Welcome to TBL Weekly #75—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning and happy new year everybody!

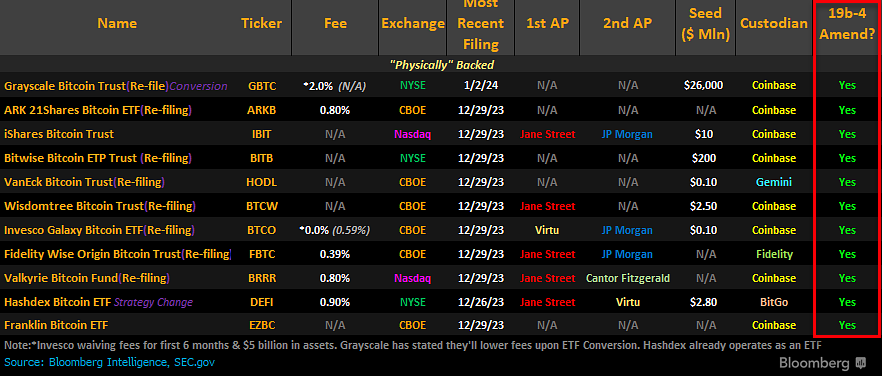

The SEC requested that all 11 bitcoin ETF applicants submit amendments to their 19b-4 papers by today, and all 11 of the applicants managed to file them before today’s deadline. Word on the street is that the SEC would like to approve every ETF at once. We are now just inches away from the finish line, folks:

GBTC says the exact same thing: mass approvals are imminent. As GBTC converges with its net asset value, traders price a higher probability that it is converted into a spot ETF. Given the SEC wants to do an all-at-once approval of all pending applicants, the narrow 5.5% discount tells us we’re now just days out:

This is the most highly publicized event surrounding bitcoin in the last several months, and arguably since the fall of FTX. Given that markets are discounting mechanisms, the soon-to-be-approved spot ETFs should be thoroughly priced into bitcoin’s spot price by now; this isn’t fully the case.

Markets may have complete information but that doesn’t mean they are perfectly efficient with said information, especially as it pertains to bitcoin. Bitcoin’s monetary properties have been well known for several years, yet it still trades like a tech stock. Markets are not operating efficiently with the knowledge that bitcoin ETFs are imminent, and it has not priced itself accordingly.

How do we know this? According to Bitwise, of 437 surveyed in the US, only 39% of financial advisors believe a spot bitcoin ETF will be approved in 2024. Compare that to Bloomberg’s estimated 90% chance of 2024 spot ETF approvals and 88% of said advisors interested in buying bitcoin once they’re approved, and you have a massive arbitrage that paints one clear picture: the spot ETFs are not fully reflected in bitcoin’s current spot price.

Spot bitcoin ETFs have had an impact thus far on bitcoin’s price: early-bird positioning from a dedicated cohort of people who are actively involved in bitcoin and trying to front-run the flows, flows that have not come yet. To say that bitcoin’s price already reflects the billions of dollars that will deploy into bitcoin ETFs is foolish as none of these vehicles are trading yet, and therefore none of these billions of dollars in flows have been deployed.

There is one last-minute hurdle that could prove to be a minor fly in the ointment to these mass approvals slated for some time next week. Better Markets, a special interest group connected to Elizabeth Warren and her banking cronies, has released a plea to the SEC at the 11th hour when filings and amendments are all but wrapped up begging them to not approve them:

The letter was addressed to SEC Secretary Countryman and explicitly named 7 out of the 11 spot ETF filings that are slated to be approved all at once in this letter. The letter states that just because the SEC lost its suit against Grayscale does not mean it should “rush” these ETFs into approval, and cites investor protection from speculation and volatility.

Here’s the rub though: the same comments were sent to the SEC at almost every step of this approval process and have completely fallen on deaf ears. Fraud and excessive speculation have been staples of the “crypto” ecosystem that exists adjacent to bitcoin, sure. However, the recent brush-clearing effort in wiping out Celsius, FTX, Binance US, and hordes of other bad actors has been a deliberate measure from the SEC to increase investor protection as these spot ETFs near. As such, the disingenuous concerns from Warren and the gang will likely fall on deaf ears once more.

Bitcoin has primed itself like a springboard leading into all of this. Short-term holders of bitcoin as a percentage of outstanding coins are still near cycle bottoms and dormant holdings of bitcoin rising daily, so we believe there’s an increasingly limited supply to go around as institutional demand comes onto the market. Get the fireworks ready, one might suggest.

Speaking of increasingly limited supply, we didn’t even mention bitcoin’s 50% programmatic supply schedule reduction that’s just three months away. Yet another tailwind for our favorite orange coin. Are you enjoying 2024 so far, folks?

Next Week

In the week ahead, CPI on Thursday is back to claim front and center stage. With the money market thoroughly convinced that interest rate cuts are on the horizon, the only debate becomes when. The debate around when comes back to the fact that the Fed wouldn’t be justified cutting rates with where the economy is today.

If you connect one dot to the other, money market traders are essentially wagering that the data-dependent Fed will run into trouble some time in the next several months. Here’s the way we see it:

Our call just before the Fed pivot was for Fed rate cuts by June 2024. We are still biased to thinking this is the earliest we might see any cuts, especially with where the economy is today (on fairly decent headline footing).

Our belief that cuts will be here soon is rooted both in money market pricing and in our analysis of the economic cycle—a persistent cutting bias has been with the market since March 2023’s regional banking crisis, and while much of it was premature, the Fed is also saying the path of least resistance is lower.

One enormous consideration that we haven’t discussed as much of late is QT. The Fed finally admitted in the recent minutes that the end of QT, or a slowdown in QT, has at last entered the conversation. We believe this a big deal, as the Fed is aware that reserves might be at a point that is a cause for concern. We’ll be diving deeper into this over the coming weeks.

If the Fed is data dependent, cuts by June means something will go wrong with the economy and/or inflation by that time that justifies a marginal reduction in policy rates. Remember, rates are at 5% and can be lowered to 3.5% in order to guide the Fed’s desired soft-landing scenario. We see this as the path of least resistance—data that is souring just enough to justify modest rate cuts that can be explained as a gentle easing. If the Fed ends QT early or slows it down, it can also help potential issues in financial plumbing.

Speaking of financial plumbing, we have a pair of very large Treasury auctions next week:

Wednesday, January 10th: 10-year auction (settles Tuesday, January 16th)

Thursday, January 11th: 30-year auction (settles Tuesday, January 16th)

We include the settlement date for the reason of repo; when Treasuries are auctioned, the money doesn’t settle until a few days later. It is only at that point at which banks have to pony up for their dealer allocations, and almost 100% of that money can be assumed to be financed in the repo market. If money isn’t available in the repo market, banks run into problems. Luckily for them, interbank relationships and the Federal Reserve make problems hard to come by—usually there is somebody to lend a helping hand, especially with Treasury funding. But if you’re looking for problems within the system, problems for which the Fed might have to go back to easing or balance sheet expansion, the place to start looking would be Treasury settlement day.

Over the next few quarters, Treasury settlement days have the potential to bring drama. The Fed’s admission that QT is being discussed means that we are not the only ones wondering what will happen in the repo market when too many Treasuries hit the street. For the coming week, however, CPI and Treasury auctions will have our closest eye:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Wednesday

In this episode, Nik explains key differences between Bitcoin ETFs and purchasing bitcoin via an exchange, including why ETFs do not allow shareholders to actually use bitcoin. He explains that while people may prefer a fully custodial and non-deliverable bitcoin solution, ETFs don't allow shareholders to participate in the decentralized nature of bitcoin.

Check out—Bitcoin ETFs Are Here: Should You Use Them?

Thursday

A very heartfelt Happy New Year to every single one of you! Thank you for making us part of the beginning of your 2024. And what a year it is sure to be for bitcoin. In addition to analyzing every Fed meeting, economic survey, and price chart across global markets, The Bitcoin Layer is excited to provide full-color commentary for what should be a year of fireworks. Today, I bring together the most important issues facing bitcoin and macro, while relating each to the major themes we’ll be watching over the next several months, and conclude with a philosophical proposition.

Check out—Leishman: You had 15 years to front run Wall Street

Friday

In this video, Joe unpacks a sour ISM Services report and a labor report that reveals Americans working multiple jobs to make ends meet is at an all-time high. We dive deeper into the data than any news organization so you can get the real impulse of what's going on around the country.

Check out—Americans Are Struggling: Unpacking Today's Bad Data

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Great post with actionable insights. I also appreciate your fixed income perspective and inclusion of items like the US government repo market of which I have had long career exposure to. An underappreciated but important piece of the system.

Regards John