US job data slides & regional banks are warned of danger yet again: TBL Weekly #60

Welcome to TBL Weekly #60—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Well, that just happened.

The week we’ve long been forecasting is finally past, where the labor market data that has been sour for quite some time finally shows up after a several-month lag in the headline unemployment rate kicking higher.

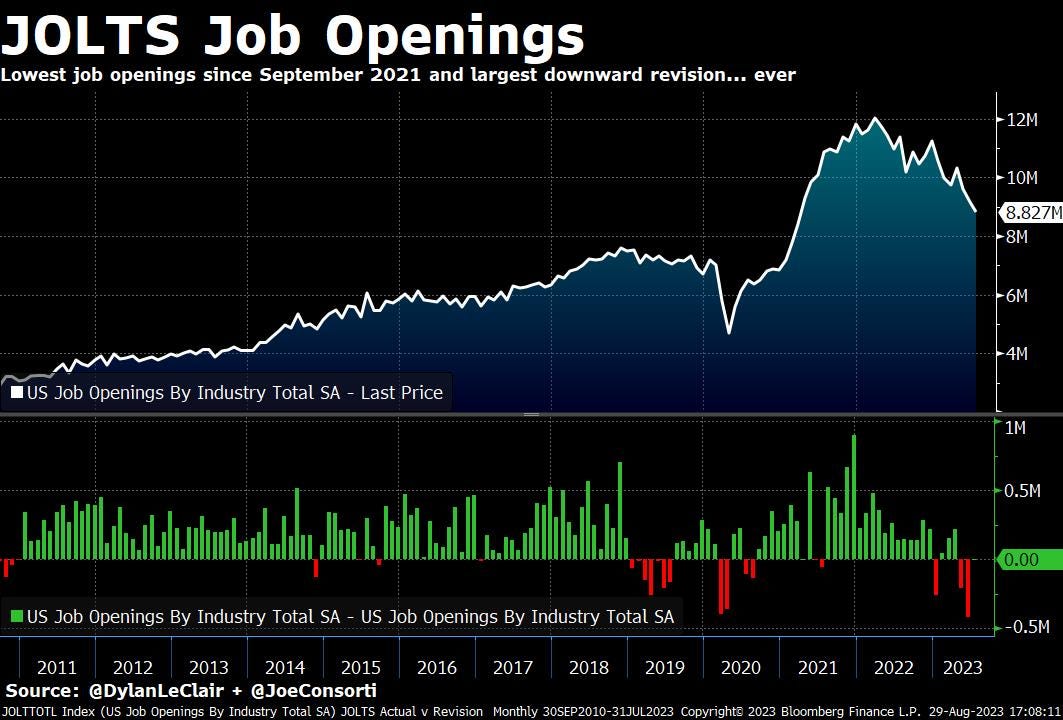

On Tuesday, US job openings fell to 8.827 million, the lowest level since September 2021. Worse yet, last month's data was severely overestimated. It was revised down by 417,000 jobs, the largest downward revision in job openings... ever. Data missing expectations more often than not coincides with the start of recessions. But when it’s this bad? All bets are off. Here we go:

Then on Wednesday, new data showed US job growth slowed materially in August. ADP employment gains fell from 371,000 in July to 177,000, missing expectations by 17,000—adding to Tuesday’s sour job openings data. Cracks are spreading in the labor market, rate hikes' impact is finally hitting after 19 months:

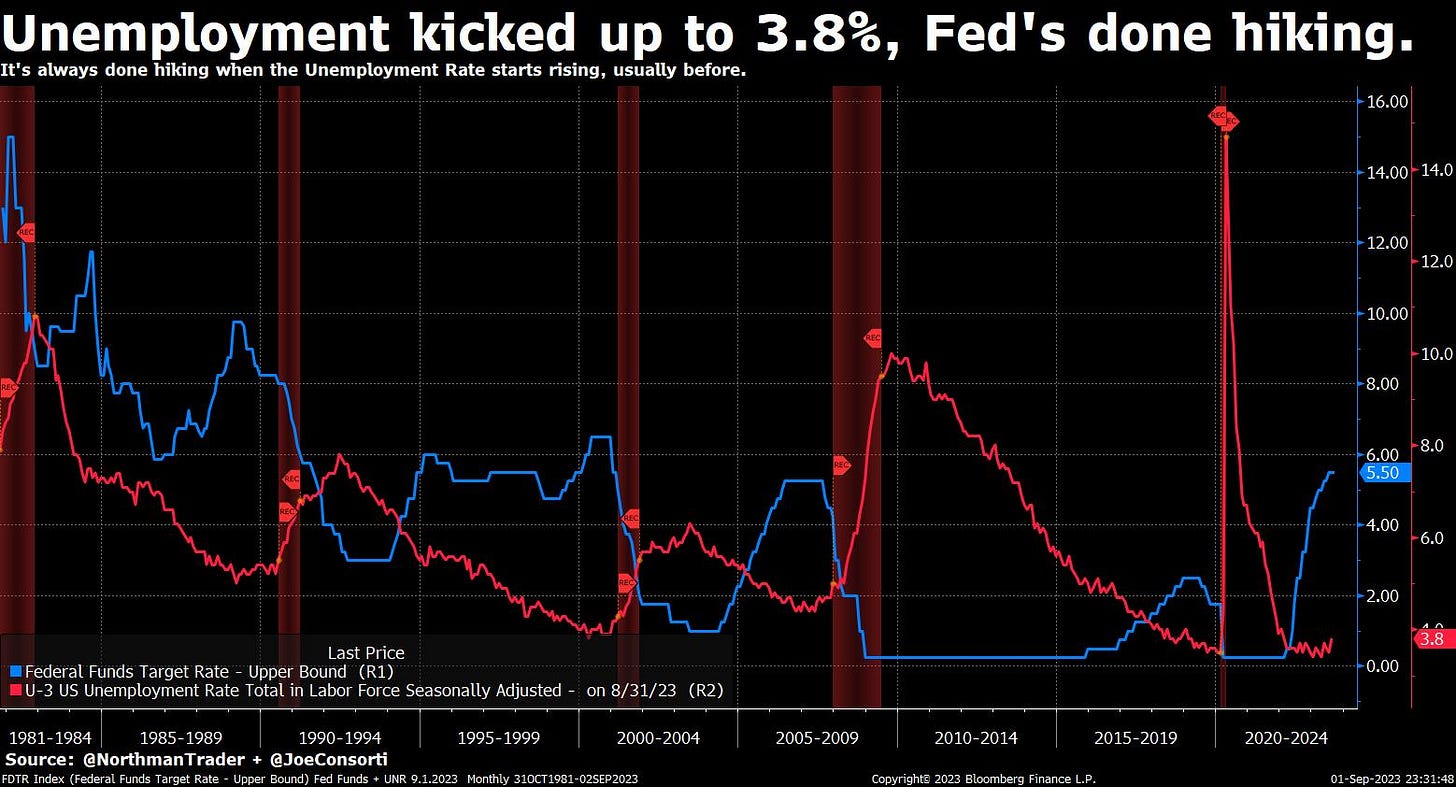

Though the labor market as illustrated by the data above has been decelerating for several months now, the headline unemployment rate lags quite far behind, usually by about a year and a half. However, on Friday, it finally showed signs of life when it rose to 3.8% versus the expectation of staying flat at 3.5%, its highest in 38 months. Given that the labor market has already been in a secular decline and lending standards sitting at multi-year highs forecast where the unemployment rate is going, one thing is certain—this is only just the beginning:

The U6 unemployment measure that counts discouraged workers and those working part-time for economic reasons jumped to 7.1%, the highest since May 2022. More fuel to the fire that consumers are doing all that they can to make ends meet and stave off winding up destitute.

Consumers are at the end of their rope. July’s personal income data rose just 0.2% while personal spending rose 0.8%—a disconcerting trend of accelerating consumer spending fueled by savings and credit instead of wage increases:

To put a spin on the classic “oh shit” scene from The Big Short:

"Personal spending is accelerating but personal income is flat, that means spending is propped up by debt, not assets"

Downward revisions have become the norm across all leading and relevant economic data, as is typical around the start of recessions. As of Friday’s data, August marks seven straight months of downward nonfarm payroll revisions, and new home sales for 13 of the past 16 months have been revised down. This downturn has been faster and harder than economists have expected, or they’re willfully ignoring economic weakness for other interests they may be serving. We’ll let you be the judge on that one:

The Fed is done hiking.

At the very least, we’re closer than ever to that sentence being a reality this cycle. Why? They are always done hiking once the unemployment rate starts or is about to start rising. Given that it’s kicked up to 3.8% from 3.5% on Friday, the pause is here. The Fed’s mission to “loosen” the labor market (Fedspeak for making people lose their jobs) is taking shape. The operative question is the length of the runway before it starts cutting rates:

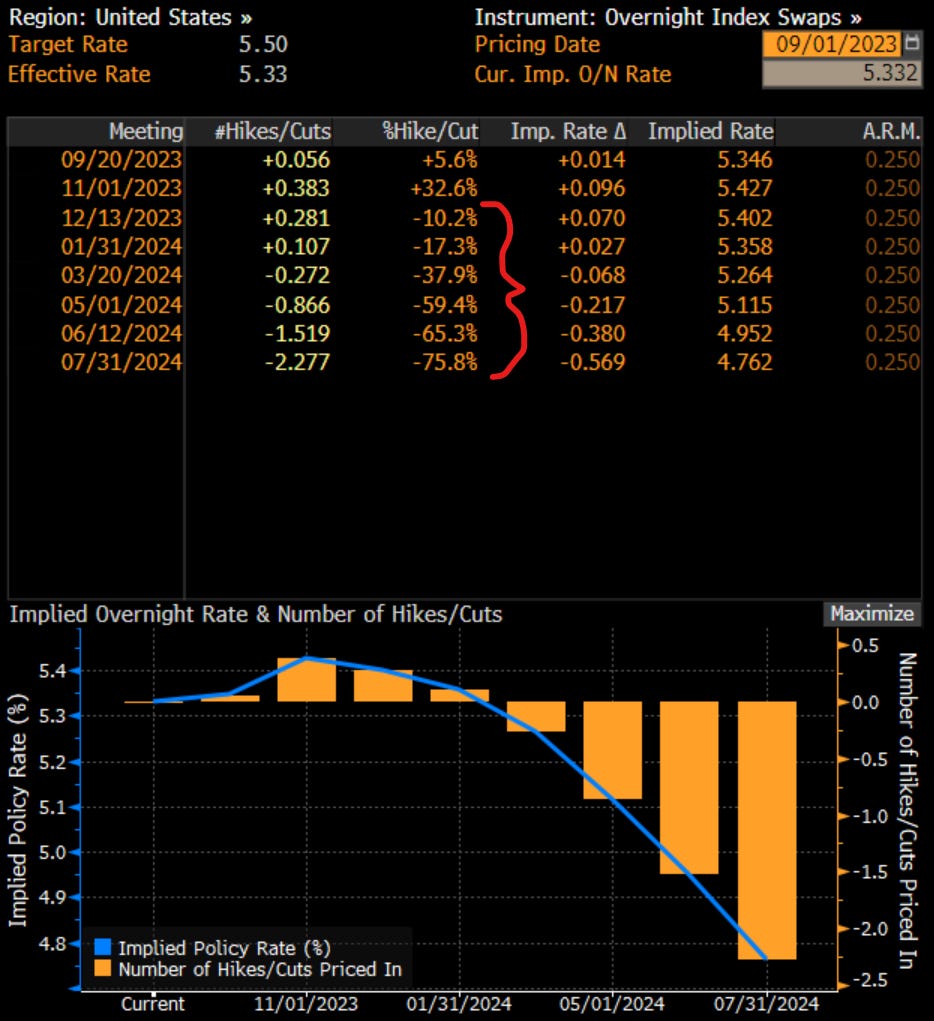

There is now just a 32.6% chance that the Fed hikes once more in November, down from 38% last week, with cuts right after in early 2024:

So off of weak job openings, GDP being revised down on Wednesday, slowing job growth, and the unemployment rate rising to a 3-year high, most of the relevant economic data sucks. So why are stocks ripping?

Bad news is good news right now.

Sour data relaxes investor fears of a hawkish Fed—igniting hopes of relaxed monetary policy to support asset prices. We don't make the rules. This relationship ebbs and flows, but now stocks are looking ahead to dovishness:

Emergency loans at the Fed's BTFP have hit a new high of $107.52 billion, usage basically hasn't risen for 12 weeks. Why? Regional banks are dumping consumer loans to shore up losses instead of using BTFP, packaging loans into ABS and selling them—which now yield their highest since 2008 of above 5.75% on average. This is a measure banks are taking to survive instead of the Fed:

It is not rosy for regional banks.

As we’ve long said, BTFP is merely a band-aid to the real problems lurking beneath the surface—unless the Fed intends to recoup all of banks’ losses for them and perpetuate moral hazard, the music will have to be faced soon.

And well, it seems like the powers that be are realizing this too and getting out of dodge while the getting is still good. San Francisco Fed Bank-Supervision Chief Azher Abbasi is retiring on October 1st. He was responsible for oversight of lenders including… SVB and First Republic Bank, the two landmark regional bank failures up to this point in 2023.

The Fed didn’t give a reason for his sudden departure. If there is anybody who knows just how bad things really are behind the scenes, it’s that guy. Leaving without warning during a lull period as the Fed’s tightest rate hiking regime in decades has impaired regionals to the point that they are dumping all of their assets like water from a sinking ship to survive? This does not inspire confidence about the risks facing regional banks.

Amidst the quiet pandemonium, the Fed is ramping up its oversight of small US banks. Citizens, Fifth Third, and M&T have been warned privately by the Fed to shore up capital and liquidity planning—seems strange to warn lesser-capitalized banks to raise provisions if the economy is purportedly headed for a “soft landing,” isn’t it? Regionals are still in trouble, and the Fed knows it:

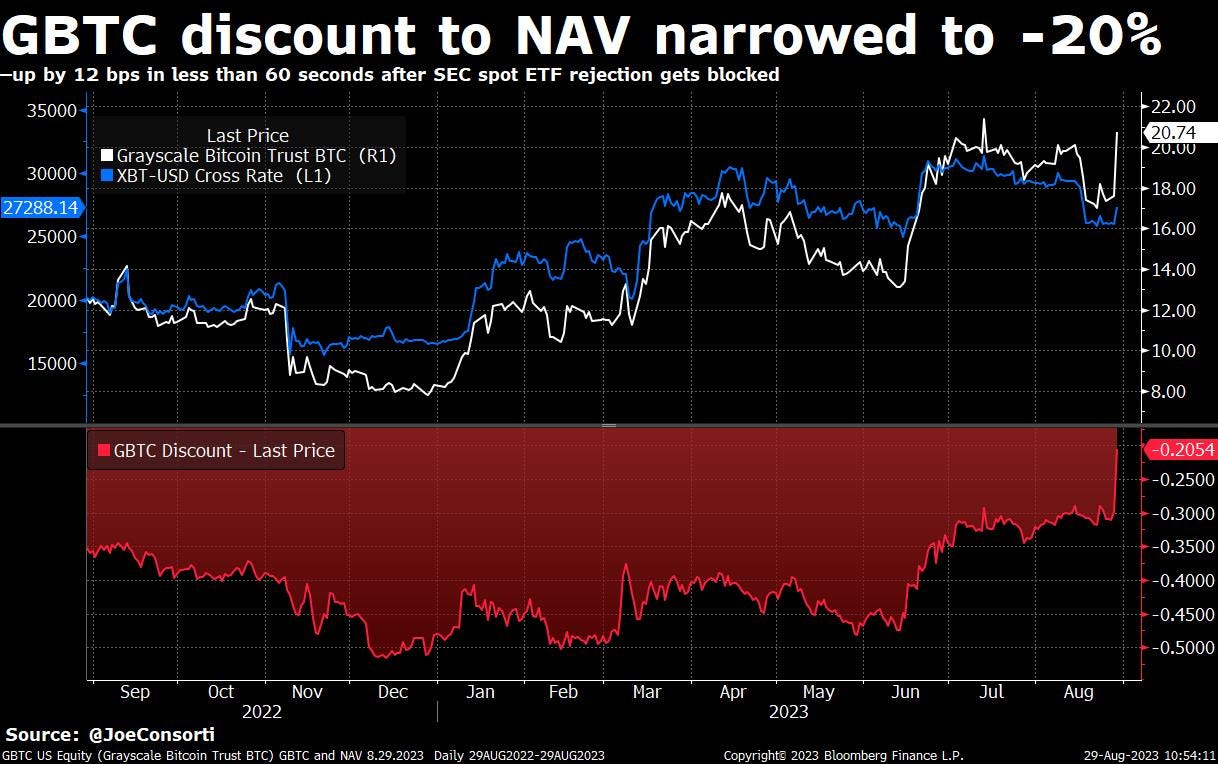

Now for a quick update on the bitcoin front. Grayscale won its lawsuit against the SEC’s rejection of its application to convert GBTC into a spot bitcoin ETF. On the news, GBTC rallied from a -32% discount to a -20% discount to NAV in less than a minute, though it has given up some of those gains and slid along with bitcoin itself in the days following the win:

Fun in Binance and Tether Land as CZ called Tether a black box, and Bitfinex proceeded to launch perpetual BNB futures with a 20x leverage limit.

Let’s just say: if Binance has to shore up liquidity to meet margin calls on a totally non-existent BNB-collateralized loan now that there’s a conceivably unlimited amount of short pressure on BNB, bitcoin will experience gale force levels of selling pressure. Fun!

Next Week

In the week ahead, there is one material economic release that we'll be watching for as portfolio manager vacations officially end after Labor Day. Wednesday brings the ISM Services data—this week's ISM Manufacturing showed some modest albeit still contractionary levels of output, but services have been able to remain in growth territory. That is expected to continue as the US marches toward an entire 2023 without landing the proverbial economic airplane. While labor markets are certainly showing signs of a shift, consumers and their consumption of services have yet to trend toward the doomsayers' pit of recession. After all, borrowing powers, and household debt payments as a share of disposable income are at tame levels, historically speaking.

Markets will focus on the choppy end to the week in Treasury yields, and The Bitcoin Layer will have its close eye on yields across the pond—German 10-year yields are trying to form a top and head lower, a major sign to us that global investors are finally comfortable locking in longer-term fixed income instruments heading into a major slowdown. While the world fears higher Treasury yields and what they might do to other asset classes, lower Treasury yields might in fact be even more dangerous, as they would be the symptom of a recession instead of higher yields causing writedowns elsewhere:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, we are joined by Blockstream's Director of Research, Andrew Poelstra. Andrew has released a new book that provides a fascinating offline solution for secret sharing. We discuss how his book works and how it applies to bitcoin storage and verification. Andrew also shares his early motivations for working on bitcoin.

Check out—Store Your Bitcoin SECRETLY | Andrew Poelstra

Tuesday

College has long been considered the “next step” for American teenagers.

Far from its heyday as higher education reserved for those with forethought career paths, now, everybody goes to college regardless of career ambition. It has morphed into an extension of high school thanks to guaranteeing student loans to aimless, meandering high schoolers who don’t need them—far from the higher education reserved for doctors, lawyers, engineers, and other select jobs that require specialized schooling that it used to be.

This paradigm shift in the American university system has created rampant capital misallocation, not across businesses, but across American citizens.

Debtors have increasingly diminished in quality as the college dream proliferates across the USA to those who never intended to attend had it not been pushed on them. Their collective ability to pay back lenders has diminished too—the main evidence we have for our claim in today’s post. Now that March 2020’s post-COVID emergency student loan forbearance is ending in 2 days, a multi-trillion-dollar deleveraging is heading for the US economy.

While it may not kick off the next credit event, the real economic fallout will be the 180° heel-turn in consumer spending, and the subsequent collapse in economic growth that will result.

Check out—45% of student loan borrowers expect to go delinquent

Wednesday

In this episode, Joe walks through how 45% of federal student loan borrowers expect to go delinquent once payments resume in October, and the crushing impact it very well may have on consumer spending, and by extension, US economic activity.

Check out—Student Loan Payments Will CRUSH The Economy

Thursday

Earlier this week, a favorable ruling for Grayscale in its pursuit to convert GBTC into a proper ETF gave the bitcoin price a nice 5% pop, and a mainstream financial media narrative quickly arrived in which spot ETFs would soon be approved. Bloomberg analysts even moved the odds of approval by the end of this year to 75%. Instead of asking the probability of a broad acceptance of bitcoin ETFs, let’s instead reset and ask ourselves if and why this SEC battle even matters.

Check out—ETF approval only matter of time

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL and receive $5 free when you buy $100 in Bitcoin.