Welcome to TBL Weekly #48—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

After filing two separate lawsuits against Binance and Coinbase early in the week, the SEC has filed a TRO (temporary restraining order) against Binance US. While these aren’t often granted, especially this soon after an initial lawsuit filing, the devastation caused by the collapse of many crypto exchanges in 2022 could sway the judge into granting it. This would force Binance US into receivership as soon as Tuesday when the TRO hearing is held, freezing its assets. In advance of this, Binance US has halted all dollar deposits and will be suspending withdrawal channels as soon as next Tuesday when the temporary restraining order is brought before a judge and could be granted. Check out yesterday’s must-see episode with Joe Carlasare for an explainer on TROs and a breakdown of both suits. Binance US released the following statement:

In an effort to protect our customers and platform, today we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD.

The tweet goes on to mention that all customer assets are held 1:1 in reserve, a claim that is disputed by both on-chain evidence and insider information included in the SEC’s temporary restraining order filed Monday.

Binance US has also swiftly delisted over 40 altcoin trading pairs voluntarily in response to the lawsuit while also pausing OTC trading—a speedy response pointing to the sad reality that Binance may have known about its wrongdoing all along, only waiting for the SEC to take formal action before stopping it. Coinbase on the other hand has no plans to delist any of the tokens alleged as securities in the SEC filing, per its CEO Brian Armstrong.

Bitcoin has regained ~50% of its losses since these suits were filed. With the largest onramp for bitcoin liquidity in the world potentially having its US-based assets frozen come next Tuesday, bitcoin faces more headwinds as users come to learn of the ongoing legal battles and leave exchanges or sell their bitcoin in response:

About 32,000 bitcoin have flown off of Binance since Monday as users seek to cut their exposure to the embattled and questionably incorporated exchange:

Crypto.com announced that it is shutting down its US institutional exchange in less than two weeks, citing a lack of demand. While this is certainly believable given the slump in high-net-worth interest and venture capital deals in crypto this year compared to last, we must say, it’s rather convenient timing considering the events of this week regarding how crypto is treated in the US regulatory purview. What is officially a move out of the US due to low demand doubles as a move, intentionally or not, to get out while the going is getting worse.

Importantly, Matt Damon now joins the likes of Larry David and Cristiano Ronaldo in the pantheon of disgraced celebrities that shilled fleeing, dying, or now-dead crypto exchanges.

The US Treasury dipped its toes in the water with some light cash-management bill issuance this week that will ramp up slightly in the days ahead. Some $306 billion in US Treasury debt is maturing next week, and it is set to be rolled into a currently announced $296 billion of fresh Treasury debt comprised mostly of bills, with an additional set of unannounced bills ranging from 4 to 28 weeks also being auctioned off. Adding it all up will likely bring next week’s total borrowing closer to $400 billion for a net addition to the Treasury’s coffers of $100 billion in one week:

The projected size of the US Treasury’s cash balance has been revised downward from its initial May 1st estimate to $450 billion by the end of June, meaning that auction sizes will continue to be sizeable over the next three weeks in order to achieve that. This bill-oriented refill of the TGA will suck capital from the Fed’s overnight reverse repo facility as money market funds seek higher-yielding paper, and will likely draw capital from bank reserves, commercial deposits, and other assets too. We are in a period of supportive liquidity now as the Treasury has yet to do the brunt of its cash account refill and bank reserves have risen for many weeks, but once reserves are draining and the Treasury’s cash balance is rising consistently, expect a much more substantial liquidity drain to begin impacting financial markets.

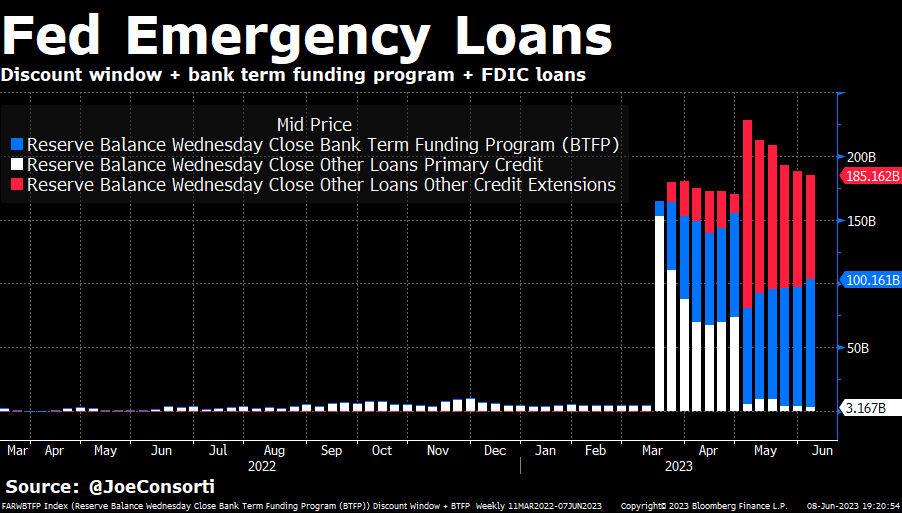

Usage of the Fed’s new emergency lending facility crested $100 billion. BTFP has acted as a band-aid for the bank funding crunch we briefly experienced in March and April, but will have deleterious long-term consequences in a year if the facility is discontinued. Distressed banks can borrow against their devalued Treasuries in secret, repairing any holes that may have otherwise killed them without their counterparties knowing:

These are the losses that BTFP has allowed banks to hide from their counterparties:

Banks are also tapping Federal Home Loan Banks (FHLB) for a record $1.04 trillion to save their skins. Just as with BTFP, FHLB allows banks to dip into the emergency liquidity pool without revealing that they did:

The composition of the Fed’s emergency lending has shifted into mostly BTFP, and away from the discount window and FDIC bridge loans. Both of these facilities have a stigma attached to using them and don’t lend at par, so it’s no wonder why banks are jumping ship for the new sweetheart facility:

Mortgage rates over 7% have pushed countrywide average home prices into deflation for the first time since 2012, falling -1.14% since this time last year. Falling home prices help the Fed on its mission to slow consumer spending since they lower the value of homeowners’ assets and bring down their ability to borrow along with it:

Saudi Arabia surprised the world by announcing further production cuts, a deliberate measure by Saudi Energy Minister Prince Abdulaziz to inflict pain on short sellers via the power of surprise. This is the second surprise oil production cut from major exporting nations in two months. Saudi Arabia will cut output in July by 1 million barrels per day, or 10%, stating that further cuts will come if need be—OPEC+ has ruled out further production cuts in 2023 for now.

As well as the Saudi cut, OPEC+ lowered its collective production target for 2024 and the nine participating countries extended the April voluntary cuts to the end of 2024. — Reuters

These cuts are an effort to maintain the price of crude oil amidst falling global demand. Oil exporting nations need to maintain pricing power, and not adjusting their output to align with with falling demand would hurt their country’s balance of payments and their standing on the global stage.

The Week Ahead

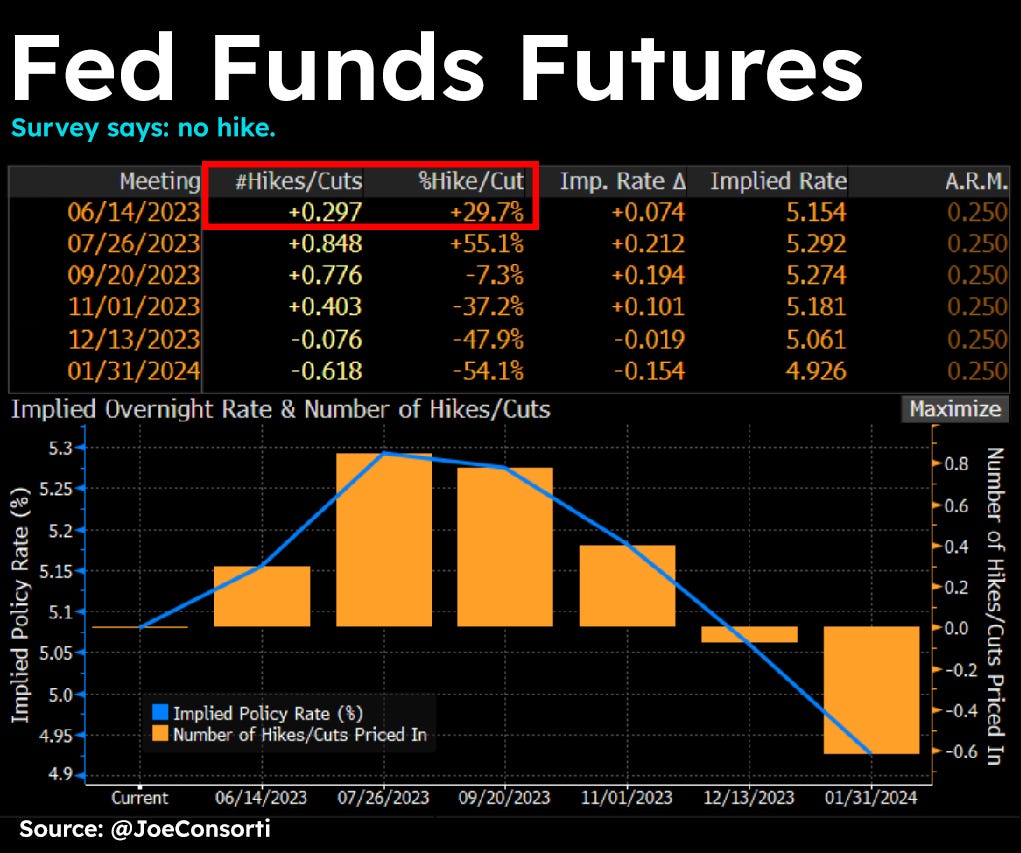

Fed Funds futures are pricing in a 30% chance that the Fed hikes by its lowest 25-bps increment at next Wednesday’s FOMC meeting. In other words, apart from edge-case hedging activity that has skewed the probability up, the market is in consensus that the Fed won’t hike at all. When we’re this close to an FOMC meeting, the Fed has never deviated from what the market has priced. In keeping with the Fed’s goal of not spooking markets, we feel it will move in line with the locked-in expectation for no hike at next Wednesday’s meeting:

In the week ahead, we look to CPI on Tuesday with a high degree of anticipation. The annualized level of inflation is expected to fall almost a full percentage point from April to May—a 4.1% print is the current survey. Core measures are also expected to fall, and subcomponents will be studied closely. Producer inflation hits the tape on Wednesday, but with the Fed’s decision arriving later in the day, nobody will pay much attention to what is expected to be a continuing trend of falling producer prices. The market will adjust to life without interest rate hikes, Treasury will issue a boatload of T-bills, and we’ll get to see how the S&P 500 behaves above essentially all resistance levels from the past year.

See what a best-in-class Bitcoin mobile wallet feels like with Envoy.

Download it today for free on the iOS App Store or the Google Play Store.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, TBL Africa Correspondent Noelyne Sumba sits down with African teacher and educator Lorraine Marcel to discuss how she is spreading the significance of Bitcoin in the lives of African women, the importance of educating women about Bitcoin, and how it can contribute to the growth and prosperity of their community.

Check out—Teaching BTC In Africa | Bitcoin In Africa with Noelyne Sumba

Tuesday

After several years of investigation, the SEC has thrown the kitchen sink at Binance and Coinbase with a litany of charges spanning all walks of US financial crime.

The two largest cryptocurrency exchanges in the world are now under fire, not only for operating as unlicensed exchanges, broker-dealers, and clearing agencies, but for listing securities unregistered with the SEC as well.

Given that the crypto ecosystem is a hodgepodge of unlicensed financial instruments and opaque protocols masquerading as the future of finance that exist solely because of 14+ years of zero-interest rate policy, we’re just surprised it took this long for formal legal action. Nevertheless, here we are now. Now that money is no longer free, Gary Gensler is striking while the iron is hot—seeking to correct a years-long error in allowing rampant financial crime to take place. It’s hunting season.

Check out—SEC Sues Binance & Coinbase For Breaking US Securities Law, Shocking Absolutely Nobody

Wednesday

In this episode, Nik sits down with Graham Krizek, the founder and CEO of Voltage, a bitcoin company building out lightning network infrastructure.

Graham describes his journey to create Voltage and gives his take on the current state of the lightning network ecosystem including the biggest risks, his take on other layer 2 technologies, Voltage's recent partnership with Google Cloud to service a more global customer base, and the future of lightning and Voltage as the bitcoin application ecosystem grows.

Check out—Lightning Network Adoption Pulse with Graham Krizek

Thursday

It’s over, finally. You might have become tired of our constant warnings, from “hikes slowing from 75 to 50 basis points” to “a pause has likely arrived,” this publication hasn’t been short of descriptors (and posts) for this hiking cycle’s demise.

And when my birthday rolls around on Wednesday just in time for the next FOMC meeting, I might not receive that gift certificate I wanted for a round of golf at Pebble Beach from Jerome Powell, but I’ll settle for what real estate agents are probably begging for: a reprieve.

Check out—Jerome, Our Skipper

Friday

In this episode, Joe sits down with Joe Carlasare, a partner at Amundsen Davis and the foremost authority on the crossroads of crypto and law.

They discuss all of the charges levied against Binance and Coinbase, the implications of classifying "crypto" as securities, whether or not these businesses can survive on a bitcoin-only model, and why asking for forgiveness rather than for permission has led to dire consequences for both of these unlicensed exchange, broker-dealer, clearing agency hybrids.

Check out—

Unpacking the SEC's Charges Against Coinbase & Binance with Joe Carlasare

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER