The Delusion Surrounding Central Banking

Jerome Powell facing some legal trouble. We hope he finds a good lawyer!

Dear Readers,

I feel like I’m taking crazy pills. While I am not intensely interested in the legal trouble in which Jerome Powell seems to find himself, nor will I be reading articles on the Department of Justice’s efforts here, the outcry of support for the Fed is truly remarkable. And by that, I mean remarkably silly.

In today’s letter, I’ll tell you exactly how I feel about the Trump/Powell tango (it takes two) and then show you just how dangerous the United States fiscal picture has become under the Fed’s QE regime. It’s fair to say that the hoopla got me fired up. Our young analyst, Demian Schatt, wisely pointed out that due to overregulation, the average American commits three felonies every single day. Here’s looking at you, Jay.

As bitcoin’s role in the global financial landscape evolves, understanding its potential impact on your wealth becomes increasingly crucial. Whether we see measured adoption or accelerated hyperbitcoinization, being prepared for various scenarios can make the difference between merely participating and truly optimizing your position.

This is why Unchained developed the Bitcoin Calculator – a sophisticated modeling tool that helps you visualize and prepare for multiple bitcoin futures. Beyond traditional retirement planning, it offers deep insight into how different adoption scenarios could transform your wealth trajectory.

What sets this tool apart is its integration with the Unchained IRA – the only solution that combines the tax advantages of a retirement account with the security of self-custody. In any future state, maintaining direct control of your keys remains fundamental to your bitcoin strategy.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

Why? Because securing your generational wealth on paper is risky.

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why.

This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Use code TBL to take 15% off your purchase.

Jay Powell, the untouchable?

First of all, if Powell lied under oath, he broke the law.

If he didn’t lie under oath, he should hire a good attorney to fight any case against him. But the silly part is why global central bankers and certain politicians feel the need to defend Powell against legal actions when there is no way they could know the details of the case. In what scenario do foreign central bankers, such as Christine Lagarde (who participated in a joint statement admonishing the DOJ news), have the right to pre-opine on matters of American justice before any official cases or indictments are brought? It reeks of “central bankers are God, don’t mess with us,” and it is honestly a bit disgusting.

Let me be clear here on my opinion: President Donald Trump has been both the victim of a weaponized justice system and an employer. He was viciously attacked with lawfare during the Biden presidency. His family’s bank accounts were frozen. His name was almost prevented from even appearing on the 2024 ballot in several states. Now, in his efforts to reform the United States, in his eyes, he is going after enemies of the agenda. It’s war, and instead of watching it play out, foreign central bankers and even members of the American establishment, whether Democrat or Republican, are picking a side — the “independence” of central banks.

On whether we believe in the independence of central banks and whether that should remain the power structure of our financial system, we have doubts. Our belief is rooted in 19th century Bank of England lore, namely Walter Bagehot’s lender of last resort concept. It’s also rooted in a Gilded Age that did not have a central bank in the U.S. (1870-1900). Lastly, it’s rooted in the fact that a central bank is not in our Constitution, and efforts to create and destroy a United States central bank are literally part of our Day 1 history.

My grand point here is that neutral observers must let this play out. Challenging the independence of central banks might sound odd to those firmly set in the status quo, while anybody with a good sense of history takes it as part of the ebb and flow of American history. As Treasury Secretary Scott Bessent has repeated since he took his seat, the Fed is an engine for inequality. It has enabled the least productive spending binge (also the fault of Congress and the Executive branch, bipartisan) in our nation’s history, and it now leaves us in a terrible fiscal position. The inequality gap is larger than it ever has been, yet for some reason, none of these facts are present in Lagarde-type reactions.

Can we please stop with Europeans telling us to obey banking overlords? Please?

We interrupt your regularly scheduled readings to introduce you to our…

TBL Research Dashboard

The TBL Research Dashboard is our LIVE research platform for tracking bitcoin, global liquidity, and macro conditions in real time.

Inside the dashboard you get:

The TBL Liquidity Index and a live Buy/Sell signal

The TBL Liquidity Wave with 6-month forward projections for bitcoin and the S&P 500

30+ live Macrobond charts covering labor, inflation, productivity, money markets, and the Fed

Bitcoin models and on-chain data including Realized Price, MVRV, 200-day MA, Power Law, and funding rates

Built-in methodology and explanations for every model and signal

The dashboard is continuously updated as new charts, models, and research are added. It is available exclusively to TBL Pro members.

The dire US fiscal picture and possible solutions

It’s time to get into the numbers, because without a central bank, perhaps the market would have forced Congress to make material adjustments to its spending and taxation equation. Alas, we have a Fed that loves to print and a Congress that loves to extend last year’s budget, no matter how much pork, into the next year. If you want a better understanding of how broken our budget process is, try this interview with former U.S. Senator Ben Sasse, who has recently tragically announced that he has late-stage cancer.

Aside from a broken Congressional budget process, we must look at the damage already done and imagine how the country reverses its course.

We begin with debt to GDP. Right now, the U.S. hovers around 120% debt to GDP using the current stock of Treasury debt, which at $38 trillion outstrips our $31 trillion economy.

Within those numbers, what matters is how much tax revenue we earn versus how much we spend. If spending outweighs tax revenue, debt will increase. How much does GDP increase as the debt increases? That’s the key question, because if GDP grew more than the increase in debt, the debt appears to be productive. Unfortunately, that has not been the case over the past couple of decades.

The reason is that much of the new debt goes toward consumption, retirement, and health, instead of productivity, factories, and infrastructure. Without productive debt, debt just stacks higher and forces debt-to-GDP higher.

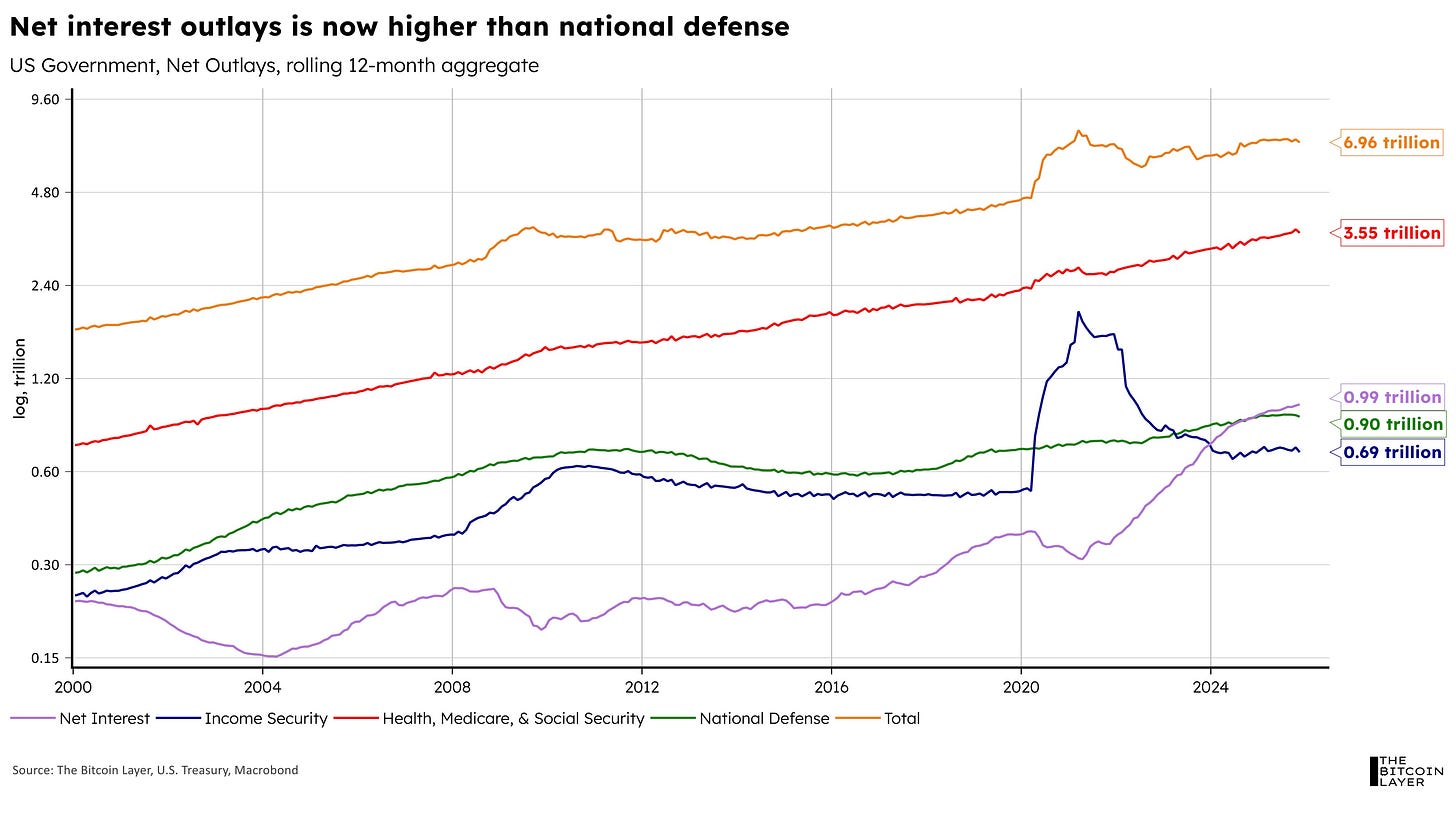

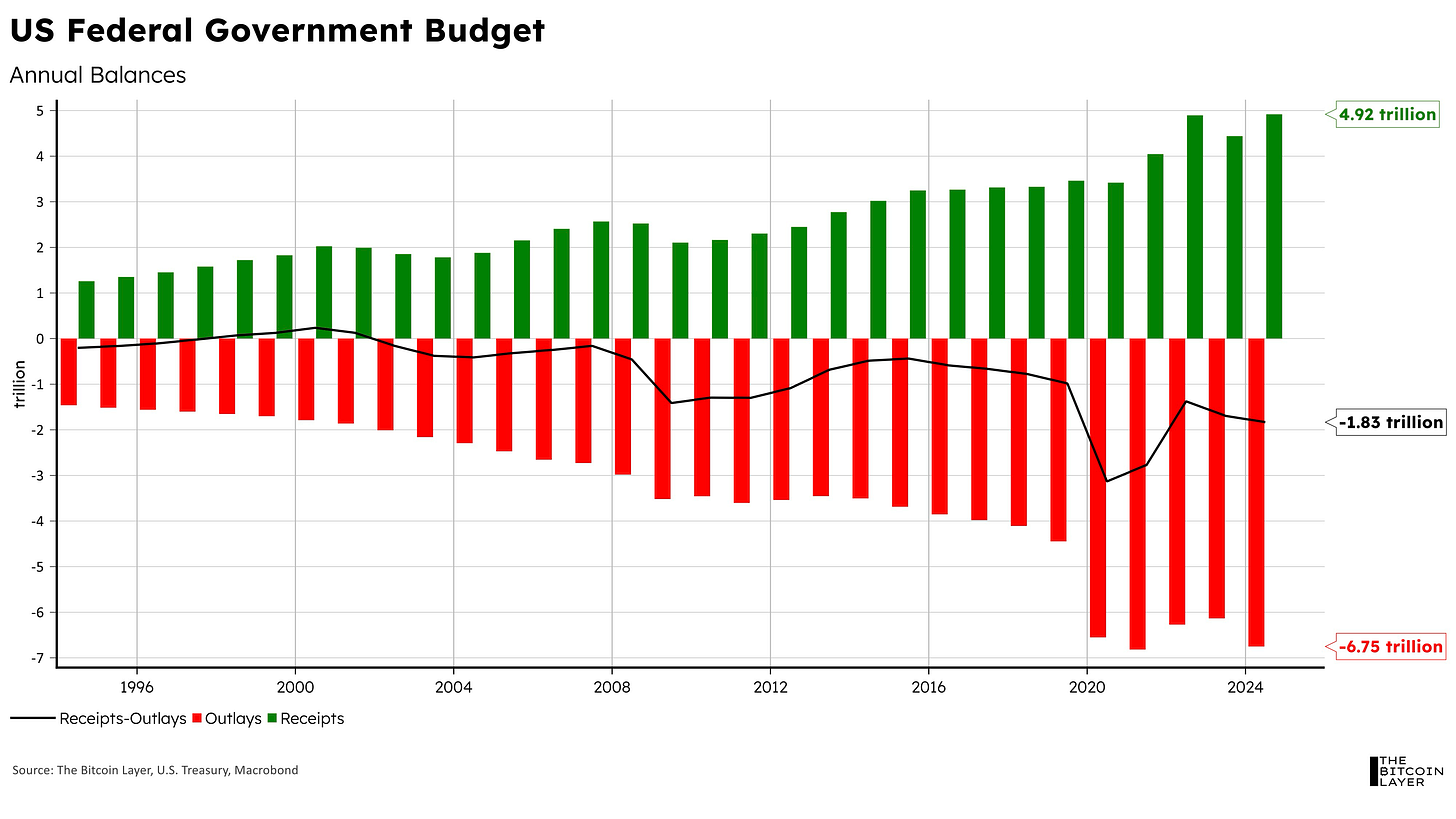

Next, let’s look at the spending itself. We are running at a rate of about $7 trillion in spending versus about $5 trillion in tax receipts. Of the $7 trillion, almost $4 trillion goes to entitlements and $1 trillion to interest. That means all of our tax receipts go to interest and entitlements, without factoring in any defense spending or productive spending such as infrastructure. That’s a problem.

Here’s how much of the total outlays are going to purely interest. Fourteen percent is NOT sustainable. Treasuries must be rolled at lower rates, the spending-receipts gap must shrink, and the receipts line item MUST grow as a function of growing GDP. If we want our nation to survive, there is no alternative outside pure Fed monetization and a downstream jubilee, which I would argue would be catastrophic in that it ends modern finance as we know it. On a side note, going away from independent central banks would simply rewind the clock just over 100 years — I’m sure the Treasury department would do just fine without TGA (Treasury General Account, Fed liability) and instead bank with Jamie Dimon and the crew over at Citibank like it used to.

Finally, here’s a look at the whole equation. The red bars must flatline (recall the Sasse argument on the carryover budget), and outside of a complete Congressional overhaul and an inward moment regarding the specifics of our Constitution, we can’t truly expect them to decline. The green bars must jump at a high, compounding positive rate, and this can happen by reviving domestic investment — we have seen significant signs in 2025 wholly due to President Trump’s reordering.

Make no mistake, the new global order is being made in Trump’s eyes, and whether you like him or hate him, the consequentiality of his tenure might be unmatched in the modern era. I don’t agree with all the policies; I can certainly see the ones that are heavily weighted toward cronyism, and I don’t always like his style of communication, but I strongly favor the direction this nation is going on policy because I can see the red bars and green bars heading, finally—albeit marginally—in the correct direction.

Why do I favor the policies at hand? Take tariffs, for example, which almost every talking head claimed would bring about a new Dark Age, uncontrolled inflation, and economic mayhem.

Tariffs have so far:

brought American and foreign companies back to the United States to build productive facilities;

driven American and foreign companies to plan production shifts permanently back to the United States;

not raised inflation but rather dampened it (whether causal or not);

dramatically lowered the American trade deficit;

positively impacted GDP;

not led to any broad decline in investor confidence;

changed behavior of our trading partners and trade war adversaries; and,

officially moved the world out of globalist tendencies run by shadowy groups meeting across (mostly) European enclaves.

Do we need an independent central bank in its post-2008 form? Or do we need a better fiscal equation as a nation? While these two might not be mutually exclusive, I would argue that the “independence” of the Fed is a cover for banker bailouts and has significantly and negatively impacted wealth inequality and American financial health, and therefore, the longevity of the nation. That, my friends, is the true crime here.

Until next time,

Nik

My favorite TBL article YTD.

Thank you! Some friends of mine, who generally lean small-government, reacted negatively to this news and I felt like I was taking crazy pills. I went on a End the Fed feather-ruffling email flurry that would have made Ron Paul proud. Thanks for making my points seem less crazy (to me at least).