TBL Weekly #5

Our weekly recap of The Bitcoin Layer posts, videos, and market analysis for the upcoming week.

This week saw yet another leg up for bitcoin, as risk assets breathed a sigh of relief now that Treasury yields have continued falling. A technical recession might sound like bad news for risk, but we know that markets are forward-looking. We believe that as the economic news continues to disappoint, such as increasing layoffs, the threat of monetary policy tightening will disappear. We also released part 5 of our Bitcoin-Native Financial Theory series.

Welcome to The Bitcoin Layer Weekly #5. Grab a coffee, and let’s dig in.

Tuesday

Nik answered viewer-submitted questions in the first edition of Ask Nik. Recession potential, risk asset trend reversal, and the potential for a Lightning Network yield curve are all covered, a must-watch!

Wednesday

Nik provided his outlook on the global macro situation. Based on the recent price action in rates markets, he presents our latest narrative switch—the worst of the tightening is over. After 10-year Treasury yields swiftly rejected the 3.5% level, and 5Y5Y inflation swaps ease off of their highs, it’s safe to say that forward growth expectations have been squashed, making more Fed tightening less likely. This is putting in a trend reversal for risk assets.

Don’t miss this important and timely macro update.

Thursday

Nik ran through his entire Layered Money framework in less than 10 minutes. A fast-paced and informative video that recaps the key points of his Amazon best-selling book—Nik is really in his teaching element with this one!

Friday

Joe published The Time Value of Lightning Network, part 5 of our Bitcoin-Native Financial Theory series, originally started in 2018 with The Time Value of Bitcoin.

The potential for a bitcoin-denominated global capital market powered by the rails of the Lightning Network is gradually becoming a reality.

With the rise in secondary markets for liquidity and multi-asset functionality powered by Taro—allowing all the world’s currencies to flow through bitcoin’s liquidity— bitcoin has the potential to become a deep and liquid alternative to other capital markets, underwritten by an asset that, when custodied, incurs zero counterparty risk.

Read the full, free research publication here:

Market Analysis

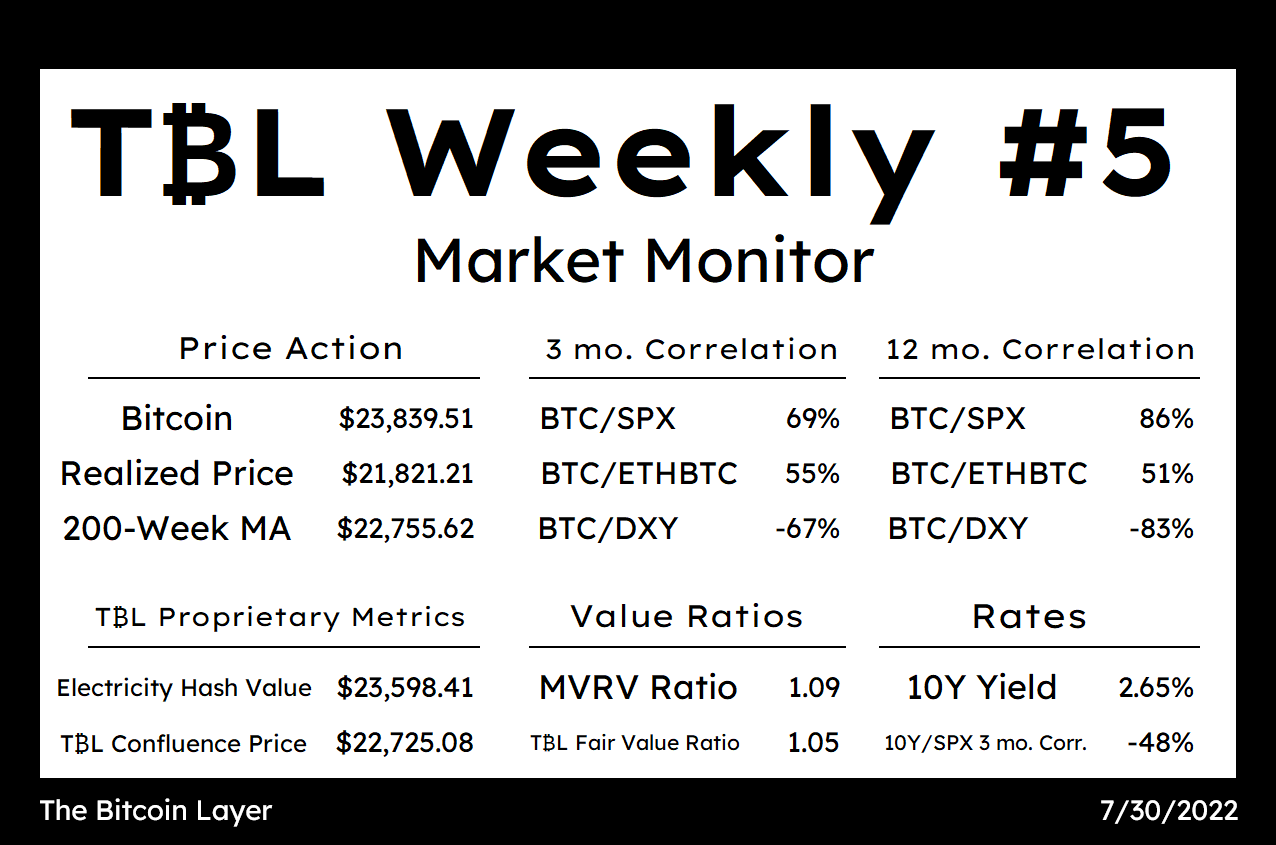

Here is our market analysis for the week ending Saturday, July 30th, 2022. Notable events in our Market Monitor include bitcoin holding steadily above its key valuation levels— reiterating that bitcoin trades with risk and has benefitted from this trend reversal. Bitcoin saw its 3-month correlation with the S&P 500 fall by 10% this week due to its increased upside gains. We will also note that our active call for 2.5% in 10-year Treasury yields is approaching faster than we may have anticipated—10-year yields closed the week at 2.65%.

Enjoy your weekend, and get ready for a less tense week of economic releases, with some PMI releases, including ISM manufacturing and ISM services.