The Corporate, CRE, and AirBNB Debt Timebomb

For borrowers the world over, it's time to sell assets or downsize to operate at higher rates. Anything to avoid default.

Dear readers,

The era of easy money is over.

After 14 years of near-zero policy interest rates, followed by a 15-month grace period during which the effects of policy tightening had yet to impact borrowing costs, the price of money is finally rising—to the dismay of borrowers the world over.

Capital has been grossly misallocated across corporate debt and real estate thanks to zero-interest rates shifting time preference forward and quality backward. As the piper comes a-knockin’ to be paid, that grossly misallocated capital will be wiped out.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Today’s topics

High-yield bonds are at risk as businesses downsize to adjust to higher rates & avoid default.

Office loan delinquency has skyrocketed to 5% and banks are trying to dump their exposure.

The AirBNBubble is bursting—vacancies have subsumed revenues in an oversaturated market with a weakening consumer.

Corporate bonds & loans

A wave of corporate bankruptcies has arrived in 2023. From the nadir of 25.4 in early 2022, the Bloomberg Corporate Bankruptcy Index has risen to a staggering 73.7 at the time of writing.

When companies go bankrupt, they are officially declaring that they can no longer pay down their bond and loan obligations. There is $590 billion in corporate debt at risk of not being paid back to banks and bondholders.

Most of this debt will end up in default, and lenders will stomach a loss. When that happens, they tighten their belts by extending less credit into the economy. This is what’s called deleveraging, an event where the overall amount of debt in an economy falls due to voluntary repayment or involuntary default. The early deleveraging is underway right now, preceding an oncoming recession:

High-yield bonds and leveraged loans (two segments of the debt market reserved for less creditworthy businesses) have doubled from 2008 to $3 trillion in 2021. A big explosion of junk debt relative to the size of the US’ economic output is unhealthy, as it makes the economy more prone to shocks and sudden downturns from higher interest rates. China and Europe are facing the same explosion of junk debt—EU junk bond sales jumped 40% in 2021 alone.

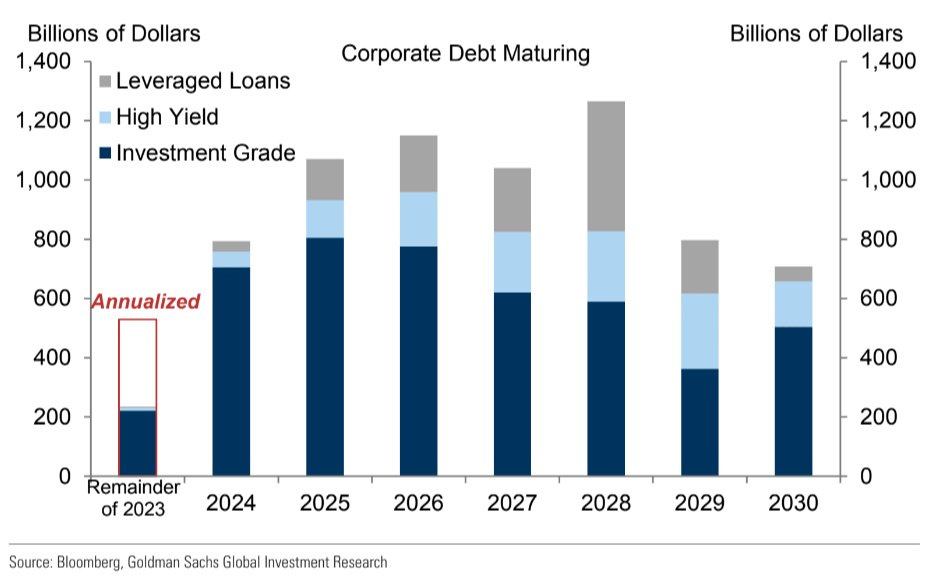

These HY bonds and leveraged loans are all part of the $785 billion global wall of junk debt that is swiftly coming due. Over 40% of junk bonds coming due were issued during the pandemic, enjoying the cheap borrowing that came along with it. Companies that can’t stomach an expensive refinancing at a spread of 4% or higher will sell assets to raise the funds for it, take on less new debt and downsize, or default on current debt:

We’re seeing option B already. Junk debt issuance from companies has cratered, much like the leadup to the Great Financial Crisis and the 2001 dot-com blowup:

More stressed borrowers are dumping assets in order to pay back their debt loads and stave off default. Pubs and grocers in the UK and France are selling hundreds of locations in order to pay down their debt, while New York, San Francisco, and Houston office space is being liquidated at discounts to do the same.

One hundred and twenty major bankruptcies (corporations with at least $10 million in liabilities) have occurred in the US alone so far in 2023. Only less than 15% of the $590 billion in distressed global debt has defaulted so far, meaning that half a trillion in debt is still at risk of not being paid back to lenders.

About $230 billion of this debt matures throughout the rest of 2023, $790 billion in 2024, and the meat of the refinancing comes in 2025 when $1.07 trillion matures:

Companies that cannot survive a jump from 2% to 8-10% interest rates will die.

Moody’s conservatively expects defaults to peak at 5.1% by April 2024. Its pessimistic scenario is HY defaults jumping as high as 13.7%—exceeding the level reached during the GFC crash.

Given the history of rating agencies severely underestimating the probability of crisis out of either malice or incompetence, we’d lean toward the latter.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

Commercial Real Estate bonds & loans

We’ve been on top of the unique and acute risks facing CRE mortgages and the owners of those mortgages for months now. Since we began our close CRE coverage early this spring, conditions have only worsened.

Here’s the CRE delinquency rate—loan payments on industrial, lodging, multifamily, and office properties that are late by 30 days or more. Note how each category of loan delinquency has risen over the last year, with past-due payments for office space having the sharpest rise out of all of them:

Office buildings are the most acutely impacted due to the combination of higher rates paired with post-pandemic vacancies due to the work-from-home shift. These vacancies have dried up cash flow and created a double-whammy that other mortgages only contending with higher rates aren’t facing.

Total US metro area office space vacancy has risen to 19% as of March 31st:

Though, this data is owned by Moody’s. As we said earlier, you can always trust rating agencies to downplay the severity of a credit crisis. Vacancies in major metropolitan areas may be closer to 50% according to some firsthand accounts.

Isolating the delinquent rate of office mortgages, the rapid rise in late payments is already outpacing the Great Financial Crisis:

Distressed US offices, those most at risk of defaulting on loan payments, have jumped to $24.8 billion. They lead all other properties in default risk.

Even without defaults, most will just drop their leases and leave the empty buildings to the banks. The banks (mostly regionals) won’t have a market to sell them into as CRE supply is abundant and conversions to residential property are rare, expensive, and time-consuming. Small banks hold 68.2% of all CRE loans:

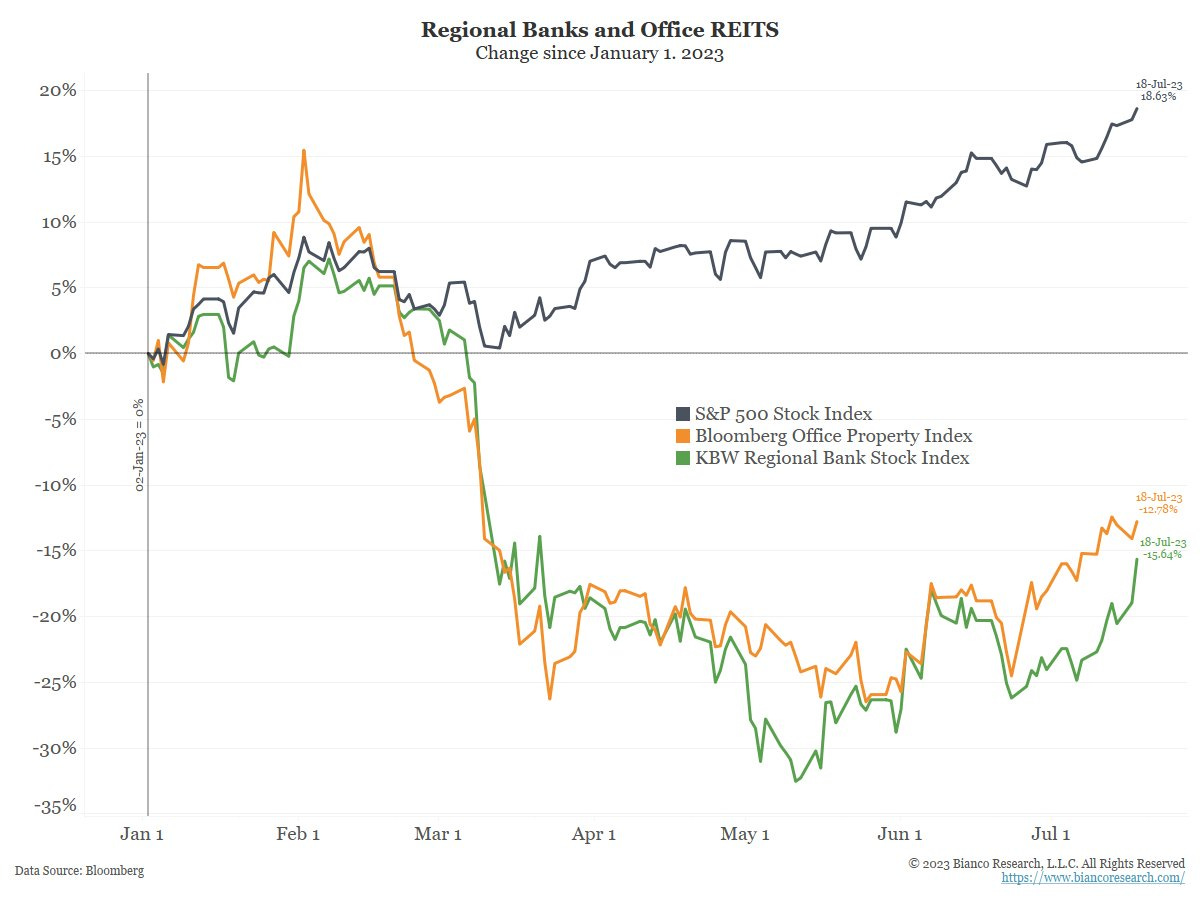

This high concentration of commercial real estate loans, which is an especially at-risk loan category right now, will be a death knell for plenty of regional banks. Note the correlation their two respective stock indices have. As goes office space, so too goes the regional banks:

The pandemic really changed things. Surveys indicate businesses are planning on cutting down physical office space. Pair that with downtown shopping and dining centers whose commerce is also withering away, and you have a feedback loop of abandonment that will hollow out activity in many major metropolitan centers and leave lenders with massive holes in their balance sheets.

Some older office towers had actually sold, at huge discounts of 50% in Manhattan, of over 70% in San Francisco, of over 80% in Houston, and in one case, the largest office tower in St. Louis, it sold for so little in a foreclosure sale that all the proceeds were eaten up by fees and expenses, and lenders got zilch. — Wolf Street

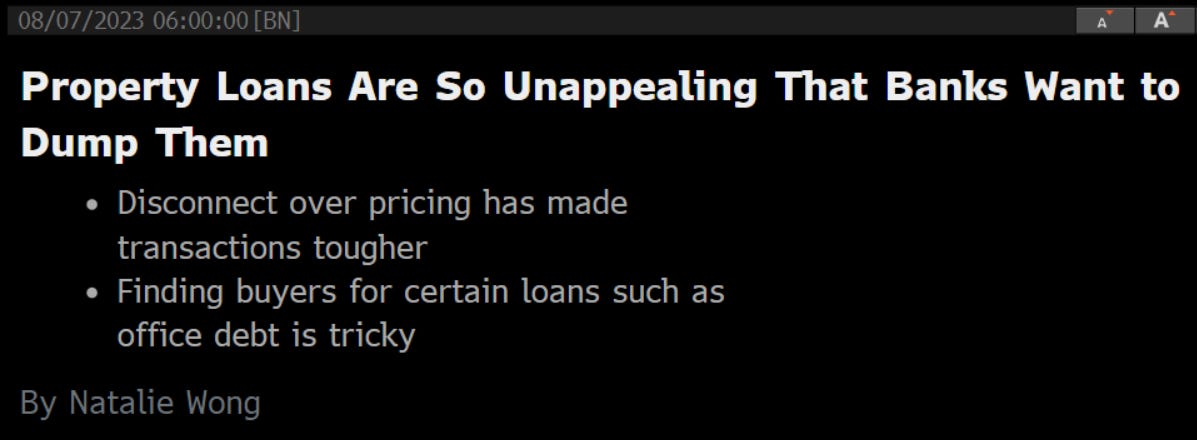

Banks looking to unload these commercial property loans and derisk a bit have been met with a market flush with sellers but not many buyers.

The rules of the game haven't changed, only the field that it's being played on this week. In 2008, there was a swathe of unsellable mortgage bonds due to risky origination, and in 2023, there is a swathe of unsellable mortgage bonds due to a structural change in work culture that eliminated the need for this kind of property.

WeWork’s bonds which were sold in 2018 at 8.4% now yield almost 90% (basically trading at default levels)—just a small preview from a uniquely terrible commercial real estate firm of how nonexistent the demand for CRE debt is:

The now-quiet unloading of CRE debt from regional banks’ assets will soon turn into a rush for the exits.

The AirBNBubble is bursting

AirBNB ownership exploded in popularity over the last several years, ramping up following 2020 as travel started to pick back up and low-rate borrowers led on by social media gurus sought to capitalize on the “passive income” craze.

Turns out, there is no passive income. It is all just one big carry trade with a different name.

A carry trade is when you borrow at a low-interest rate and invest at a high-interest rate. These are usually performed on a cross-currency basis, say borrowing in low-cost yen to invest in higher-yielding dollar markets, then capturing that spread between your borrowing and lending rate as profit.

There is one rub with carry trades though: they fall apart when your borrowing rate rises, particularly if it rises above the rate you’re earning on your investment.

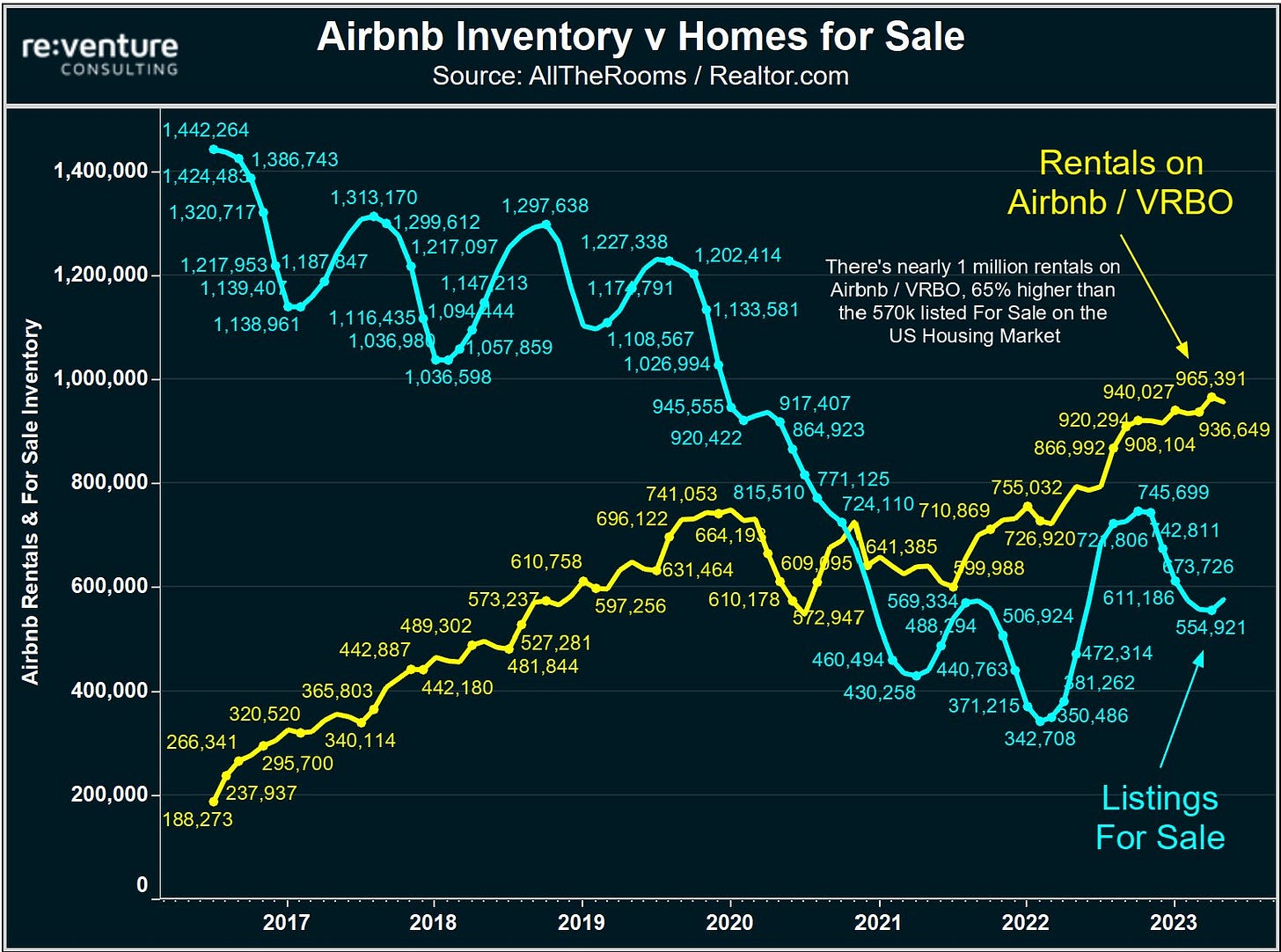

This is precisely what is happening to AirBNB owners today. Interest rates on mortgages available to multiple-property owners are rising and revenues are down astronomically in key markets by nearly 50%:

Revenues are getting killed from a combo of oversaturation with AirBNBs that drives down prices and a weakening consumer who is battening down the hatches—reducing their outstanding credit, cutting down on discretionary spending like travel, and bracing for recession. Revolving credit net change is now negative:

There are 1 million vacation-rentals-by-owner on AirBNB and other short-term rental platforms, and only 570,000 properties for sale in the housing market. The oversaturation of AirBNBs relative to existing housing and dwindling demand has never been more stark. When owners decide to sell due to revenue falling below their financing cost, there will barely be a market for them to sell into:

