Thanksgiving Bitcoin & Macro Talking Points

If you can predict the questions, you can prepare the answers.

Dear readers,

It’s that time of year. I’m referring to when your family is either lauding or berating you for being a bitcoiner. Something like one year on, three years off—sound accurate? Whatever the seasonal pattern, this year’s will likely be above-average on the laud-berate scale, making it the perfect year to lean in on some key talking points that we believe should permeate the public.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Make a wish

If you keep with the wishbone Thanksgiving tradition, make yours that somebody near and dear to you is curious about your longstanding or perhaps brand-new obsession with bitcoin and its immense potential for humanity. Then, remember these talking points and have at it:

Bitcoin’s outperformance is staggering.

Equip yourself with trailing 12-month and trailing five-year returns. The outperformance of bitcoin alone should really shock you into some realization that bitcoin isn’t the fading fad many thought it was. Adoption and technological reasons aside, consistent outperformance over multiple time horizons through pandemics and hiking cycles is impressive, to say the least, and alarming to those with false bubble narratives.

Rebased to 100, an investment in bitcoin 12 months ago would be worth 230 today, more than doubling your investment over the past year. The S&P 500 has returned 16% on a total return basis, for comparison. An index of Treasuries would have lost you a little over 2%.

Looking back over a five-year horizon, bitcoin starts to make other assets look trivial. The outperformance is in fact staggering: an 87% return in stocks compared with a 741% return in bitcoin. Gold underperformed stocks and Treasuries would have lost you a little over 2%.

The US government will never ban bitcoin.

ETF approvals for BlackRock, Fidelity, and many others are coming soon, along with the conversion of GBTC to a proper ETF and a reconvergence with net asset value. We are in the final stages of the SEC’s process, in which it is now specifying the exact mechanisms to be used by each manager. Take that and contrast it with a belief that the US government is going to ban bitcoin—the two are not in congruence. For bitcoin in the United States, there is now a formidable effort to keep up with other nations such as Singapore and Switzerland, as opposed to hide in the shadows. Efforts to promote the business activity of bitcoin mining are now becoming law in many states across the country. Whether or not the courts are filled with cases for and against bitcoin for decades to come (they most likely will be), bitcoin’s legality itself is not in question.

Bitcoin mining emits carbon? No, it mitigates methane emissions.

Prepare yourself with the environmental argument against bitcoin in an engaging and potentially mind-bending way. Not only is bitcoin not bad for the environment, it is instead one of the greenest technologies in the world. While we don’t fully (only somewhat) expect you to pull up a YouTube video during your turkey feast, you can use these three points. First, bitcoin mining doesn’t emit carbon in any way. It consumes electricity, just as electric vehicles do. The energy source used for electricity grids depends on those utilities providers, not on the machine consuming the electricity. The easiest way to combat the argument is to ask the person their stance on electric vehicles, and then argue that much more energy used for the charging of electric vehicles comes from dirty sources than the energy used for bitcoin mining. And that brings us to the second point: bitcoin mining is powered by over 50% renewable energy, the highest rate across any sector in the world. For comparison, banking uses 39% renewable because much of its activity is computing-based. Bitcoin mining is drawn to renewables because of the relative cost advantage. Finally, bitcoin mining can seriously assist in the mitigation of methane emissions from open-pit landfills around the world. This is a very nuanced corner of what is happening in the bitcoin mining industry, but it has the potential to explode in popularity and net benefit to humanity. We recommend watching our recent episode on the crossover between bitcoin mining and methane emissions from landfills as a tremendous jumpoff for an advanced conversation about bitcoin today versus “bitcoin is a bubble” Thanksgiving conversations of last year.

Not crypto, bitcoin.

Every time they say crypto, correct it by reminding them that crypto currently describes an industry that exists as the echo boom of bitcoin. Crypto is currently suffering an embarrassing fight against rational investors, financial regulators, and the judicial system. Meanwhile, bitcoin is thriving with worldwide adoption, commodity classification at the regulatory level, and phenomenal investment returns. See point 2 about the evolution of ETF approval as well, as none of the prior mentioned conditions apply to 99.9% of crypto projects, which are mostly venture-backed technology projects with varying localized adoption.

US Treasuries are a good asset to own in this environment

On the topic of US interest rates, and the rates on Treasury securities, regular readers of this publication understand that they are cyclical, and that heading into a slowdown of growth and inflation, a decline should be expected. A curious argument that the US Treasury security is being dumped broadly as a reserve asset is based on “pick and choose” data at best, while the argument that interest rates can rise in consumer recession due to inflationary impulses of fiscal spending—a term more commonly used today to describe this phenomenon is fiscal dominance—is much more compelling but doesn’t have us convinced. If family members are ready to debate the nuances of the petrodollar and Treasury recycling, OPEC tendencies, and fiscal dominance, we applaud you. In the more likely case that dollar doomers are quicker to support bitcoin talking points than others, be sure to enforce that bitcoin can rise for decades to come in a world in which the dollar remains the dominant government/fiat/credit-money global currency. After all, that is what is currently happening. Rates are now on hold at the central bank, while market rates head lower to price in the next move in policy. Once the pause arrives, the next move is down:

Looking at market yields at the short end of the curve, you can see Treasury bill yields rolling over. This is the market preparing for the Fed to cut rates next year, even if just a tiny bit:

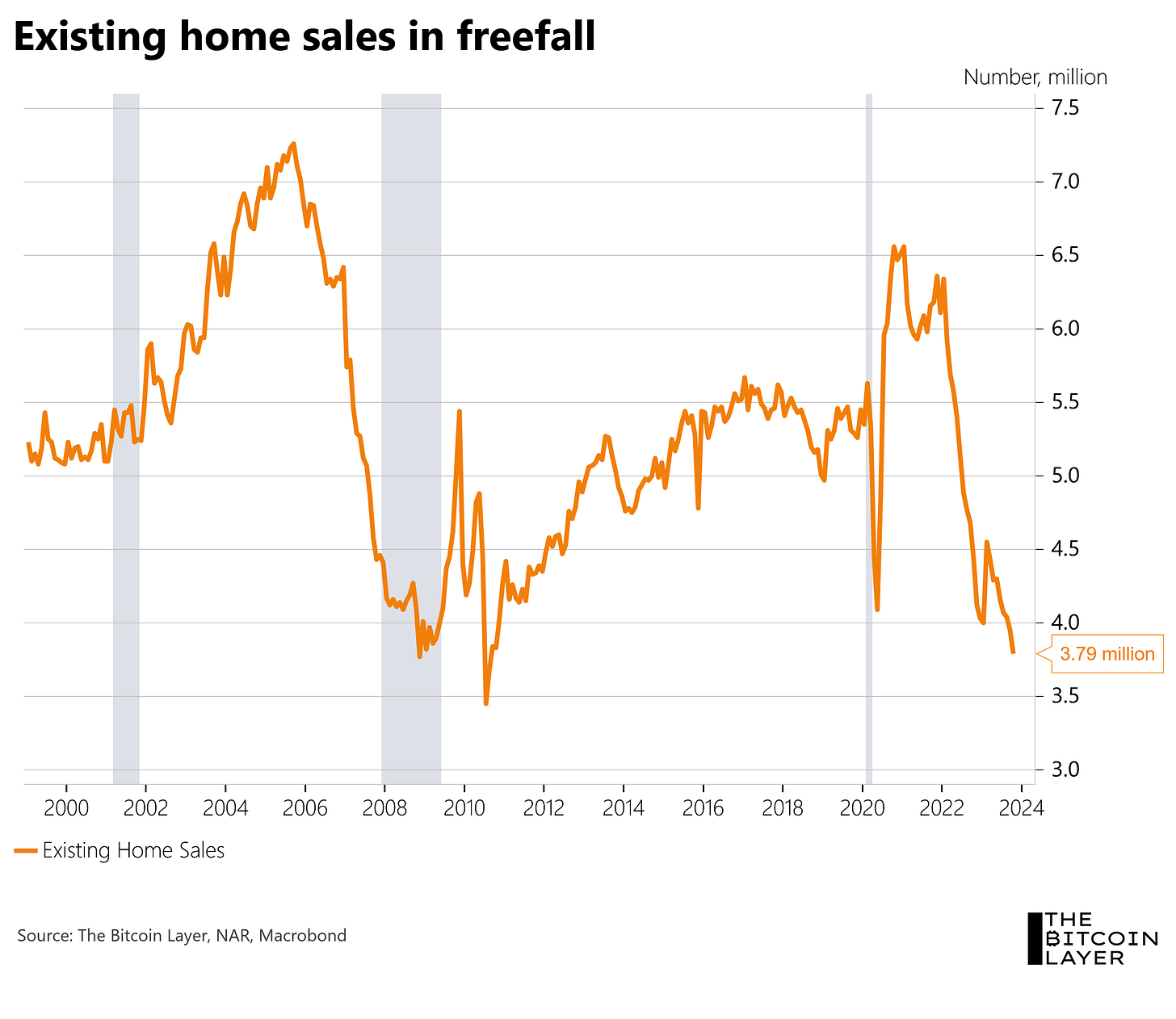

The business cycle has turned. Real estate sector will struggle in 2024.

We received updated existing home sales data this morning, and the trend is intact—sales are in freefall:

Several fire sales of large office buildings across the nation are hitting commercial price index data as well. Office buildings are pricing in a recession, and the downturn started several months ago:

We hope you and your family have an incredibly peaceful and blessed Thanksgiving holiday, and that the conversations err on the side of amicable. After all, bitcoin is for everyone.

Until next time,

The Bitcoin Layer

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.