Bitcoin Drops 17% In First Big Week of ETF Outflows: TBL Weekly #86

This is the first week of net outflows for bitcoin's spot ETFs since January.

Welcome to TBL Weekly #86—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

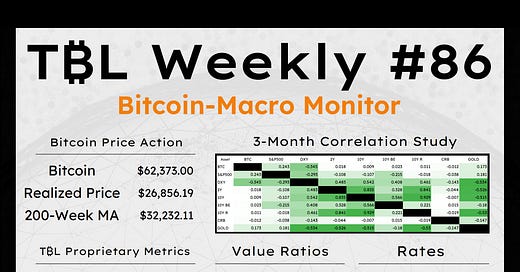

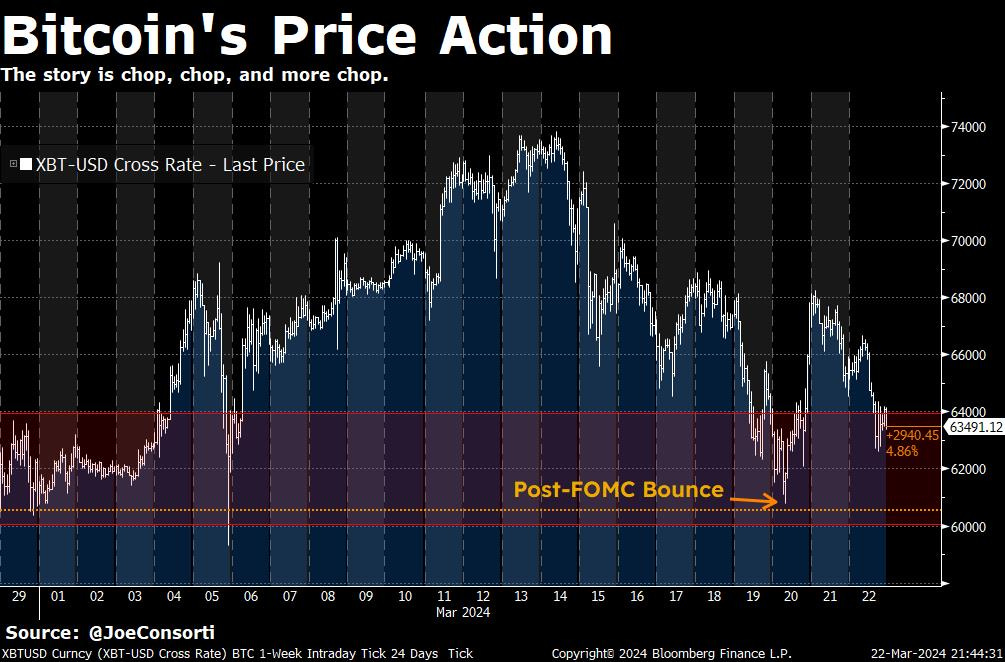

Consolidating in a bull market

Bitcoin has had a very choppy week, ending $5,000 lower than it started and closing our Friday’s trading at the $63,000 mark. The story of the bull so far has been chop, chop, chop, enough to make Gordan Ramsay blush. Consolidation is par for the course in a bull market, as profit-takers trade places with dip-buyers. Bitcoin has a strong support range in the low-$60k range to gather steam before the bull market can chug onward:

GBTC liquidation from Gemini bankruptcy and Gemini Earn

The S&P 500 was up over 200 points this week, so what gives for bitcoin? The first part of the answer has to do with forced selling of GBTC in bankruptcy proceedings, which has caused all of the spot bitcoin ETFs to have their first week of net outflows since January at -$637.5 million, highlighted in blue in the far right column:

Not a bad start for Q1. This shift in the ETFs started at the end of February when a judge approved the sale of both Gemini and Genesis’ GBTC holdings totaling 65.9 million shares of GBTC, or 17% of its total supply. Genesis, the now bankrupt lender is liquidating all of its GBTC, while Gemini is merely selling its GBTC and rotating into BTC as it unwinds the collateral for its defunct Earn product—so realistically, only half of these GBTC sales are impacting bitcoin’s spot price. The outflows are also in dollar terms in the charts I’ve created, so considering the price fell 8% this week and what outflows have occurred have been largely a result of bankruptcy proceedings, spot bitcoin ETF owners are holding the line very well, albeit with a minor reduction in inflows to the other vehicles, which you can see here:

According to Bloomberg’s Senior ETF Analyst Eric Balchunas, boomers are an investor class which heavily contribute to ETF flow and tend to “get it right.” Boomers, although not all ETF buyers are boomers, dumped $167 billion into ETFs in 2008 when SPY was down 35% and $600 billion in 2021 when SPY was down 17%. Generally, 401k contributions increase when the market is down, they don’t fall, and this point of observation backs that up.

Bitcoin drawdowns may be larger given its high market beta, but this is a mature investing class that knows what they’re getting into, and capitalizes on dips rather than capitulating. It is actually the bitcoin owners who tend to be more flighty, at least the short-term holders who make up large amounts of bull market liquidity.

Selling pressure is not coming from a blowout in derivatives either. Derivatives still have a long bias with positive funding rates across the board, but short and long liquidations in both the options and futures markets are more or less balanced, and there have been less than $100 million in daily liquidations in futures, which is low:

Selling isn’t coming from derivatives land, and it is not coming from these ETFs in a meaningful enough volume to send the price tumbling 15%, so who is selling? Occam’s razor: we can deduce the selling is coming from profit-takers. Like in every bull market, we’ll endure several consolidation phases before moving higher. I discussed this on Tuesday but I’ve made this clear chart to illustrate it: bitcoin’s last two bull runs have had between 10 and 15 drawdowns of 10% or more. We are on 10%+ drawdown number two or three of this bull run, so there’s plenty of air left in the tires

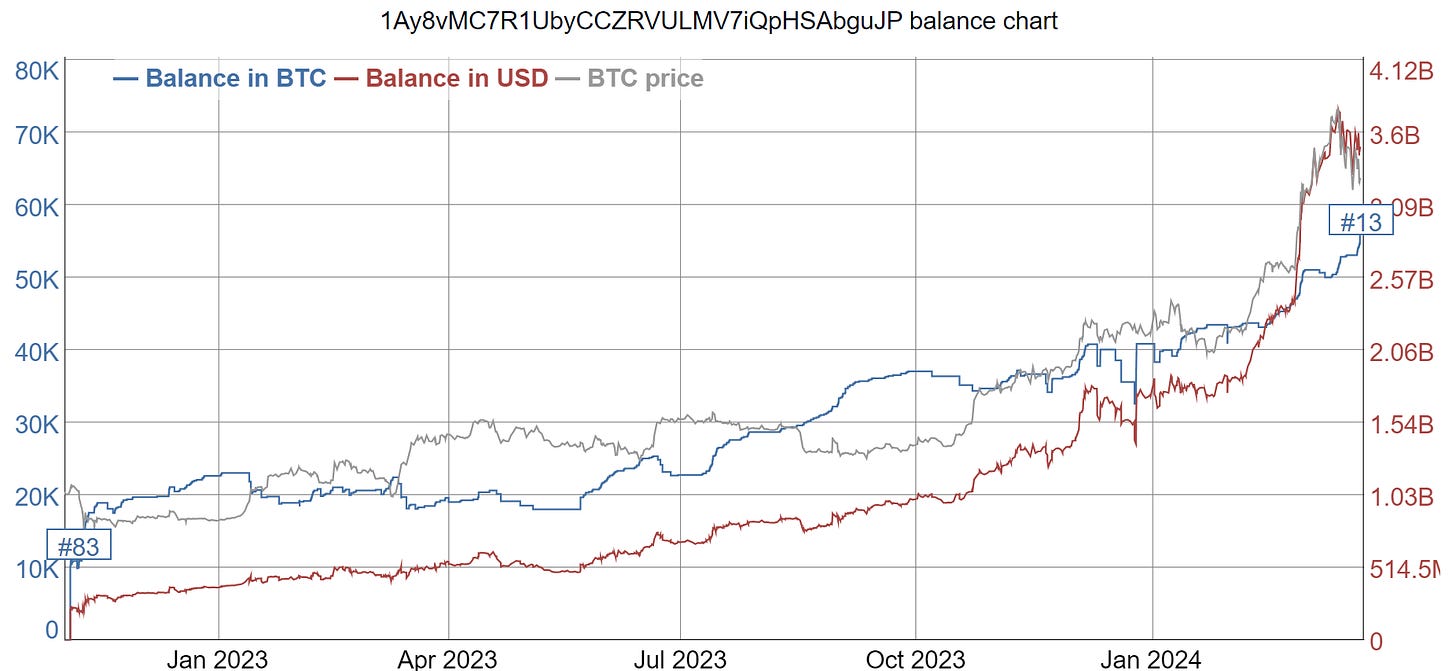

Whales keep accumulating under the surface

Under the surface and like ETF investors, whales are stacking the dip in earnest.

The market is currently observing some interesting behavior. There is a single address with over $3 billion worth of BTC leaving a highly fascinating footprint. A South Korean exchange called Upbit is linked to purchases in 100 BTC increments. According to on-chain analysts, this is not an entity buying bitcoin on behalf of an ETF, this is instead by our understanding a segregated balance acquiring BTC via Upbit. Who is it, and what other details do we have? We will investigate this further—the pattern has caused the community to give “him” the name Mr. 100. He has slowly built his holdings to 54,925 BTC, making him in control of the 13th largest bitcoin address. Instead of perpetuating rumors, we’ll patiently await more evidence. The whole episode is a healthy exercise in observing the semi-anonymous nature of bitcoin.

This behavior is a perfect representation of this more mature and capital-rich investing cohort coming into the bitcoin ecosystem, instead opting to buy spot bitcoin rather than the ETF products:

Retail investors continue to make up the majority of addresses on bitcoin, with individuals holding 10 or fewer BTC, denoted below in pink, rising persistently since 2018 without fail, bull or bear. It is encouraging from a protocol security standpoint that bitcoin continues to be dominated by smaller participants and further distributing balances and the ownership of the network around the world:

With bitcoin’s 4th halving approaching in just 26 days, potentially around April 19, 2024, supply is about to get a whole lot tighter. Whales and ETFs combined are scooping up 10x the daily BTC issuance on a normal day, and bitcoin’s supply constraint is slated to enter completely unchartered territory as these buyers only grow more interested and the supply shock hits the market like a ton of bricks. As Nik said in his latest stellar interview with Peter McCormack on What Bitcoin Did, you need to prepare for $100,000 bitcoin, because it’s coming sooner than you think.

One last thing: Congress decided to add $1.2 trillion in spending to FY2024, which only has 6 months left (at 2 AM Eastern Time, no less). We’re spending more than bitcoin’s market cap in 6 months and pushing the deficit for the 2024 fiscal year even higher while doing it:

Next Week

In the week ahead, bond markets are closed for Good Friday. Nevertheless, PCE data still falls on Friday, putting the market in a somewhat awkward spot for Thursday trading. Investors will focus around the massive amount of Treasuries to be auctioned, all inside seven years to maturity. No matter the tenor, all securities need buyers and financiers, turning our focus as always to the repo markets and how another net settlement (and QT day) meets a quarter-end. We are quite certain of one thing: portfolio managers are not going to want statements going out that indicate an underweight risk position given the euphoria in stocks. Those that are underweight are holding on to the fundamental expectation that monetary policy this restrictive should eventually factor in. Or maybe, restrictive just doesn’t mean what it used to.

In other economic news, we want to investigate changes in the residential real estate market given the recent realtor ruling and have our minds generally on housing as a huge net-contributor to GDP. The 2023 bounce in home prices could have saved equity bears 2024 headaches using the simple wealth-effect methodology. We ourselves are almost tiring of the bullish risk impulse dialogue, from fiscal dominance to corporate bond issuance to home prices to easy financial conditions. But there hasn’t been a hint of bearish risk appetite since 10-year Treasuries touched 5%—a very long time ago. Why would we fight it? Readers know we haven’t for a while.

Our last thought is about the dollar. With some weakness in the Japanese yen and Chinese yuan, echoed by all-time weakness in less pivotal currencies such as the Indian rupee, we smell the wrecking ball. The United States’ relative strength is too palpable not to act on—and major economies such as Japan and China look to be guiding their currencies weaker to further motivate dollar bulls. Switzerland just cut rates to frontrun the ECB cutting rates, all to prevent the Swiss franc from strengthening. The dollar won’t get guided lower by the market without Powell acting on his promise to cut rates, and a stronger dollar brings danger—it is the financial condition on the offshore-dollar world.

Here is the week in economic data:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik is joined by Blockstream developer Rusty Russell for an incredible conversation about Lightning Network. Rusty explains why he agrees with the thesis of Lightning Network as a type of layered bitcoin, how it is evolving, and how he measures its success.

Check out—Lightning Network Is Layered Bitcoin

Tuesday

Today, we’ll take a timely look at what central bankers have in store and how their decisions will impact the global economy.

We have a huge lineup of central bank meetings and interest rate decisions, starting off with the Bank of Japan and Reserve Bank of Australia on Tuesday and proceeding with the Fed, the Bank of England, the Swiss National Bank, and more. For our purposes today, we will be focusing on Japan, the UK, and the United States.

Check out—Japan Scraps Yield Curve Control As England Eyes Cuts & Powell Panics

In this episode, Joe discusses bitcoin's current 15% pullback. He walks through several charts to discuss how how these pullbacks happen 10 times or more during typical bull markets, potential levels of support for bitcoin's price as it regains its footing, and why given long-term holder behavior, the halving, and the macro backdrop, he believes this is merely a minor pullback in an overall bull market.

Check out—Bitcoin Dips 15% In Bull-Market Correction

Wednesday

In this episode, Nik is joined by Daniel Batten of CH4 Capital to discuss anti-Bitcoin propaganda. Daniel summarizes how Bitcoin helps the environment by miners removing harmful methane emissions, identifies anti-bitcoin propaganda as a mix of ignorance and incumbent malice, and explains the source of propaganda as primarily European financial institutions.

Check out—Banks Are Funding ANTI-BITCOIN Propaganda

Thursday

Overnight, the Swiss National Bank (SNB) cut rates in a surprise move and the first move lower among major Western economies. Yesterday, Jerome Powell insisted that cuts are eventually arriving later this year. Yet corporate bond issuance is at an all-time high, global air traffic is at an all-time high, and stocks literally cannot find a lid. Today I bring you my understanding of the current dissonance, why I’m starting to fade the consensus view, and a key look at the S&P 500 chart.

Check out—Switzerland surprise cut. Why?

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.