The Bitcoin Layer's 2023 Year In Review

Looking back at this year's market developments & looking ahead at what's to come.

Merry Christmas, and Happy New Year 🎅🎄

As 2023 draws to a close, we can’t help but reflect on a year best summed up in two words: paradigm-shattering.

Where the market expected a credit event due to the Fed’s unprecedented rate hikes, we experienced perfectly functional credit markets and new all-time highs across all major stock indices. Where the market expected a consumer meltdown in the face of multi-decade highs in interest rates, we experienced a consumer who has weathered the rate-hike storm and has yet to buckle even underneath the weight of prices 25% higher than three years ago. Where the market expected a housing crash, we merely got a swift reversion to the mean without so much as major deflation in most major US counties.

Resilience abounded this year, much to our shock and the market’s; but like any good surfer, we can’t fight the waves, we can only ride them. Let’s break down 2023’s major market moves and look ahead at what’s to come in the new year.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Liquidity & The Fed

The breakneck nature of the Fed’s monetary tightening was thought to be the ton of bricks that would break the economy’s back in 2023. What many failed to consider was the monetary and fiscal bazooka that was set off in 2020 and 2021, which has provided a cushion for consumers, businesses, and financial markets to soften the impact of the Fed’s campaign.

Using the M2 money supply as an example, we soared way above the long-term trendline following the direct fiscal stimulus of 2020/21 and have spent the 22 months simply reverting to the mean. The impact of the Fed’s insane tightening hasn’t disrupted financial markets because of this visibly large cushion:

Another view is total liquidity from the Federal Reserve, which is also several trillion dollars above its pre-COVID monetary and fiscal stimulus level. In fact, it’s risen by some $500 billion after hitting a local bottom in January, so 2023 has actually seen the liquidity from the world’s largest central bank rise, not fall:

The Fed has also staved off any deflationary event with the creation of its new emergency lending program, BTFP, back in March. This facility allows banks to exchange their devalued Treasuries for a loan at par.

This complete elimination of the need to sell devalued collateral means that lending which would normally pull back during a market downturn does not. The reflexive feedback loop of devalued collateral and loan-standard tightening does not occur as often if at all, and the marketwide derisking impulse that would lead to slowdown and recession never happens. This, at least in part, is a good explanation if not undeniably the reason that the risk-on impulse has persisted with such vitality without fading through all of 2023.

To date, banks have tapped the facility for $123.76 billion in emergency loans. Should the facility end on March 11th next year as scheduled, it would instantly take down several small banks and leave others on life support as cash reserves fall below their constraint level when BTFP loans get called in. For this, the Fed is likely to keep BTFP around but tighten up the requirements to use the facility to minimize the impact of what is effectively a get-out-of-jail-free card for banks, such as raising the collateral requirements.

The Fed has also managed to reduce its balance sheet by $1.2 trillion in 21 months, undoubtedly helped by BTFP which has eased liquidity troubles in the US Treasury market as the Fed gradually exits it. BTFP simply cannot end:

The Fed has successfully managed to engineer a pseudo-soft landing, for the time being, wherein the unemployment rate and economic growth are well intact, and financial markets are functioning normally even after 525 bps of rate hikes. The downside to the Fed staving off a prolonged recession is a speculative mania that has raged well into the Fed’s hiking cycle, defying all historical analogs.

Speculative Mania

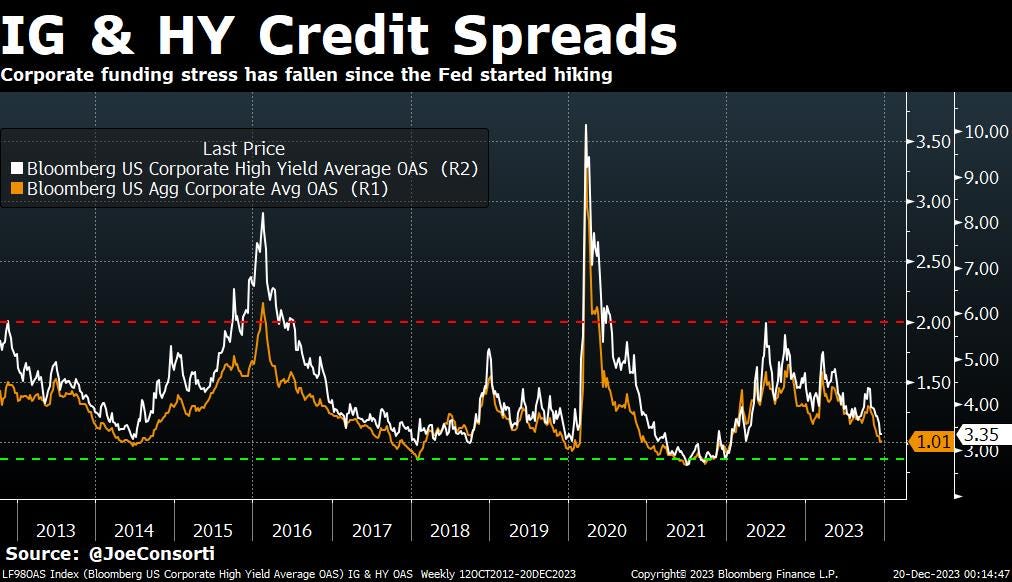

Starting with credit spreads—readers can see here that spikes in credit spreads happen when a financial crisis is brewing (an increase in credit spread is an increased fear of default by investors, as a higher yield is required to compensate for potential bankruptcy). Not only are credit spreads subdued, they are basically at the low end of the range for the past decade. In searching for financial crises and recessions, investors will not find anything in the corporate bond market worth noting. We can assure readers that a dip in asset prices will not occur whatsoever unless investors genuinely shy away from corporate credit. In 2023, fear never materialized:

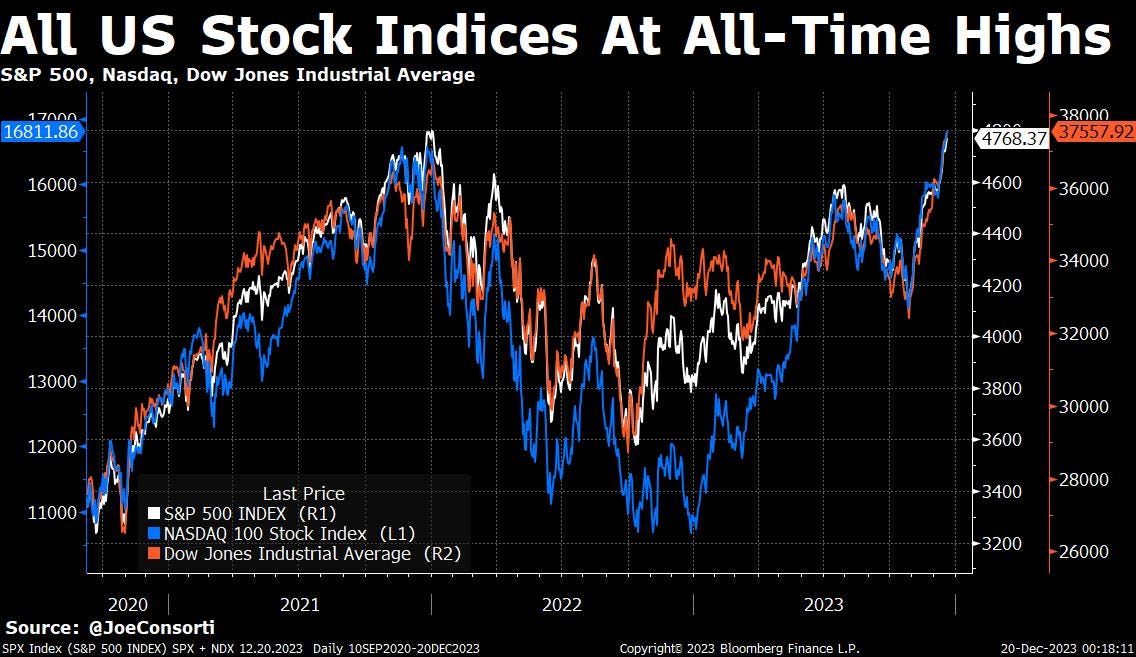

All three major US stock indicies are at all-time highs. The S&P 500, Nasdaq, and Dow Jones Industrial Average have fully attached themselves to the Fed pivot rally and are taking advantage of an enormous wave of rate cuts priced into 2024. With easier policy, risk investors have reduced fear, hence these 2023 returns. Once again, recession worries take a pause when assessing equity performance. It doesn’t mean that a recession is off the table—stocks can experience euphoria all the way until the bottom drops out:

Economic & Consumer Data

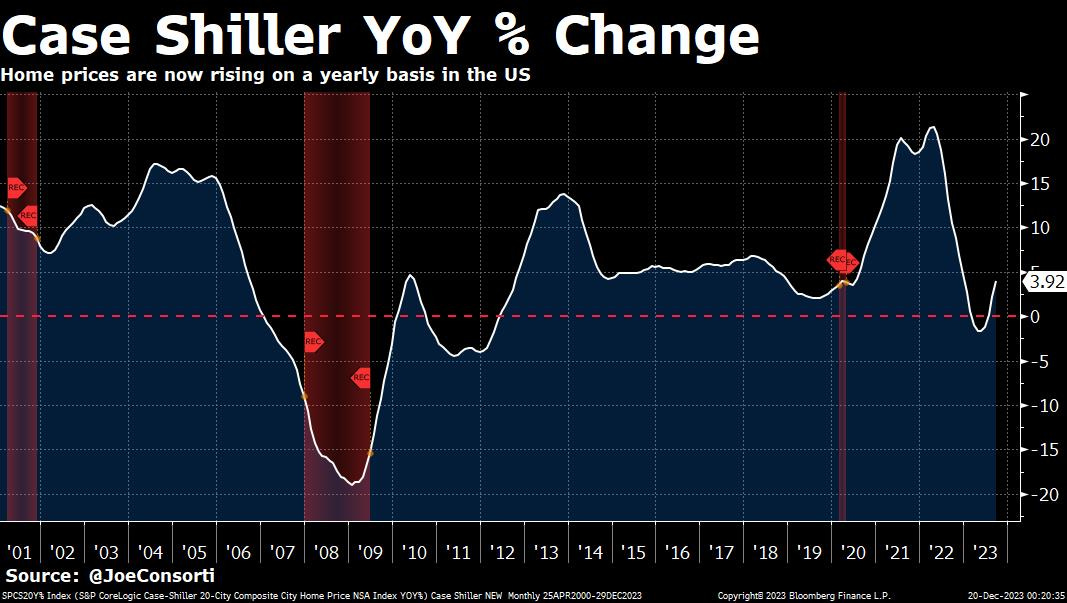

Home prices slowed significantly after the initial work-from-home and supply-shortage boom in housing during 2020 and 2021. However, over the past few months, they have stabilized in a way that brings a general optimism to a housing market experiencing plenty of bearish conditions, such as sluggish existing home sales and high mortgage rates. While mortgage rates have come down lately, they still remain restrictive to many potential homebuyers. Nevertheless, a shallow inventory pool has supported home prices. This is a key metric to watch heading into next year, as home prices have a major impact on consumers’ propensity to spend:

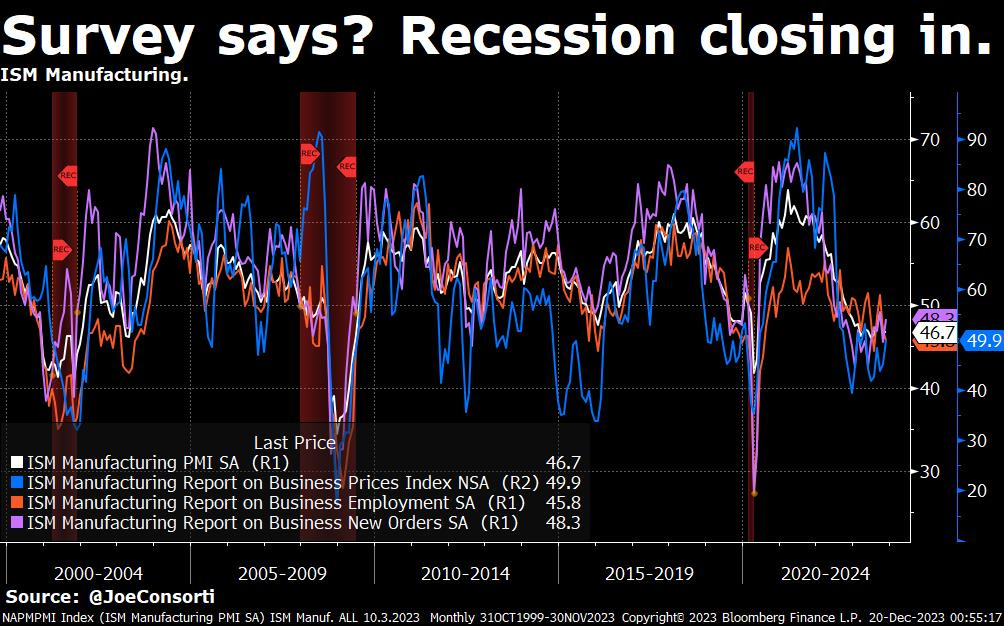

Economic surveys indicate that the US manufacturing sector is in recessionary territory. So why isn’t GDP responding? This is one conundrum that has many market participants confused—with manufacturing in contraction, and manufacturing employment also sluggish, many are expecting the rest of the economy to follow. The reality is that it hasn’t, leaving us all watching the services sector, corporate profitability, and the housing market for any signs that the rest of the economy is following suit. With ISM Manufacturing readings consistently below 50, we are not shy to remain biased toward a 2024 recession:

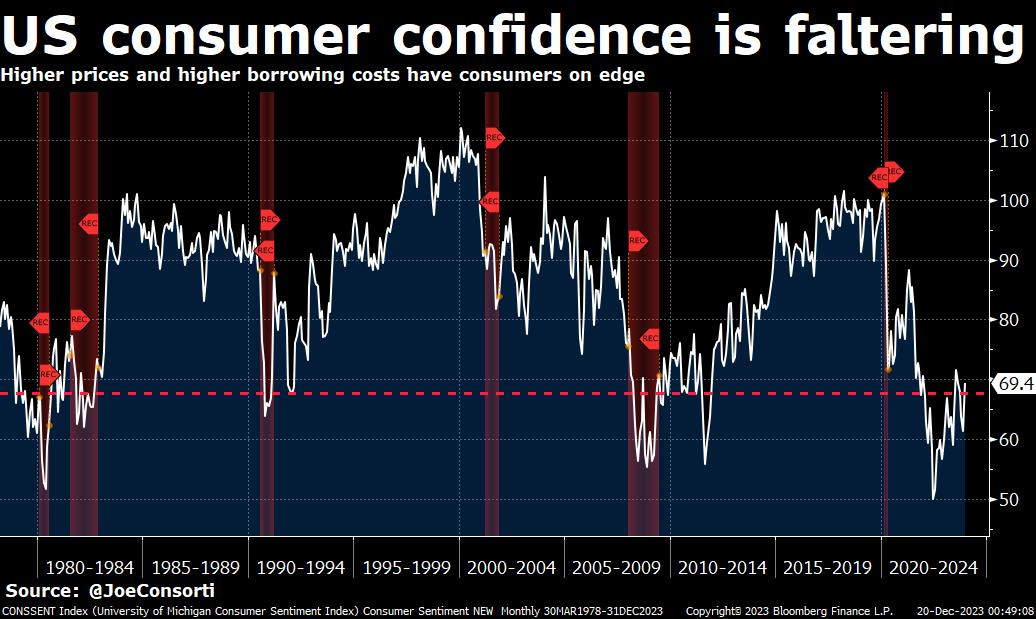

Consumer confidence is low, historically, but has bounced back nicely this year. Rising stocks are certainly a contributor, as are stable home prices:

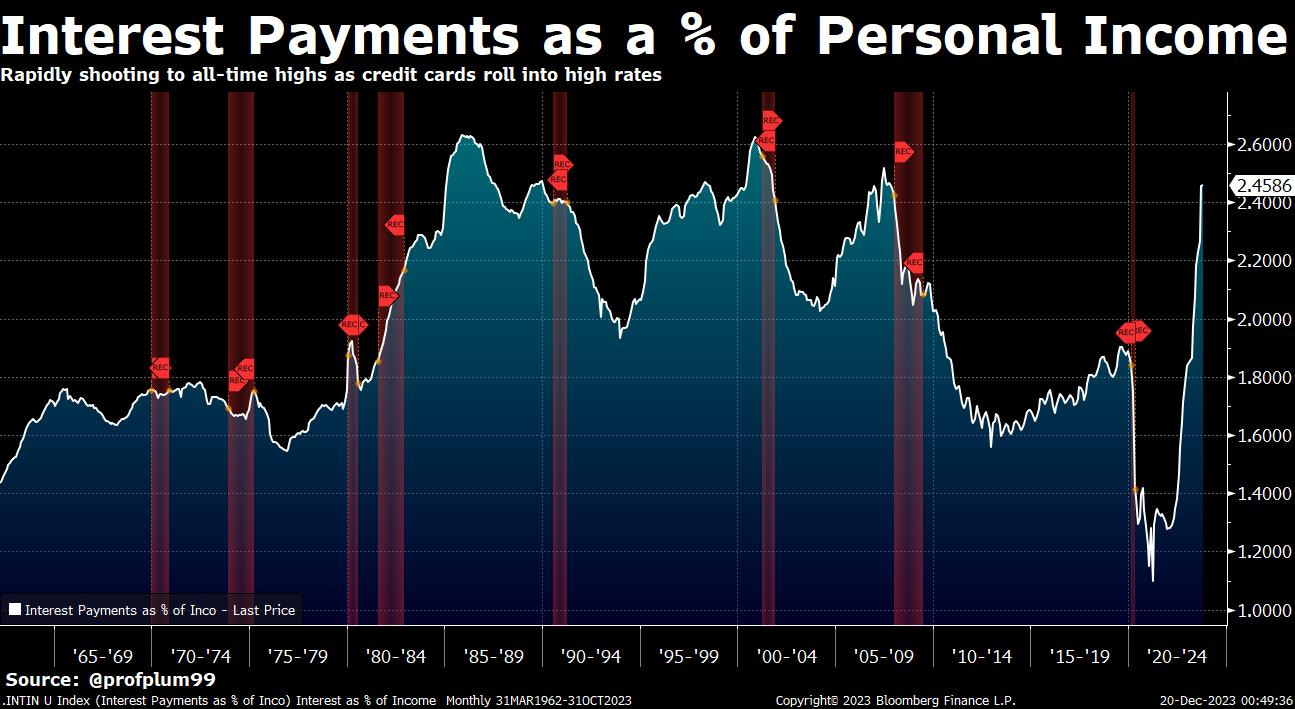

On the other hand, interest payments as a percentage of personal income are becoming restrictive on families’ balance sheets. Will this translate eventually into falling consumer spending, increased default rates, or both?

Heading into next year, we can learn from our anticipation of recession during 2023—while the indicators might show slow growth or even contraction throughout various pockets of the economy, driving the US into a full-blown recession is a difficult task, to say the least. Consumer resilience, the most diversified economy on Earth, a competitive technology breeding ground, and a weak but still effective fighting off of European-style socialist tendencies make the US a difficult recession-nut to crack. We’ll continue to watch all indicators but can categorically state that unless unemployment rises materially above 4%, the economy and asset prices will continue to trek without tripping.

On the cautionary side, we understand that over 5% of monetary policy tightening will have its impact and heads will roll. With all the “no landing” and “soft landing” narratives, it can almost feel controversial to assure readers the plane will indeed land, and that landing will coincide with people losing their jobs. Markets can lower yields, as they have with mortgage rates of late falling below 7%, but the policy rate remains where it is until the Fed and Jerome either have seen enough inflation come out, unemployment rise, or feel threatened by politics in an election year. A high policy rate will bring pain, all else equal, and we cannot unsee past ramifications of end-cycle rate hikes.

For bitcoin, 2024 is set to be an enormous year. Instead of coming out with a wild price prediction, we can instead say that BlackRock’s and Fidelity’s entrance to the market, even if simply as a manager, will bring new notoriety to the orange coin that none of us have experienced. Prepare yourself for a bull market with knowledge, and we hope you’ll join us in 2024 at The Bitcoin Layer for research, analysis, and education that will keep you thoughtfully invested.

Until next year,

The Bitcoin Layer

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

A very nice year review, thank you!