The Hills Are Alive With The Sound of Recession: Global Macro Update

Recent economic data has been dismal. Treasury yields falling, bitcoin's buyers of last resort, and lots of charts.

Dear readers,

A few months ago, we started offering an institutional service of more in-depth charting and market study, but we are discontinuing it. In short, The Bitcoin Layer wasn’t able to tier our research because we didn’t want to shortchange our paying subscribers. And so here we are, with our best foot forward to bring you a massive global chart pack, covering all the things: rates, risk, bitcoin, and everything else that matters.

As central bankers deny, the hills are alive with the sound of recession.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself.

Create a node in less than 2 minutes, just visit voltage.cloud

Today’s Topics

Economics (4 charts)

Rates (3 charts)

S&P 500 & Volatility

Oil

Bitcoin

Global slowdown intensifies

Economic data releases of late diagnose us with contraction. The depth of the recession, as well as the timing, are impossible to forecast. But one thing we know for certain is that business sentiment, new orders, employment, and prices paid are all in contraction. The trend of slowing growth has been in effect for many months, but the latest increase in interest rates has caused businesses to begin layoffs and plan for a slow 2023 global economy. This weakening sentiment is reflected in yesterday’s ISM Manufacturing release, now below 50:

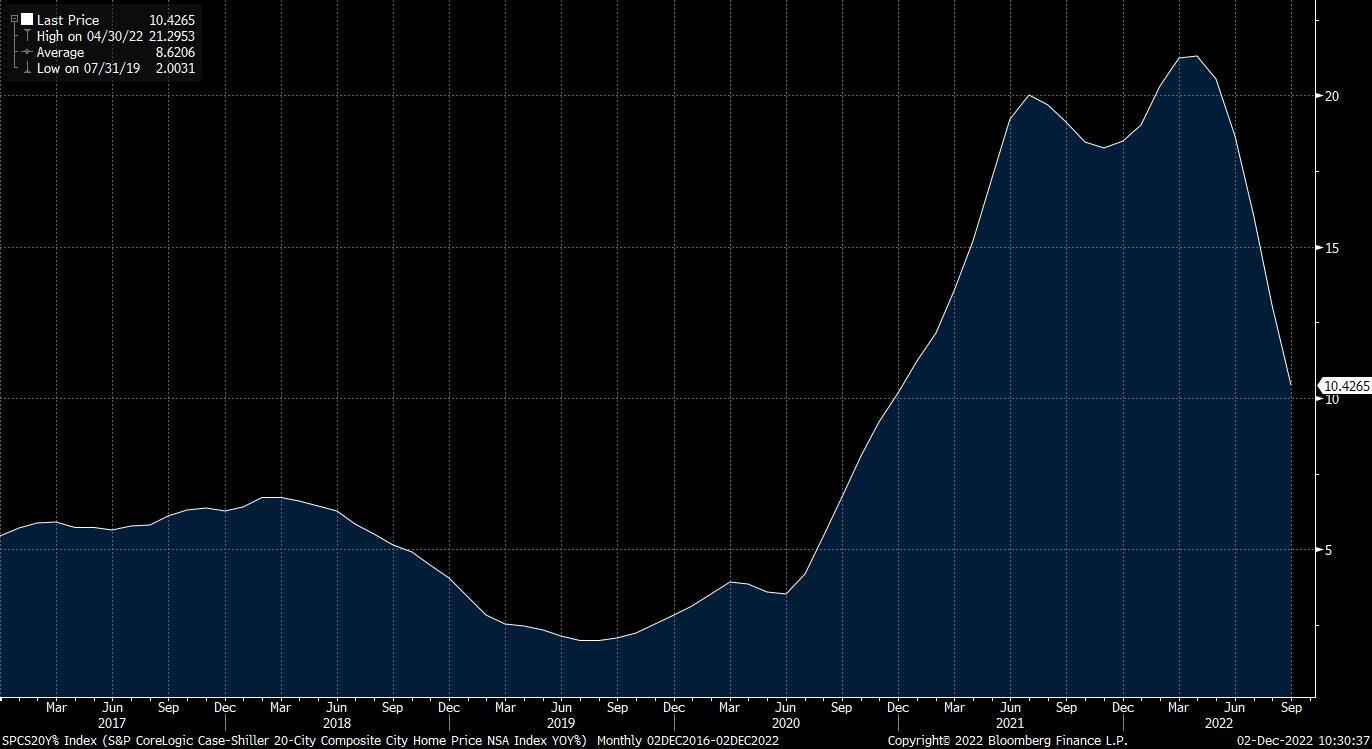

Expensive borrowing costs have pummeled the US housing market. Home sales are down well over 30% from last year, monthly prices are in nationwide decline, and year-over-year price increases (which still exist) are falling rapidly. Housing is one sector that will have an outsized impact on the rest of the economy, and the last few years of euphoria will now face a sustained period of correction and digestion. Wealth effects from this, as well as all sectors that service the housing market, will remain in contraction for the near future. Home price increases are rapidly decelerating:

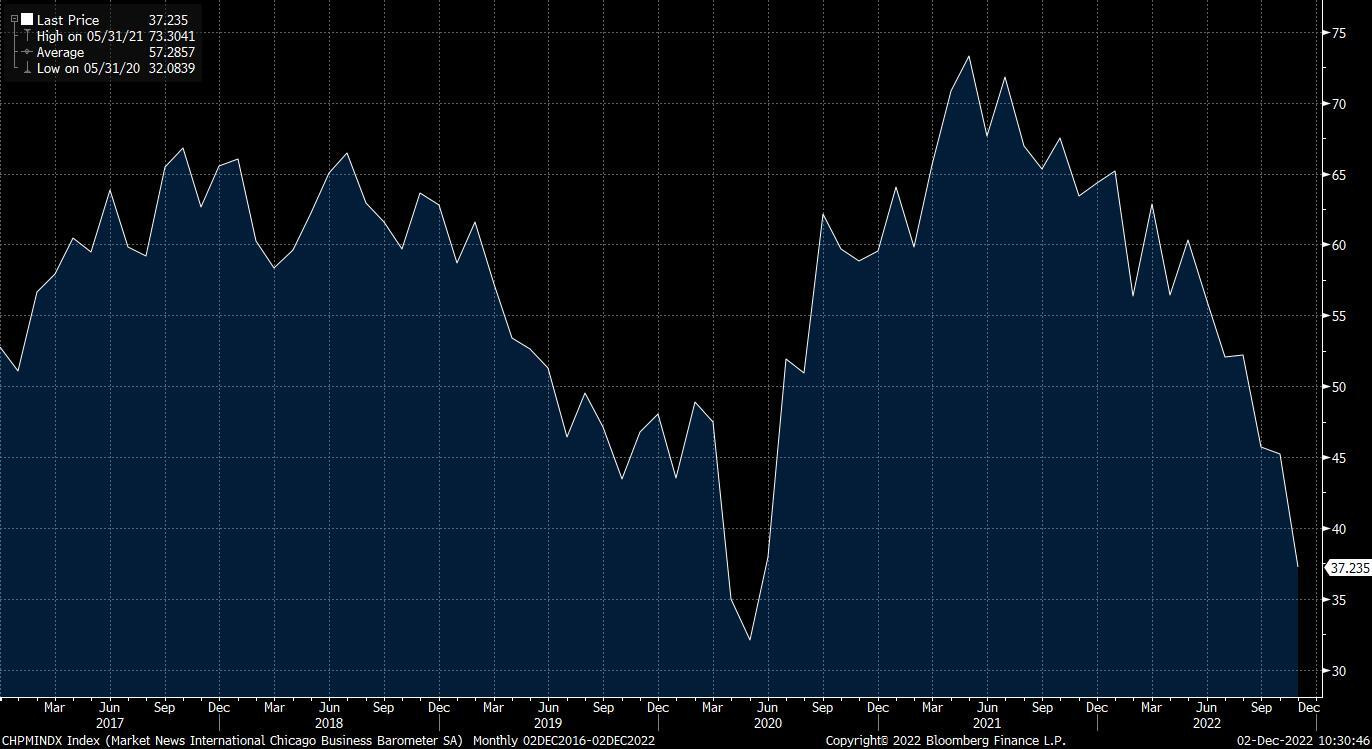

We don’t usually bring you the regional business sentiment surveys, but this Chicago PMI number made me fall out of my seat. The reading is now almost at COVID levels:

We are in a recession, no matter what the official designations currently pontificate. The contraction in enough sectors, namely housing and manufacturing, loudly dictate that the marginal direction of activity is negative. Mass layoffs confirm this—one of the internals of this morning’s job data which is not as rosy as the headline:

The job market has been struggling for as long as home prices have been declining (on rate of change). We know what comes next, but it’s the job of central bankers to talk markets up, and away from the probability of a recession. Ask yourself: when was the last time a Fed member forecasted a recession before it happened?

While you scratch your head and think about it, let’s continue.