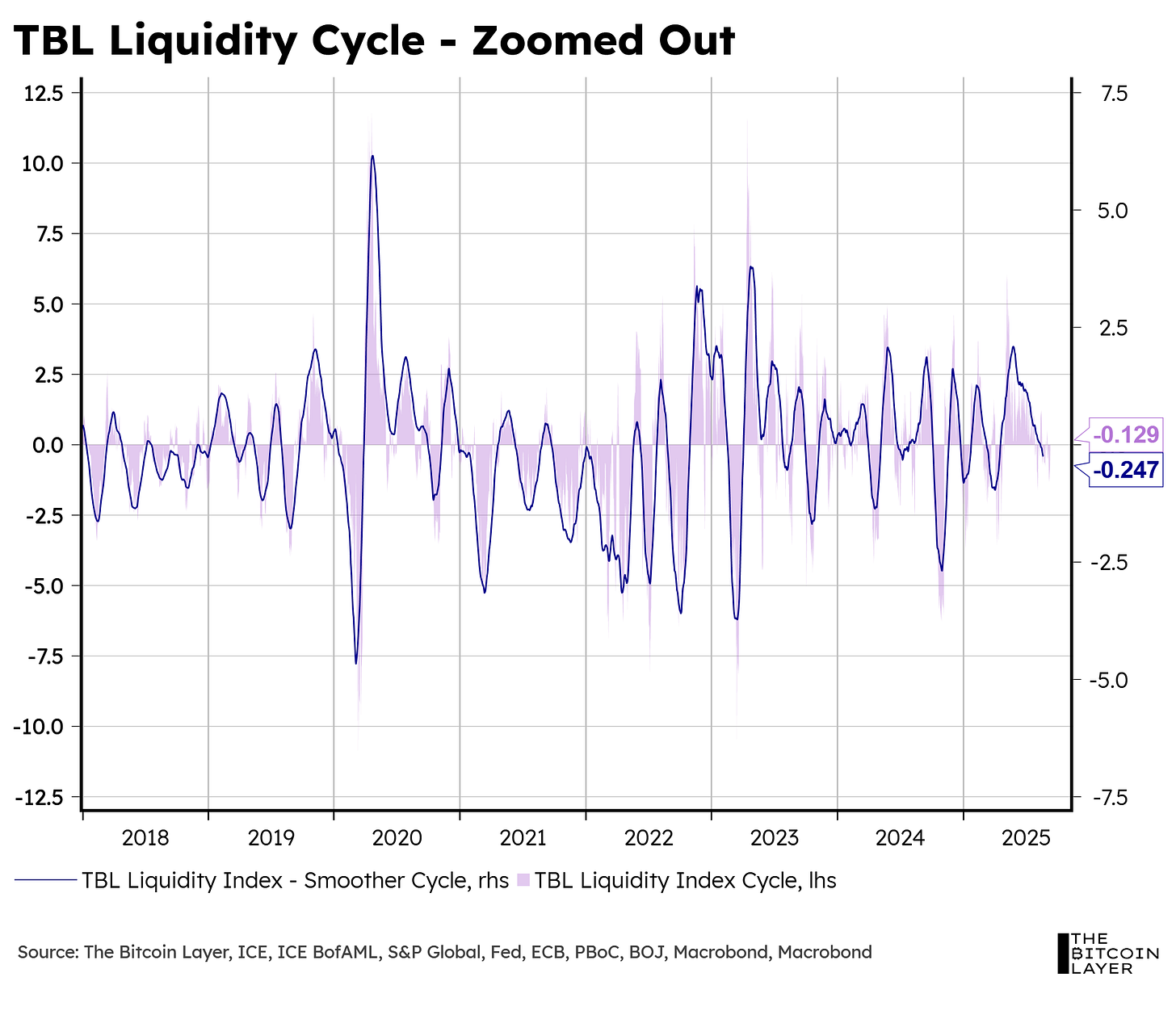

The point here is that the original statistical bands we derived to detect troughs and peaks were okay, but not good enough leading indicators because cycle levels can be different from one year to the next. Take a look at this zoomed-out version of the cycle:

So, how can we properly detect seemingly ever-moving troughs?

Over 10,000 investors downloaded the original report calling for $120k when bitcoin was just $27k. With that price level now achieved, Tuur is back with the 2025 edition refreshed for the bull run with new data and insights—including Adamant Research’s latest price outlook.

The bull run is heating up—now is the time to take it seriously.

You’ll also get exclusive access to an HD recording of Tuur Demeester’s new 30-minute video presentation, Charting Our Way Through Chaos, breaking down why this boom might be only just beginning—and what forces could push it to the next level.

Read the first-ever mid-cycle report from Adamant Research:

We are also happy to announce our newest sponsor this month: Arch Lending!

At TBL, we help you decode Bitcoin’s macro trends and give clear market signals—holding Bitcoin is just the beginning. Arch lets you borrow against your Bitcoin—unlock cash without selling:

Instantly access a Bitcoin-backed line of credit

Borrow from just $5k for up to 2 years

No rehypothecation. Ever.

Insured custody at Anchorage Digital

Stay long, stay liquid.

Use code “Nik” for 0.5% off interest rate for 2 years.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

Derivatives

During our call, Nik suggested using derivatives. No, not financial securities, but a literal derivative of our TBL Liquidity Cycle function.

Here’s our definition of a derivative in relation to this article:

Our TBL Liquidity Cycle is simply the trailing 30-day nominal change of our raw TBL Liquidity Index (shown in the first chart of this article).

A first derivative for our TBL Liquidity Cycle would thus be the rate of change of this rate of change.

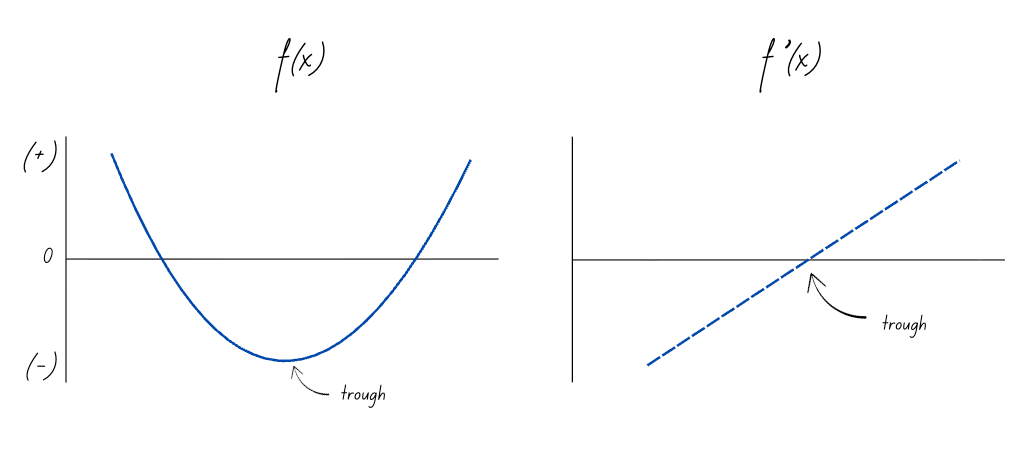

When our TBL Liquidity Cycle, which itself is a rate of change, turns from ‘decreasing’ to ‘increasing’—even if it is negative territory—the first derivative will turn from negative to positive (refresher diagram below):

So, we went ahead and derived the 1-day change of our TBL Liquidity Cycle, and used that as our derivative function: