Good morning Readers!

Like most weeks over the past few months, this week had no shortage of market-moving news. After reciprocal tariffs were announced to the world on Liberation Day, on Wednesday, April 9th, the administration was forced to walk back some of the talk as markets experienced heavy turmoil (namely, Treasury markets). Our understanding that tariffs are only one piece of a greater reordering, burden sharing, and trade deficit reduction has increased, helping us see through the volatility and understand the market’s propensity to bounce this week.

The 90-day pause is something our friends at Yardeni predicted the Administration would do—that, as well as a quick reaction function from the Fed. In an interview on Friday, April 11th, Boston Fed President Susan Collins remarked that the Fed is ready to provide some liquidity should financial turmoil continue bulldozing through markets. That said, how did equities perform this week?

The S&P 500 managed to stay above one of our key levels: 4,800—a level we’ve been eyeing for quite some time now.

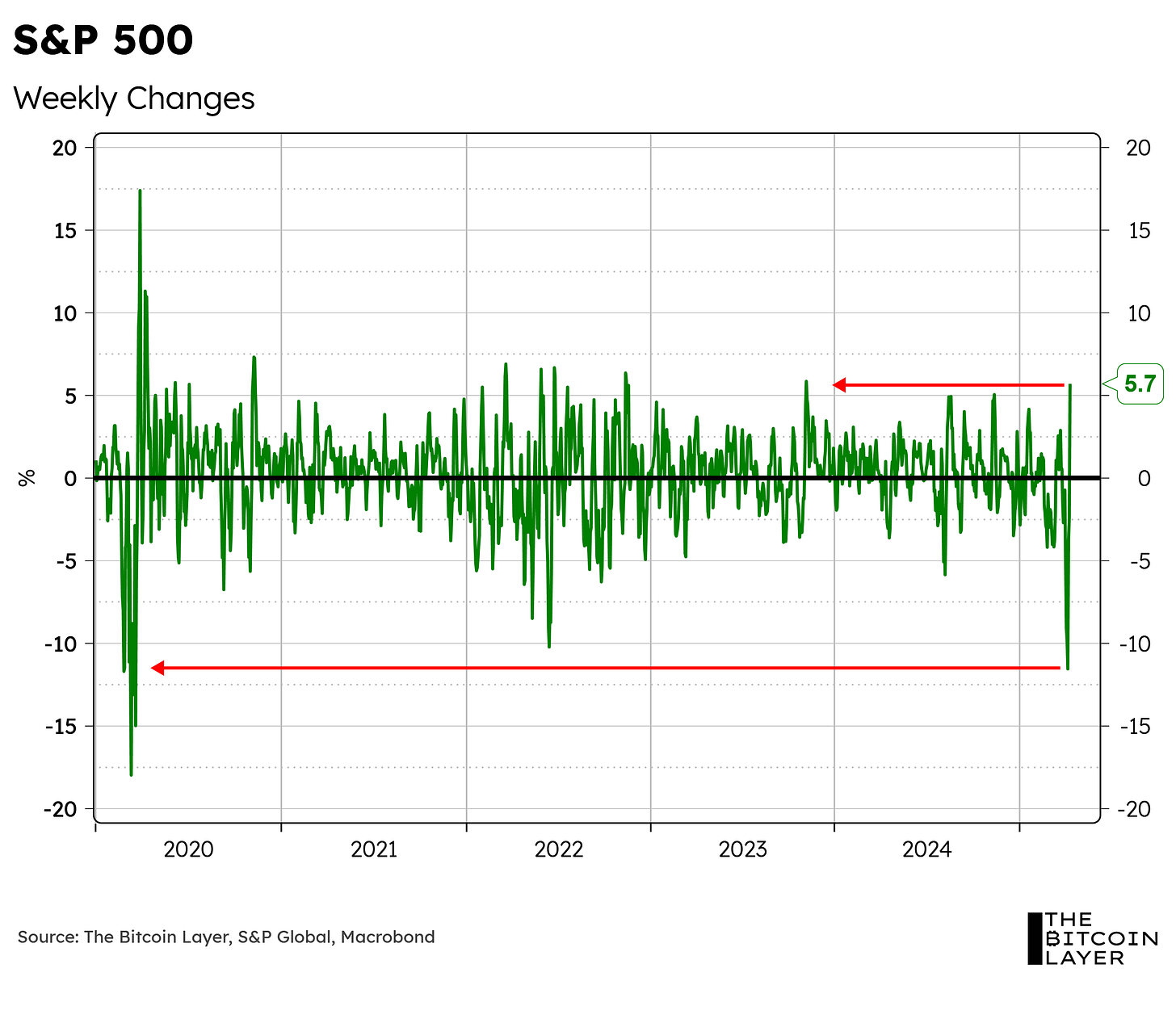

Not only did stocks manage to stay above that support level, but they did so by a 10% margin, with the S&P 500 closing the week at 5,363. In fact, after last week’s major dip (a weekly contraction of -11.5%, a decline not seen since 2020), this week, stocks pulled their largest weekly gain since late 2023. These wide-spread ranges showcase just how volatile markets are right now:

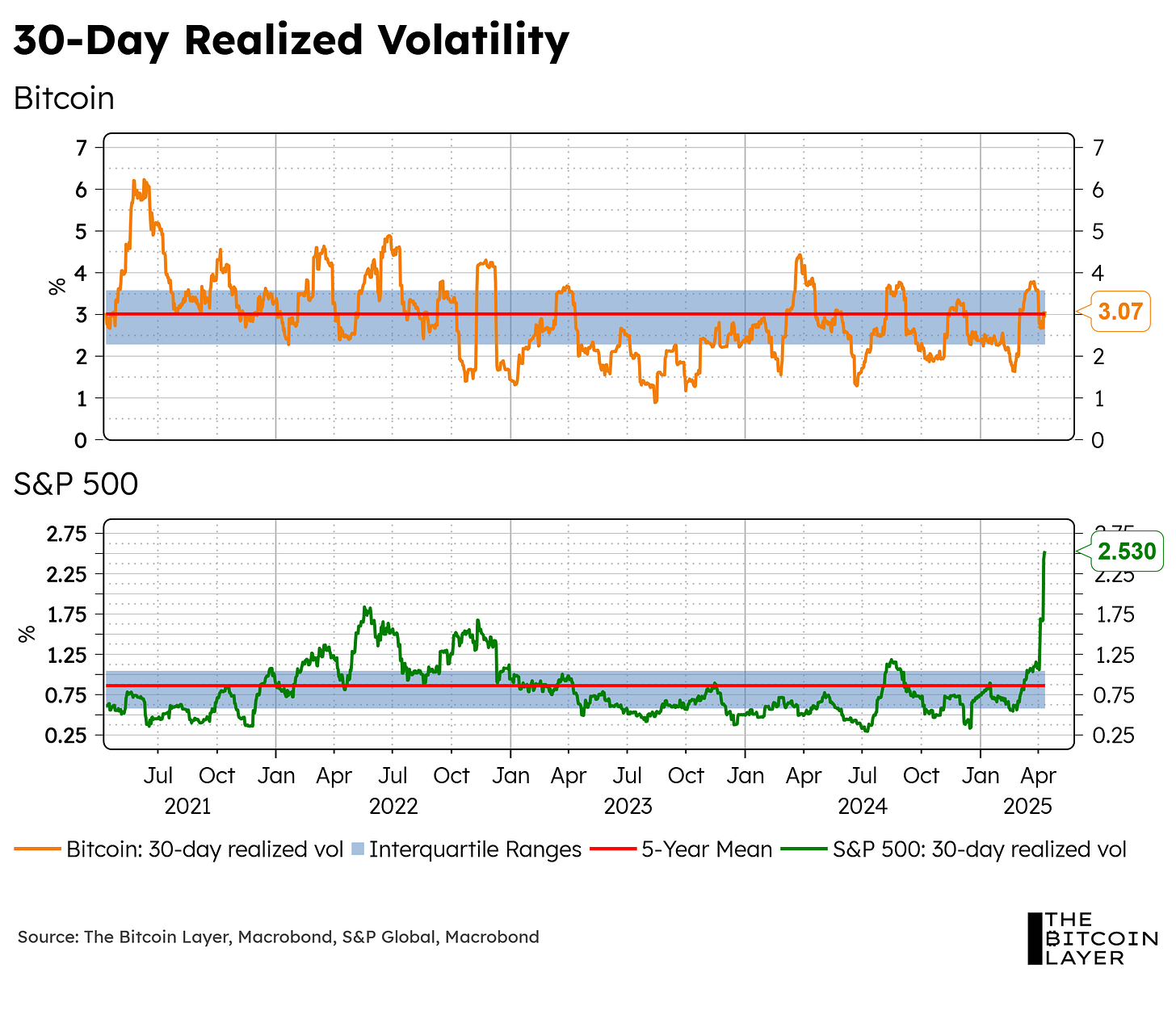

What about bitcoin? Where does our favorite asset stand in all this realized volatility? To answer this question, today’s Weekly will:

Analyze the so-called Trump put

Look into bond market volatility

Analyze the ‘Recessionary Steepener’ now seen on the yield curve

Hypothesize on the divergence between the dollar and 10-year yields

So, without further ado, grab a coffee, and let’s dive into TBL Weekly #136.

The first months of the new administration have sparked an unprecedented push for cost-cutting and efficiency within the federal government—but DOGE Can't Fix The Dollar. Join us on April 16th to hear PhD economist Peter St. Onge explain how bitcoin brings true efficiency to governments while protecting your generational wealth. With macro uncertainty driving a dip in bitcoin prices, now is the time to understand the fundamentals driving the global shift to sound money.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Weekly Monitor

Weekly Analysis

Did the Trump Put Happen?

To ease bitcoiners’ minds, let’s first compare realized 30-day volatility in both stocks and bitcoin:

Notice something interesting?