The Time Value of Lightning Network

Exploring the maturation of bitcoin's evolving capital market layer.

Abstract

Lightning Network formalized lending practices, such as liquidity marketplaces, will facilitate greater economic activity native to bitcoin. Lightning Network (LN) has already positioned itself as the capital market layer of bitcoin. Taro and its added multi-asset functionality will broaden the scope of these capital and money markets underwritten by LN, underwritten by bitcoin.

The Time Value of Bitcoin

A widely reported return on capital is the precursor to a collateral market.

The standard Lightning Network routing fee is the first variable to extrapolate the time value of bitcoin, and the first of many necessary variables in developing a robust capital market underwritten by the rails of the bitcoin network. Attracting sufficient capital for this requires a collateral market, which requires the time value of bitcoin to be standardized and published for market participants to view.

Standard LN Routing Fee: Base Fee + Fee Rate (Routing fee)

Here’s where we stood in July 2018—only two, self-reported data points of annualized node interest rates on the Lightning Network:

In March 2019, BitMex compiled several data points to formulate node APR based on fee rates:

Years later, we are finally inching closer to a consensus interest rate calculation methodology for LN. Standardization, along with positive nominal interest rates will attract bank-like entities seeking to earn a positive return using efficient channel management and security.

Multi-asset functionality made possible through Taro, a new bitcoin and LN-based protocol for asset issuance, will exponentially increase the possibilities for using LN as financial rails, thereby increasing the number of bank-like entities willing to enter bitcoin over LN trying to accrue a return.

Over three years removed from the last entry in Nik’s Bitcoin-Native Financial Theory series, significant developments in Lightning Network marketplaces and Bitcoin-Lightning protocol development finally warrant part 5—The Time Value of Lightning Network. This publication will expound on the rapid developments across bitcoin and LN that are paving the way for a LN-derived, bitcoin-denominated capital market.

Maturation of LNRR

The first LN APR out in the wild, and the potential for a yield curve.

An emergent issue on Lightning Network is procuring sufficient inbound liquidity to one’s channel—thus attracting enough channel connections to make transaction routing profitable. While we expect this issue to wane as bitcoin’s path toward a medium of exchange raises the demand for efficiently operated Lightning channels, inbound liquidity remains an issue in the interim.

Enter Magma—a Lightning liquidity marketplace that allows nodes to buy and sell liquidity by leasing other network participant’s channels for a minimum specified period of time. Magma compresses several data points into a single interest rate on channels, so buyers can peruse what fits their needs, and sellers can earn an auxiliary rate of return on top of the standard LN routing fee discussed earlier.

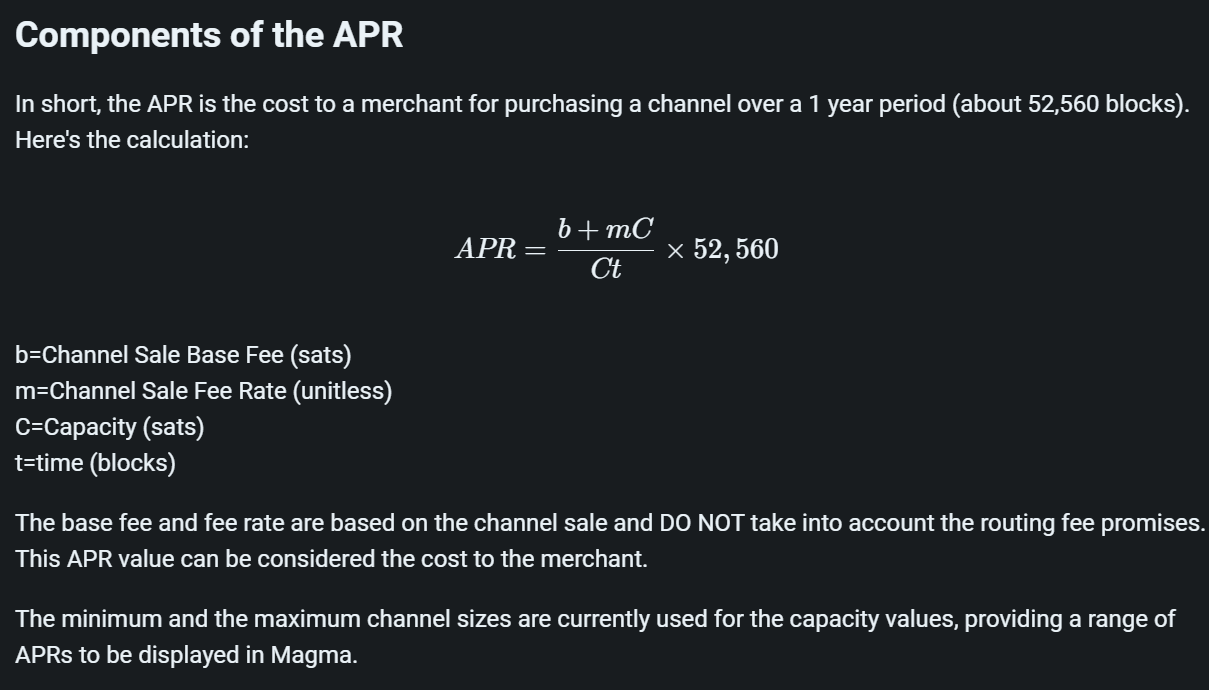

Magma APR: {Base Rate x [Fee Rate*Capacity]/[Capacity*Time]} x 52,560

This is the first major example of a standardized method for calculating and reporting realized interest rates of Lightning channels—a substantial leap in turning the Lightning Network into a fully-fledged capital market.

Unlike standard routing fees, the base fee and fee rate calculated in the Magma APR have nothing to do with routing within the channel and are only based on the channel sale—making this an annualized return on selling liquidity by lending one’s channels. While Nik’s proposed NAR (node accrual rate) relied on nodes volunteering their channel data to make a reference rate, the Magma APR is reported at each sale of channel liquidity.

Given that this rate is not derived from the routing of transactions natively in a Lightning channel, it is more accurate to describe it as a lightning-adjacent reference rate—still, it’s our first example of a rate trading at a positive spread over the theoretical native Lightning node APR. This rate supplements the compendium of Lightning Network-derived interest rates.

Rate variability on Magma is determined by a variety of factors including reputation, as is the case in traditional finance lending markets. Credit history and collateral value are replaced with this proprietary reputation metric, which allows would-be borrowers to browse the selection of channels up for lease and choose one based on their risk tolerance. This is akin to a credit spread in traditional fixed income markets, where a reputable node operator like River Financial would be able to borrow at a tight spread above LNRR (Lightning Network Reference Rate), not unlike a reputable company such as Apple being able to borrow at a tight spread above US Treasury yields.

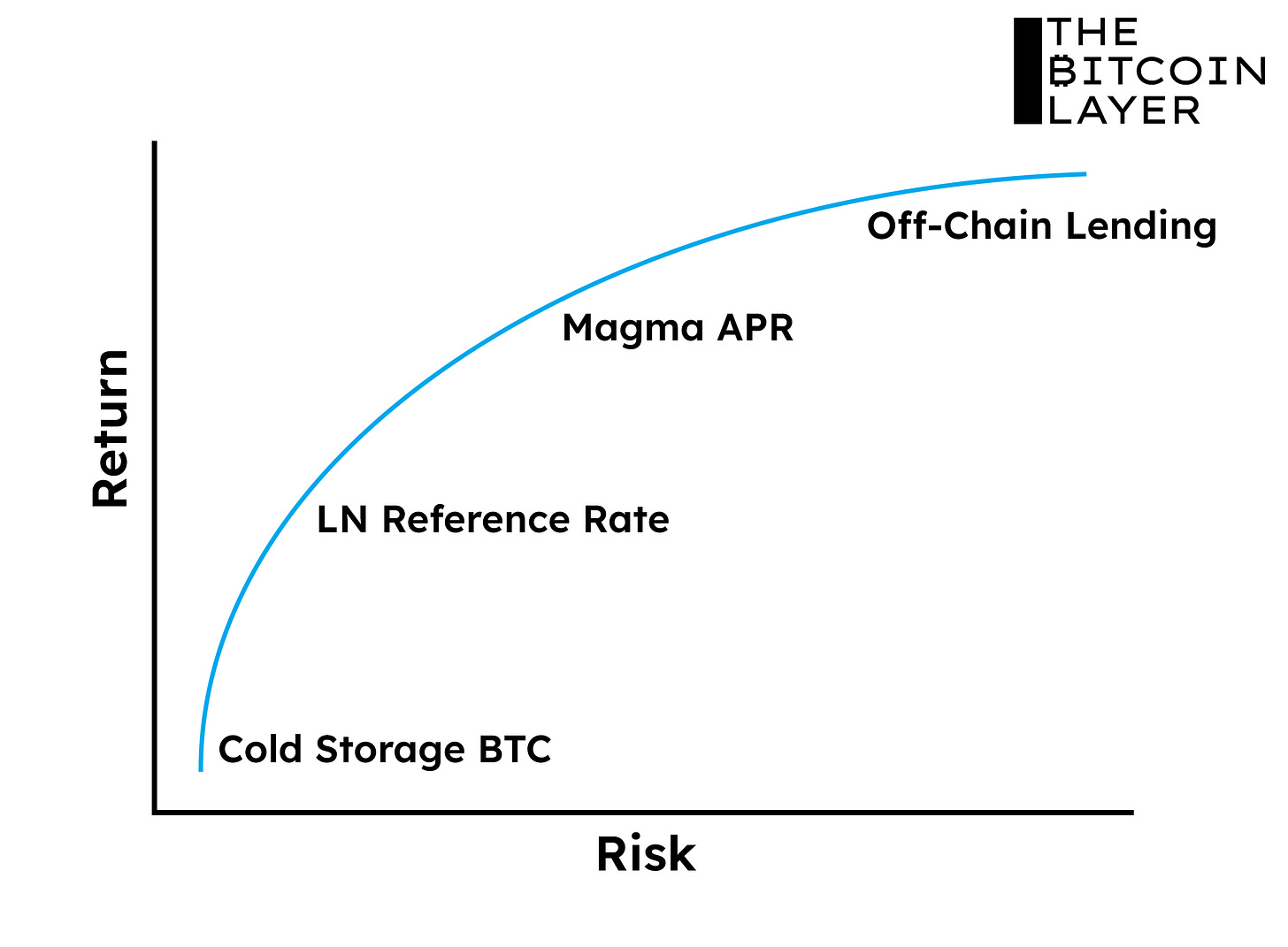

With this new rate comes a new iteration to the Bitcoin-Lightning Risk Curve. The lowest point on the risk curve belongs to Cold Storage Bitcoin, which incurs no counterparty risk. Moving up the curve is the LN Reference Rate, which incurs risks unique to operating a Lightning node with channels like hot wallet risk, inactive peer risk, and forced closure risk, among many others. With the Magma APR, leasing one’s LNBTC channel liquidity is a step up the risk spectrum, as it incurs risks not present by running and operating your own channel—reputation penalties, early or unplanned channel closure, and marketplace system failure. And of course, Off-Chain Lending incurs counterparty risk, placing it at the furthest point on our risk curve.

LN-native channel management and fee routing are akin to a gold lease rate without custodial risk, selling channel liquidity incurs minor additional risks, and lending entirely dislocated from bitcoin and Lightning (off-chain) incurs default risk—thus a higher return on capital is warranted as we move up the risk curve. Only the non-yielding, non-custodial, counterparty-free Cold Storage Bitcoin could be considered close to risk-free—the proverbial moniker given to US Treasuries.

A widely reported return on capital attracts liquidity to the Lightning Network — the impetus for a deep collateral market on the road to being a widely used reference rate.

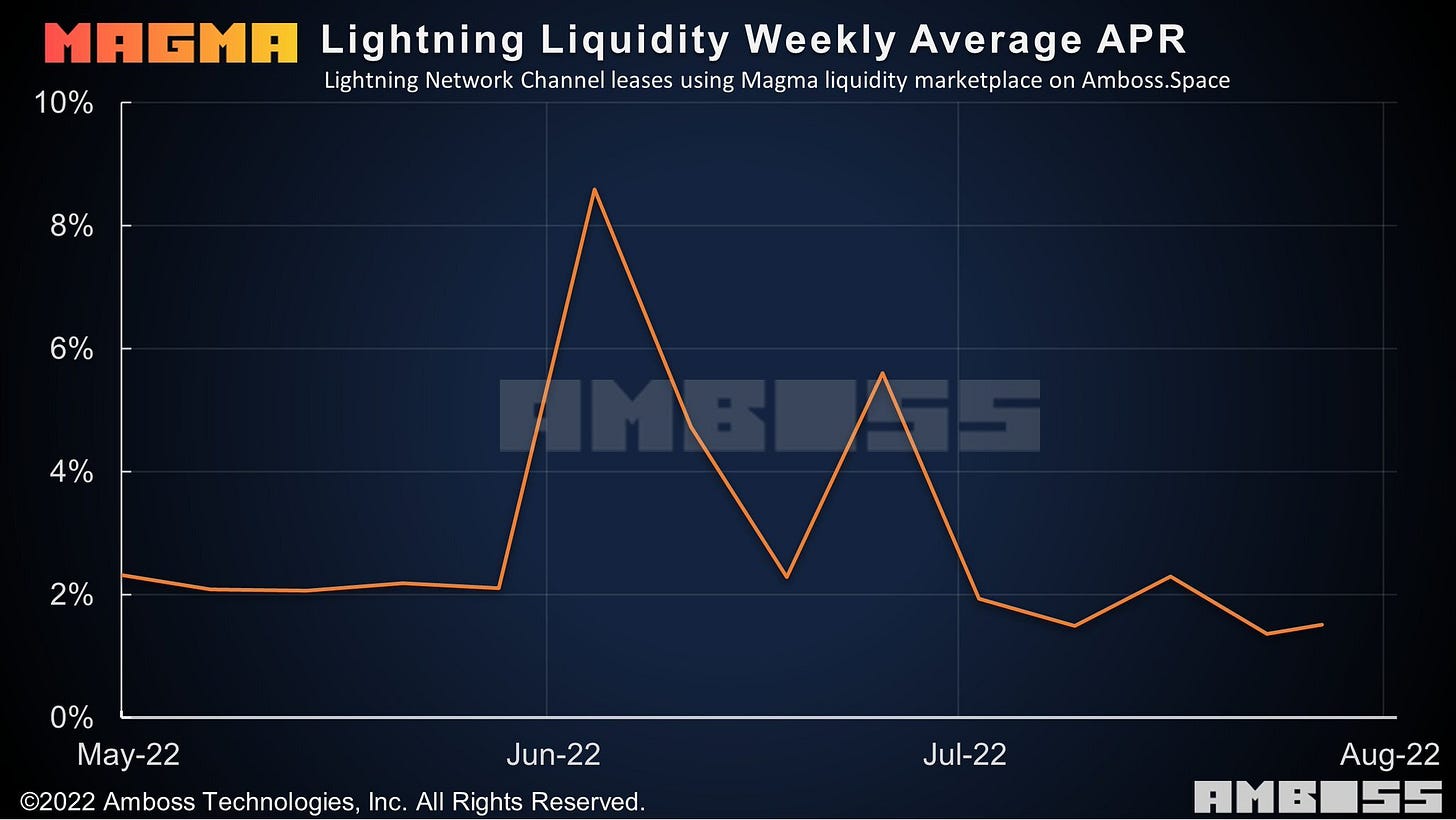

Standardizing and publishing the time value of bitcoin is a major step in attracting sufficient capital to make bitcoin and Lightning a substantial market for collateral—deep and liquid enough to compete for the role of a global capital market. The average Magma APR chart being published weekly is a milestone in bringing this conceptual reality closer to eventual certainty.

As you’ll note, the average APR is higher than the Standard LN Routing Fee—offering lenders a spread above LNRR as they take on a higher risk profile.

Through time, Lightning Banks will emerge. As market participants lack the technical wherewithal to efficiently operate Lightning channels, most Lightning Network channel management will be subsumed by these entities who specialize in it.

Lightning Network will birth Lightning banks. Their first function will be to provide liquidity to Lightning Network by funding payment channels. They will try to position themselves as central routing hubs, capturing as many fees as possible. Competition will be open and fierce. Those with the greatest ability to efficiently manage payment channels and actively optimize routing positioning will profit.

Magma is the first iteration of a marketplace for Lightning Banks—having built the infrastructure needed for a central entity to fund payment channels anywhere in the network. This will pave the way for efficient node operators to expand their operations and become de facto Lightning Banks—earning fees by routing transactions but also by leasing inbound liquidity to other market participants, like a bank issuing loans. All this will be done with less counterparty risk than the legacy financial system—made possible with forced channel closure by the node operator should the borrower fail to make their payments, since ownership of the channel is retained by the node during its lease.

A fascinating prospect is a Lightning Network-derived yield curve constructed using the APRs across different tenors (minimum ages) for leasing channels on Magma.

Previously it was not possible to construct a yield curve using the Lightning Network alone. Since inbound liquidity can be pulled from a channel at any time, any APRs pulled using open network data would be using non-standardized periods of time — therefore could not be accurately curated into a yield curve. Magma solves this with its minimum channel age variable acting like a traditional fixed-income tenor. In theory, by plotting the APRs for leasing liquidity across different minimum channel ages, an actual Lightning Network-derived, bitcoin-denominated yield curve is possible.

One potential limitation in constructing a viable yield curve is that LN channels aren't very durable—many end in early closure, which is not the case for US Treasuries that are instead sold on the secondary market once their owner wishes to part with them. A workaround would be to use predetermined lease durations, which would clean up the data by standardizing APRs even if the channel was to be closed early, pushing a yield curve closer to viability. This would be more conceivable once there is more available data to construct the curve, actively updating for buyers and sellers of collateral to view. But the bones are there.

A regularly updated yield curve would show market participants that they can mobilize their capital via Lightning and earn yield with less default risk than corporate fixed-income markets. Formalizing a framework for this would greatly accelerate adoption. We will be delving deeper into the concept of a fully-functional bitcoin-denominated yield curve, and we encourage readers to share this publication and accelerate bringing this concept to fruition.

Bitcoin’s Capital Market

The world’s currencies flowing through bitcoin’s liquidity

The emergence of Magma and other marketplaces like it demonstrates a structural demand for secondary markets of liquidity, where participants can buy and sell collateral as needed—eventually blossoming into a deep and liquid capital market. Could a capital market become deep and liquid while being denominated entirely in bitcoin, in a world full of dollars, euros, yen, and yuan? Actually, yes, it could.

Enter Taro, a protocol for issuing assets over bitcoin that can be transferred on Lightning—allowing for any currency to route through existing network liquidity and take advantage of near-instant settlement.

In other words, Taro makes bitcoin and Lightning interoperable with everything. A position in the Lightning Network now not only allows node operators to extract time value from routing bitcoin, but also from routing any other asset as well. The time value of bitcoin held in Lightning Network has taken new forms never seen before in finance.

With Taro, people theoretically have the ability to hold dollars with their bitcoin in a single wallet and send them across LN. Over bitcoin or LN, users could interact with their domestic government money in the same interface as their bitcoin, readying and sending payments over the bitcoin blockchain or the Lightning Network. For new users in emerging markets like El Salvador, this is a critical improvement for user experience and accessibility. For the first time in history, anybody with a smartphone and an internet connection will be able to transact inter- and intra-currency in a functionally peer-to-peer manner.

Strike has a similar business model — but relies on traditional banking relationships in order to facilitate transactions. Conceptually, Strike could leverage Taro to cement itself firmly in the Lightning Bank category of businesses.

Taro is in active development by Lightning Labs, but in theory: any party would be able to issue an asset. Nodes would maintain the price of these assets, acting like a decentralized exchange. Parties would be able to send and receive these assets without the channels that route the assets needing to be aware that they’re sending anything other than bitcoin. How? The current infrastructure of channels just moves value from one side to the other—same deal with Taro: if Party A were to send 100 USDT (Tether) to Party B, the asset value would be converted to sats (1 satoshi, or sat, = 1/100,000,000 BTC) at the stored exchange rate, transferred instantly across the network as sats, and converted by the receiving Party B back into USDT. The middleman LN infrastructure just routes liquidity.

For the Lightning Network, this means more network volume, more network liquidity, and more routing fees for node operators, driving more innovation and capital into the space. Any increase in demand for transactional capacity that will come from these new assets (think stablecoins) will correspond with increased liquidity on the bitcoin network to facilitate these transactions. Using sats as the transmittal rails for transactions across every currency opens the door for a bitcoin-denominated global capital market.

Suddenly with Taro, the protocol for a deep and liquid capital market is emerging to meet the structural demand for liquidity demonstrated with marketplaces like Magma. While today’s $100 million Lightning Network capacity is a far cry from the $100 trillion locked up in dollar-denominated bonds and equities, the Taro protocol opens the floodgates for this traditional finance liquidity to be subsumed by a faster, counterparty-free settlement network.

Below is the Traditional Finance Risk Curve, a way of visualizing the United States dollar capital market in its $100 trillion+ depth. Physical Gold incurs no default risk, no counterparty risk, and no custodial risk if held physically and securely by the owner. US Treasuries are higher up the risk curve, for despite being touted as the risk-free dollar instrument, there is explicit and implicit default risk with these vehicles. Corporate Bonds have higher default risk, so they trade at a spread to US Treasuries. Equities and Venture Capital have the highest level of associated risk.

Each successive rung up the curve has a higher risk profile—thus demanding a higher rate of return for the lending party.

Bitcoin’s capital market and the risk profile of each instrument can be illustrated with the conceptual Bitcoin-Lightning Risk Curve.

Standardized language has been used to describe each point on the curve, with LN Liquidity Lease formalizing marketplaces like Magma, all trading at a spread notated in basis points to the counterparty-free LN Reference Rate—the bitcoin capital market equivalent of the risk-free rate provided by US Treasuries. As mentioned previously, only the non-yielding, non-custodial, counterparty-free Cold Storage Bitcoin could be considered devoid of all default risk, counterparty risk, and custodial risk — mirroring Physical Gold in its risk profile. Taro Asset Lending is a name we’ve assigned to theoretical lending of a Taro-issued asset, which incurs all of the risk associated with any independent asset issuer. At the end of the curve sits Off-Chain Lending, which has the largest counterparty risk profile, not present in the first three points on the curve.

Higher tiers on the risk curve require less maintenance but incur more risk, whereas the lower levels on the risk curve incur less risk but have a higher barrier to entry for the average person who lacks the technical wherewithal for maintenance and security best practices. To solve this, Bitcoin-Lightning Banks will emerge in order to facilitate the security of Cold Storage BTC—just as naturally as the emergence of goldsmiths and banks as the desired way to store one’s gold.

Why is the United States dollar currently the world reserve currency? It’s not because of our military might or economic prowess, it’s because of our deep and robust market for collateral. Dollars just happen to denominate a slew of financial instruments which dollar-holders can purchase to park their wealth—hence world reserve currency. For bitcoin to become a world reserve currency, a deeply liquid capital market is an intrinsic requirement—and the Taro protocol is a promising step in making that happen. While bitcoin and LN are trillions of dollars away from becoming a legitimate alternative to other capital markets, they arguably maintain the lowest collective risk profile of any capital market in existence, as they are underwritten by an asset that when custodied incurs zero counterparty risk.

Conclusion

To echo the conclusion of the first entry in the bitcoin-native financial theory series: LNRR is not some magical solution. The people and businesses who continue dedicating themselves to building the functionality of Bitcoin-Lightning lending and utility are pushing us towards the solution. A global capital market operating on top of bitcoin-denominated financial rails is inching closer with each new onramp. Developers: if you make it, they will come. Innovations in Bitcoin-Lightning lending have brought the reality of a bitcoin-denominated capital market to our doorstep, and the possibility of multi-asset functionality exponentially increases the total addressable liquidity of this market. The transition from reserve asset to reserve currency is well underway.

Follow us on Twitter @timevalueofbtc and @JoeConsorti

Check out our Substack sponsor Voltage — provider of enterprise-grade Bitcoin and Lightning Network infrastructure. Visit them today at voltage.cloud

Sources

Bitcoin-Native Financial Theory: Parts 1-4

The Lightning Network Reference Rate

Magma by Amboss Technologies, Inc.

Taro by Lightning Labs

Other Lightning Liquidity Marketplaces

Lightning Pool by Lightning Labs

Setting Up Liquidity Ads in c-lightning by Lisa Neigut of Blockstream

Lightning Network