TBL Weekly #1

Introducing our weekly recap of The Bitcoin Layer posts and videos.

Welcome to our first TBL Weekly! This Saturday edition of The Bitcoin Layer will wrap the week’s content, provide valuation updates, and track any active market calls made by this publication.

Tuesday

Our bitcoin video for the week covered realized price—our favorite on-chain metric to measure bitcoin’s relative valuation. This explainer video introduces the basics of using bitcoin’s blockchain for insights:

Here is a look at bitcoin’s current price, realized price, and MVRV (market-value-to-realized-value) ratio:

Wednesday

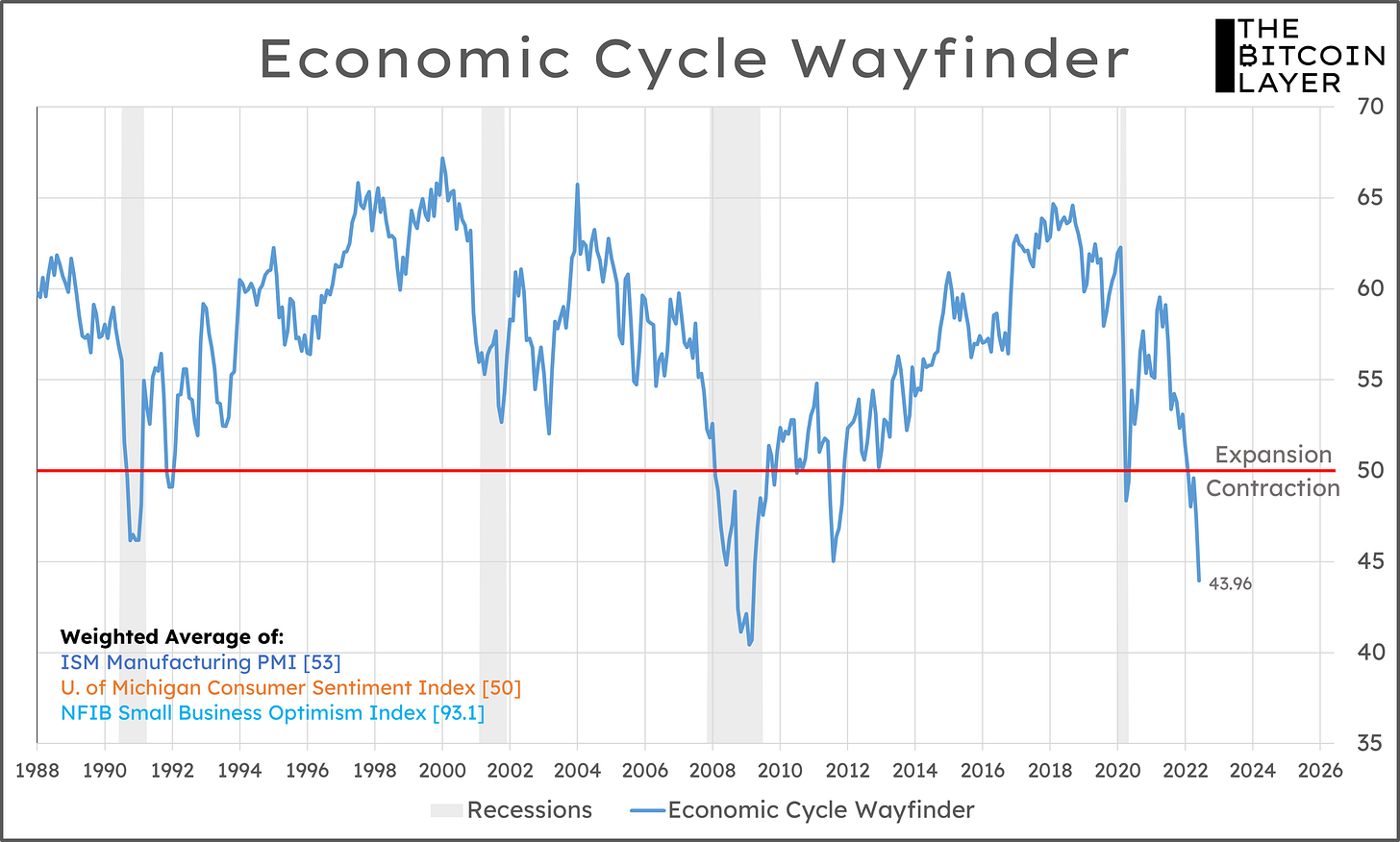

We introduced our “economic cycle wayfinder,” a simple weighted average of our three favorite and most reliable leading economic indicators: ISM Manufacturing, University of Michigan Consumer Sentiment, and NFIB Small Business Optimism. Our cycle-approach to investing is also discussed:

Here’s our latest iteration of the wayfinder, now weighted so that 50 marks the expansion/contraction level just as PMI surveys do. The US economy is already in contraction:

Thursday

Our macro video for the week introduced the big idea for our YouTube channel—building out an entire investing framework with dozens of interacting components, including rates, bitcoin, economic analysis, price study, and so much more. Don’t miss the graphics and animations our team put together:

Thursday was our first double feature. Joe crushed this summary of the GBTC drama in short order Wednesday night after the news broke:

Friday

Yesterday, Nik delivered a timely chart pack, making an active call: US Treasury 10-year yields are heading back down to 2.5% due to a slowdown in growth and inflation expectations. Implications for bitcoin are also discussed:

Bitcoin price study

Here is our Fair Valuation Framework showing bitcoin’s price within the bands:

And our Fair Value Confluence price and Ratio, showing bitcoin that is trading at fair value:

Finally, a summary of where our most monitored bitcoin metrics stand:

Prices, metrics, and ratios are as of Friday, July 1, 2022.

Learn more about my Lighting-Network-focused YouTube sponsors, Zebedee and Voltage!

ZEBEDEE: https://thebitcoinlayer.com/zebedee

VOLTAGE: https://thebitcoinlayer.com/voltage