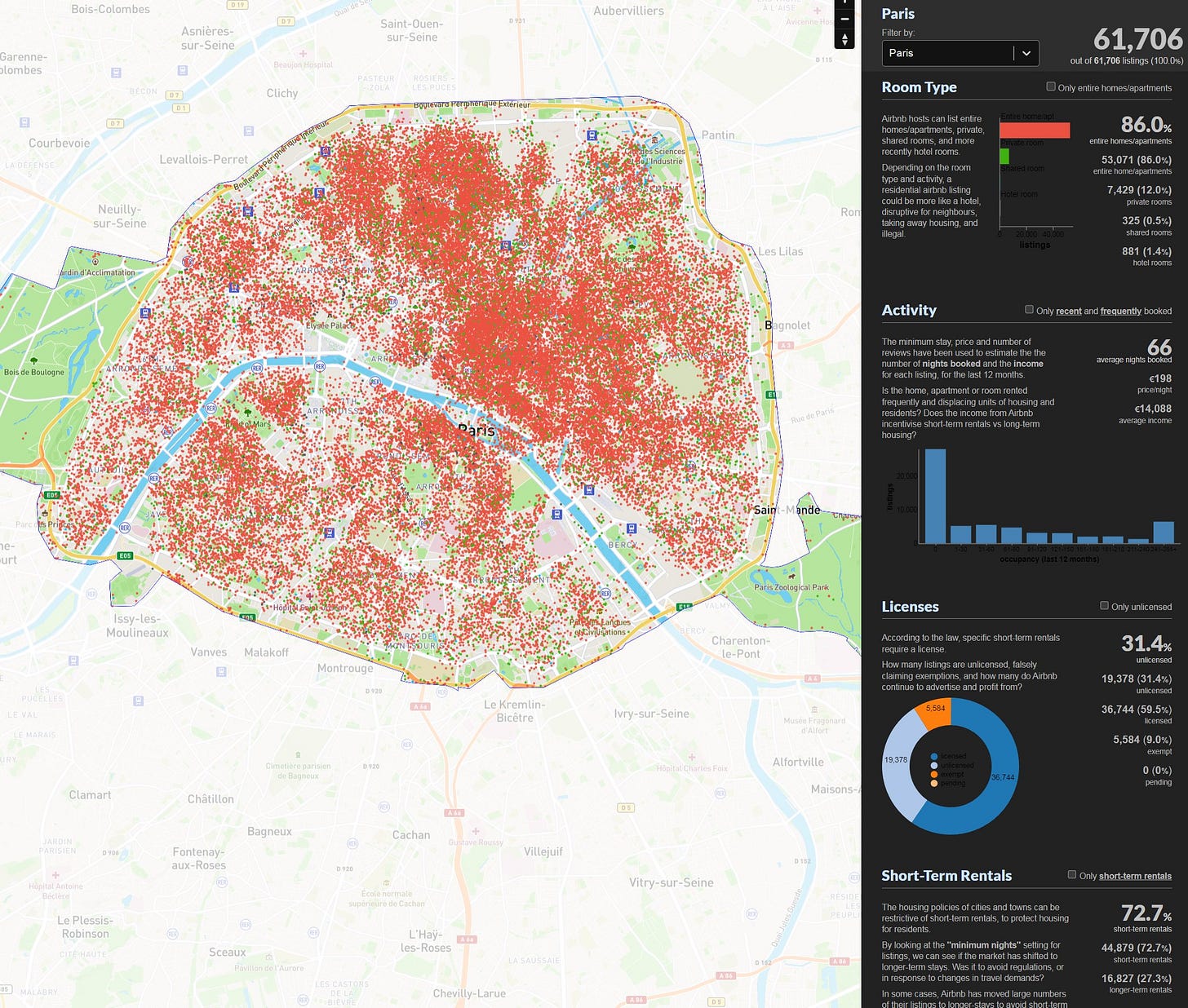

Tallying AirBNBs in cities is getting as exhausting as tallying the 17 Dunkin’ Donuts locations in my small New England town. There are 44,000 in NYC, 82,000 in London, 45,000 in Los Angeles, and Paris is inundated with 62,000 AirBNBs, completely covering a map of the city:

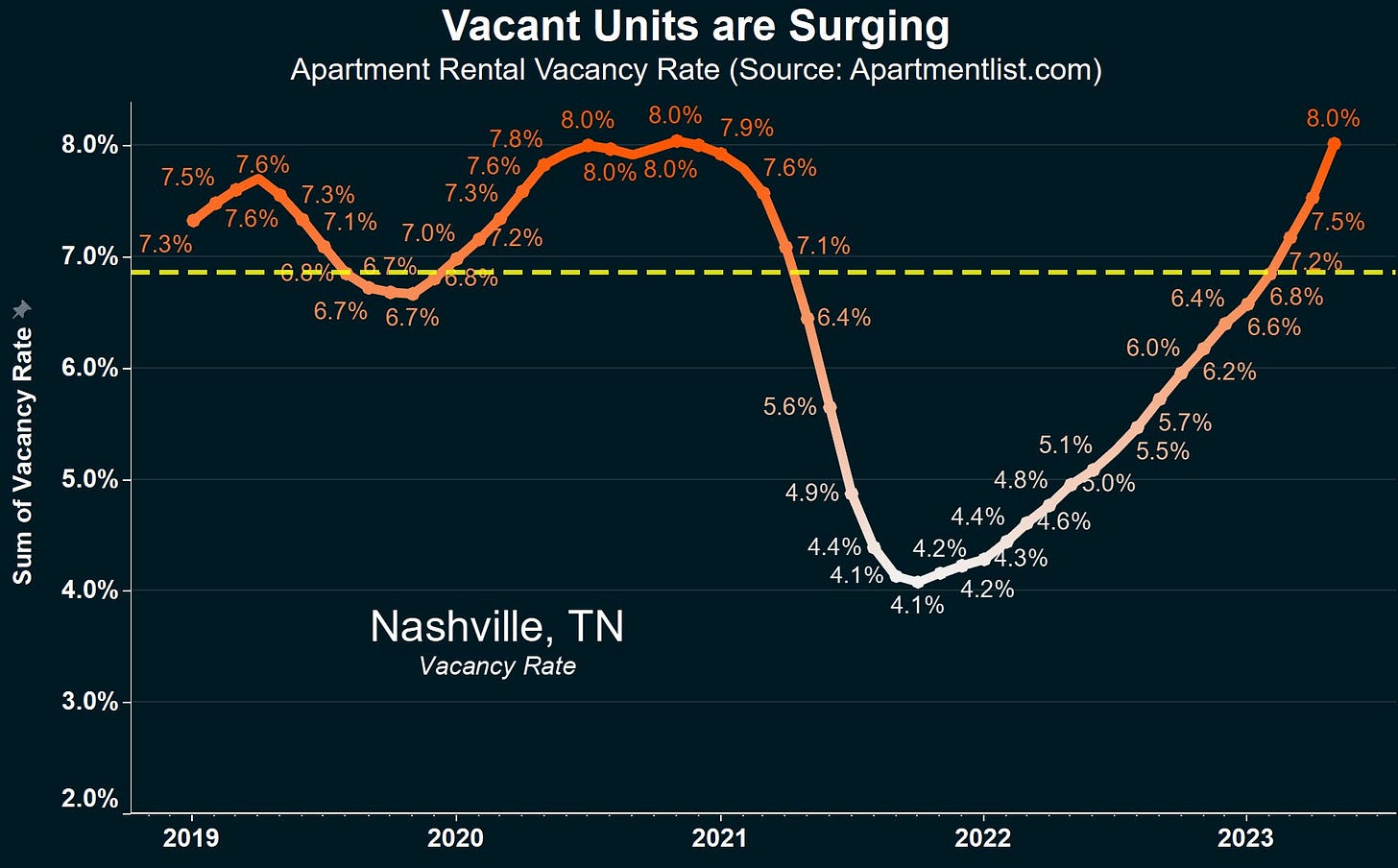

Will owners be able to salvage their properties’ cash flow if they pivot from short-term to long-term rentals like apartments? Nope. Like office space, apartment vacancies have surged, up to 8% in the burgeoning Nashville, TN:

Loads of struggling AirBNB owners will be left to sell into a market with few or no bids at all, taking extreme losses in the process. It’s the same situation that regional banks are facing with their CRE mortgages and CMBS—no buyers.

Mortgages in 2007 were originated by unethical mortgage brokers preying on the American dream of owning a home. Mortgages in 2022 were originated to unsuspecting victims of Airbnb “passive income” gurus on TikTok who were really just selling an expensive carry trade to the financially illiterate.

It ends the same way.

School teachers, recent college graduates, and carpenters now have mortgages on several short-term rental properties that are no longer producing adequate cash flow. Here’s hoping that the fallout is minimized and does not snowball.

The Airbnb co-founder selling $1 billion of his own stock since January doesn’t exactly inspire confidence about the short-term rental market’s stability:

It all comes back to the lenders and how badly they will suffer losses. Credit cards, auto loans, and total charge-offs have more than doubled from the second to third quarter for banks like Wells Fargo. That’s an insight into consumer lending. Imagine how impaired small banks are holding the far-worse-off CRE loans.

Credit card usage doubling at the same time that charge-offs have doubled may point to this: more debt is being taken on without the intent to pay it back.

The crescendo before the finale.

How many lenders will go belly up, and who will throw in the life preserver?

Market cycles are like an elastic band.

They can be stretched to their extreme but always have to return to a relaxed starting position. The elastic band expanded during COVID, but is contracting now that the Fed is trying to engineer a soft landing.

Elastic bands don’t just go from expanded to relaxed—there is no discrete state change. The continuous change from stretched to unstretched can either occur with steady relaxation, or with a snap.

Until next time,

Joe & Nik

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.

Great data and certainly appreciate the entertaining presentation of the view. It's why I subscribe and always read your views. Would play devils advocate on one or two points though - and would be curious if you have any thoughts. 1) The ICE BofA HY effective yield got as low as ~3.9% in Sep '21 and spent most of '20/'21 with a 4 or 5% handle. Recent HY spreads are the lowest they've been in '23, indicating the better-than-feared growth environment (which has driven the gov't curve higher). I'd think either a) growth hangs in and you don't get the recessionary environment that leads to a spike in defaults or b) you see growth roll over in '24 and the Fed starts to cut (Fed futures pricing 125bps of cuts for next year). Unless you see a complete falling out of bed, that would lead to lower gov't rates and potentially a HY effective yield that is similar or possibly lower than today. I'm not saying HY is a pound the table opportunity, but in a growth environment that's hung in, 8-9% yields that provide a decent amount of cushion and the S&P forward P/E at 19 or 20x... you could do worse than credit. 2) With CRE, it seems like extend and pretend is the way most of this will play out. It doesn't interest anyone to have significant defaults. My view is that it just is one component that leads to overall tighter lending standards out of banks (esp small and mid-sized banks as you note). There will be anecdotal situations of major RE/PE firms walking away from properties in the most stressed metro areas, but I'd still take the other side of the potential armageddon scenario playing out. 3) With AirBnB - a good example in why following the herd can lead to a poor outcome. However, I'd assume the vast, vast majority of these mortgages were fixed in nature and aren't at all sensitive to rates moving higher. And with overall, for sale inventory at historic lows, I'd think you don't have a) a cliff in home prices or b) the average AirBnB owner feeling like they're in such a financial pinch necessitating they sell. Maybe less desirable cash flow than anticipated, but I fail to see the armageddon scenario here either. All that said... looks like a trip to Paris would make a lot of sense right about now! Thanks as always for the content that makes you think.