Welcome to TBL Weekly #76—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

Good morning, everyone.

Bitcoin just had the largest single-asset ETF launch by volume of all time. We could end the post right there, frankly. Early adopters (including you and us) of bitcoin felt vindication by the sheer volume traded across all 10 of these new spot vehicles on Thursday’s launch and Friday's trading.

The previous record for most volume on an ETF launch day was roughly $2 billion, compared to these 10 new vehicles combined, minus GBTC, which saw $2.32 billion in volume on day 1. Extrapolating this out from the two-day launch window, and we’re likely to continue seeing outsized performance of this ETF suite in the coming 6-18 months. The appetite for spot vehicles has finally been quenched and capital inflows should pick up the pace as more people learn of their existence and call up their broker to allocate. As has been the case with every major investment category over the past couple of decades, ETFs are the gateway to mass market allocation.

Inflows into the 10 new bitcoin ETFs hit +$1.4 billion over Thursday and Friday. Subtracting GBTC's outflows of -$579 million we get a net inflow of +$818.9 million into the 10 new vehicles:

So, why did bitcoin’s price disappoint despite these massive inflows?

No doubt that people rotating out of GBTC and into the other ETFs with lower management fees played a role. Instead of fresh outside capital buying spot ETFs, and then issuers buying bitcoin for the new shareholders, many are selling GBTC and buying these other ETFs, and all new bitcoin-buying from the new vehicles is being offset by Grayscales selling of their underlying bitcoin holdings. This is confirmed by the net outflow of $579.14 million from GBTC, which has a 1.5% management fee, and a new inflow into everything else.

We expect this dynamic to continue and cause most ETF-related inflows to be neutral to bitcoin’s price until many of GBTC’s holdings are sold and investors have rotated into the lower-fee vehicles, or Grayscale reduces its management fee to be competitive with its counterparts. From that point forward, outside capital will run the show and ETF inflows will be much more telling and directly visible in bitcoin’s spot price.

As for anybody panicking, these sorts of corrections are a bitcoin mainstay. We just saw a +96% rally over the last 4 months after a multi-year bear market, meaning a minor correction was a certainty to reset leveraged positions and set a better foundation of spot buyers is healthy. Zoom out and chill out!

This meme from Eric Balchunas perfectly encapsulates how newly anointed bitcoiners must be feeling after their first Friday night price dump:

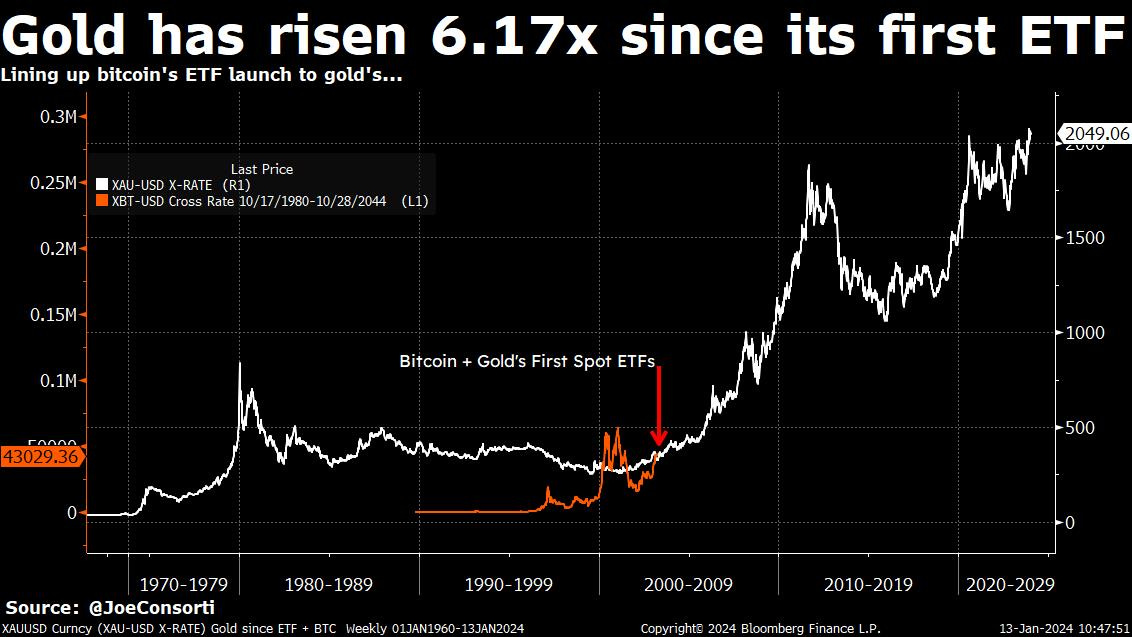

When the first gold ETFs launched on March 28, 2003, in Australia, gold was trading at $332 and had a market cap of roughly $1.5 trillion. Since then, gold has risen to $2,049, up 6.17x since its ETFs came onto the market:

And gold's market cap was already $1.5 trillion at the time its first ETF began trading, today it is $13.7 trillion; compare that to bitcoin’s $841 billion market cap today, less than half of what gold’s was when its ETFs were approved.

Bitcoin’s size is not only half of that of gold pre-ETF, but only has 6.7% of its supply left to be mined, over a period spanning the next 116 years. Putting bitcoin and gold on the same chart with the date of their respective spot ETF launches overlaid with one another, we can get just a glimpse of what bitcoin could do. Due to bitcoin’s absolute scarcity and near-infinite divisibility, the reality of how its price will rise is simply too high for the y-axis of this chart to accommodate. None of this is priced in. Don’t sell your bitcoin to BlackRock:

The yearly CPI inflation rate rose in December from 3.1% to 3.4% well above expectations of a 3.2% yearly increase. Housing, gasoline, airfare, and car insurance price increases all accelerated. The Fed has plenty of runway to keep rates high until the consumer's back breaks.

On the market side, the 2-year yield has fallen 51 basis points below its 200-day moving average, the lowest it has fallen beneath this long-term trend during this entire cycle. In this week alone, it has fallen 20 basis points despite stubborn consumer prices. Because the Fed has already forecasted rate cuts in its minutes and in several speeches by Fed members, investors are hanging on to every sign of disinflation—this week it didn’t appear in CPI but in PPI. Producer prices were negative month over month, and it sent rates tumbling. Talk of the early end of QT and an announcement of a change in balance sheet policy as soon as March is the Fed moving firmly into the easing bias.

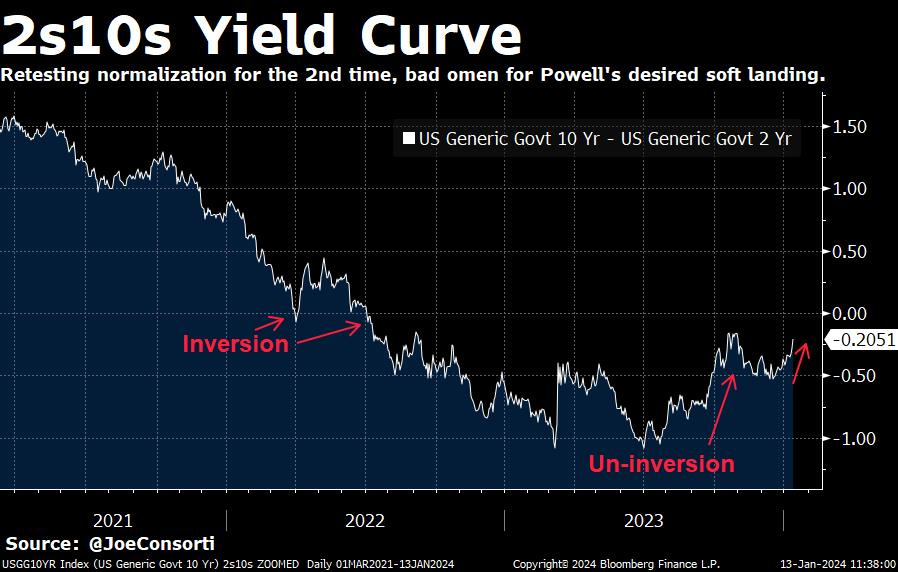

The 2s10s yield curve is making a second run at un-inversion as investors aggressively price in rate cuts from the Fed, now just 20.5 bps off of normalizing:

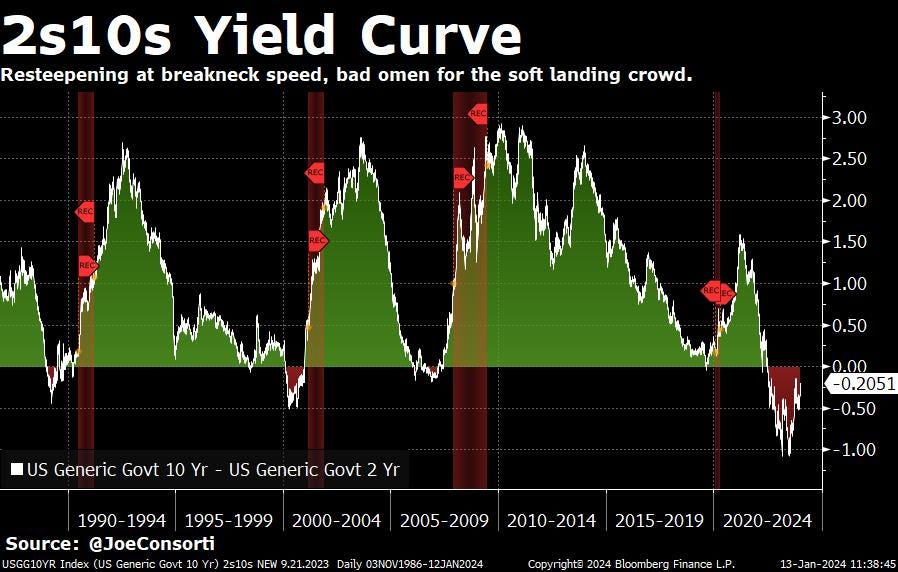

Here’s a zoomed-out view. Curve normalization always resolves in a recession:

Aggressive rate cut pricing is also reflected in the spread between the 2-year yield and the Federal Funds rate, which is now at its deepest inversion of this entire cycle. The market’s conviction that financial conditions will ease more than they already are has never been stronger. If the Fed fades this, it could be catastrophic given how skewed positioning is towards imminent easing and it will fumble its soft landing hopes.

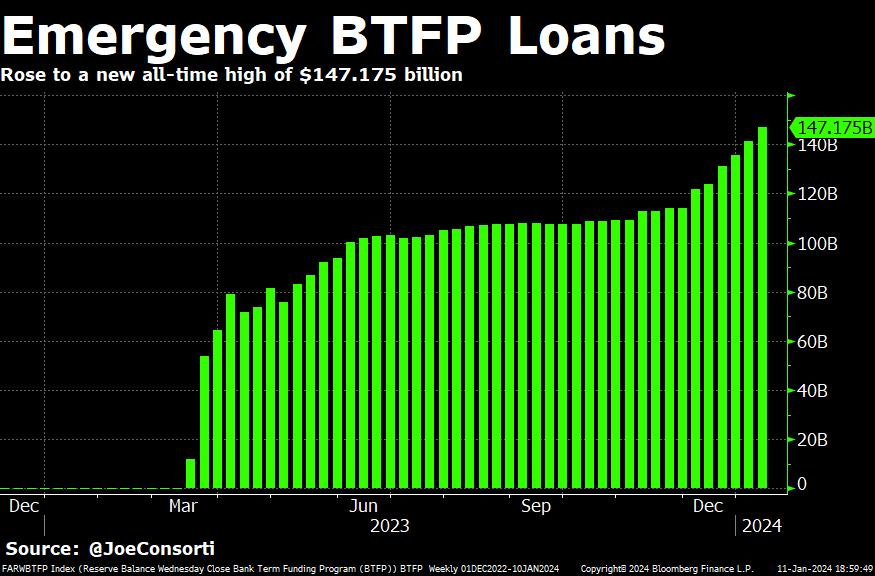

The Fed's BTFP emergency loan facility rose $6 billion this week to a new high of $147 billion. Banks have been tapping the facility in earnest before it is set to "expire" in March. NY Fed President Williams says that it’s not surprising or worrisome to see BTFP is getting used, touting the availability of the Fed’s longstanding discount window for liquidity, saying that he expects BTFP measures to end on March 11th as previously planned.

JPMorgan has worries about this, expecting more liquidity to be drained from the financial system if BTFP expires when expected in March. It notes that BTFP expiring would mean that $60 to $80 billion of liquidity will be withdrawn from financial markets that month, in addition to $75 to $80 billion from QT. The Fed’s plan to slow the pace of QT will certainly dampen the impact of BTFP ending, but it will still add upward pressure on SOFR (Treasury repo rates) and substantially tighten financial conditions from where they are now. All eyes on March 11th and the weeks leading up to it to see if the Fed changes course:

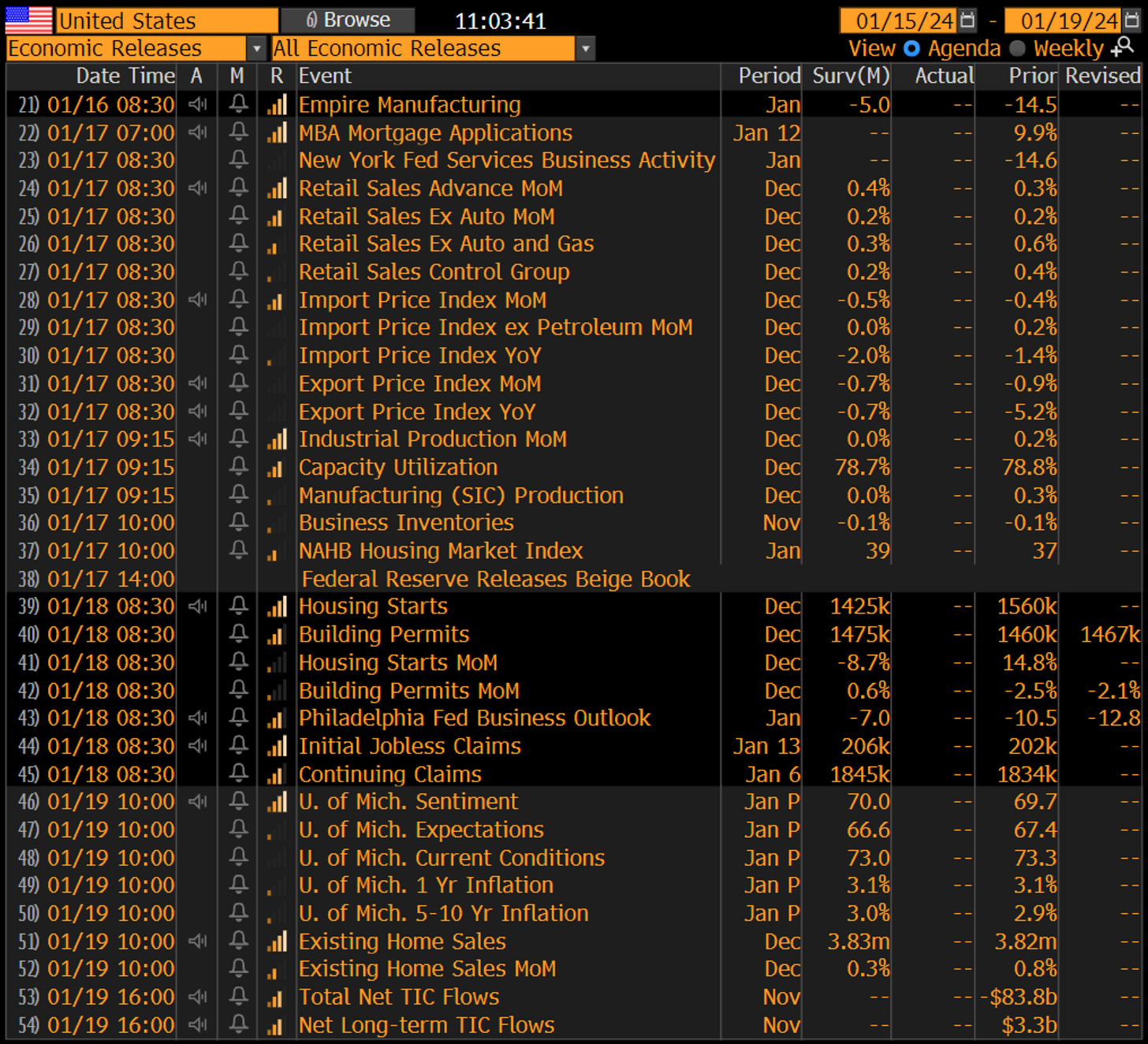

Next Week

In the week ahead, markets must first focus on getting past the net settlement of duration. This means that 10- and 30-year Treasuries auctioned last week must settle, meaning that money must be available, meaning that repo funding must be secured. Large net settlement days during QT are important to us at The Bitcoin Layer because they test the margins of the system’s health. Each passing settlement day gives the rest of the market room to leverage up, and it’s our best estimate that the Fed is praying it avoids any issues heading into the end of RRP balances, the end of BTFP, and a QT program full-steam ahead. In summary, our focus begins (as always) with money markets and repo.

On economic data, Wednesday’s retail sales always have a strong impact on the consumption component of GDP, making every print a relevant one. This is the star of the week. Housing data and the preliminary University of Michigan consumer and inflation surveys will also have our attention.

In addition to Tuesday’s settlement day, 20-year Treasuries and 10-year TIPS will be auctioned, both with end-of-month settlement. The yield curve’s full un-inversion, which can only take place with an aggressive rally in the front end of the curve (2s), which takes place during Fed capitulation, could be here as early as by the Fed’s meeting on January 31st.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, Nik explains why the Fed has already started teasing an early end to Quantitative Tightening. In order to fully understand the Fed's motive, we dive into RRP (Reverse Repo) balances declining, define SOFR and why this rate can tell us about the health of financial plumbing, and forecast why the end of QT sets the table for QE in the next financial crisis. Nik also ends with the news that Bitcoin ETFs will begin trading on Thursday.

Check out—Fed Will End QT Early! Is QE Next?

Tuesday

After a two-year campaign to wind down the balance sheet, the Fed has all but confirmed to slow the pace of quantitative tightening to minimize the risk of a liquidity crunch in financial markets, while lengthening the time it can maintain a tightening stance. In the days since December’s FOMC meeting minutes have been released, the market has rebounded off of the Fed’s latest comments that it will not only slow and eventually stop running down its balance sheet, but also plans on one or many 25-bps rate cuts in 2024.

In the Fed’s oxymoronic pursuit of quelling runaway inflation expectations while maintaining loose monetary policy, bitcoin stands primed and ready to benefit from the monetary tomfoolery. The Fed wants to have its cake and eat it too, and the biggest winner may be you.

Check out—End of QT is near, Bitcoin ETFs are here

Wednesday

In this episode, Nik brings us a timely global macroeconomic update. He explains why the global economy is on very weak footing, dives into record-high office vacancy rates, previews Thursday's CPI release, and teaches us how to interpret today's inverted yield curve.

Check out—Record-High Office Vacancies Ahead of CPI Report

Thursday

Bitcoin ETFs finally began trading today—vehicles that are legally charged with purchasing and storing part of the network’s maximum supply of 21,000,000 coins. Many felt emotion, especially those who expended 10 years of painstaking effort to bring this asset class into the mainstream investment landscape. Today was one of bitcoin’s most historic moments; it must not be judged by a 0% change in price on the day but by the lasting victory of bitcoin and the will of the investing public. The featured event now begins and the question can finally be answered: will the fact that these new ETFs are spot—required to purchase physical bitcoin and take delivery—squeeze the available supply at current prices? Seatbelts will be required for what’s next.

Check out—ETFs begin trading, bitcoin touches $49,000

Friday

In this episode, Nik breaks down one of the most historic weeks for bitcoin since its genesis block. ETF launches were a success, evidenced by strong volumes and solid inflows. The price suffered to end the week, but we explain recent moves in context. Finally, Nik details the recent bull steepening of the yield curve and provides a renewed outlook for Fed cuts this year.

Check out—Bitcoin ETFs: Launch Success, Price Fail

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is our Bitcoin exchange of choice.

Securely buy Bitcoin with zero fees on recurring orders, have peace of mind thanks to their 1:1 multisig cold storage custody, and withdraw at any time. Need help? They have US-based phone support for all clients.

Now introducing River Link 🔗allowing you to send Bitcoin over a text message that can be claimed to any wallet. Give a gift, pay a friend for dinner, or orange pill your friends, completely hassle-free.

Use River.com/TBL to get up to $100 when you sign up and buy Bitcoin.

GBTC counteracts only one third of the inflow, and the net inflow is still massive. So there must be other counteracting forces that result in this correction. I think one might be risk-off whales according to on chain metrics.