The Myth of DeFi and Reality of Bitcoin-Lightning Finance

Bitcoin & Lightning enable truly decentralized financial instruments and p2p marketplaces, while "DeFi" and "crypto" do their best predatory imitation of it.

Dear readers,

The era of hyper-pontification and wordsmithing is coming to an end. As the casino of Ponzi schemes vaporizes billions of investor wealth yet again, self-flatulating and vacuous words like blockchain, crypto, web3, and DeFi are being widely understood for what they are—abject scams. While we fully sympathize with the spirit of decentralized finance, trying to find it outside of the bitcoin ecosystem is presently impossible—the word “DeFi” in and of itself has been indelibly tainted by rampant centralization, censorship, and outright fraud.

As many have posited, the solution for the FTX explosion (centralized finance) may have been more DeFi, or decentralized finance, but no present or future protocol can or will achieve resilient decentralization at scale.

Thankfully, bitcoin already has achieved decentralization—and its continued growth and development of native financial plumbing indicate that bitcoin has a future as both a base layer asset and the foundation for real decentralized finance.

Voltage helps you solve the biggest problem with Lightning nodes and scaling. No more headaches with maintenance, reliability, or uptime issues. Voltage makes running Lightning instant and now easier than ever. These radical improvements to Lightning empower startups and enterprise brands to bring incredible applications and services to market. You can also spin up a personal node and pay by the hour. Scale your infrastructure as fast as Lightning itself.

Create a node in less than 2 minutes, just visit voltage.cloud

Today’s Topics

Junk bonds, low-quality borrowers, and the capital market risk curve.

Too many are attributing the FTX blowup solely to a lack of decentralization.

It was also predatory fraud enabled by affinity with bitcoin.

DeFi has failed at every turn, for one reason or another.

No protocol or entity will ever achieve organic decentralization ever again.

Bitcoin-Lightning is building a real, decentralized, parallel economy via p2p (peer-to-peer) marketplaces and protocol-native financial instruments.

Credit Risk, Junk Bonds, and the Risk Curve

Every new-fangled financial tool present on DeFi is merely an already-existing traditional finance instrument with a new name. As such, let’s do a quick rundown on some traditional finance concepts.

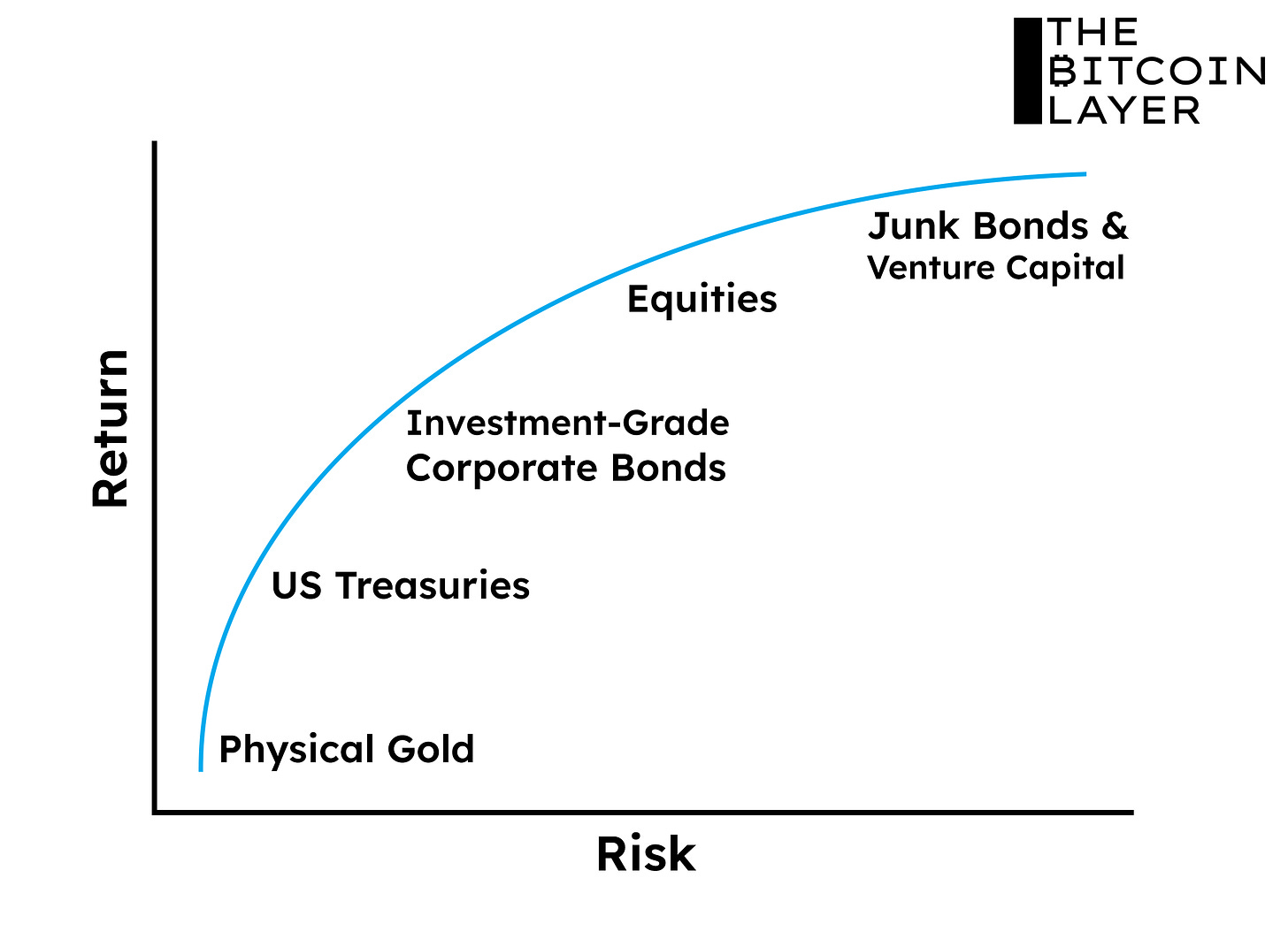

Credit risk is the probability of default of a borrower failing to repay its debt obligation. Creditworthiness, or the measure of one’s ability to make required payments, is how credit risk is quantified. The less creditworthy an individual borrower is, the higher the associated credit risk that comes with that individual—therefore, a higher rate of return is demanded when lending to these individuals.

Junk bonds, or high-yield bonds, are bonds issued by the lowest-quality debtors—as mentioned above, they offer a higher rate of return (relative to investment-grade bonds issued by blue-chip companies) given their coinciding higher likelihood of default.

A risk curve is a way of visualizing the associated risk and return profile in a universe of financial instruments, known as a capital market. Risk curves begin with the lowest returning and safest vehicle at the base, moving along the curve each vehicle gets progressively riskier and higher yielding. Here’s an example:

Coins termed by DeFi, such as “staking” and “yield farming,” are simply iterations of junk bonds—a fresh coat of paint on a traditional finance mainstay. These risky and high-yielding products are the first to be slaughtered during the liquidity cycle downturn, so it’s no surprise that weeks after the first Fed rate hike, a total meltdown began across crypto and DeFi.

The Terra/Luna scheme, in which upwards of 15% was being offered on dollar deposits in DeFi “yield farming,” turned out to be extremely risky lending to non-creditworthy borrowers—the high yield should have been a dead giveaway. Alas, when defaults ensued and people rushed to withdraw their money, they got pennies on the dollar if they were lucky. Such is the case with DeFi, which had become similar to buying a junk bond issued by a tech startup out of your neighbor’s garage.

Who else is offering conspicuously high rates of return on dollar deposits? Your favorite crypto platforms: BlockFi, Binance, Crypto.com, KuCoin, and many others.

The proclaimed “future of finance” is built as a digital junk bond universe, and that’s the inescapable problem.

CeFi was FTX’s problem, but DeFi is not the solution

The opaque nature of FTX and Alameda Research’s balance sheet opened the door for the illegal rehypothecation of client funds—fraud has happened this way in traditional centralized finance and fractional reserve lending for many decades. However, too many are attributing the FTX blowup solely to a lack of decentralization. But there’s much more to it.

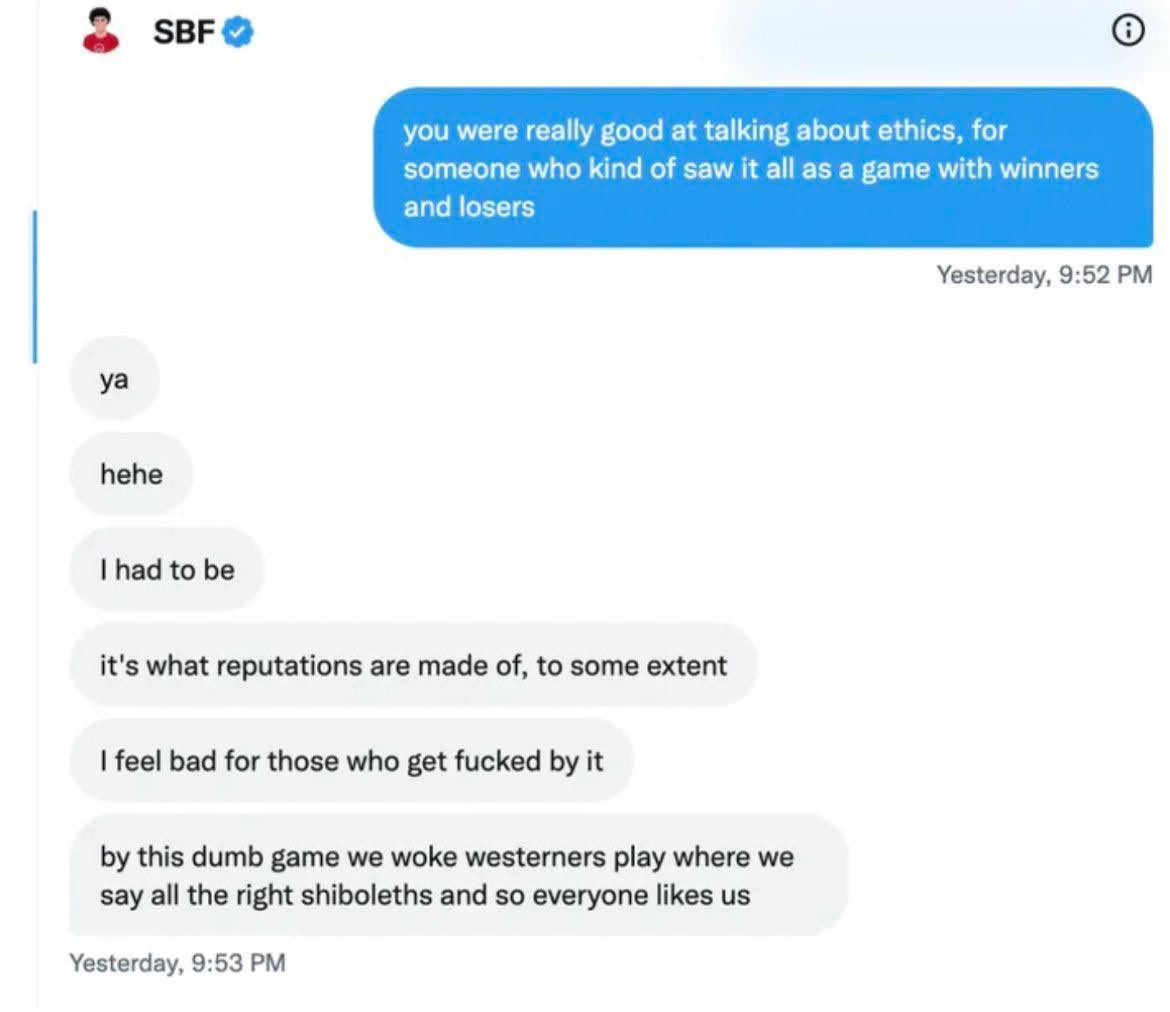

It was predatory fraud enabled by a manufactured affinity with bitcoin.

Bitcoin’s blockchain is supposed to be boring—it was created for the express purpose of verifiable ownership in a distributed fashion so money could be ported onto the internet; that’s it. It exists in the bitcoin protocol alongside the SHA-256 algorithm, issuance schedule, and difficulty adjustment as a way of verifying ownership of all assets on the network, and that all network participants are following the rules.

There aren’t other revolutionary use cases for blockchain, but it’s the mission of snake oil salesmen to convince you that there are. Grifters have taken Bitcoin’s architecture and sprinted with it, attracting billions from VC funding and billions more from unsuspecting and impressionable retail investors. They leverage predatory word choices like “accessible to everyone” and “democratization of finance” to gain affinity with bitcoin’s properties; but since Bitcoin can’t be controlled or co-opted, they create controllable alternatives and smear campaigns to badmouth bitcoin.

There is nothing about crypto or DeFi that frees you from the shackles of traditional finance, just audience capture by using buzzwords to push forward that dream.

The proprietors of DeFi know full well that they’re peddling a dream, nothing more:

DeFi’s failures illustrate why organic, resilient decentralization begins and ends with Bitcoin

Decentralization is a worthwhile pursuit, and to all those working towards decentralized applications, we see you. However, the decentralization of financial activity on cryptocurrencies such as Ethereum, which has recently stopped the ability for those staking coins to withdraw, and others such as Solana, which has exposed itself as quite the centralized platform due to insider sales and periodic shutdowns, just isn’t realistic. If the application that is trying to be built is based on either of these cryptocurrencies, it has, at a very minimum, centralized components. Furthermore, other attempts at decentralized activity, such as borrowing and lending, open such projects up to regulation. This is critical: the regulation of financial activity is a certainty in the United States. Perhaps, one day, a jurisdiction will exist that allows people to enter a p2p lending marketplace. But if that marketplace is run on servers that have a physical address (as any cloud computing naturally does), governments will attempt to regulate in the spirit of consumer protection—Ethereum is a prime example of this.

Censorship & Chain Rollbacks - Ethereum & Ethereum 2.0

Ethereum famously “rolled” back the chain and returned coins to previous owners following a mass wallet hack in 2016, so the central influence has always been present:

Following its shift to Proof of Stake, the protocol has grown even more centralized. It has begun censoring transactions in accordance with the US Treasury Department’s Office of Foreign Assets Control (OFAC). OFAC administers and enforces economic and trade sanctions in support of US national security and foreign policy objectives. In other words, the US government through its agencies now has outsized influence and is enacting protocol-level censorship on the base layer of alleged decentralized finance:

To add insult to injury, users can’t even withdraw their staked ETH in Ethereum 2.0. Clearly, “decentralization” is not the solution for centralized exchanges and protocols pausing withdrawals. The longer that withdrawals are postponed, the less public faith this protocol (more like a central governing body) retains—make no mistake, that lack of faith will lead to a mass exodus, like when a bank finally opens its windows after barring them during a bank run:

Chain Halting & Outages - Solana

Several times over the past year Solana has been down due to Amazon Web Services (not kidding) outages. Just read the sentence “The Solana team is actively working with validators to restart the network” to paint the picture—this chain is not decentralized and clearly reliant on a central party to operate infrastructure (the bitcoin node infrastructure has no central point of failure and never goes down):

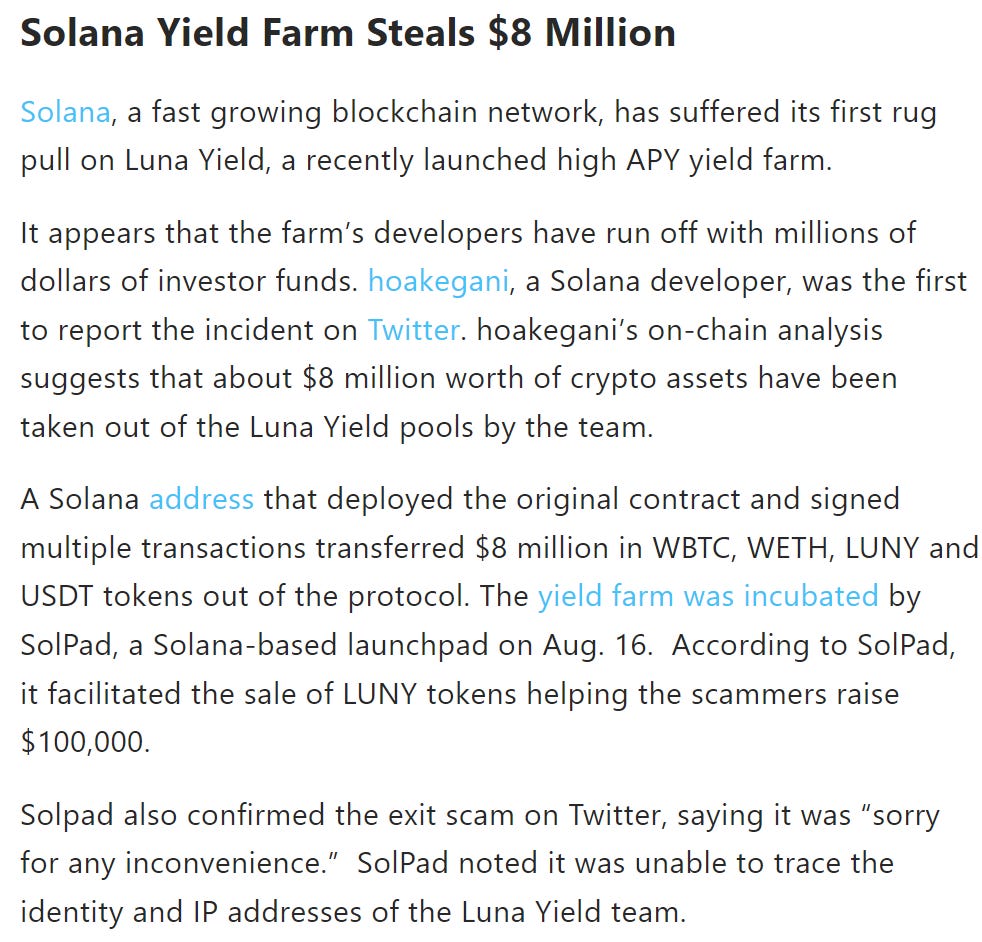

Backdoors for Theft & Rugpulls - Solpad

Protocols touted as decentralized have been built with backdoors for the theft of client funds. An example is Solpad on the aforementioned Solana network—developers made off with a cool $8 million in client funds after not allowing users to unstake their assets (sound familiar?) from a Luna yield farming scheme:

Vaporware Tokens (all of them)

Vaporware tokens are created out of thin air by major exchanges, and in some cases, such as Celsius and FTX, are borrowed against ad infinitum. The proclivity of token issuers to rehypothecate client funds behind closed doors has proved all too tempting, leading to extreme amounts of excess leverage that blows up spectacularly when credit conditions worsen. No amount of “decentralization” or “utility” of a token precludes that token’s value from going to zero.

While Celsius and FTX are the only ones caught with their pants down so far, many crypto exchanges engage in this practice. The combination of vaporware tokens and opaque balance sheets leads to hidden and corrupt leverage accumulation, regardless of how trustworthy founders may seem:

While 1:1 borrowing/lending on DeFi platforms would more or less be alright, to date such arrangements have been exposed as having hidden leverage; see Celsius, FTX. This is exactly the reason that governments try to regulate lending markets and relegate them to banks, which in the US have a backstop (FDIC insurance, access to the Federal Reserve discount window, and moral-hazard-type bailout guarantees) and reserve requirements. In the case of FTX, it did not have this line with the Fed for a liquidity backstop, and as such created devastation and total vaporization of client funds—the same shadow-bank dynamic that has precipitated financial crises of yore.

What we’re getting at with all of the above examples is that what occurred with FTX’s explosion could have happened on any one of these DeFi protocols. Lack of decentralization is not the issue, the tendency towards corruption is.

These vehicles always require a center; a center for issuance and a center for operation, halting blocks and rolling back the chain—they have merely a thin veneer of decentralization. The solution may be decentralization, but none of these or any future protocols will achieve resilient decentralization at scale. Bitcoin was the first and last to achieve this due to the immaculate conception birthed by Satoshi Nakamoto—it is often said that bitcoin was too small to garner any attention in the early years, and by the time it achieved network effects, it was too late to stop. Bitcoin’s protocol absolves itself from the influence of charismatic leaders, regardless of how large their capital base is. In other words, there already is a network with resilient decentralization on which financial instrumentation is being built.

Bitcoin-Lightning: Organic Decentralization & p2p Networks [Real DeFi]

Central entities will always exist, and they will until their convenience is matched by decentralized alternatives. With that in mind, it becomes a matter of building a parallel decentralized network that is sufficiently resilient to the whims of centralized financial institutions—bitcoin is the only instrument that fits this criterion.

Its silent launch and organic growth without a marketing team can’t be replicated in a world in which VCs are reaching for yield and capitalizing on bitcoin’s popularity. Its technological accessibility via cost-effective nodes creates organic decentralization resilient to external attackers at scale—an undesirable reality for founders that want to maintain control over the protocol for “user safety.”

Let’s observe Bitcoin’s decentralization relative to the base layer of DeFi:

Bitcoin Node Count: ~14,350+

Ethereum Node Count: Irrelevant—validators are now determined by ETH ownership, rather than the ability to spin up a node.

Bitcoin Hash Rate: 266 exahashes per second

Ethereum Hash Rate: Proof-of-Stake has disconnected Ethereum from physical reality—there is no energy expenditure to create additional supply.

Ethereum’s consensus mechanism is now asset-ownership based rather than physical capital allocation based—32 unwithdrawable ETH need to be deposited to become a validator. This alleged base layer of DeFi has disconnected itself from physical reality, essentially merging into the rule-by-decree form of money we already live under all around the world via central banking. This much higher barrier to entry is not present in bitcoin, which maintains its consensus-layer egalitarianism.

This neutrality, accessibility, and anti-fragility are only present within bitcoin and emergent Bitcoin-Lightning native financial instruments.

BTC-LN financial instruments are paving the way for real decentralized finance, a parallel economy underpinned by a suite of rates and financial instruments unencumbered by the Federal Reserve and other central banks that endlessly manipulate the price and availability of money.

p2p (actually decentralized) Bitcoin Marketplaces:

Lightning Infrastructure & Liquidity Management:

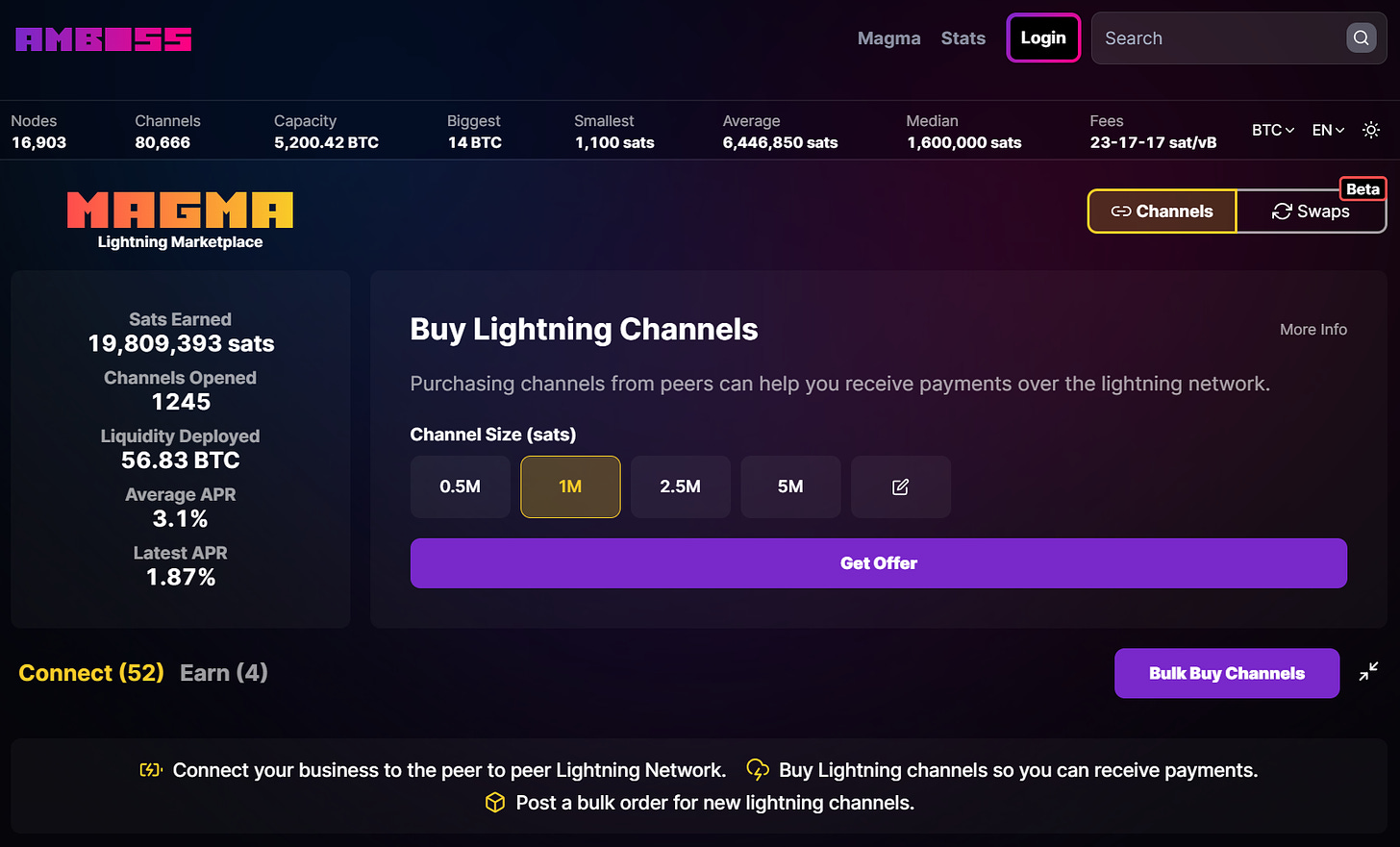

Magma by Amboss Technologies

Lightning Pool by Lightning Labs

Lightning Loop by Lightning Labs

Liquidity Ad Marketplace by LnRouter

The price you pay for decentralization is friction, and DeFi protocols without friction are not decentralized, nor are the future of finance—they are an affinity scam, adopting the moniker because it’s fashionable. Bitcoin and Lightning have a higher barrier to entry, and require technical wherewithal to become a bitcoin miner or Lightning node operator. Yield is generated by efficiently allocating physical capital and providing a positive economic value that someone else is willing to pay for—that is where BTC-LN separates itself from DeFi and its slew of options to “earn passive yield.”

In its simplest terms: Bitcoin and Lightning attract developers and effective capital allocators seeking to generate returns by providing a service, while DeFi attracts those who seek to create something from nothing—sounds awfully similar to central bankers.

Unlike other technology adoption curves of history, bitcoin is faced with growing through a multi-decade DDoS attack from thousands of other protocols, vying for attention and capital. And it couldn't have been otherwise, due to its open source and non-capital intensive nature. - Lyn Alden

How is BTC-LN contending with this multi-faceted DDoS (distributed denial-of-service) attack from crypto and DeFi? Let’s observe—across liquidity and active usage:

Liquidity: DeFi vs Bitcoin-Lightning

The total value locked (TVL) across all DeFi chains has dropped by roughly 30% this year—with the majority of ongoing activity consolidated to Ethereum, the censorship chain:

Lightning Network liquidity is raging in the same timeframe—and robust secondary markets for borrowing and active yield generation continue proliferating:

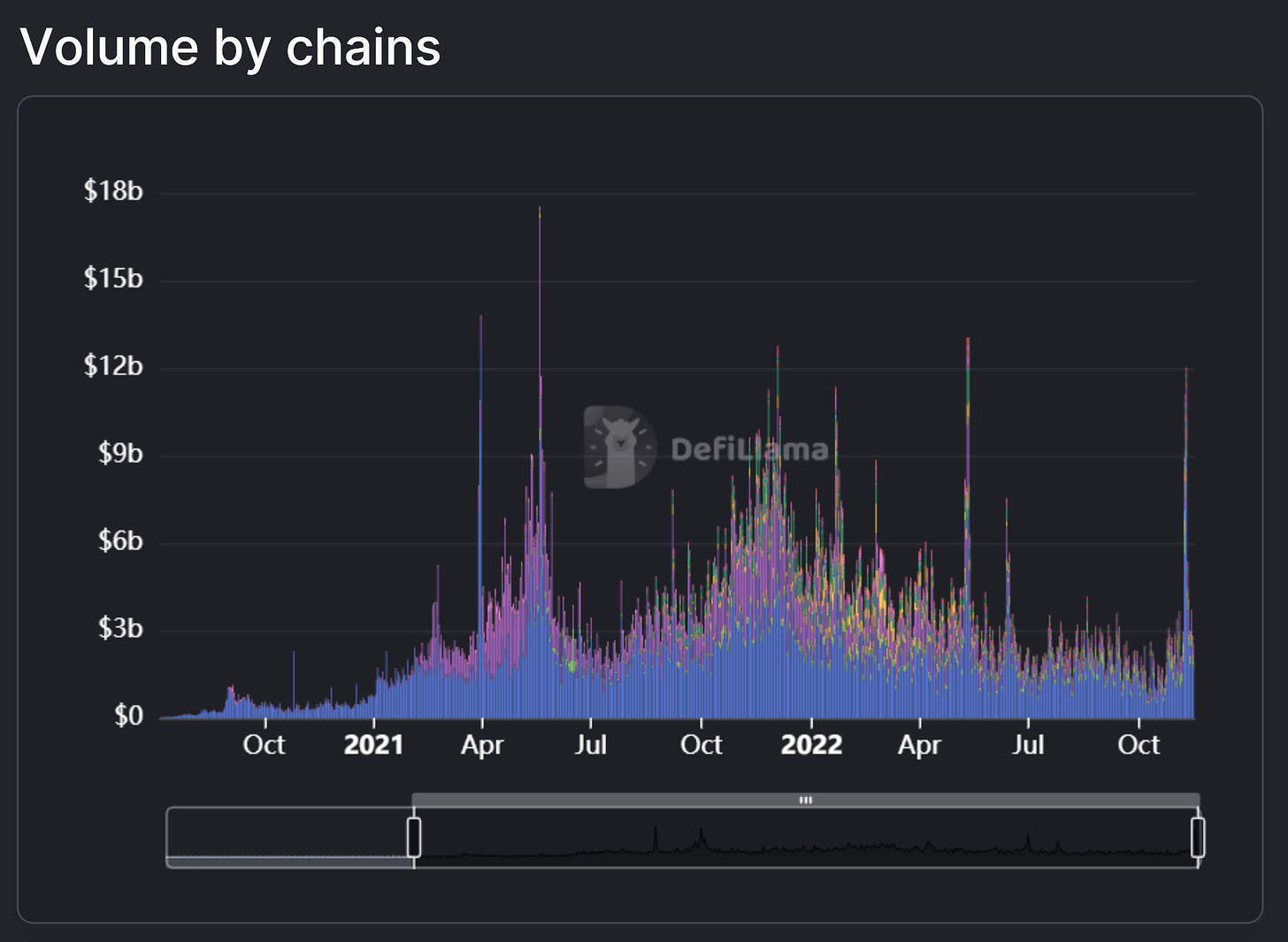

Active Usage: DeFi vs Bitcoin-Lightning

The active volume of DeFi has been in a secular downtrend this past year, with sporadic spikes here and there:

Bitcoin active addresses continue climbing in the face of the same down-only price action. LN nodes are exhibiting the same growth behavior, as market participants continue entering the Lightning Network to provide a real service, generate positive economic value (routing payments), and earn a rate of return set by the open market:

The market has voted with its dollars and feet: decentralized finance is being built on top of the Bitcoin and Lightning networks, while DeFi is slowly dissolving as the market realizes it is merely an imitation of financial freedom.

Crypto is heading for regulatory purgatory—this has never seemed more imminent:

All the while, the immutable Bitcoin network and its unconfiscatable asset are burgeoning into a base layer for global economic activity and capital allocation.

Until next time,

Nik & Joe

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud

This article furthers my thesis that TBL is incredibly underrated. Nailed it!