The 2024 Paradox: High Interest Rates & The Bitcoin & Tech Stock Boom

Unpacking the biggest contradiction of the decade.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Paradox (noun) - a seemingly absurd or self-contradictory statement or proposition that when investigated or explained may prove to be well-founded or true.

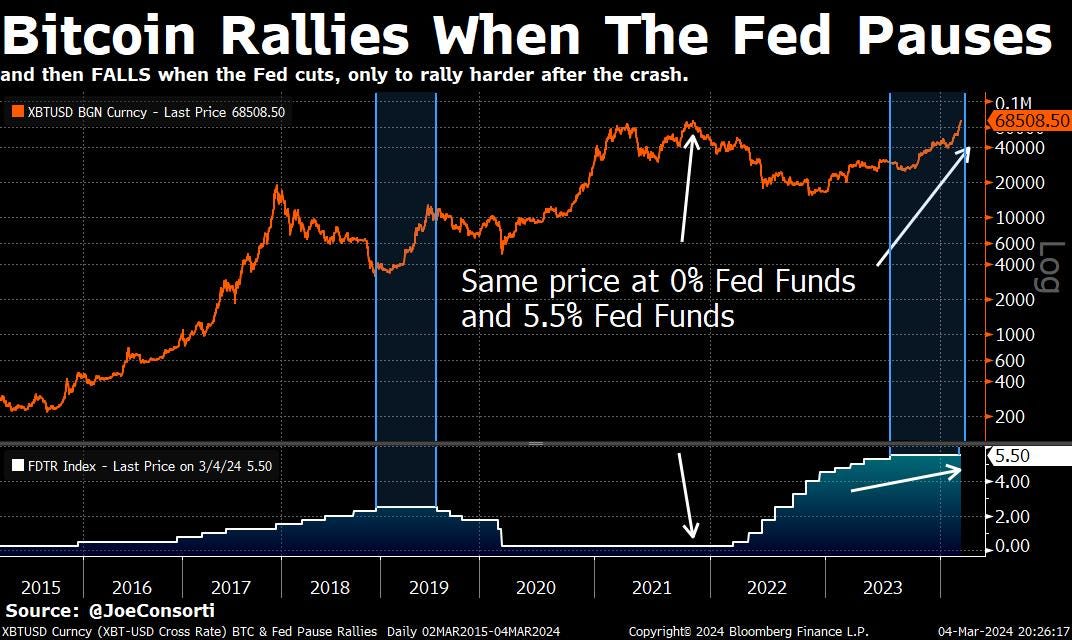

A paradox is what markets have seemingly found themselves in during this cycle. All previous narratives constructed about market cycles have been violated in one way or another. Bank failures occurred mid-bull run, which persisted without a hitch. Every US stock index has breached new highs, corporate credit has not slowed down, and corporate earnings remain strong, all after the Fed increased its policy rate from ~0% to 5.5%. We’ve been calling for a Fed pause rally for the past 18 months now, but no honest investor predicted bitcoin would be inches away from blasting past its previous all-time highs after the Fed reached peak monetary tightness:

The contradictory apparent tightness of monetary policy yet extreme ease in financial markets has baffled many and likely left many portfolio managers severely underperforming after foolishly battering down the storm hatches for what turned out to be a sunny, cloud-free day. But is any of this contradictory? Not necessarily. We need to dive deeper into the fiscal side of affairs to understand why markets are behaving as they are, and when we do, uncover how this is just the beginning of what could prove to be a regime change in markets. The US fiscal train is barrelling down the tracks and the only entity that can sustain it is the one with the money printer.

Lyn Alden’s recent February newsletter offered a fascinating insight into the state of affairs between the US’ contradictory monetary and fiscal policy, describing it as a tug of war that has led to a fiscal-driven reacceleration of the US economy. Today, we add some color to her stellar analysis, provide our typical monetary plumbing lesson or two, offer variance, and continue to relate our framework to those you read and respect.