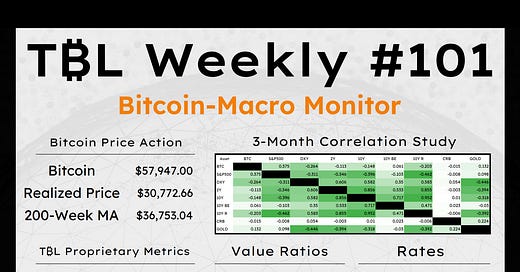

Yen-tervention, Cool CPI, BTC Withstands Germany Sales, Rate Cut is Locked In: TBL Weekly #101

Welcome to TBL Weekly #101—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

Good morning TBL Readers, happy Saturday ☕

Welcome to TBL Weekly #101. You’ve seen their splash in Thursday’s post as well as in our Saifedean interview—we’re excited to introduce our new partner, Unchained. Working with the industry leader in full-service bitcoin multi-sig is really a dream come true for us. Together, we’re going to bring you more of the best bitcoin and global macro research, along with custom reports, exclusive content for TBL Pro members, and much, much more in the weeks and months ahead.

Without further ado, let’s get right into it.

The Japanese yen just can’t catch a break, except when its government gives it one.

Once again, Japan has intervened in the FX market to support the rapidly deteriorating JPY. The slow decline of the Japanese yen is a bygone era, and in its place is a rapid and disorderly unwind of the yen, and with it, the global relevance of JPY.

Longtime readers of TBL may recall that the yen is a popular borrowing currency for the FX carry trade, where global players borrow at low (even negative) interest rates found in Japanese capital markets and invest at a higher interest rate in other countries’ capital markets, capturing the spread.

The carry trade was killed when Japan stopped capping its government bond yields. Take a look at this price action since March when Japan officially stopped YCC. Bloodbath:

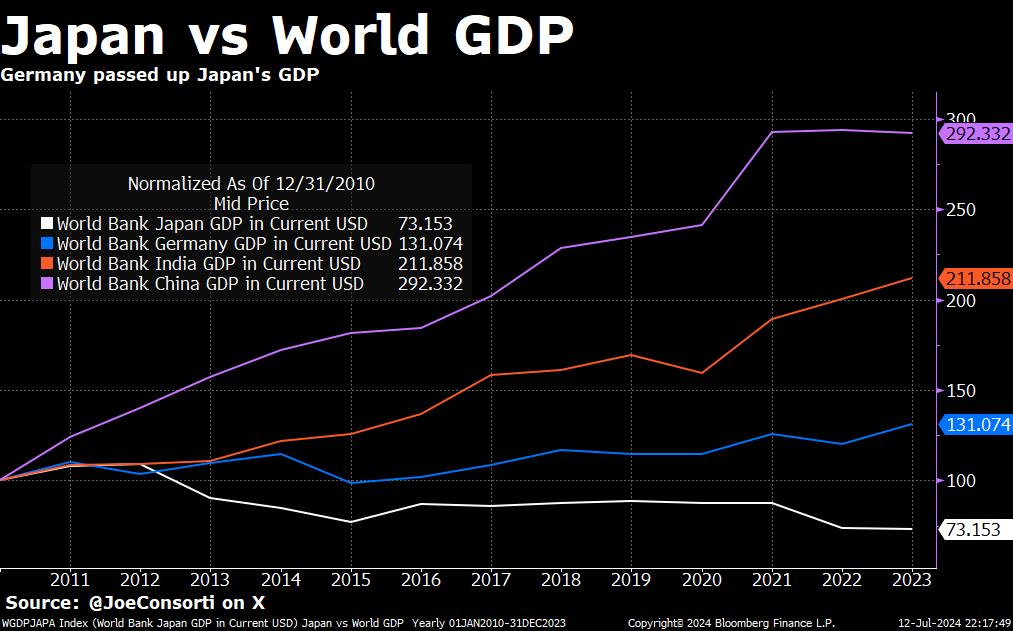

Japan has to keep yields negative in real terms due to its massive debt pile, causing further depreciation in the yen. The only solution is for Japan to grow its way out of the problem. Let’s see how that’s going. Over the last decade-plus, Japan has been passed up by Germany, who’s being trounced by India, with China (taken at their word) having the strongest GDP growth of the lot:

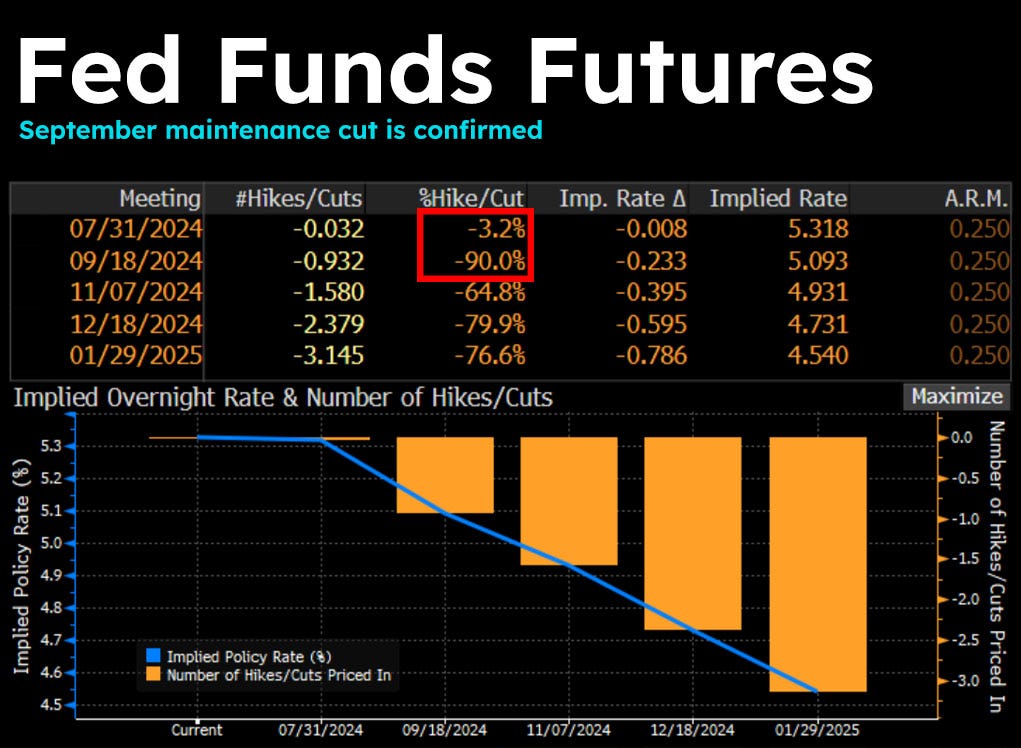

CPI on Thursday added more fuel to the disinflationary fire. The Fed has more cannon fodder to cut now than at any point this cycle, and markets are pricing in essentially 100% certainty of one 25-bps rate cut in September. The odds of a cut at the end of July are ~0%, while the September meeting at 90% is a surefire guarantee.

Here’s a snapshot of 10s taken from Nik’s Thursday post. The last two daily candles provide a great deal of signal—on Thursday we dropped 15 bps to underneath the 4.25% level, and we closed the week firmly below it, at 4.18%. Tens have fallen naturally with falling growth and inflation expectations, destroying the narrative that QE or YCC would be needed to bring them back down. The US Treasury market, regardless of increased auction sizes and the magnitude of the fiscal deficit, remains the go-to fixed-income market globally. Sensationalists stay mad, this is American exceptionalism:

Despite today’s hot PPI data, with core coming in 20 bps above expectations and headline hot by 10 bps, rates were still down on the day. Markets are deadset on the path of growth and inflation: deceleration.

The Fed doesn’t like to upend market expectations this far out from a meeting. At this point in the cycle, where the disinflationary stars are aligned and the last shoe to drop is housing, which will come down to target purely from the ~21-month lag effect between rent disinflation and the OER component in CPI, now is the time for Powell to bring the market its first 25-bps maintenance cut.

Check out Nik’s Thursday post for further analysis on CPI, where it’s headed, and the Fed’s imminent September rate cut.

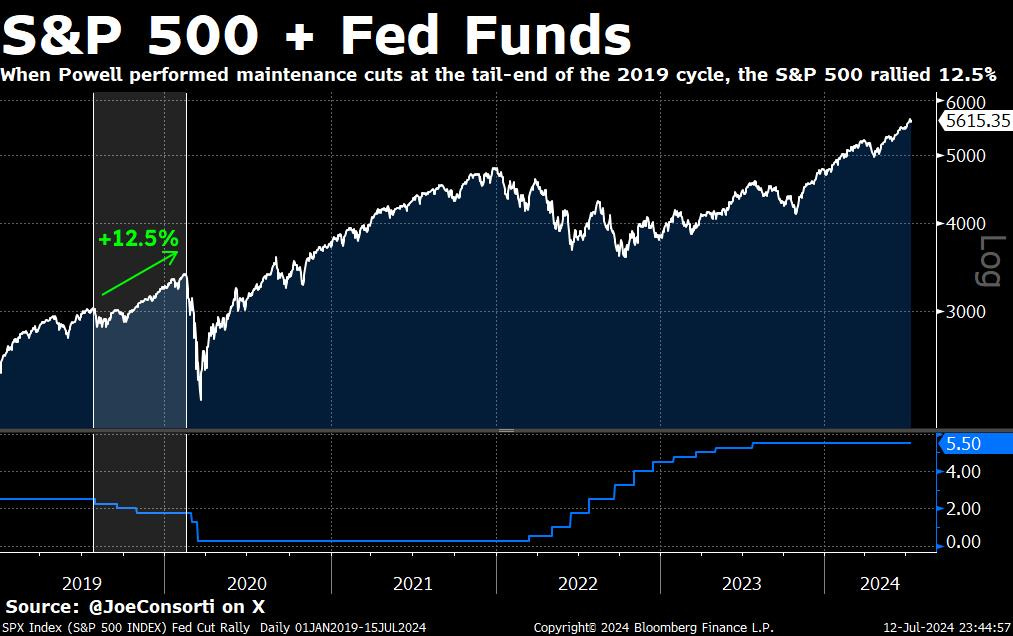

Risk assets like the S&P 500 and bitcoin love when Powell performs maintenance cuts. Take a look at when Powell’s Fed in 2019 performed 25-bps cuts after its long on-hold period—the S&P 500 rallied 12.5%:

With credit spreads still at cycle lows and maintenance rate cuts set to begin, we’re closer than ever to achieving the coveted “soft landing”—where the labor market doesn’t explode, inflation and growth normalize without falling into negative territory/below trend, and the expansion of the next cycle begins without a bust.

It has never happened, but we’re very close to it happening now in a post-2020 world where the Fed’s increased sensitivity to financial stress has never been higher, reducing the likelihood of any kind of collapse upsetting US financial markets for an extended period.

It’s not our base case, but it’s our duty to tell you what the data is showing us:

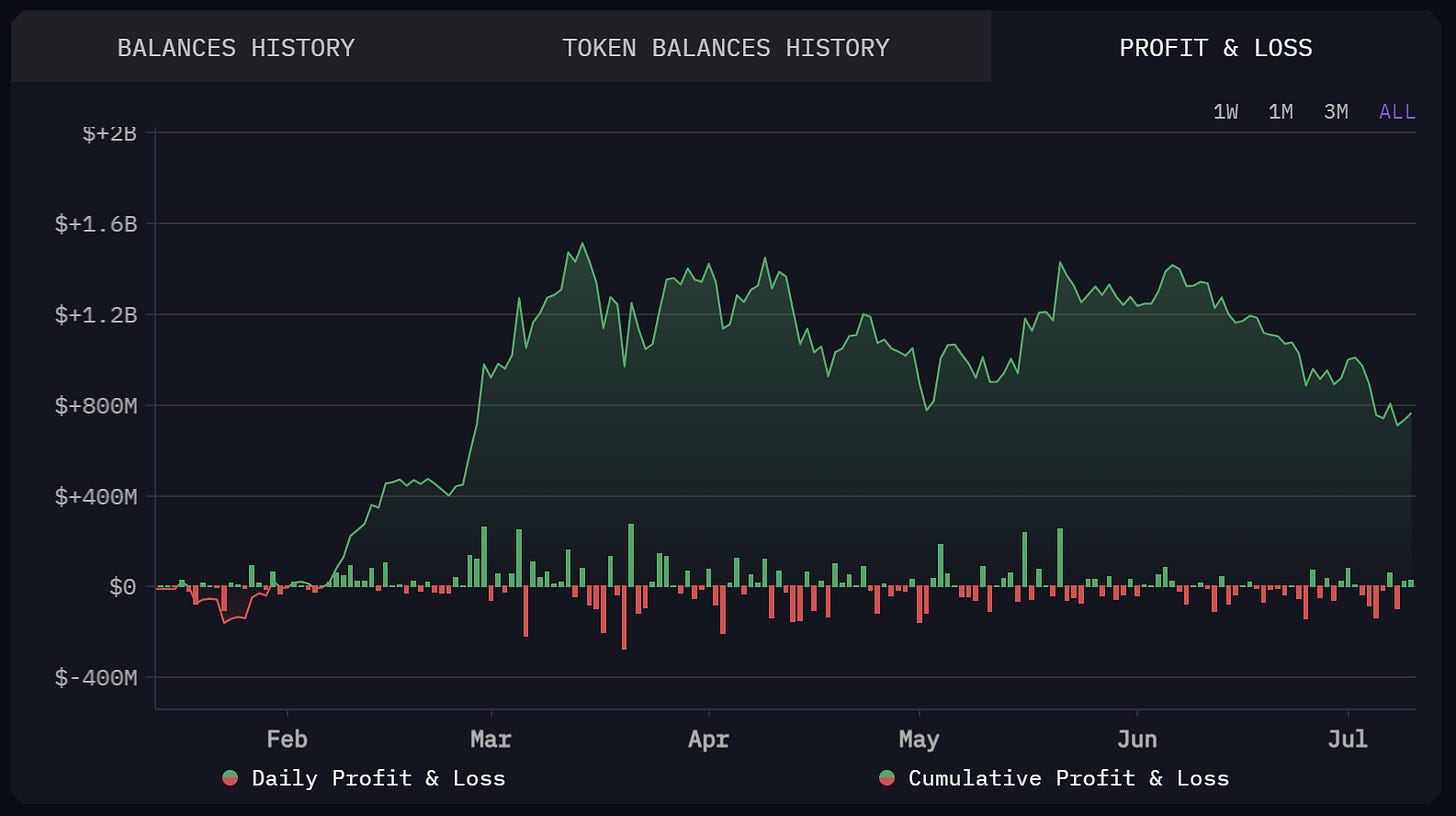

Germany sold all 50,000 of its bitcoin. What a colossal decision that they will live to regret in the years and decades to come. Using the Arkham Intelligence on-chain explorer, we can look into the cluster of wallet addresses belonging to the German government. All of their BTC, seized by German authorities from criminal operations, is gone:

Despite being up +$1.6 billion in profit on an investment they got for free, by stealing it from their citizenry, they’ve sold all of it for roughly $3.5 billion, or 3.2 billion euros in proceeds. For context, this isn’t enough money to cover 3 weeks’ worth of Germany’s interest payments on its debt. What Germany just did is the equivalent of you liquidating the bonds Grandpa gifted you as a baby, 15 years before maturity, to go buy a few tanks of gas. An unfathomably stupid move:

Despite the heavy selling from Germany, spot ETF flows have picked up over the same 6-day period. Issuers have purchased $1.186 billion in bitcoin on behalf of their clients. This resurgence of net inflows is a prime example of investors setting the floor for the next leg higher:

Persistent net ETF inflows have served as support amidst the selling from Germany, and the selling that is ostensibly coming from Mt. Gox creditors who’ve received nearly 100,000 BTC from in-kind distribution that began last week. I drew a line on this chart of bitcoin ETF holdings and bitcoin’s market price to represent a proverbial “string” that has held bitcoin’s market price up during this period:

Now that these two huge selling events are over/already underway and bitcoin is taking these shots to the chin, I am reminded of this clip from Batman vs Superman. Bitcoin withstood two major and concurrent selling events, and with maintenance cuts on the horizon, it’s looking like all system’s go for our favorite orange coin:

Before I close out for the week and pass it off to Nik to look ahead at what’s next, here is a disconcerting fun fact about the United States’ accelerating interest expense problem.

In June, the US spent $140 billion on debt interest, bringing the YTD total to $868 billion, on pace to hit $1.144 trillion by EOY. This was the single-biggest monthly outlay ever. How big, exactly? That's over 30% of all US revenue (mostly taxes) in June... just to cover debt interest.

If you earned $1 million every day since Jesus Christ was born, you'd only have 85% of what the US government has spent to cover its debt interest so far this year. Seems totally sustainable. The human mind doesn’t intuit exponential functions naturally, so I hope that this example sheds some light on how dire the straits are for the US. Despite its position as the world leader, where the appetite for our debt is the strongest of them all, and hasn’t waned even with increased issuance now, this is a problem that Congress has to wrap its head around and fix before it’s too late:

Next Week with Nik

In the week ahead, markets will settle into the reality of a September rate cut while digesting some relevant consumer and housing data. As Joe cited with the 90%+ probability priced into the September meeting, markets will lean into every bit of data that might suggest whether we are on a path to a soft landing, which might warrant 1% of rate cuts over the next year, or a recession, which could bring up to 3% of cuts. The disparity as well as the uncertainty of how things will play out leaves the market grasping for signal. It will be watching retail sales to see if the uptick in unemployment has dampened the consumer, unemployment claims for further indication of economic weakness, and the reaction in 2s and the shape of the yield curve to measure the extent of 2025 rate cuts. As far as 2024 rate cuts go, it now becomes the path of least resistance for the Fed to engage in quarterly 25 basis point cuts. This would put rates lower by 50 basis points heading into Christmas.

If you’re enjoying today’s analysis, consider supporting us by joining TBL Pro. As a TBL Pro member, you get full access to all research as it drops, access to the comment section, and access to Nik & Joe for a live Q&A every month.

Here are some quick links to all the TBL content you may have missed this week:

Monday

What a ride in the bitcoin price over the weekend. Understand our risk outlook in today’s Mean, Median, Mode—a weekly quantitative report summarizing bitcoin price analysis and global macro narratives to position investors and bitcoin watchers with the data that matters. Don’t forget to register for our next Virtual Q&A, scheduled for July 25th—link for July’s Zoom is below.

In this week’s version, we present analytics on bitcoin’s weekend price crash and provide economic narratives on rising unemployment. Here is Mean, Median, Mode—your weekly bitcoin & global macro risk report.

Check out—Mean, Median, Mode: July 8th, 2024

Tuesday

In this video, Joe walks through how Bitcoin's 4-week 25% correction may be coming to a close. Despite Mt. Gox now redistributing 94,500 BTC, and the German government selling $21 billion in BTC over the weekend, bitcoin managed to spring off of the low-$50,000 level. Factors that have been headwinds for BTC over the last month are no longer hurting its market price, and after a 7.5% weekly drop, the 4th largest since FTX collapsed, bitcoin may have just set a local bottom for the remainder of the bull market.

Check out—Bitcoin Update: $500-Million ETF Inflows, Market Absorbs Mt. Gox BTC, $50K Level Defended

Thursday

The Bitcoin Layer started a new chapter this week, linking up with bitcoin full-suite financial services powerhouse Unchained. We made this decision to help you find your way in these new bitcoin-centric times—custody can be intimidating, and planning for the future is paramount. Click through to their website today to see what they have to offer, and make sure you tell them TBL sent you!

Today’s letter rounds up the drama in markets of late. I have some all-important bitcoin price analysis, both on daily and weekly candles. We’ll also discuss the rage fest going the stock market, a huge miss on CPI, and of course, rate cuts. Finally, I’ll opine on a misconception, which is that lower rates will help housing. Sorry, but it’s not so easy. Rates are the superstar today, and housing is just an onlooker.

Check out—Markets update: bitcoin, rates, & CPI

In this episode, Nik is joined by author Saifedean Ammous for a masterclass on economics. Saifedean teaches us about the importance of property rights in a capitalistic system and why anti-capitalist rhetoric can be so dangerous. He also explains the role of bitcoin, allowing people to properly save instead of consume. Limited government, taxes, and privately-funded infrastructure are also discussed.

Check out—Property Rights, Capitalism, and Bitcoin with Saifedean Ammous

Friday

It’s Thinking time. This week we learn about more troubles in commercial real estate, the boom in US airline travel, and a powerful Chinese hacking group.

TBL Thinks is our way to summarize the most important paywalled, longer reads relevant to global macroeconomics, helping you cut through the noise. With that in mind, please enjoy.

Check out—TBL Thinks: CRE Fraud & Chinese Hackers

In this episode, Nik delivers a global macro update focused on the Fed cutting rates in September. He explains why the Fed is now officially locked in on rate cuts, offers insights on the signal we gain from Treasury yields, touches on the strength in stocks and the volatility in bitcoin, and finishes with a recap of the latest CPI inflation release and the power of falling rents.

Check out—Fed To CUT RATES In September

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

Unchained empowers you to fully control your Bitcoin with a collaborative multisig vault, where you hold two of three keys and benefit from a dedicated Bitcoin security partner. Purchase bitcoin directly into your cold storage vault and eliminate exchange risks with Unchained's Trading Desk.

Unchained also offers the best IRA product in the industry, allowing you to easily roll over old 401(k)s or IRAs into Bitcoin while keeping control of your keys.

Don’t pay more taxes than you need to. Use code TBL for $100 off when you create an account.

The Jesus fact is wild