Dear Readers,

This past week, we finally got a glimpse at what the US economy is shaping up to look like under this new administration. The American economy contracted during the first quarter of 2025 after 11 consecutive quarters of growth.

This momentarily sent risk assets—or, more specifically, the S&P 500 and bitcoin—on a decline before an almost immediate recovery. A recovery that has been well underway since the Trump administration announced a 90-day pause on tariffs after “Liberation Day” put the fear of recession into the bones of market participants across the US.

As mentioned in previous editions of TBL Weekly, these recession fears could be the reason investors have moved out of American markets and into foreign markets, which could explain some of the outperformance of equities offshore:

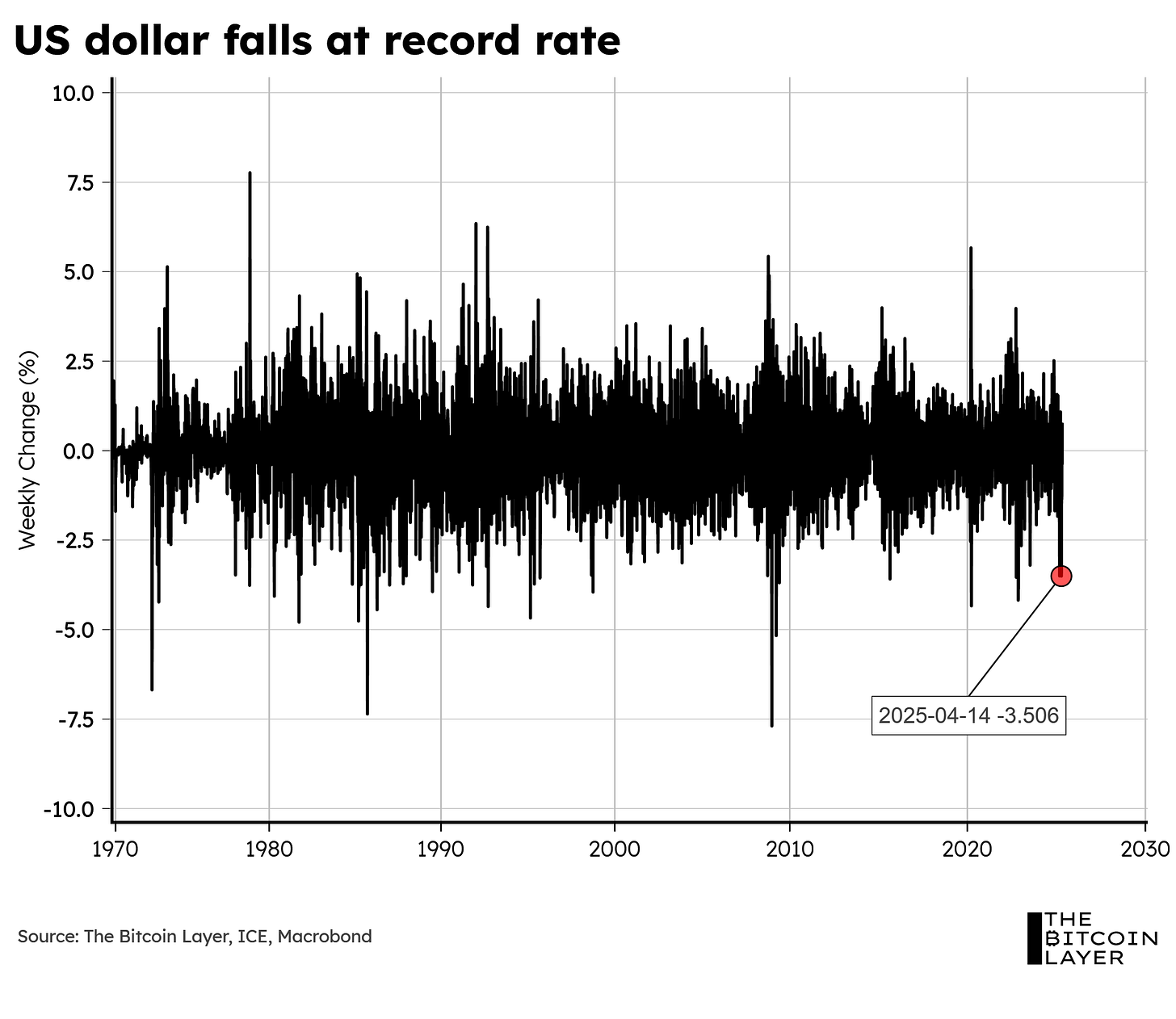

…not to mention the recent historical dollar sell-off:

So, the question on Wall Street, Main Street, and at the Federal Reserve is whether or not these recessionary fears are justified. We looked under the hood and found some signs of economic resilience in the US, despite the uncertainty currently tormenting markets.

Today, we will go over:

Why GDP contacted

Why this GDP print was actually stronger than many people think.

What markets are saying about future economic growth.

What TBL Liquidity is telling us.

So, without further ado, let’s dive into TBL Weekly #139.

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

The Financial Freedom Report is a weekly newsletter from the Human Rights Foundation (HRF) that tracks how authoritarian regimes weaponize money to control their populations and suppress dissent. It also spotlights how freedom technologies like Bitcoin are helping everyday people reclaim their financial independence and freedom.

A one-of-a-kind newsletter connecting the dots between financial repression, geopolitics, and emerging tech.

Smart macro analysts don’t just watch the Fed. They watch the world.

❌ DON’T WRITE YOUR SEED ON PAPER 📝

It’s estimated that ~30% of Bitcoin is lost forever. Poor seed phrase security is a big reason why. This is why we use Stamp Seed, a DIY kit that enables you to hammer your seed words into a durable plate of titanium using professional stamping tools.

Heat-resistant to 3,000ºF, rust-proof, crush-proof, and time-proof

Compact and easy to hide

No loose parts, such as screws or letter tiles

Take 15% off with code TBL. Get your Stamp Seed today!

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube X LinkedIn Instagram TikTok

Weekly Analysis

Looking underneath the surface:

As highlighted in last week’s article, we noticed a massive jump in imports during both January and February of this year, at $75B and $66B, respectively. This historical drop in the trade deficit is precisely the reason GDP dragged during this year’s Q1:

Not coincidentally, this increase in the trade deficit perfectly aligns with the average US tariff rate on all imports jumping to levels not seen since the 1940s:

In short, US importers are wisely front-running uncertainty in the protectionist policies that will follow this 90-day pause.

But…where’s the strength we speak of?

The US consumer:

Let’s start off by looking at a key measure that removes all the noise from international trade: