The feeling, the warning, and the hammer

Jerome Powell delivers the beginning of an easing cycle.

Dear readers,

On November 3rd, we wrote “Did you feel that?” and described the stunning move that made us feel a shift. On November 30th, we followed up with “Have you recognized this warning sign?” in which we put 3.5% 10-year yields in play. Yesterday, we officially received the hammer from Jerome Powell—rate cuts are not just around the corner as we previously wrote, but are now officially locked in. Even though I constantly remind myself of how quickly the shift happens, it never fails to amaze me. We begin with a self-administered report card from my January outlook to reflect on whether I should even bother with another in 2024, and we conclude with what might be the most important news in the history of bitcoin accounting.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

An FOMC presser to remember

Before the Fed kicked off its capitulation series of events starting with its statement and ending with Jerome giving Treasury longs everything they could possibly imagine, I had the urge to go back to my 2023 outlook and truly critique my own analysis. For one, I’m sure that I’ve called the end of this Treasury bear market early on more than one occasion, and I lost a wager to a close friend that Fed Funds wouldn’t advance beyond 4%—one which was placed when Fed Funds were around 3%. But I knew that I hadn’t felt this way about the cutting cycle commencing.

The reality is that you don’t pay for this subscription so we can spew predictions around without accountability—it should be our duty to reflect on things we are saying, and it is our belief that your ongoing readership is proof that enough of what we write is both intelligible and actionable.

My first relevant prediction in January:

Our big [2022] claim was “don’t assume that the Fed will pivot at the first sign of equity weakness”—this ended up being correct. Our next claim was that hikes would slow to a pause by the end of the year—this did not happen, but slowing inflation makes us confident we are merely early to the call.

This one was spot on. The pause that we expected from late 2022 didn’t materialize until mid-2023, and thus my lost bet. But the next forecast is where I was the most inaccurate—I just didn’t see how long it would take for monetary and fiscal stimulus to run out, and therefore, I incorrectly assumed a recession would eventually arrive this year, and that weakness in housing would soon demand lower rates:

This year, the debate will center around rate cuts during a recession. For that, we’ll need to understand when the recession has actually arrived (it hasn’t yet, especially with a relatively strong fourth quarter of GDP), how serious it is, and how much the housing market physically requires lower rates to carry on. The Fed’s job, in its own eyes, is not to rush to pivot its policy rate lower, but rather to maintain a restrictive rate for as long as it can to ensure inflation has come back down.

So what is different now about my rate-cut outlook? In trying to articulate it over the past several weeks, I basically only lost out to Jerome himself, who brought the freaking hammer:

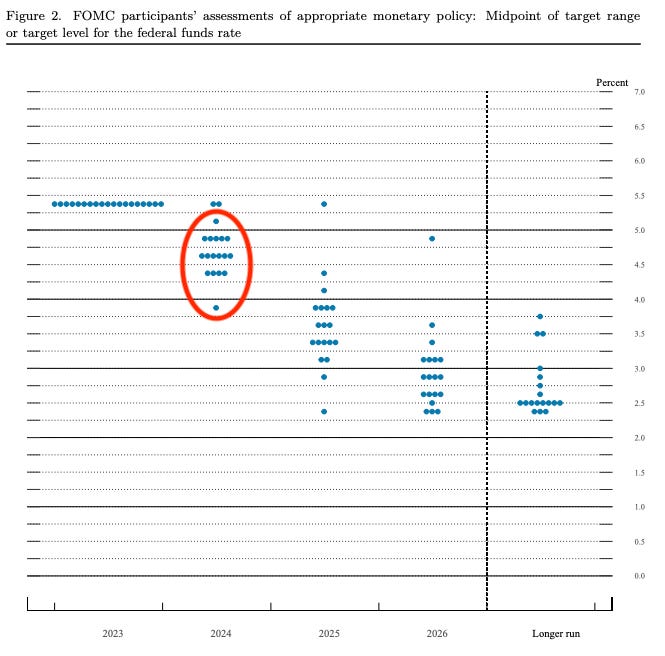

Rate cuts are clearly a topic, says the Fed chair who still today tried to convince us that further hikes are still possible should inflation accelerate. We thought he would try to push back on rate cuts that were getting priced in; instead, Jerome Powell laid down on the floor and let Treasury bulls walk all over him. Rates acted accordingly, but first a look at the Fed’s own projections of the policy rate: all but two members are in for cuts, and most of them have a whole cutting cycle going next year:

How did the market react? Our recent call for cuts by June almost seems mild now.