There’s No Need To Fear, Fed Reform Is Here: TBL Weekly #146

Dear Readers,

As many bitcoiners know, this one chart alone says much more than the thousands of books written about it…

In fact, it is this very chart that has pushed every person reading this article to subscribe to The Bitcoin Layer. At TBL, we like to keep a balanced approach. One in which bitcoin and the current Treasury market coexist. Oftentimes, when bitcoiners are first orange-pilled, they look at a chart like the one above and realize just how unsustainable the path of any fiat currency is; so much so that the best next step is to become cynical about the entire financial system—and more power to you! However, it is also important to dilute the orange-pill effects with some fiat reality.

And that reality currently states that US Treasuries are the safe-haven asset of the world (whether we agree with it or not), and we don’t see that reality changing anytime soon. Accordingly, we study the inner workings of the Treasury market, as whatever happens to the safest asset across the globe affects bitcoin in a myriad of ways.

Today, Treasury demand dynamics stand at the forefront of developments in the US rates market because of fears that the current administration may push investors away from US debt. As such, a topic has become rather popular among different Treasury analysts: the Supplementary Leverage Ratio (or SLR for short).

In today’s article, we:

Introduce SLR balance sheet dynamics

Review expected SLR reform

Explain the repercussions that these changes have on risk assets

So, without further ado, let’s dive into TBL Weekly #146.

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be. Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

The Financial Freedom Report is a weekly newsletter from the Human Rights Foundation (HRF) that tracks how authoritarian regimes weaponize money to control their populations and suppress dissent. It also spotlights how freedom technologies like Bitcoin are helping everyday people reclaim their financial independence and freedom.

A one-of-a-kind newsletter connecting the dots between financial repression, geopolitics, and emerging tech.

Smart macro analysts don’t just watch the Fed. They watch the world.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

What is the SLR?

Here’s the official calculation:

Check out the Office of Financial Research for more details on both the numerator and denominator, but to keep things simple, let’s think of this ratio using the following formula:

When looking at the simplified formula (for explanation purposes only), you see why the name has “leverage” in it. If we were to flip the formula upside down, the ratio would show just how many assets shareholders own per dollar of equity (i.e., how much leverage your ownership stakes have).

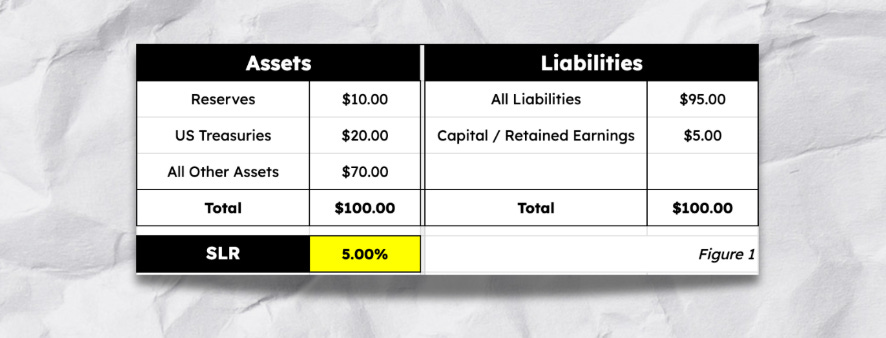

Let’s look at an SLR example—check out figure 1 below:

Using the simplified formula above, we calculate the SLR. What this balance sheet shows is that there are $20 of assets for every $1 of equity (i.e., a 5% SLR).

Why is this important?

Well, it allows you to see how well a bank can perform under asset stress. Say, for instance, some of the bank’s clients undergo financial troubles and are unable to pay back $3 loans. Here’s how that would affect the balance sheet:

As you can see, three things happen: (1) Assets decrease in value, (2) capital absorbs the loss on the liabilities’ side, and (3) the bank’s SLR decreases, which means it would need to put in more capital (more on this in the section below).

Overall, capital allows a bank to absorb asset losses, which keeps it solvent.

Why was the SLR established?

If we could psychoanalyze the financial system, the concept of asymmetric information would be first in mind—namely, moral hazard and adverse selection. When thinking about mandated SLR, moral hazard is the dominating factor. The idea here is that when you are forced to have more skin in the game, you are less likely to take on risky ventures. And do not forget about the outside influence of foreign banking institutions such as the Bank for International Settlements in Basel.