Dear readers,

Last week, I sent an important global macroeconomic update. A free, shortened post went out to everybody, and the full analysis was sent to paying subscribers:

The feedback I received was positive, but almost everybody told me they had to read it more than once. I realized that I had slipped back into trader mode.

Rookie status

I remember the days of understanding absolutely nothing on the trading desk. The only way to figure out how the entire capital market worked was to ask a million questions, and then a million more. The title of my previous post itself contained three words—tightening, flattening, and inversion—that took me years to grasp, yet I threw them around like I was typing away on an IB (Instant Bloomberg) chat or sending a note to a portfolio manager. For that, I apologize. To remedy, I’ll break down some of the basics of the rates market and demonstrate whey they crucial to understanding the bull case for bitcoin.

Size

Here was a typical conversation between me and people that would ask about my job:

Person: What do you do?

Me: I trade financial markets for a large asset manager.

Person: Stocks?

Me: No, US Treasuries.

Person: [silence]

Fixed-income securities and interest rates are not widely understood despite overshadowing the equity market in size. For example, the total fixed-income market in the United States is larger in market size than the NYSE and NASDAQ combined (the US Treasury market is larger than each of the American stock exchanges by itself). The size of the bond market is massive and deserves more attention, not less, than the equity market does in trying to figure out what is going on with the economy.

Equity markets

The Federal Reserve has two official mandates. It is assigned with maintaining price stability and maximizing employment. However, those following the Fed over the last dozen years know that its unofficial mandate is the S&P 500. Stocks are not allowed to go down.

In this way, the stock market has become a terrible signal for macroeconomic analysis. At the first glimpse of equity market decline, the Fed intervenes with easy monetary policy.

Fed policy: easy or tight?

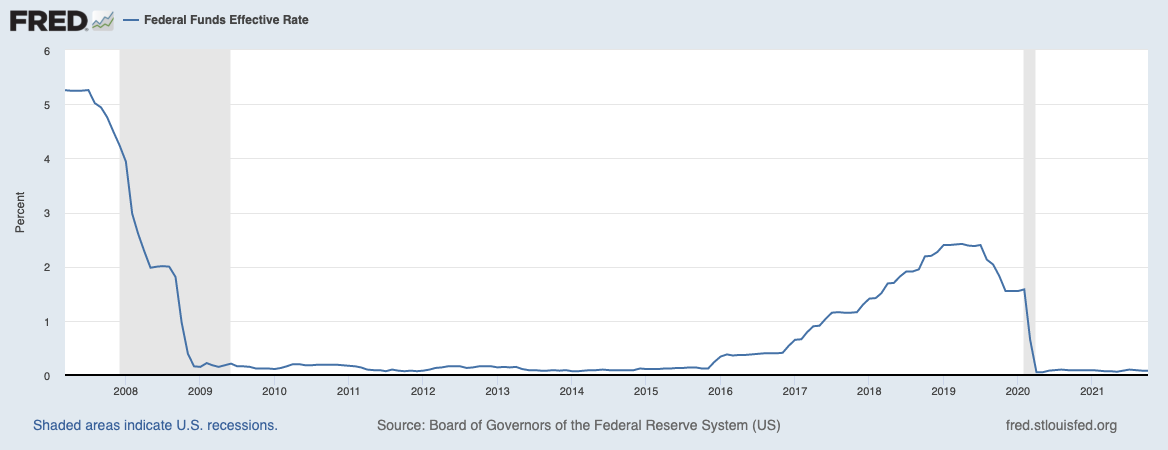

Monetary policy is how a central bank prices its money. Historically, this has been via a short-term interest rate. The Fed’s rate (called Fed Funds) has been stuck at zero for practically the entire time since the 2008 financial crisis.

In this chart, you can see that the Fed’s monetary policy rate was slashed to zero during the 2008-2009 recession, was slowly raised from 2016 until 2019, when it quickly returned back to zero. In easy/tight terms, the Fed kept policy extremely easy for 7 years, tried to tighten it for 3, failed miserably, and retracted policy back to ultra-easy.

Quantitative Easing

But what happens when policy is ultra-easy, rates are at zero, and the Fed still needs to make things easier? Said otherwise, what if rates are at zero and stocks are still going down? The Fed does something called Quantitative Easing (QE), which is another way of saying it buys US Treasury securities by expanding its balance sheet (or creating reserves from thin air). QE is a “new” type of easy monetary policy that the Fed had to invent in 2008-2009 because taking Fed Funds down to zero did not provide the full economic stimulus it had hoped for.

Debt monetization

The definition of debt monetization is when a central bank directly finances the fiscal activity of its government. This implies that government spending can be conjured up instead of requiring future tax revenue to offset it. Mainstream economists are easily triggered if you try to tell them that the Fed has monetized trillions of US government debt. But if it looks like a duck and quacks like a duck, it’s a duck. The Fed has expanded its balance sheet by purchasing over $5 trillion in US Treasuries since 2009. This is $5 trillion that the US government will never have to raise from the public. The Fed conducts QE as part of monetary policy and maintains that its policy is independent of the Treasury Department. But based on the Fed’s own mandate of maximum employment, monetizing the debt of the US government over the past 12 years was its only choice, no matter what you want to call it.

Rates will be low forever

If I received a nickel for every time I heard somebody incorrectly predict that interest rates are going “much, much higher,” I’d have enough money to buy a whole bitcoin. Instead of listening to people that have no idea what they are talking about, look at a chart of the 10-year yield on US Treasuries for the past four decades:

Rates have never been able to sustain any long-lasting increase because of the fundamentals of our indebted dollar system. It will continue like this, despite whatever inflation individuals face on a daily basis. Be skeptical of any analysis that claims rates are going “much, much higher” because it lacks historical context and doesn’t factor in what happens when rates actually increase for the entire global economy—debt is more difficult to service, leading to a decline in economic activity, leading to easy monetary policy all over again. And lower rates.

When rates go down, prices go up

Bond prices and bond yields have an inverse relationship. That means, when yields decline, prices are rising. When US Treasury yields go down, prices are going up. More demand than supply, as they say. This is where your responsibility begins. As investors, it’s your duty to monitor the rates market for economic signals. The loudest one is a declining rates environment.

Flattening and steepening

When a yield curve flattens, it means that long-term yields are declining relative to short-term yields. The curve, which usually has steepness to it (long-term yields are higher than short-term yields), flattens when expectations change. Bond traders buy long-term bonds to try to profit from declining rates. Yield-curves flatten, for example, when central banks raise short-term rates to combat overheating inflation, but investors buy long-term bonds because they believe tighter monetary policy will eventually slow the economy. That is exactly what is happening right now.

Pay attention to the rates market

The stock market won’t tell you anything is wrong. In fact, stocks are constantly reaching new all-time highs in part because the investing public has already reached the conclusion that the S&P 500 is the Fed’s most important mandate. The hidden message comes from the rates market, which tells the story of a Fed stuck in permanently easy monetary policy. Critics will always fault the theory that QE is the reason for bitcoin’s astronomical rise, but go out and ask some of the largest investors in bitcoin, and they will almost always cite QE as a driver of their long position. Therefore, the more QE we see from the Fed and the more easy monetary policy we witness at a global scale, the investment case for bitcoin keeps getting stronger. I’ve said before that Layered Money’s $500,000 price prediction for bitcoin was likely far too conservative because the Fed’s permanent easy policy and debt monetization have become a fixture in the US dollar denomination. The US government and the Fed are never going to figure out how to fix it. And I mean never.