The market has a gambling problem

Same-day options are growing in popularity, making an already fragile market more prone to volatile explosions. Is this a recipe for a stock market crash?

Dear readers,

The Fed’s mission to reduce its balance sheet and raise rates has gone on much longer than most expected. Traders have been positioned for a rate pause since Q3 of last year—at first, the terminal rate was priced at 3.5%, then 4%, and now 5.5%, which was inconceivable just nine months ago.

With an increasingly difficult-to-place narrative, markets have had a hard time settling on a direction. Even amidst this chop, portfolio managers still need to make money—enter: zero-day-to-expiry (0DTE) options. These highly leveraged vehicles can make even the most minor shifts in equities caused by economic data and Fed speak into tradeable events. They have grown into the preferred method of hedging for an increasing share of equity traders.

Now, as much as it ever has, the market has a gambling problem.

Today’s topics

Short maturity options like 0DTE are more akin to gambling than hedging.

Options markets can drive the direction and price of equity indices.

The dominance of 0DTE options has made the real level of volatility invisible.

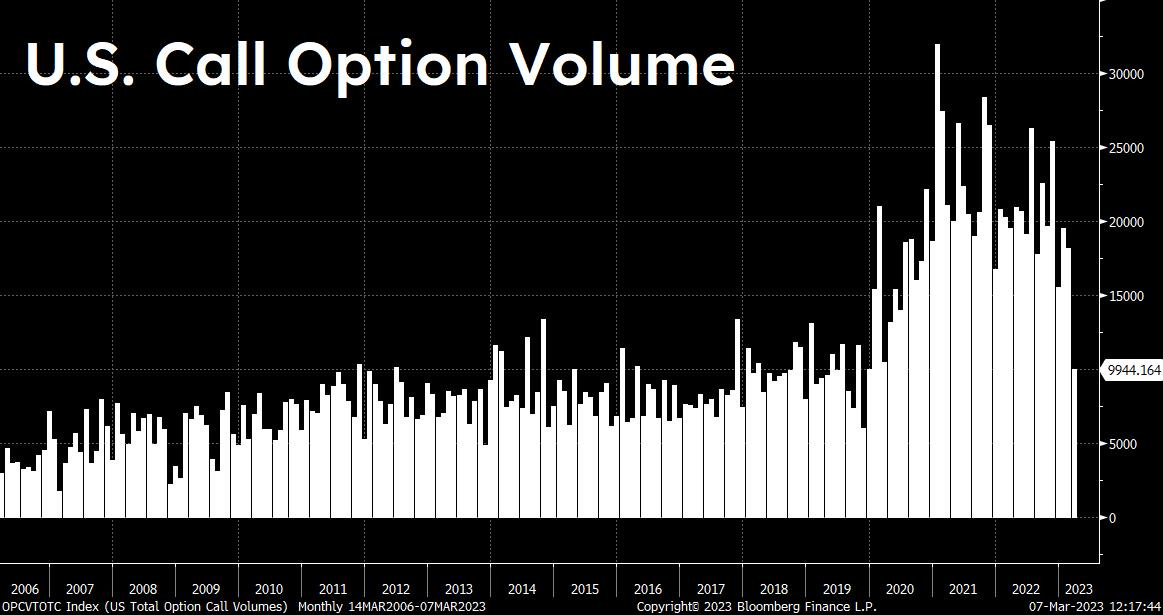

Options basics

Stock options provide the option buyer the right to buy or sell 100 shares of a stock at a specified date and price sometime in the future—though this is the main mechanical feature of options, it isn’t the main draw. Options traders generally don’t exercise the right to purchase or sell 100 shares at a specified date and price; they instead utilize options as a method of profiting in an outsized manner from movement in the underlying security. In layman's terms, if the price of a stock moves up, the price of a call option on that stock will move up more—this asymmetric return profile is what makes options so popular: options are a form of leverage. The rounds of monetary and fiscal stimulus following COVID gave way to rampant speculation in asset markets and rise to the popularity of stock options, with volume more than doubling from 2019 to 2021:

As the market continues to lack clear direction, 0DTE options have exploded as a method of profiting off of teeny-tiny market moves that dominate today’s choppy price action. Over 45% of options volume on the S&P 500 is now 0DTE: