Good morning Readers!

$100,000…incredible, isn’t it? After many Thanksgiving dinners (hope you all had a great one, by the way) being the laughingstock at the table, how the tables have turned. In today’s Weekly, we want to slow it down from the excitement around six digits. As we break through $100,000, we enter price discovery territory, and we have more questions than answers. Here’s what we’ll statistically inquire today:

Bitcoin

Equity Markets and TBL Liquidity

US Rates

ECO and the Fed

So, without further ado, welcome to TBL Weekly #121. Grab a coffee, and let’s dive in.

Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year.

Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order?

If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul.

Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way.

With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below:

Weekly Monitor

Weekly Analysis

Bitcoin:

Today we bring back a chart that we used a few weeks back displaying weekly changes in bitcoin’s price.

Here is a quick summary of what the chart shows: the upper pane shows bitcoin’s price on a log scale. The lower pane shows the price’s weekly changes, and with it, a line similar to a 10% Value-at-Risk measure, except this time it measures the top 10% historical weekly gains.

As you can see on the bottom pane, whenever we get an accumulation of tall blue bars, bitcoin’s price falls because gains are overdone.

We would like to quickly draw your attention to the horizontal red line on the bottom pane, what we call the “outsized gains” VaR—that line is drawn at a weekly return of 13.6%, which is exactly 1.24 standard deviations away from the mean weekly return of 1.5%. Here’s another chart to showcase this:

Why do we care about this? We know that 10% of all weekly returns over the past 10 years lie beyond this vertical, dashed line (the right-tail of this distribution). However, as you can see from the opening chart, most of these observations are not equally spread across bitcoin’s history. In reality, these high returns happen back-to-back (for the most part). The past four weeks have averaged approximately 9.5% weekly returns, and only one of them went above our threshold. We need to see a cluster to sound an alarm, and at this point, we’d characterize the existence of outsized weekly returns as a “gathering,” as opposed to a party. Lastly, a trio of 14% gains from here puts the price at $150,000.

Equity Markets:

One place to watch for negative signs for bitcoin is the US stock market. TBL Liquidity, our model for risk assets, is ticking nicely with the S&P 500:

As you can see, over the past 2 months, liquidity has driven markets upward, mainly as a result of more stable Treasury collateral. However, we are also wary of S&P 500 futures positioning of institutional asset managers:

What is this telling us? Managers are very bullish on equities (currently near record highs). Historically, whenever we reach this level of net long positions on futures, we experience some pullbacks on the S&P 500. It is also important to note here that bitcoin’s 3-month rolling correlation with equities lies near 40%, so a pullback on equities could also suppress bitcoin’s returns. We’re trying to look for signs of risk to counter our bullishness in new six-figure territory.

US Rates:

Now, let’s dive into one of our favorite charts: the 2s10s curve.

US Treasuries have been in a bull-flattening recovery mode since mid-November, which continues to fight off any re-steepening potential. This has resulted in stronger collateral and therefore more market liquidity—hence the growth in both bitcoin and equities. That being said, we want to point out an observation here. As time passes, the 2s10s spread gap between its 200-day-moving-average has been closing, now approximately 19 basis points wide. The last time these two lines touched was in July of this year, and the curve started to steepen soon after. We may be approaching that time again—especially as the Fed sets to cut in the upcoming meeting.

Speaking of re-steepening, let’s look at one more chart:

Using previous recessionary periods and looking at where the 2s10s curve was at the time those recessions started, we derived a “watch” range: 19-100 basis points.

If the curve surpasses the 19-basis-points level and makes its way to 32 basis points (halfway between the 2020 and 1990 re-steepeners), we will start looking for signs of an economic slowdown, which leads us to our next section.

ECO & The Fed:

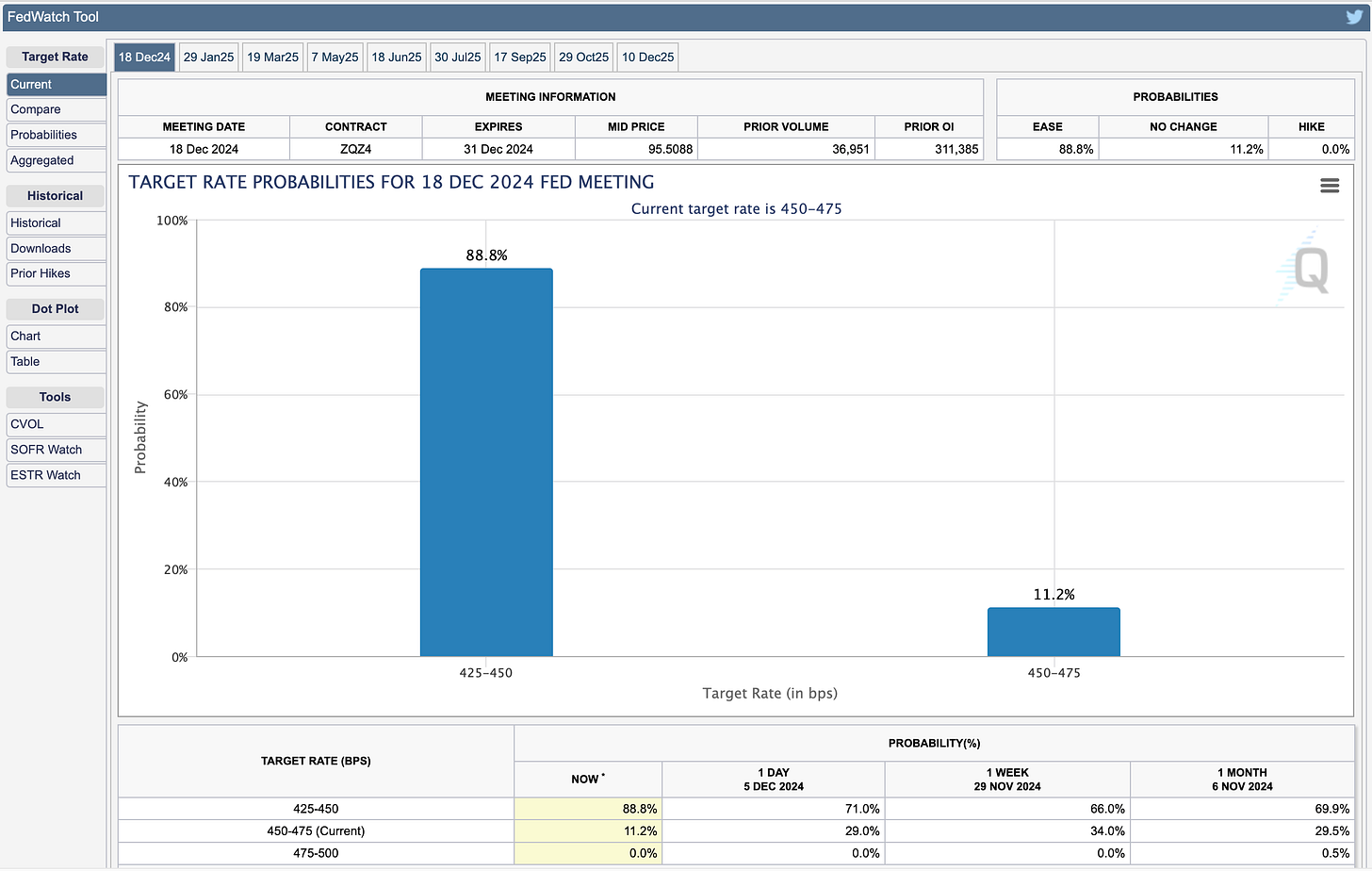

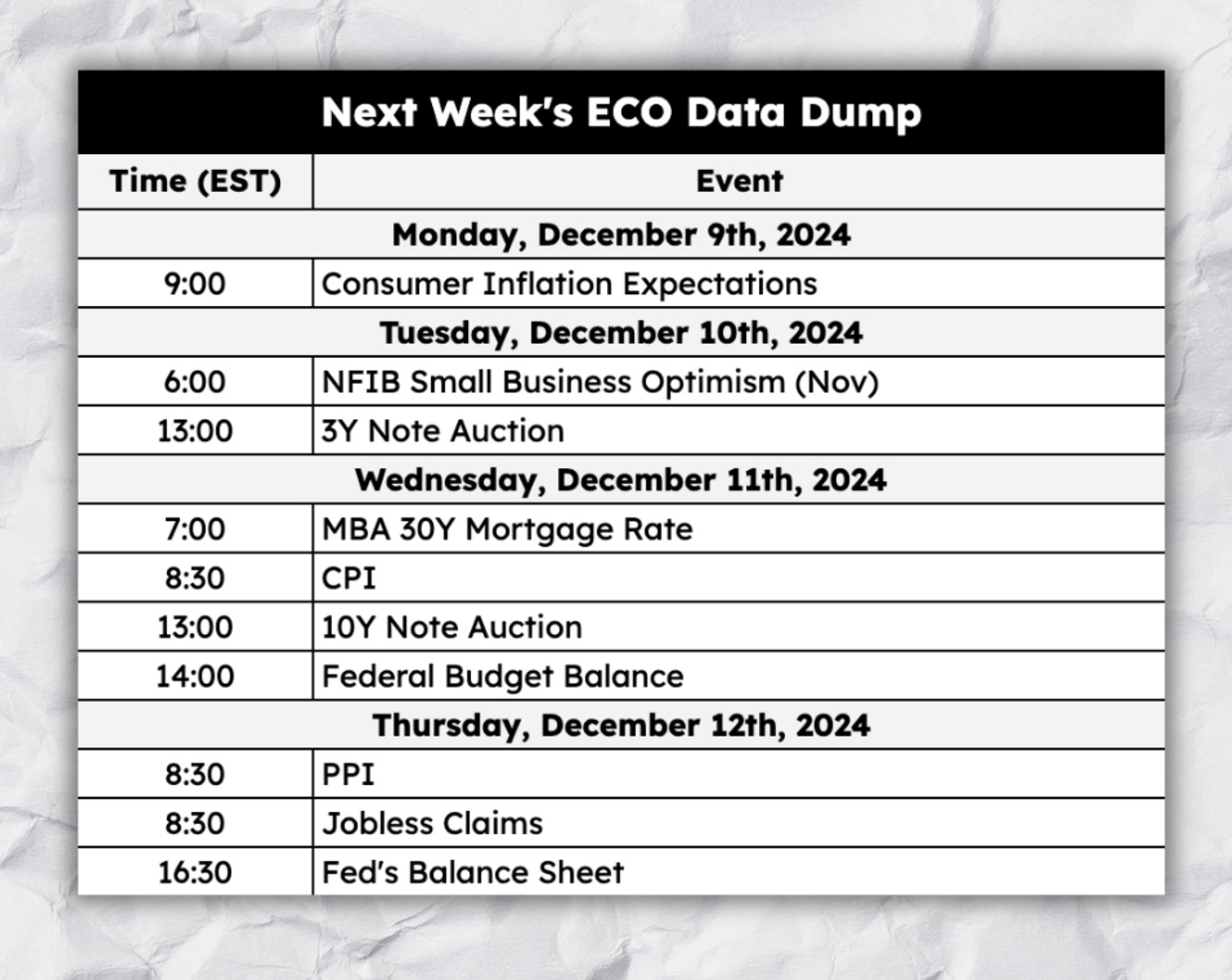

Here are the most important economic data dumps of the week:

After nearly five months of growth in the services sector, we finally saw a slowdown in this seemingly omnipotent portion of the US economy—granted it is still above 50, and therefore in expansionary territory, but a slowdown, nonetheless. Interestingly, just as services started slowing, we also saw a manufacturing sector showing signs of recovery.

As per the labor market, despite the recovery from non-farm payrolls (mainly as a result of normalizing data from hurricane and corporate strikes outliers), unemployment ticked upward, which has put more than a thumb—perhaps an entire arm—on the scale in favor of a rate cut.

Although this is bullish for bitcoin in the short run, after December’s cut, we expect the Fed to momentarily pause any more cuts as we start 2025. Over the past two weeks, some Fed officials have spoken up about their hawkish stance—in short, they are in a “proceed with caution” mode. This, in turn, creates another headwind for bitcoin and equities going into 2025, except for those who understand what they are buying.

Next Week:

In case you missed it: TBL on YouTube

Global Liquidity with Michael Howell: Trump 2.0, US Dollar Influence, and the Next Economic Era

In this episode, liquidity expert Michael Howell explores the economic implications of Trump 2.0, focusing on the US dollar's pivotal role in global liquidity and market dynamics. He examines how a strong dollar helps contain domestic inflation while tightening monetary conditions abroad, fueled by capital inflows into the US and the risks of exceptionalism driving market bubbles. Howell also discusses the Federal Reserve’s easing stance, rising public debt, and the challenges posed by the 2025 maturity wall. Offering a global outlook, he addresses Europe’s economic struggles, China’s dollarized economy, and investment strategies for inflation hedges like Bitcoin and gold, highlighting opportunities amid shifting market conditions.

Here are some of the key insights:

Trump 2.0 and the Strong Dollar: Howell analyzes the implications of a strong dollar under Trump’s administration, emphasizing its centrality in combating inflation and influencing global liquidity. While a robust dollar supports U.S. markets, it acts as a “wrecking ball” for global liquidity, pressuring foreign central banks and tightening monetary conditions worldwide.

Liquidity Expansion and Monetary Inflation: U.S. fiscal policies, including short-term debt issuance, continue to expand liquidity by increasing bank balance sheets. Howell explains how these dynamics fuel monetary inflation, driving up asset prices for Bitcoin, gold, and equities while creating a challenging environment for bonds.

Debt and the Maturity Wall: A significant portion of low-interest debt issued during the COVID-19 era will mature starting mid-2025, increasing demands on global liquidity. Howell warns that this “maturity wall” could heighten refinancing tensions, potentially triggering financial crises if liquidity growth fails to keep pace.

Bitcoin and Asset Sensitivity to Liquidity: Bitcoin is highlighted as one of the most liquidity-sensitive asset classes, thriving in environments of monetary inflation. Howell contrasts Bitcoin with equities, noting its stronger performance as a hedge against liquidity-driven cycles, alongside gold and prime real estate.

Geopolitical and Regional Dynamics: Howell explores the challenges facing Europe, China, and Japan. He predicts that Europe’s structural imbalances and dependency on external energy and trade will intensify under a strong dollar. In China, the yuan is under devaluation pressure as policymakers navigate debt deflationary challenges and global trade shifts.

Outlook for 2025: While global liquidity is expected to expand, Howell foresees slower growth compared to 2024. He advises investors to “dance near the door,” preparing for potential shocks as markets approach their cyclical peaks. He also underscores the importance of monetary inflation hedges like Bitcoin, gold, and real estate in navigating this environment.

Can We Really Abolish the Federal Reserve? An Interview with Peter St Onge

In this video, Peter St. Onge breaks down the complex machinery of the Federal Reserve, exploring the historical, economic, and political dimensions of potentially abolishing central banking. From the evolving landscape of populism to the intricate power structures governing monetary policy, Peter dissects the moral hazards of bailouts, examines the historical context of financial crashes, and challenges conventional wisdom about the Fed's necessity. Peter also walks Nik through the shifting Overton window, the potential for radical tax reforms, and a provocative look at how free speech and economic policy intersect in shaping our financial future. This interview provides a blueprint for reimagining the fundamental structures of modern economics.

Here are some of the key insights:

Ending the Federal Reserve: St. Onge critiques the Fed’s core functions—bailouts, inflationary monetary policies, and regulatory roles—arguing that all are either inefficient or unnecessary. He suggests that ending the Fed could restore free-market banking principles, though logistical and political obstacles make this unlikely in the short term.

Replacing the Income Tax with Tariffs: Highlighting Trump’s proposal to abolish the income tax in favor of tariffs, St. Onge explains that tariffs are less destructive to economic productivity compared to income taxes, which dampen innovation and entrepreneurship. However, replacing income tax revenue entirely with tariffs would require significant cuts to government spending.

Free Speech as a Pillar of Reform: St. Onge emphasizes the critical role of free speech in challenging entrenched power structures, calling it the most important battle of our time. He credits Elon Musk’s acquisition of Twitter for restoring free discourse and enabling public pushback against elite-driven agendas.

Moral Hazard and the Banking System: Discussing the history of financial crises, St. Onge critiques the Fed’s “bailout culture,” which fosters reckless behavior through moral hazard. He contrasts the pre-Fed banking era, when financial institutions bore the consequences of their failures, with today’s system of taxpayer-funded rescues.

Global Power Structures and Economic Trends: The episode explores how entities like the World Economic Forum and NGOs influence global policies. St. Onge distinguishes between “Baptists” (idealists advocating for causes) and “bootleggers” (those profiting from these movements), framing this dynamic as a driver of regulatory capture and economic inefficiency.

Bitcoin as a Lifeboat Asset: With public trust in fiat systems eroding, St. Onge identifies Bitcoin as a critical hedge against inflation and systemic collapse. He predicts a gradual generational shift from gold to Bitcoin as a store of value, envisioning its role in a decentralized, freer financial future.

Restoring Economic Balance Through Public Opinion: Both Bhatia and St. Onge argue that meaningful reform will only come through public pressure and voter engagement. Free speech, they assert, is vital for fostering the transparency and accountability needed to disrupt entrenched interests.

Retire with Bitcoin: Leveraging IRAs, Custody, and Long-Term Wealth Strategies

In this episode, Nik Bhatia is joined by Connor Dolan of Unchained to explore the growing intersection of Bitcoin and retirement planning. They discuss how individuals can leverage tax-advantaged accounts like IRAs and 401(k)s to incorporate Bitcoin into their long-term financial strategy, emphasizing the critical role of secure multisig custody solutions in eliminating single points of failure. Connor highlights the benefits of donor-advised funds for tax-efficient charitable giving and how Unchained’s innovative custody and retirement solutions empower individuals to take control of their Bitcoin investments. They share educational resources for navigating Bitcoin’s evolving role in wealth management and the importance of a proactive, long-term approach to financial planning.

Here are some of the key insights:

Bitcoin in Retirement Accounts: Connor explains how Bitcoin can be held in tax-advantaged accounts like IRAs and 401(k)s. He highlights Roth IRAs as a powerful tool for Bitcoin holders to avoid future capital gains taxes, enabling tax-free withdrawals upon retirement. Unchained offers a unique IRA solution allowing users to retain control of their Bitcoin through a collaborative custody model while maintaining compliance with tax rules.

Collaborative Custody for Security: Unchained employs a multi-signature (multisig) custody model to enhance Bitcoin security. Clients control two out of three keys, ensuring they retain full access to their funds while minimizing single points of failure. This structure is pivotal for both IRA and non-IRA Bitcoin holdings, offering a secure way to self-custody Bitcoin for the long term.

Donor-Advised Funds for Bitcoin: Dolan introduces donor-advised funds (DAFs) as a tax-efficient charitable giving vehicle. Unchained enables users to donate Bitcoin into a DAF, allowing for continued growth of the funds before distributing to nonprofits. This solution also supports direct Bitcoin donations, aligning with the ethos of supporting Bitcoin-based causes.

Transitioning from Exchanges to Self-Custody: Addressing the risks of holding Bitcoin on exchanges like Coinbase, Connor stresses the importance of taking ownership of private keys. Unchained’s services help users transition to self-custody seamlessly, empowering them to secure their Bitcoin and reduce third-party risks.

Educational Initiatives for Bitcoin Holders:

Unchained’s "Get Your Bitcoin House in Order" initiative provides resources to help Bitcoin holders optimize their holdings for retirement, inheritance, and security. This includes online events featuring industry experts like Tur Demeester and Jeff Vandrew to educate clients on macroeconomic trends and Bitcoin-specific financial planning.

Long-Term Vision for Bitcoin: Dolan emphasizes the importance of viewing Bitcoin as a long-term asset rather than focusing solely on price movements. With Bitcoin’s evolving role in global finance, he advocates for preparing holdings for generational wealth transfer and economic shifts over the next decade.

$100,000+ Bitcoin: The Revelation Behind Its Path to $1 Million

In this episode, Nik delivers TBL's most critical global macro update yet, breaking down Bitcoin’s surge past $102,000 and unveiling a revelation that redefines its path to $1 million. By exposing the transformative role of credit creation in Bitcoin’s rise, Nik challenges traditional views of asset rotation and highlights the forces driving its explosive growth. He analyzes key technical and on-chain metrics, macroeconomic trends like Treasury yields and dollar strength, and the broader implications of institutional activity. Closing with insights into geopolitical and fiscal shifts heading into 2025, Nik outlines how this revelation could shape the next era for Bitcoin and global markets.

Here are some of the key insights:

Breaking Past $100K and Targeting $150K: Bitcoin recently surged above $100,000, solidifying a new base range of $100,000 to $150,000. Nik highlights that Bitcoin now trades in $25,000 increments, marking a transformative phase as it enters six-to-seven-figure territory. This new range represents a step toward Bitcoin’s eventual million-dollar valuation.

The Shift from Rotation to Monetization: Historically, Bitcoin’s growth relied on a “rotation” of funds from traditional assets like stocks or real estate. Nik now emphasizes a "monetization" thesis, where Bitcoin’s demand will increasingly stem from new credit creation by financial institutions, such as loans issued to purchase Bitcoin or related securities like ETFs.

Credit Creation and Bitcoin Demand: Using the analogy of housing as a credit engine, Nik explains how Bitcoin, as pristine collateral, is monetized through credit creation. This shift represents a departure from reliance on existing capital, positioning Bitcoin to grow alongside the broader financial system.

ETF Inflows and Institutional Demand: Bitcoin ETFs, such as iBit and fBTC, have seen record-breaking inflows. Nik explains how these inflows are often financed by margin borrowing and credit creation, reinforcing Bitcoin’s integration into traditional financial markets.

The Role of a Strong Dollar: Nik discusses the implications of Trump’s pro-dollar policies, which aim to cap inflation and support the dollar's strength. A strong dollar influences commodity prices and global liquidity, shaping Bitcoin’s trajectory alongside geopolitical and economic trends.

MVRV and Long-Term Valuation: On-chain analysis shows that Bitcoin’s valuation is far from overheated, with the MVRV ratio and other metrics indicating room for continued growth. Nik predicts Bitcoin could reach $1 million as it scales alongside the global financial system, potentially surpassing $100 trillion in total asset value.

The Case for Seven-Figure Bitcoin: Nik reiterates that Bitcoin’s journey to $1 million will be driven by its adoption as pristine collateral and its ability to be monetized through new financial instruments. This revelation underscores Bitcoin’s potential to grow independently of traditional asset rotations.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

TBL on Substack

Every week, we bring you our global events recap TBL Thinks. This week we look into France’s current political shifts and the future of trade in North America under Trump’s administration.

Check out TBL Thinks here:

What TBL Pro Is Reading

Nik also published his weekly letter where he explains his foundational reasons for why he believes the world is changing, and what his overall expectations are under this new era.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Bitcoin is hitting its stride. With massive ETF inflows, major geopolitical changes, increasing corporate adoption, and a proposed U.S. strategic reserve, 2025 is shaping up to be a defining year.

Here's the real question you need to be asking yourself: Are you ready? Is your bitcoin house in order?

If you're not sure, you're in luck. On December 10th, Unchained is hosting an essential session focused on helping you get positioned for what's ahead. You'll walk away with a clear plan for your end-of-year moves, smart strategies for bringing your family into bitcoin, and the confidence of knowing you're set up for the long haul.

Join Unchained General Counsel Jeff Vandrew and Adamant Capital Founder Tuur Demeester to understand what makes this moment different and the key moves you need to consider - from year-end planning to bringing your family into bitcoin the right way.

With the bull run gaining momentum, this is your window to get ready for what's ahead. Register below: