Bitcoin Halves Block Reward To 3.125, Transaction Fees Explode: TBL Weekly #90

Welcome to TBL Weekly #90—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Bitcoin had its fourth halving yesterday, and the first one to take place on a Friday night! Perfect timing for parties. This was its fourth successful monetary policy adjustment, this time halving issuance from 6.25 BTC per block to 3.125 BTC per block. If only monetary policy were this elegant at the Federal Reserve. Nik and I would be out of a job, there’d be nothing to talk about.

The biggest news of the night has got to be the unbelievably large block reward associated with block 840,000 and beyond. For reference, here’s a typical clock roughly 3.5 hours before the halving took place, with about a 7 BTC block reward, currently worth around $450,000:

Block 840,000, the block that ushered in bitcoin’s fourth supply schedule reduction, had an eyewatering 40.7 BTC block reward, worth some $2.6 million. Total rewards for the halving block quintupled their norm thanks to insane transaction fees:

Why did this happen? And why have blocks since 840,000 had similarly huge transaction fees and a massive total reward? A new token protocol went live on block 840,000 that uses OP_RETURN called Runes, used for inscriptions that have no explicit monetary association with BTC itself—reminiscent of other crypto pump and dumps.

The good news is that plenty of people who tried to mint their tokens in block 840,000 lost thousands of dollars due to their transaction being accepted by one mining pool but not making it into others, or minting a Rune and having it sell out before their transaction was confirmed. Said more simply, non-BTC activity clogged up the blockchain. Hundreds of bitcoin were paid to mint and buy Runes within just the first 10 post-halving blocks. Though it’s a game of greater fools in which essentially everybody loses, it does detract from block space and accentuate the need for hastening the development of and further expansion of liquidity on layer 2 scaling solutions like the Lightning Network.

Transaction fees a percentage of the total block reward jumped to their highest level ever of 75%, a preview of what’s to come in bitcoin mining economics decades from now as bitcoin monetizes into a $10-trillion+ asset, demand for the network is orders of magnitude larger than today, and we’ve had a few more halvings:

The good news is that total fees per block are beginning to stabilize back down closer to historical norms, with the last few blocks hashed onto the chain coming it at around 7 and 8 BTC:

Let’s switch up the board to the macro side of markets. The Fed’s messaging has been made crystal clear over the last few weeks given the totality of economic data: rate cuts are pushed to late 2024 if not further, rate hikes are still off the table, and QT tapering, a slowdown in the pace of the Fed’s balance sheet reduction, will be announced shortly. This new Fedspeak Index visualization tool from Bloomberg paints the picture of cautious dovishness for financial stability’s sake as I explained above. The probability of a hike was completely wiped off the map from the start of 2024, while the probability of rate cuts still hasn’t materialized despite the December pivot:

Fedspeak shifting dovish—but not fully to active cut territory—beginning in earnest last October has significantly loosened financial conditions, contributing to the sticky price inflation and nominally hot economic activity we’re now experiencing. Jumping the gun has kept both the rate of price increases and interest rates high. It is not hyperbolic to say that this is one of the worst periods in the last half century in terms of affordability, and Powell is to blame. We are reminded of the Fed’s chief policy tools: forward guidance. Take a look at how the Fed’s dove-talk had loosened up financial conditions, it seems to be completely botching the guidance:

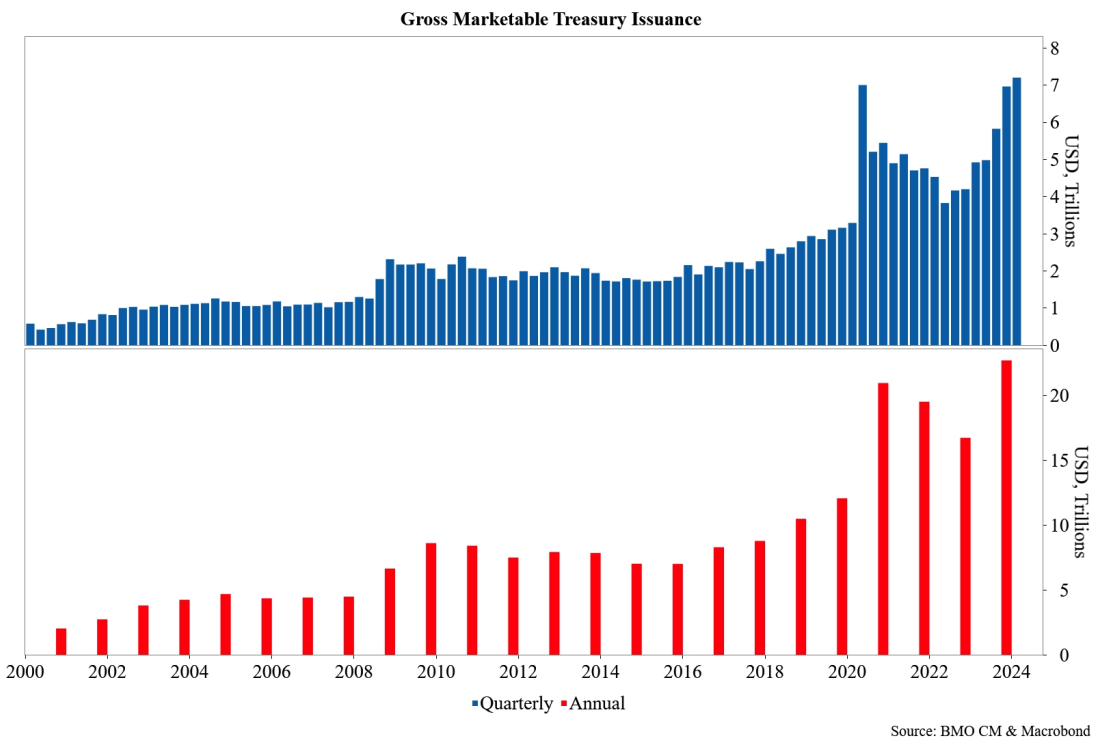

Here’s a chart from our friend Ian Lyngen over at BMO. Gross marketable Treasury issuance has doubled from before 2020, from roughly $10 trillion annually to $25 trillion in 2024. There is no reasonable justification for this, nor a reasonable explanation. Interest payments on the debt are a problem, of course, but the unending nominal economic expansion hasn’t driven US productivity up to a level where revenues are going to be able to pay all of this off. It is just irresponsible:

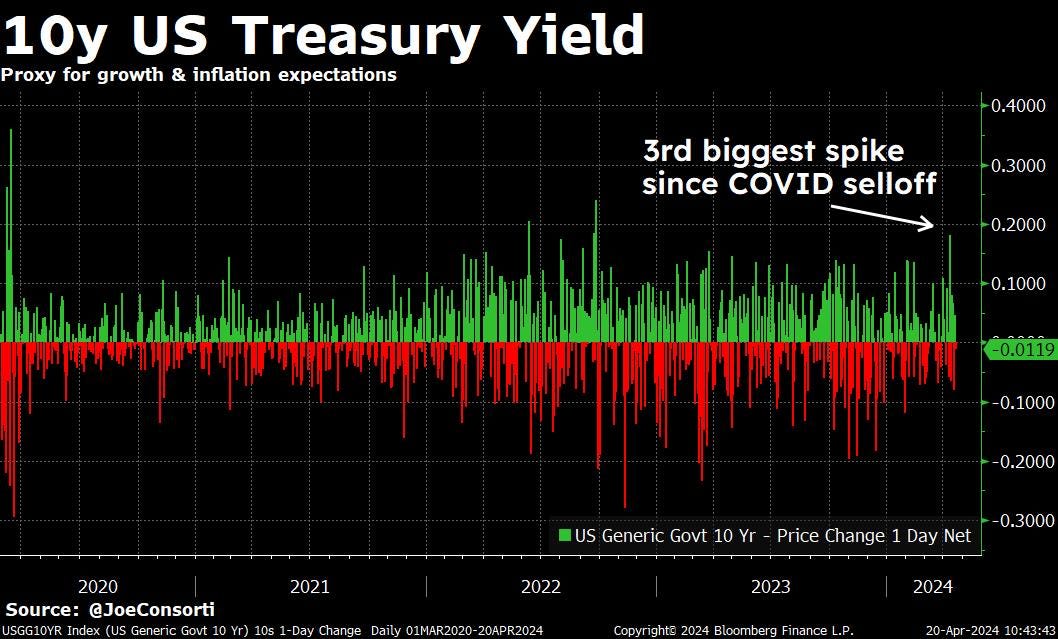

Volatility from all of this issuance is visible in the US Treasury market due to increased auction volume, but not instability yet. The 10-year yield had its 3rd largest spike since the COVID US Treasury selloff just last week. No need for the Fed to step in at this time, but Powell is readying his shooting hand and lowering it down to his holster of UST market support tools, ready to fire at a moment’s notice:

NVIDIA had a huge meltdown this week, falling 14.5% from $890 to $762 per share—Nik flagged a double top on April 4th. The Nasdaq 100 sunk to a 10-week low and the S&P 500 sunk to an 8-week low on Friday, meanwhile, bitcoin is entering its 8th week of consolidating between $60,000 and $70,000. Trouble in paradise? Cycle shift? We have our eyes on this space:

Next Week

In the week ahead, Treasury will auction an enormous amount of securities—$183 billion predominantly in the front end of the curve:

Of course, most eyes will be on the first release of Q1 GDP growth, which is expected to show US nominal growth slowed to 2.7% annual pace. With volatility in the inflation component of real GDP, whether the number is closer to 3% or 2% matters slightly less than the fact that nominal GDP at around 6% is the main ingredient in inflation cooking. Along that line, PCE should show that sticky inflation is the predominant reason for 2s hitting 5% again. The long end of the curve and potential steepening will have much more to do with Treasury’s decision on how many bills to issue versus coupons—much more on this in our interview below with quarterly refunding guru Andy Constan.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Joe sits down with Alex Thorn, Head of Research at Galaxy, live at the Bitcoin Policy Summit in Washington DC. Alex discusses his keynote speech, why bitcoin values are American values, and how property rights are now digitally ensured. He also explains the embedded geopolitical resiliency of the bitcoin network.

Check out—Bitcoin Values Are American Values

Tuesday

We see your feedback. There is something of high value to those of you who read multiple macroeconomic researchers and use The Bitcoin Layer as a resource to either compare, contrast, or put us in our place. With each passing day, I personally take the role of researcher more seriously due to the constant realization that yet another component must be added to the framework.

The past four months have been spent within bank balance sheet mechanics, scribbling T-charts furiously in my notebook until I felt command over the changes. Since listening to Russell Napier wax poetic on the coming Chinese devaluation, I find myself in the trenches of capital accounts, current accounts, balance of payments, and foreign exchange drivers. Learning will never stop—my only frustration stems from difficult decisions of how to divide my reading time.

In today’s post, we’ll tour through each major asset class, and I’ll propose questions to both you and myself on the state of the economy and markets. While I don’t claim to have all the answers, I’m certain my questions are thoroughly relevant given recent trends in volatility. Behind the paywall today, my curiosity extends to how high US Treasury yields can go, the move in gold, what China is doing, how the Chinese yuan and Japanese yen moves are impacting the world, and of course, how low stocks can go. Additionally for paying subscribers, I will be sharing some hand-selected research papers from my USC students on big-picture topics such as the future of the dollar and central banking. Now, let’s dive into the markets with 16 beautiful Macrobond charts to help us tell the story.

Check out—Stocks go oops

Wednesday

In this episode, Nik joined once again by portfolio manager and fixed-income expert Andy Constan. Andy explains his bearish view on the stock market as a reaction to inflation refusing to come down and the Treasury department likely to keep coupon issuance high. He also breaks down why he does not view today's situation as fiscal dominance any longer and how restrictive monetary policy will ultimately impact the economy. Andy briefly discusses Michael Howell's liquidity framework and why gold's move tells us the Fed is losing on inflation. We also get a rare bitcoin mention from Andy!

Check out—Why Andy Constan Is Bearish Stocks

In this episode, Joe sits down with Felix Maradiaga, the leader of the Nicaraguan Opposition Party, Human Rights Defender, and 2024 Nobel Peace Prize Nominee. Live at the 2nd Annual Bitcoin Policy Summit hosted by the Bitcoin Policy Institute, Felix discusses financial repression in Nicaragua, the modern threat of techno-dictatorships, and how bitcoin functions as the apex tool for advancing financial freedom globally.

Check out—Bitcoin Against Autocracy: A Modern Tool for Freedom

Thursday

Trammell Venture Partners, an Austin-based venture capital firm and long-time friend of The Bitcoin Layer, released its 2nd Annual Bitcoin-Native Startup and VC Ecosystem Research. We were fortunate enough to receive a copy of the research during its embargo period. Now that the embargo is lifted, let’s unpack what they’ve put together, analyze the growth of bitcoin-native VC deals relative to crypto VC deals, and map out the trajectory for startups in this ecosystem in the years to come.

Check out—Bitcoin-Native Venture Capital Deals Trounced Crypto Deals in 2023

In this episode, Nik is joined by veteran investor and former Goldman Sachs commodities trader Michael Kao. Michael explains the case for an upcoming currency war and competitive devaluation starting in Japan with a weakening yen. In this fantastic overview of the global monetary system's game theory, learn as Michael breaks down the decision trees for Japan, China, the ECB, & Janet Yellen and the US Treasury.

Check out—CURRENCY WAR: Competitive Devaluation & Central Bank Contagion with Michael Kao

Friday

In this episode, Nik is joined by bitcoin analyst Checkmate. In a brilliant overview of measuring bitcoin price and determining cycle position, Checkmate breaks down bitcoin's novel price performance relative to traditional assets, closely examines the current round of selling at $70,000, and most importantly tells us exactly what to look for in order to identify the legitimate end of this bull market. Learn why he doesn't believe the current market is "top heavy."

Check out—Understanding Bitcoin Price Movements & Cycles with Checkmate

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 full reserve multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.