Bank runs continue, Fed lending to everyone, market expects rate cuts: TBL Weekly #37

Welcome to TBL Weekly #37—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The global bank run marches on

We’d like to welcome all of the new subscribers that are just joining us this week—here at TBL, we aim to provide front-page markets research so you can survive, thrive and navigate the market cycle with ease, thank you for joining us! Now let’s dive in.

Deposits held at US banks declined by the largest amount in several years this week, falling by $98.4 billion to $17.5 trillion at both large and small banks:

Despite this mass exodus of depositors, Janet Yellen has made it abundantly clear that the banking system is sound and resilient. If that were true, would you need to continuously yammer and pound the table about it, Jan?

The Council discussed current conditions in the banking sector and noted that while some institutions have come under stress, the U.S. banking system remains sound and resilient.

— Financial Stability Oversight Council, March 24th, 2023

Where are depositors going? Yield! Money market funds saw their second consecutive week of twelve-figure inflows this week as total assets grew by $110 billion—more than the $98.4 billion worth of deposits that fled banks:

Fear spreading quickly across European banks

Europe is growing increasingly worried about its banking sector, and rightfully so. the ECB doesn’t have the ability to make dollars domestically without the Fed, so it’s a lot harder to intervene and prop up failing banks. Traders are hedging their counterparty exposure to European banks by purchasing credit default swap contracts—as such, the spread on many of these swap contracts has widened substantially. CDS spreads should not be taken as gospel, as they are often too small and infrequently traded to provide any real signal about the probability of default. However, in the case of large banks and an actively traded contract, there is plenty of signal to be taken from a widening CDS spread.

The market bets that Deutsche Bank, the largest bank in Germany and a Global Systemically Important Bank (GSIB), is potentially the next shoe to drop—its 1Y CDS spread doubled on Friday alone, sending it up to 712 basis points:

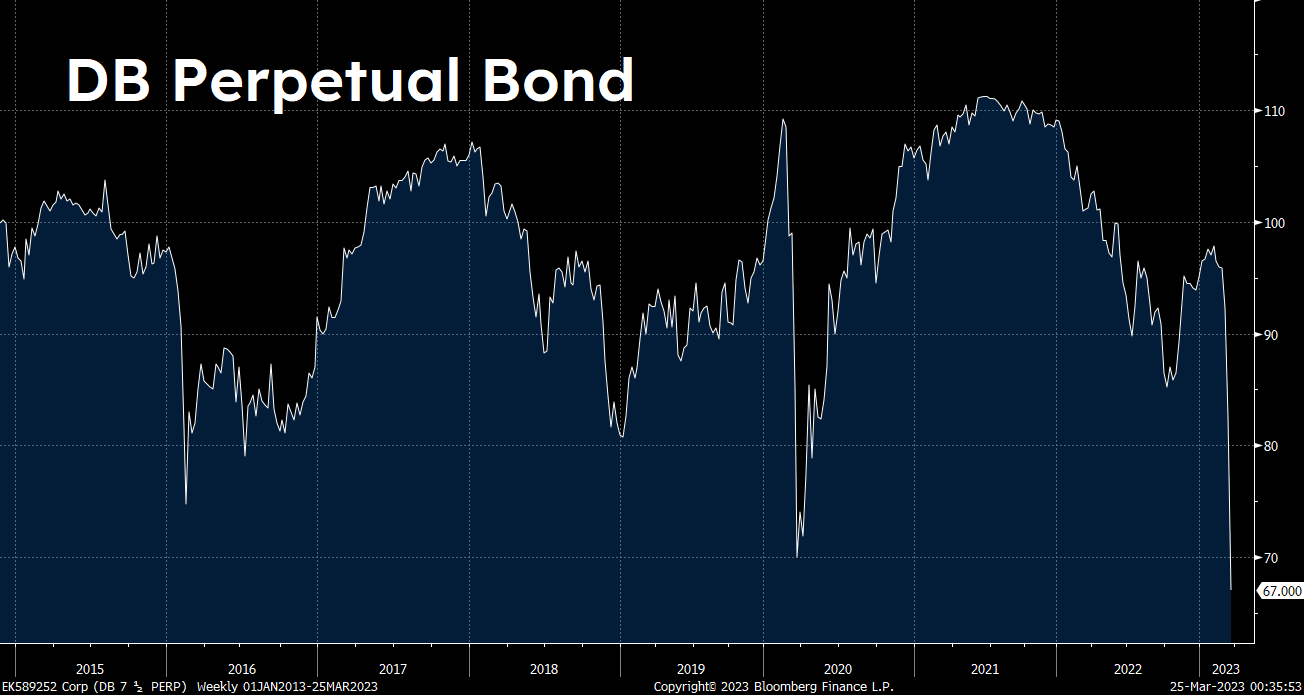

Deutsche Bank, not unlike Credit Suisse, has long been considered as hot garbage by the financial community, and it could be the next victim of the credit contraction that brought down its fragile partner in crime across the border in Switzerland. Deutsche’s perpetual bond is trading at its lowest level ever, just 67 cents on the dollar—not a sign of confidence in the bank. What’s worse, Nik has started having nightmares about DB collapsing like it’s 2018 all over again. DB’s death knell, portended for over a decade, may finally come to pass if markets are pricing this rationally:

It is important to remember that CDS are market-ascribed risk of default based on whether or not people are buying the contract, not the actual likelihood that it will default on its debt. Deutsche Bank currently has ~$302 billion in cash/cash equivalents and marketable securities on its balance sheet, that’s roughly 45% of its deposits in liquid instruments that can be readily sold onto the market to meet withdrawal requests—a far cry from being in deep or imminent trouble like Credit Suisse.

As a global systemically important bank, sovereign support from the German government may be next if the fears of Deutsche’s inability to meet withdrawal requests or meet its debt obligations aren’t unfounded. As we saw with Credit Suisse and its late-Sunday-evening rescue package from the Swiss National Bank, central banks are ready and able to act on a moment’s notice to offer support in the form of a liquidity infusion, buyout from another large bank, breakup, or a mix of all three.

We are not pounding the table for the collapse of the European banking system, but we’d point out that risk happens fast. Banking is a confidence game, and European banking is a confidence game without the world reserve currency status afforded to US banks and their prevailing monetary authority. As confidence wanes in banks globally, depositors rush for the exits, and non-US institutions have their solvency tested, fragile banks go one after another to the chopping block—if the market is pricing its CDS spreads rationally and the headlines are founded, DB may be the next-most fragile entity to face the music. Readers need to start preparing for the non-zero chance of a DB unwind this year.

This is a dollar shortage, and the Fed is the only USD dealer

What we’re witnessing ravage financial markets at home and across the pond is a liquidity shortfall, also called a dollar shortage. Following the Fed’s hiking cycle last year, either from losses on rate-sensitive assets or the higher cost of capital, the ease at which financial transactions are taking place is falling—liquidity is deteriorating.

Liquidity is a necessity for credit creation, which as you are well aware is what keeps the global economy growing and functioning properly. If the engine room of the global economy is sputtering to a halt, you’d better believe the engineer is going to pull out all the stops to get it moving again: that’s what the Fed is doing right now.

This is a dollar shortage and a bank funding problem, so the Fed is extending USD loans to any distressed bank at home and abroad that needs them.

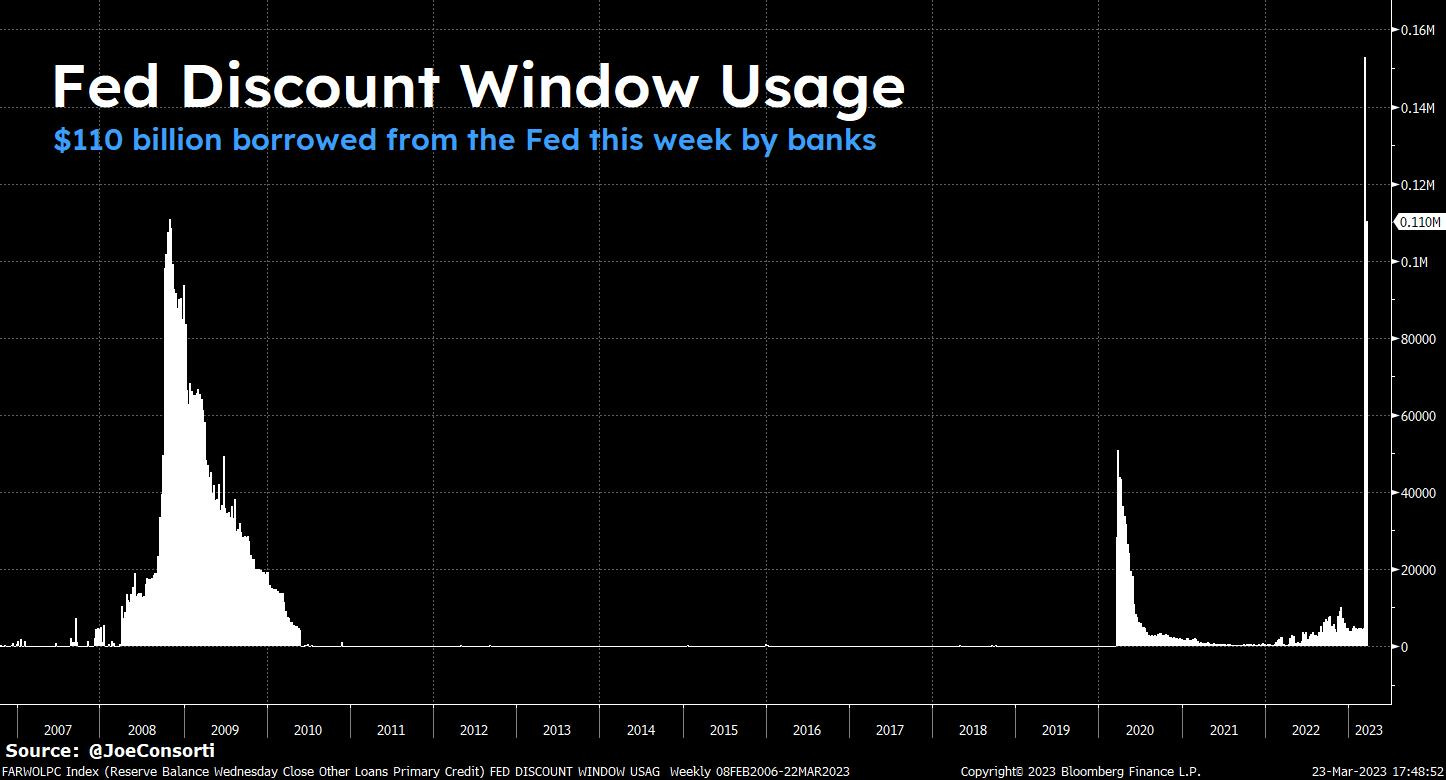

On the States side, US banks tapped the Fed’s discount window for $110 billion in liquidity, down by ~$42 billion from last week:

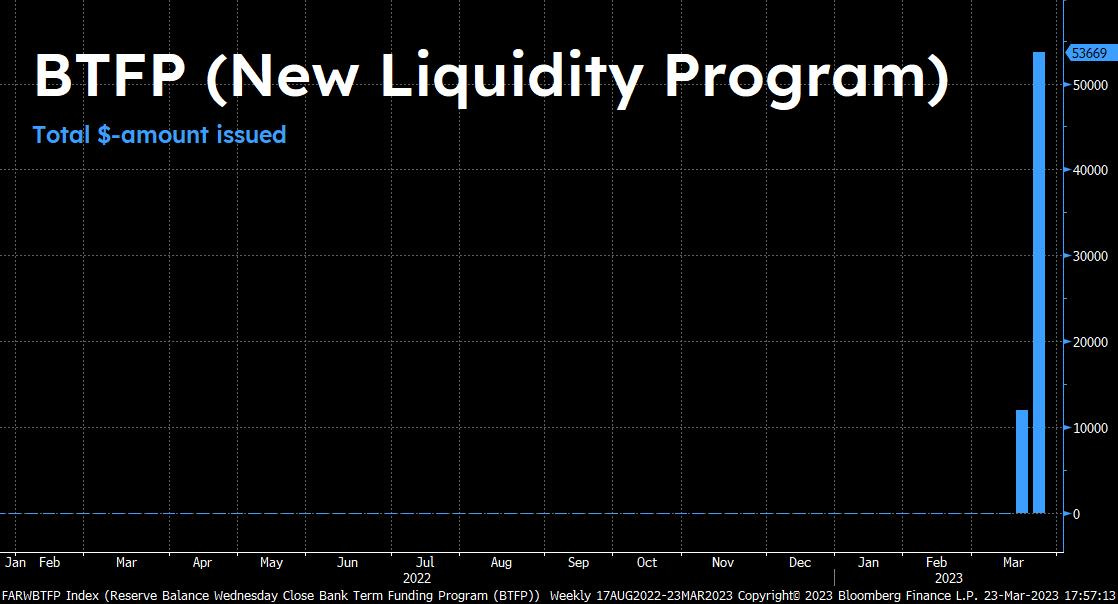

Wondering where the $42 billion worth of borrowing at the discount window went? Straight to BTFP, which rose by exactly $42 billion.

The Fed’s new loan program, BTFP, allows banks to borrow dollars against their discounted Treasuries and Mortgage-Backed Securities in secret, and at par value. Not only are banks able to wipe away their unrealized losses, but they can also be distressed without their peers finding out that they borrowed from the Fed. This prevents the existing interbank credit crunch from rapidly worsening due to word of mouth, but it also allows risky institutions to die another day, and without their peers knowing who to avoid, distributes risk throughout the system even further—creating what we’re calling hidden fragility in the banking sector.

It’s no wonder that so many borrowers migrated to the more discreet and forgiving lending facility in BTFP, which rose by $42 billion to $53.6 billion this week:

Upon the swift collapse and rescue of Credit Suisse, central banks from around the globe convened to determine how to jointly stabilize the world’s financial system. For the Fed’s part, to provide a steady flow of dollars to those that need them, weekly swap line operations—in which central banks can pledge their currency with the Fed and borrow dollars—have been made into a daily facility to meet the rising need for dollars in an increasingly fragile environment. Swap lines have yet to fully activate, though—banks only borrowed ~$502 million this week:

That demand for dollars is being met by the Fed’s foreign repo window—a facility that works exactly like the discount window (US Treasury-collateralized borrowing) rather than USD liquidity swaps (currency-collateralized borrowing). This borrowing facility dished out $60 billion in USD loans to foreign central bank(s):

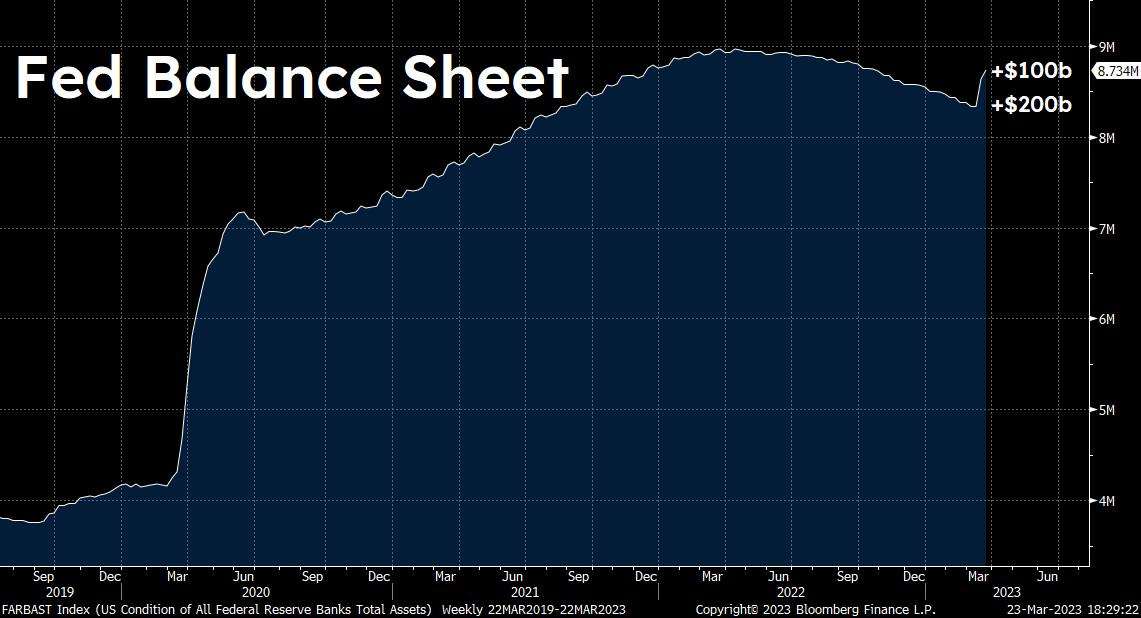

The BTFP and now-daily swap lines are easing financial conditions in the hopes of alleviating the interbank credit crunch and getting financial plumbing back on track. However—these facilities also have the secondary effect of eliminating the need for banks to sell their Treasuries and shore up cash to swap for dollars, as they can just pledge them with the Fed and borrow dollars instead. These two facilities, for the United States and the rest of the world, are preventing the firesale of US Treasuries and other assets that could topple hedge funds, pension schemes, and other critical financial infrastructure if they needed to be sold to meet withdrawal requests from depositors around the globe.

This notion is little more than conjecture, but the staggering domestic and global demand for dollars makes one thing certain: the “death of the dollar/Eurodollar” narrative can be soundly put to bed—goodnight, sleep well.

With all of this emergency lending, the Fed’s balance sheet has expanded by $300 billion in two weeks, undoing 64% of nine-months-worth of QT in the process:

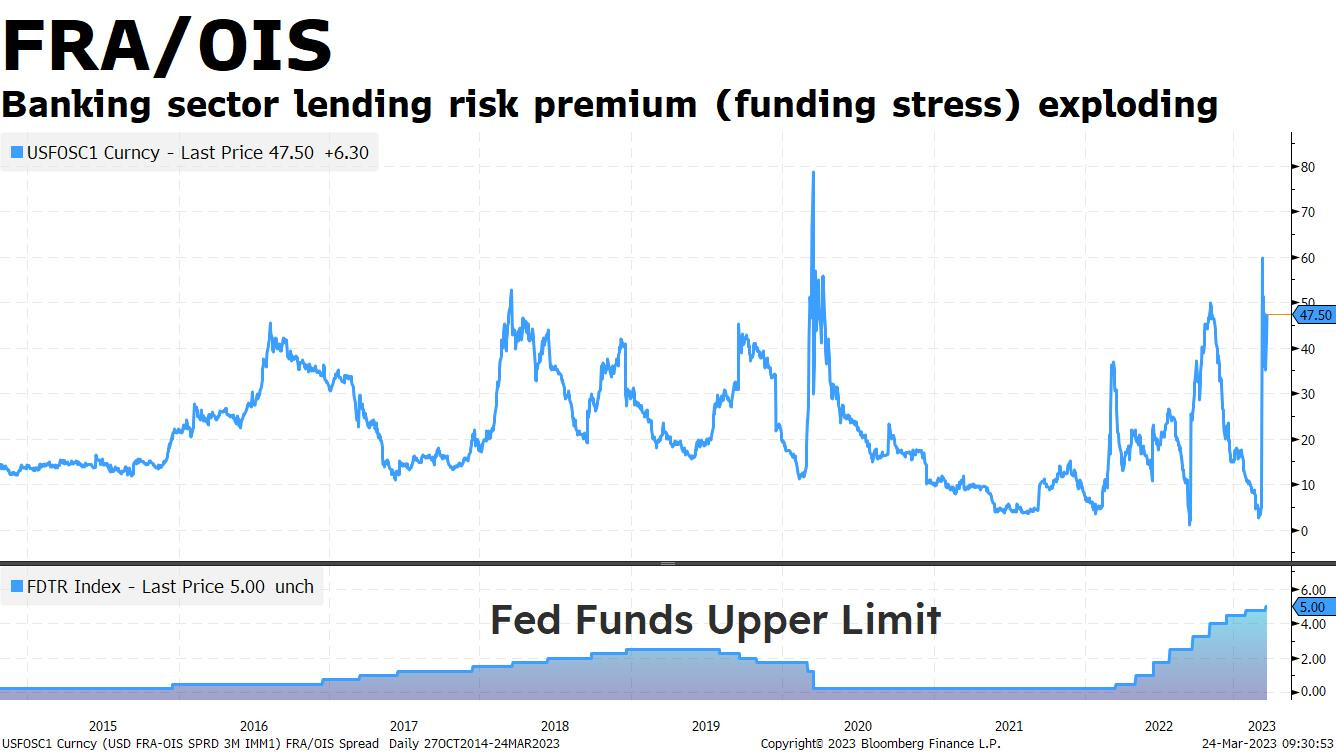

This is what credit contraction looks like. Banks back off from borrowing from and lending to one another, so they go to the Fed to meet their funding needs or default on their obligations—default or repayment are the two ways that credit contracts. Take a look at interbank funding stress, sitting at elevated levels. This is why you see so many institutions tapping the Fed for liquidity—their buddies won’t do business with them:

The more that unknown banks hit the Fed’s line for emergency funding, the worse that lending standards ostensibly become as the credit cycle continues contracting. Banks are starting to tighten their loan standards for consumers—the passthrough of the banking sector credit crunch to the real economy is already occurring:

Liquidity contraction begets credit contraction and an actual slowdown in credit creation—that’s where the real recession begins.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

Rates lead the Fed, they are signaling cuts

The cycle has shifted. Wednesday’s FOMC revealed the Fed no longer intends to continue raising rates. Whatever dot plot projections and Fed speakers suggest otherwise, the explicit words used within the statement and by Powell himself at the presser have signaled the end of rate hiking. Rates lead the Fed, and they have already repriced in wild fashion this past month to reflect Fed rate cuts—the 2y is down 100 bps in 30 days, the most historic collapse in the front end since the crisis of October 1987:

The front end of the US Treasury curve can be thought of as expectations for the Fed’s policy rate and the long end reflects growth and inflation expectations. All throughout last year, the yield curve “inverted” when the long-end rates moved below front-end rates, meaning growth expectations were lower than the policy rate—this makes sense, as the Fed embarked on its hiking cycle with the goal of slowing growth.

Now we are on the other side of that trend. The yield curve is un-inverting in what’s called a bull steepening, now that USTs are strongly bid. Front-end rates are falling faster than long-end rates—meaning that policy rate expectations are falling faster than growth expectations.

Translation: the market is behaviorally pricing in rate cuts from the Fed.

Every single time the yield curve un-inverts, rate cuts from the Fed have followed within 6-12 months. Right now, 2s10s is un-inverting faster than it has in four decades:

Fed Funds futures are pricing in the same—hard cuts are the only thing on the menu:

The market has quickly repriced—a hard credit contraction followed by an equally swift recession is now the baseline narrative reflected throughout market pricing. As the credit contraction moves beyond banks and reaches businesses and consumers over the next several months, economic growth will slow and the Fed will be cutting rates to stimulate credit growth into the recession. The reason that the Fed frontloaded its hiking cycle with aggressive 50 and 75 bps increments was so that when the time came for it to cut rates, it would not have to cut all the way to the zero-lower bound—it cannot go back to ZIRP and maintain its global credibility.

Well, that time is fast approaching.

The credit cycle’s full downturn has yet to be felt in the real economy, but when it does it will happen quickly, just as quickly as the banking turmoil escalated over these past two weeks. When the brunt of the contraction in credit is here, that’s when you’ll observe material rate cuts back down to the 2% to 2.5% area—we are not making an explicit call on the timing of this or the range that the Fed will target.

When rate cuts do come, they are not bullish for risk asset prices. In the months following rate cuts and any additional easing, of course equities and other asset pricing are supported; lower discount rates for companies support equity valuations. It’s the impetus that forces the Fed to cut rates, a deflationary credit bust, that is not supportive of equities or other risk assets in the weeks that follow cuts.

That said, as the Fed pause phase materializes, risk assets have begun heading higher as they have done in prior cycles. This Fed pause rally can be seen most prominently in bitcoin which is up ~20% month-to-date compared to the S&P 500’s measly 0.64% rise in that same period. As the Fed pause is digested by traders, bitcoin stands to enjoy some of its signature rapid price gains and equity outperformance, however temporary it may be once the brunt of the credit contraction sets in:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

For a live-education experience, catch Nik in Los Angeles for “Bitcoin & The Future of Money” on April 29th. A generous TBL reader has graciously donated a handful of tickets to deserving attendees—if you’re interested in receiving a FREE ticket, please respond to this email explaining why you’d like to attend this Bitcoin 101 course!

Here are your quick links to all of the TBL content for the week:

Tuesday

The Fed has pulled out nearly every stop that doesn’t involve QE or rate cuts to stabilize the financial markets.

The new Bank Term Funding Program which imbues banks with full-value reserves in exchange for their devalued UST and MBS holdings was announced eight days ago. The Fed’s discount window lit up like a Christmas tree last week with a record $152 billion borrowed from the central bank’s emergency loan facility, and now weekly dollar-swap lines with other central banks have been made into a daily facility as funding stress rises and desperation for USD liquidity hits global borrowers too.

Still, these measures haven’t been enough for some. Silvergate, SVB, and Signature failed within three days of one another, and now Credit Suisse has been rescued by UBS in conjunction with the Swiss National Bank in a historic bailout of gargantuan proportions across the pond. With the failure and rescue of Europe’s largest private lender, and another major domestic institution First Republic Bank teetering on the brink, it’s time for an update on the 2023 Global Banking Crisis.

Check out—Distressed institutions rush to bolster liquidity: Banking Crisis Update

Wednesday

TBL Africa Correspondent Noelyne Sumba sits down with journalist and refugee advocate Meron Estefanos to discuss the struggles that the people of Eritrea have faced since gaining independence and how bitcoin has become a useful tool in her efforts to rescue refugees who fall on hard times while fleeing the country.

Check out—Bitcoin Is SALVATION For Africa | Meron Estefanos

Thursday

Silicon Valley Bank collapsed on March 10th. By the time you read this, a fortnight still wouldn’t have passed. During this time period, I’ve come away with an updated view on the rest of 2023—one with more conviction as well as more caution. Forced to reevaluate my entire view on global markets coming off the rapid failure of four banks, today’s post is my most meaningful outlook adjustment of the past half-year.

Check out—Where did you come from, where did you go?

Friday

Nik delivers an updated outlook on the market based on recent moves in rates. He breaks down the rapid moves in rates and resteepening of the yield curve, explaining in detail why both of these signals point to lower rates on the horizon.

Check out—Recession & Rate Cuts Are Next, Here's Why.

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.