Wealth effects & Operation Chokepoint 2.0 flaming injustices: TBL Weekly #113

Good morning Readers! Welcome to TBL Weekly #113 — grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Weekly Macro-Monitor

Weekly Analysis

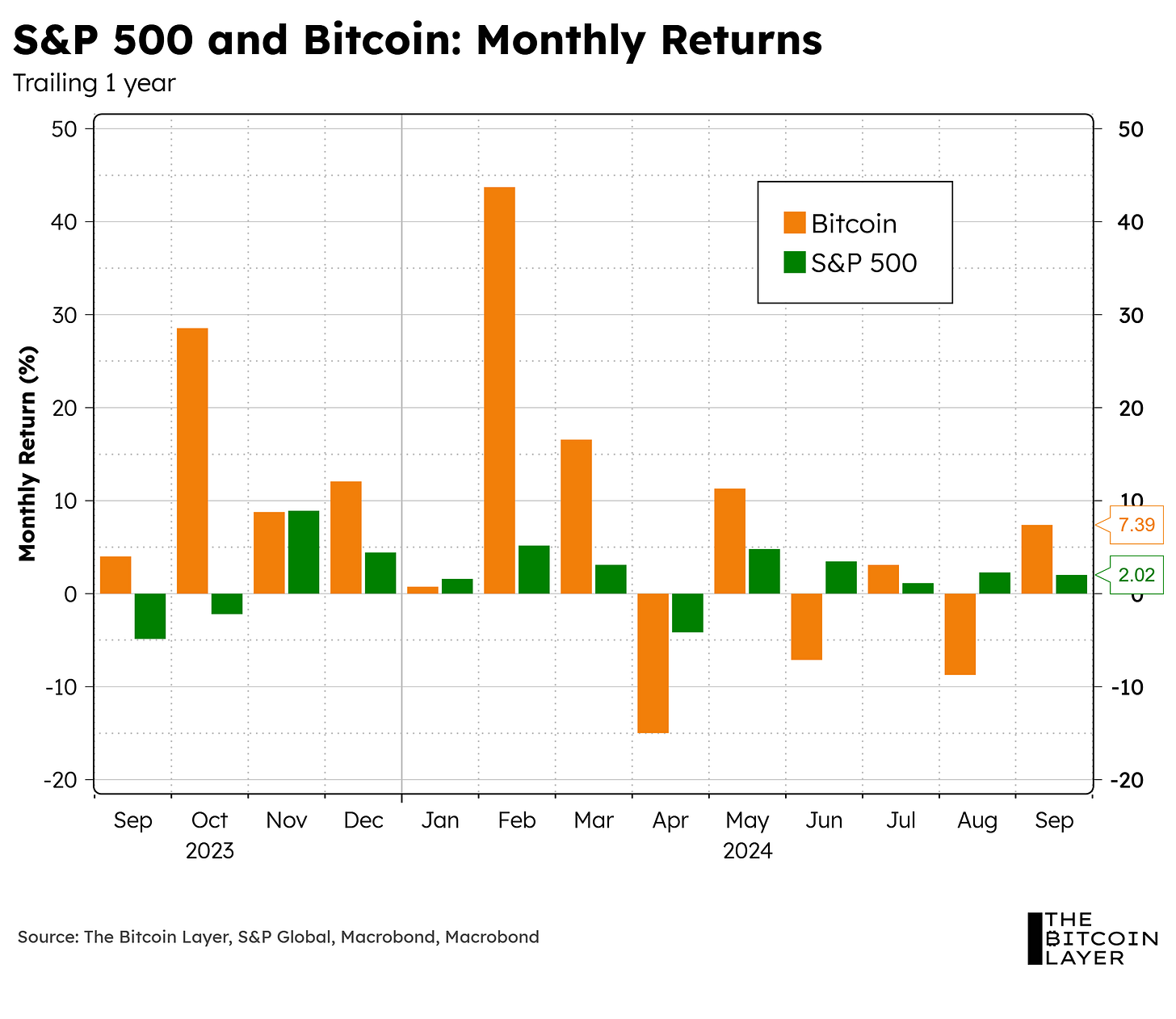

A Friday pop wasn’t enough to keep bitcoin out of a red week, but its outperformance of the S&P 500 during September was noteworthy. The bad months are much worse, but the good ones, as we saw in February and March, can be explosive.

Bitcoin closed the month of September with a higher monthly return than the S&P 500, making it the 8th out of the last 13 months where Bitcoin has beat equities. Directionally speaking, returns on both have been highly correlated (in 9 of the last 13 months, their returns have been in the same direction).

Our quantitative analyst Augustine asked Nik some questions about the week’s action.

Quant Question #1: What would de-couple these two, and how would bitcoin reduce its correlation to equities?

A decoupling, outright, is unlikely for the next several years. What is entirely possible are brief decoupling periods in which bitcoin acts on its own volition. We don’t believe this is a break from history, nor a bad thing. Bitcoin is riskier than stocks most of the time, but some of the time it is the most novel and rare financial asset to ever exist, making its pricing entirely unrelated to stocks. Don’t expect long de-couplings, but look for brief ones to emerge, likely to bitcoin’s delight.

Quant Question #2: Since June, ISM Manufacturing and Services (headline) have been completely diverging (green and blue lines). What does this mean for the US economy? Is one more important than the other in predicting recessions?

Services are in expansion, which means the US economy is growing. It isn’t in recession, and even though manufacturing has struggled, it isn’t enough to drag the economy down. Services are more and more important to the US, especially as the multi-decade technology dominance wave enters its next AI-driven phase. Regardless of our bearish view given lagged effects and real estate heaviness, an ISM Services of 54.9 tells only one story: expansion.

Importantly, both employment subcomponents are in contraction; this is a clear sign the labor market is struggling. Also recall that quits continue to trend down, meaning people are scared to leave their current jobs. Our bearish economic outlook centers in on the overall absence of hiring impulse.

Quant Question #3: Soft Landing now?

We just saw the ISM employment data, but many are drawn to the unemployment rate instead. We are sympathetic, but the BLS doesn’t help us much, especially given recent revisions so large it makes judging each number as it comes out as useful as a book of matches in the wind. Any soft landing will take place because of how quickly financial conditions feed back into the real economy. For example, if the Fed starts cutting aggressively and stocks do well (and the dollar goes weaker), the economy might feel an immediate boost due to the wealth effect (higher consumption due to higher stock prices).

Quant Question #4: Why are job openings, hires, and quits all steadily declining since 2022’s highs, but unemployment is still at historically low levels?

Because the BLS is a statistics manipulation machine with its unemployment rate and nonfarm payroll numbers. JOLTS (also a BLS number) and the household survey, in addition to Fed surveys and ISM, will tell the truth on the labor market. Wages, above all, represent the price of labor, and supported wages suggest labor doing fine.

Quant Question #5: Since April, the average monthly yield on 10s has been lower each month; however, October started off extremely bearish. Was this due to unemployment data? Or a simple bull run that’s run out of gas?

The bull run needs to consolidate, especially now that cuts have begun. Remember that an inverted curve finally un-inverts only when cuts come, because the long-end is only a sell when the economy is ready to get going (growth and future inflation should be reflected by higher yields). Now that the Fed is finally serious about cutting rates, the market is ready to take a breather on its “all-in Treasuries” mentality. It’s a natural retracement. A next round of lower yields will only occur if economic data sours.

Quant Question #6: As an investor, why would we care about this uptick in repo rates at the end of the quarter? What did it signal and why do I care if it always just goes back to normal?

An uptick in repo rates during quarter-end and month-end events represents a scarcity of capital. When it returns to normal, it can be easy to forget, but we should care because at some point it might not, and the Fed will have to come to the rescue. This means balance sheet expansion. QE, globally and historically, represents one of the core arguments for bitcoin in a portfolio.

Efani delivers premium mobile service with unparalleled protection against SIM swaps and privacy invasions. Safeguard your bitcoin and personal data with the industry's most advanced security measures.

Protect Yourself Now. If you value your privacy and security, Efani Secure Mobile is the answer. Don’t wait until it’s too late, protect yourself today. Use code TBL at checkout for $99 off the Efani SAFE Plan.

In case you missed it: TBL on YouTube

Wall Street Veteran Grills Bitcoin Professor

In part 4 of our "Teaching Bitcoin" series, Michael Howell takes the wheel and asks Nik his lingering questions about bitcoin. The pair discuss bitcoin's tax implications, regulatory frameworks, and its role in the global economy. They explore the differences between Bitcoin and stablecoins, the significance of Gresham's law, the practical aspects of buying Bitcoin, wallet security, custody solutions, and how The Bitcoin Layer emphasizes the significance of on-chain analysis.

You can also find the episode on Apple Podcasts here.

If you don’t have 65 minutes to spare, here are some of the key insights:

Bitcoin is treated as property by the IRS, impacting its use in transactions.

A law on de minimis transactions could change how bitcoin is taxed.

Bitcoin is primarily viewed as a store of value, similar to gold.

Gresham's law illustrates the dynamics of good money versus bad money.

Bitcoin's future may see it as a digital gold rather than a transactional currency.

Buying bitcoin involves using reputable exchanges and understanding wallets.

Security of bitcoin involves managing private keys and custody solutions.

A significant portion of bitcoin may be lost forever due to lost keys.

Realized price is a key metric for understanding bitcoin's market value.

The growth of bitcoin adoption is expected to follow an S-shaped curve.

Recession Watch, Economic Update, & SOFR Trouble

Nik recaps the day in economic data and financial markets, including a look at JOLTS and the slowing labor market, weak ISM manufacturing data and prices, and the repo market. In the most important financial development of the day, elevated SOFR volumes and repo rates confirm there is some scarcity in the money markets.

You can also find the episode on Apple Podcasts here.

If you don’t have 32 minutes to spare, here are some of the key insights:

The rise in job openings contrasts with a decline in the quits rate, signaling employee hesitance and concerns about job security.

Increased bond volatility has historically led to declines in risk assets, like stocks and Bitcoin.

The spike in SOFR indicates a cash crunch among banks, particularly at quarter-end.

The Fed is positioned to implement aggressive rate cuts, potentially bringing the policy rate below 3%.

The Bitcoin Layer’s new liquidity index combines banking assets and bond volatility to gauge risk sentiment and its effects on bitcoin.

The declining quits rate suggests diminishing confidence in job security.

Operation Chokepoint 2.0: The Fed’s Secret War on Crypto with Caitlin Long

Nik is joined by Caitlin Long to dissect the evolving landscape of crypto banking. She dives into the impact of Operation Chokepoint 2.0, exploring how government agencies viciously attacked the crypto sector. Caitlin explains the power that the banking lobby wields on shaping regulatory frameworks and sheds light on the inherent fragility of the traditional banking system and the dangers of blending crypto with legacy finance.

You can also find the episode on Apple Podcasts here.

If you don’t have 58 minutes to spare, here are some of the key insights:

Caitlin Long emphasizes the fragility of the banking system.

Operation Chokepoint 2.0 was instigated by Michael Barr at the Fed.

The SEC and federal regulators are imposing arbitrary rules on crypto banks.

The banking lobby has significant influence over regulatory decisions.

Caitlin argues that the ETF market is a double-edged sword for bitcoin.

There is a clear hypocrisy in regulatory actions against small vs. big banks.

The emergence of offshore dollar markets is a response to US regulatory actions.

Caitlin believes that history will not be kind to the current administration's actions.

The concept of justice in banking regulation is crucial for the future of crypto.

Caitlin warns that the collusion of big business and big government poses a threat to bitcoin.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we covered the dockworkers strike and its implications if prolonged (now resolved!), the devastation cause by Hurricane Helene and its fallout on the economy, and Fidelity trying to protect itself from a check-fraud scheme being made popular on social media platforms like TikTok and Telegram.

Check out TBL Thinks here:

What TBL Pro Is Reading

Risk is on, and we thought this would be a great time to look at even more bitcoin indicators. You’ll find an expanded bitcoin on-chain research section in this week’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters.

Nik also published his weekly letter Trader Notes, on non-investment-advice technical analysis: “this is a candlestick exercise, and one that I perform regularly to square my analysis.”

Read more by going TBL Pro.

Next Week with Nik

Next week, CPI steps back into the spotlight, but our loyal readers understand we’ll mainly be watching the dollar versus Japan and China. It’ll be another several weeks of investors debating about 25 or 50 basis point cuts, but we’ll be waiting for the election to pass while watching DXY chop around the 100-104 range trying to find direction.

Inflation isn’t going away any time soon, but we’re not sure the Fed really cares. It’s trended exactly to the “not too high anymore” range so that the Fed feels comfortable with some political cover to cut.

Small business optimism is still low compared to its historical average. We will continue to watch this metric to see if any changes in sentiment emerge from rate cuts. Economic data has been tricky to track, especially with Jerome Powell saying something that has an immediate impact on markets (higher stocks, lower rates). We label this an instantaneous feedback loop instead of the one-year lag the textbooks teach.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.