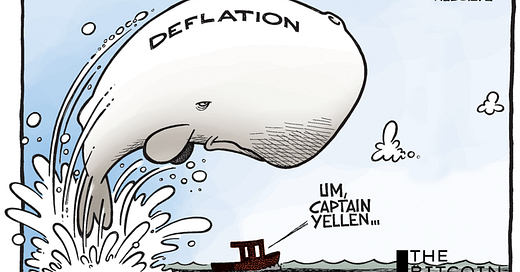

The inflation battle is won, now banks are in the crosshair

Shelter disinflation will drag CPI down like a rusty iron anchor. Now that rate hikes have slain inflation, the only target left on the battlefield is the banks.

Invest in Bitcoin with confidence at River.com

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

A day out from the June CPI report—where the yearly pace of inflation is expected to fall from 4.0% to 3.1%—Cleveland Fed President Loretta Mester says that more rate hikes are required for inflation to come down to its 2% target. After 11 straight months of falling yearly price increases and a 12th month of descent locked in tomorrow at 8:30 AM, some members of the Fed are still adamant that more rate hikes are needed:

While a few select Fed members may have their heads in the gutter for hawkishness’ sake, the market’s path for price inflation is back down to 2% with no additional hikes needed. Granted, it is a choppy one. An upside risk to US price inflation exists if China unleashes fiscal stimulus for the severe deflation and youth unemployment the country is experiencing. This is likely one factor contributing to the choppy path to 2% rather than a swift fall. Note the path in red: