Accelerating Disinflation, Deflation, & Bitcoin Rally: TBL Weekly #27

Whether you're in a rush or sitting down for morning coffee, we've got you covered on all the latest in bitcoin and macro.

Welcome to TBL Weekly #27—the free weekly newsletter that keeps you in the know with everything going on in markets. Let’s dive in.

Bitcoin-Macro Monitor

Just quickly grabbing the headlines?

Here’s your rapid-fire recap of the relevant action in bitcoin and macro:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

Bitcoin has had a handsome rally over the last two weeks. Year-to-date bitcoin has risen 26.5% to a local high of $21,253, the first time it’s crested such a level since November of last year. This was sparked by any number of things, namely bad leverage in “crypto” having been purged for now, and a preemptive rally looking ahead to a Fed pause that will be supportive of bitcoin’s price.

Bitcoin’s correlation with the S&P 500 is waning as it rallies up and ahead of it on a relative basis. So too has bitcoin’s correlation with 10-year real yields, as bitcoin’s recent rally is juxtaposed with elevated and rising real yields, which generally are not supportive of such rallies in risk assets.

The 2s10s spread has flattened and is once again approaching a triple-digit inversion, as 10s have continually caught a bid while 2s stay flat as the market deliberates how the mixed economic data will translate into policy decision at the upcoming February FOMC meeting.

There are your headlines, now let’s take a look under the hood.

Markets Analysis

Here’s a comprehensive recap of last week’s action across markets:

Accelerating Disinflation & Outright Deflation

Year-over-year CPI inflation continues decelerating. The headline came in at 6.45%, with core also disinflating to 5.71%, albeit at a slower pace due to stickier (tending to fall slower than volatile components like food and energy) services inflation:

On a month-to-month basis, we are witnessing deflation, which is helpful in the Fed’s goal to stabilize prices for now but will become a problem if it persists or accelerates. Services inflation remains sticky, rising 0.31% month-over-month, indicating a relatively robust consumer that has yet to back away from auxiliary spending entirely:

A Seemingly Sustainable Bitcoin Rally

Last week we wrote:

As bitcoin, with no earnings component has shed 75% of its market cap, the onus is on equities to face the brunt of the selloff as corporate earnings contract this year. Equities and bitcoin repriced as interest rates rose, but bitcoin’s lack of a balance sheet shelters it from the risks that loom over other risk assets this year.

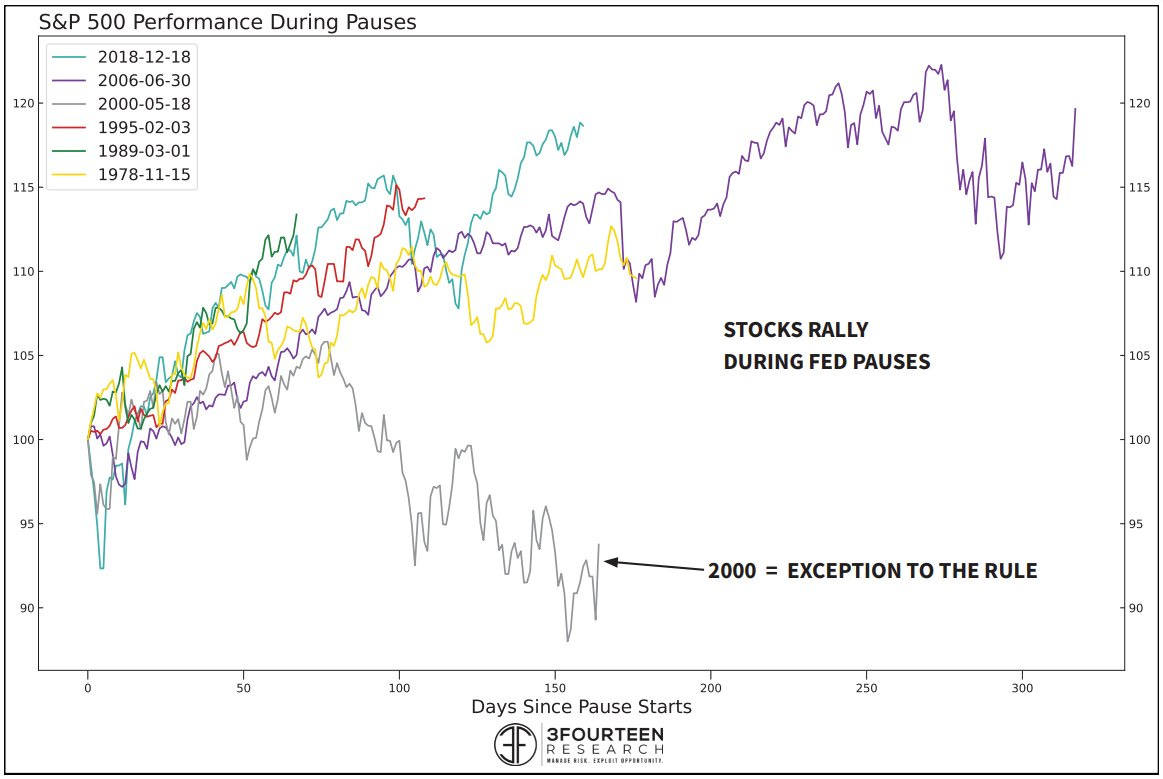

The immunity per se in its lack of a balance sheet shields bitcoin from contracting earnings that could lead to further repricing downward in equities this year. Risk assets, particularly bitcoin, are looking ahead to the anticipated Q1 Fed pause, currently experiencing a “pre-Fed pause rally” of sorts. Risk assets have also historically performed well during Fed pauses, apart from 2000 when equities were still majorly overvalued to earnings on average and had more air to let out:

Why are we cautiously denoting this rally in price as “sustainable”?

For two reasons.

The first is that ETH/BTC is performing worse on a relative percentage basis than bitcoin, a.k.a the BTC/USD trading pair. ETH/BTC rising more than bitcoin is indicative of a rally led primarily by shitcoins and all of the leveraged speculation that they bring; that leverage can be wiped out in a moment’s notice and bitcoin is back at square one—a “false rally” of sorts. We’re seeing the opposite, as bitcoin appreciating more than ETH/BTC indicates a healthy rally with bitcoin in the driver’s seat, likely driven in large part by sizeable spot buying:

The second is that, following the rally during which long options piled in, open interest in bitcoin derivatives has normalized, which tells us that the rally wasn’t solely fueled by the hot air of leverage. A healthy cohort of spot buyers seem to have taken us a leg up in price from the mid-$16,000 range up above $20,000, with lower risk of unexpected selloff given than excessive leverage isn’t present:

With this rally being driven by presumably sizeable spot bitcoin buying, we are cautiously optimistic that this could represent a leg up in bitcoin’s price to an area where we hang out for a while and experience consolidation, rather than a “crypto” characteristic fever-pitch rise followed by an equally sharp selloff.

Short rates have been carving out a top for several months now, and capital is exiting the Fed’s Reverse Repo Facility to find a home elsewhere. This is beneficial for risk-taking behavior; so too is bank reserves rising, which has a positive correlation with risk asset prices. The global liquidity tide is starting to shift, and bitcoin senses it:

Bitcoin has higher sensitivity to the global liquidity tide shifting at the margin than equities due to its lower comparative liquidity profile at just ~$400 billion and higher available leverage relative to traditional finance:

The Week Ahead

In the week ahead, we look to PPI inflation data coming on Wednesday when analysts are expecting further disinflation, and we’ll similarly look to Industrial Production for a gauge of the degree of economic slowdown. We also look to a series of housing releases in the latter half of the week, starting Thursday with Housing Starts which are expected to continue materially falling, and into Friday with Existing Home Sales expected to fall as well—both reflecting the interest-rate-sensitive housing sector cooling off:

Also on Tuesday and Wednesday, the Bank of Japan is meeting to decide the path forward for policy, including its Yield Curve Control target. Japan has relaxed its notoriously low cap on the 10-year JGB yield in recent weeks, and analysts are expecting further easing of the cap if not dropping YCC entirely.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Now, here are your quick links to all of the TBL content for the week:

Tuesday

Prices always tell a story. Over a long enough time horizon, any price chart will eventually tell a story of growth, stagnation, or decline. Opening another semester of teaching rates, global macro, and the monetary system at USC Marshall School of Business this week, the first chart shown to students was a 60-year look at the 10-year US Treasury yield. The big debate is whether the story of the past 40 years—a vicious bull market—is over. I’m not so sure it is.

Check out Bullish Treasuries Chart Pack

Wednesday

Nik sits down with Rachel Premack, a supply chain specialist, the editorial director of Freight Waves, and the author of the weekly MODES newsletter.

In this episode, Rachel discusses the post-pandemic supply chain dislocations, and what she calls 'bizarro inflation' where life's necessities reach record prices as unnecessary goods and services are getting less expensive:

Friday

In this episode, Joe is joined by Lead Analyst at Swan Bitcoin, Sam Callahan to discuss paths forward for GBTC, the Genesis of the "crypto" contagion, the reluctance of the SEC to move forward with a spot bitcoin ETF, and why there are no innocent bystanders between Genesis, DCG, and Gemini:

It’s alive! Taking Friday afternoon levels as the weekly close, we’re looking at bitcoin’s biggest week since a dead cat bounce during March of 2022. This does not mark the beginning of a bull market, but we are certainly witnessing strength for the first time in a long time. It has us cautiously optimistic, especially given news surrounding FTX, Genesis, and GBTC has yielded higher, not lower, prices.

Check out Bitcoin: It’s Alive! Chart Pack

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud

With regards to the BOJ, you write that "analysts are expecting further easing of the cap if not dropping YCC entirely". Where are you seeing this? Is that really possible given the level of Japanese government debt and the loss of credibility it would incur after drawing a line in the sand at 25 bps for so long?