The Plane Must Land

Operate with a framework so that you make quality investment decisions instead of hysteric ones.

Dear readers,

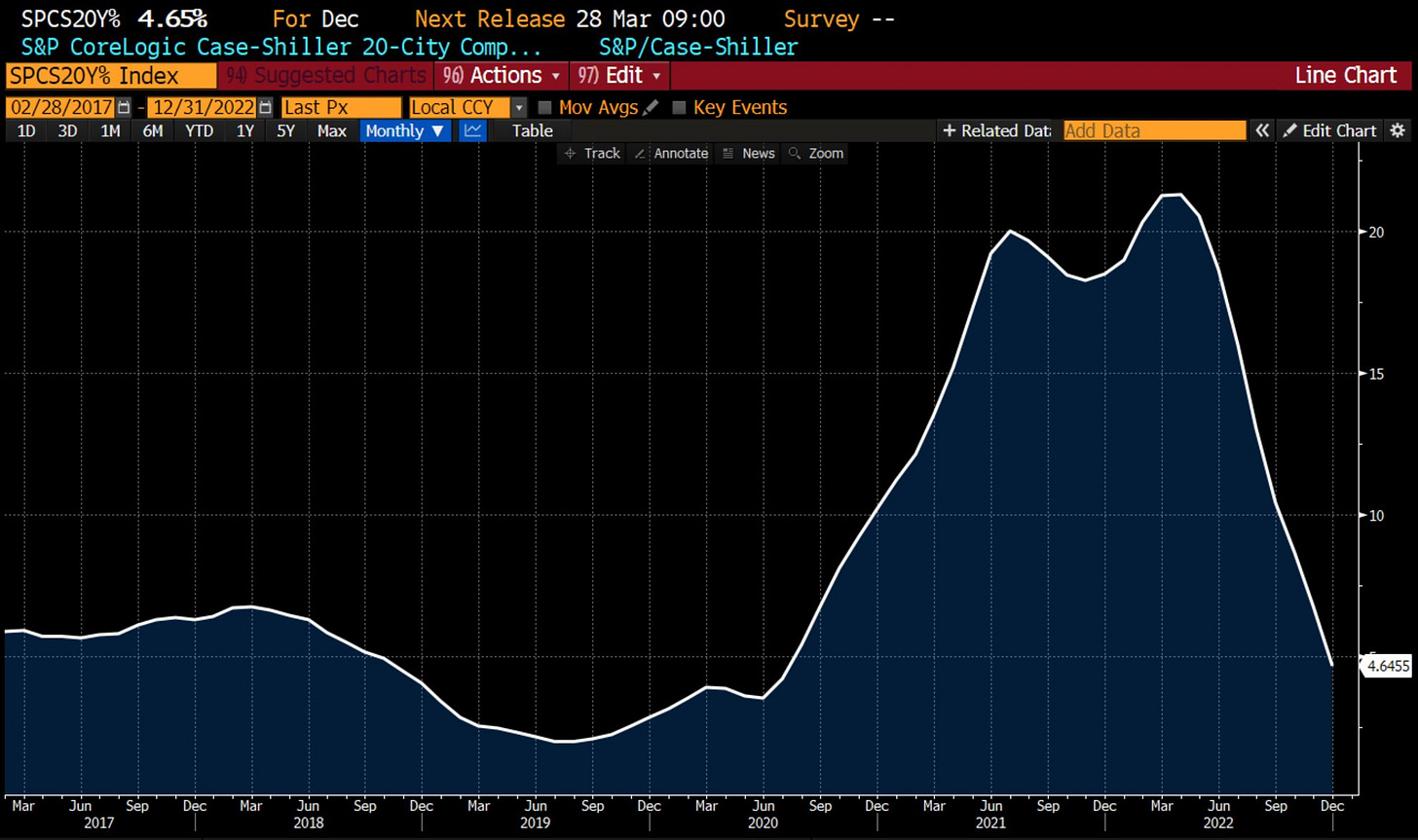

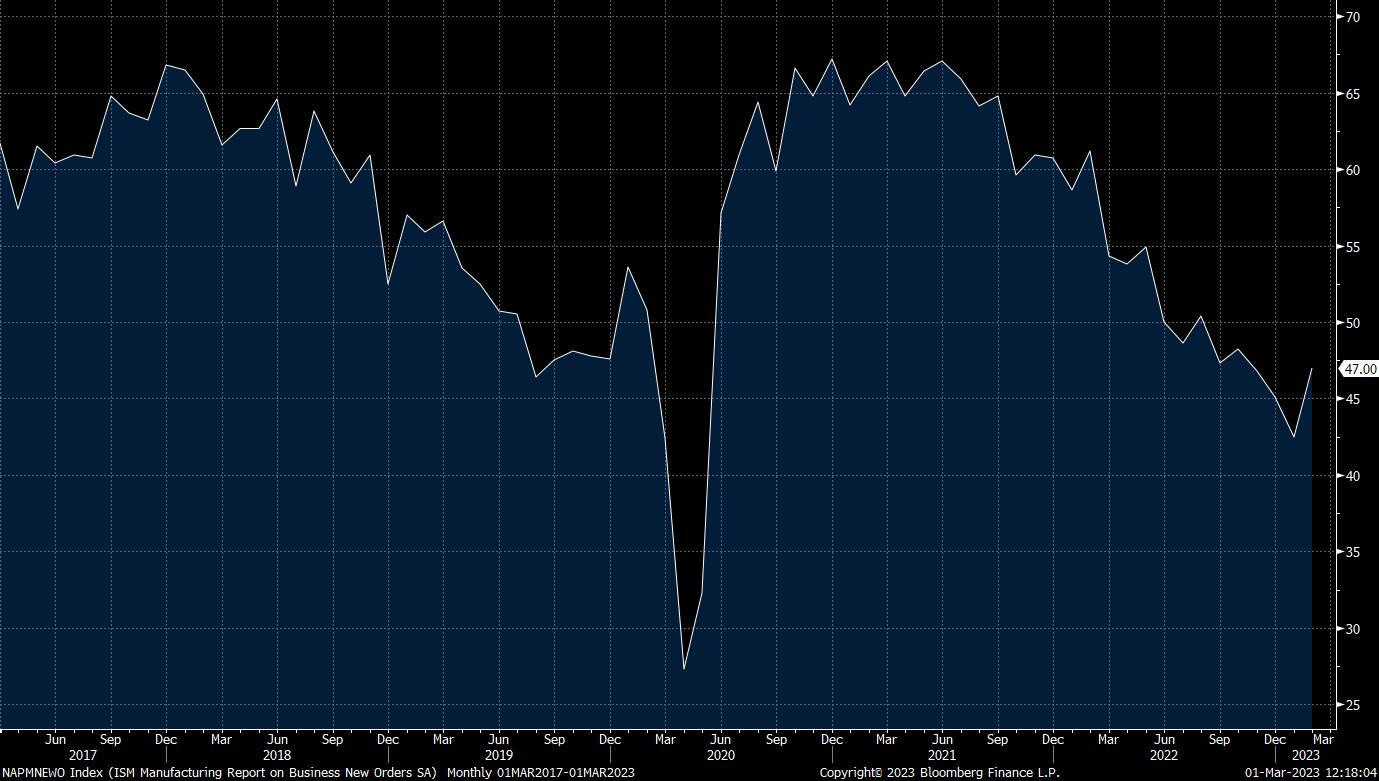

Mortgage applications are at a fresh 28-year low and down 44% from last year. Housing prices have been falling for almost a year—six-month annualized rates are now negative across the entire nation, and soon the annual rates will also be in the red. Manufacturing firms in the US have indicated contractionary conditions regarding new orders several months in a row. Despite a resilient services sector and solid (though unconvincing) employment data, the US economy is not in great shape. Why, you might wonder? For starters, 7% mortgage rates are punitive. I’m hearing stories of swaths of cash buyers, but the marginal buyer is gone due to affordability or perhaps the economy itself, ending up in lower prices. Declining manufacturing new orders is an indication that the sentiment in the economy is poor, some of which must be attributed to higher risk-free rates. As the earnings yield on the S&P 500 converges with the yield on short-term US Treasuries, the hurdle for everyone to make money notches up. This includes firms that must generate returns on equity, risk-adjusted of course, exceeding T-bill yields. When those firms can’t find the confidence to invest in projects or inventory due to a higher hurdle, the economy slows down.

Take offs and landings

I sympathize with those calling the “no landing” scenario a load of bullshit. The economy and monetary policy are cyclical. That means the economy cycles between periods of growth and contraction—when the economy is growing, monetary policy becomes restrictive causing the economy to contract. Then, when the economy is contracting, monetary policy transitions to accommodative. After the central bank accommodates slower growth, the economy can begin to expand again.