Welcome to TBL Weekly #49—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

BlackRock filed a Form S-1 registration statement for a spot bitcoin trust, the latest in a long line of failed attempts at creating an ETF-like instrument with pure long exposure to bitcoin:

iShares, a part of BlackRock, is one of the largest ETF providers in the world with a massive suite of over 1,250 ETFs. While referred to as a trust rather than an ETF, it is described in the prospectus as an open-ended spot bitcoin trust that works functionally identically to an ETF. It allows for the creation and redemption of shares at the end of each trading day—accurately rising and falling with the underlying bitcoin in the fund—which is the selling point of an ETF.

This redemption mechanism also means that, unlike GBTC, the fund will not persistently trade at a premium or discount to the net value of the trust’s bitcoin. It will always track the value of underlying bitcoin as it moves up, down, and sideways at the start of every trading day, resetting at the end of every trading day.

The SEC has famously denied over a dozen spot bitcoin ETF proposals, citing concerns of manipulation in the underlying market, while approving a short-bitcoin ETF and many bitcoin futures ETFs. It has specifically said that the lack of surveillance relating to the spot funds’ underlying assets has prevented any of the proposed spot ETFs from being approved. In other words, the SEC wants transparency and 24-7 auditability from a major exchange like the Nasdaq before feeling confident in any proposal making it to market. BlackRock even recognized this in the “Risk Factors” section of their filing:

Why would BlackRock’s trust be approved when several before it have been denied?

The size & reputation of BlackRock works in its favor

It is the world’s largest asset manager with $9.1 trillion AUM as of March 31, 2023. The due diligence that goes into its own products and investments is second to none. BlackRock’s record of getting ETFs approved by the SEC is 575-1—the event of filing for this spot bitcoin ETF in the first place is already extremely encouraging given BlackRock’s near-pristine track record of getting all proposals approved. Chances are, it wouldn’t have filed if it hadn’t crossed its Is and dotted its Ts.

BlackRock is teaming up with Nasdaq to enter a surveillance-sharing agreement

The reason SEC has denied so many spot ETFs is because they lacked this. BlackRock went out of its way to not only recognize market manipulation as a risk, but partner with the Nasdaq to share trading and clearing activity, as well as customer information for the exchange to monitor and mitigate the possibility of market manipulation by the trust sponsor. This is a show of good faith, and a sign that BlackRock did its homework in including everything the SEC rejected previous attempts for not having:

When BlackRock files for an ETF, it’s not shooting just to miss, it aims to fire and kill. This could finally open the floodgates of institutional buy-side liquidity that has been waiting in the wings without an institutional investment vehicle to gain proper long exposure to bitcoin—all of that pent-up demand will come to market.

This also frankly could destroy the value proposition of bloated exchanges like Coinbase that offer bitcoin but make the lion’s share of their money off of shitcoins and comparatively high transaction fees to what the ETF would have. Coinbase does have the benefit of custodying the trust’s assets (unfortunately not publicly available wallet addresses) but it will lose loads of customers who chose a 1-bp fee to buy the spot bitcoin ETF instead of a 100-bps+ fee to buy bitcoin on Coinbase. Of course, you can withdraw and actually own bitcoin in the latter case, but the institutional capital just looking for directional exposure doesn’t care and will opt for the cheaper alternative.

The elephant in the room is BlackRock, the world’s owner of everything, controlling, via a custodian, what will ostensibly be the largest holding of bitcoin in the world. Bitcoin will be the beneficiary of a tsunami of institutional capital finding for that sweet beta and directional exposure, but the obvious downside here is the extent of BlackRock’s control over the investment landscape.

The bitcoin bought for the trust will be controlled by two entities with wallets that will likely not be made public. The Nasdaq’s surveillance agreement will provide more confidence than something like FTX, but the custodial solution for the ETF still lacks the opacity of being able to directly observe the bitcoin via a wallet address. In the event of a hard fork of Bitcoin’s protocol, BlackRock also chooses which asset the trust will hold—a piece of fine print that reads like nails on a chalkboard. Put simply, there are plenty of negatives to be found in the otherwise liquidity-positive news—the world’s largest investor likely owning a double-digit percentage of bitcoin’s supply chief among them.

We also observe a small narrowing of GBTC’s discount to NAV, from 44% to 41% today. This can be seen as investor confidence growing that BlackRock prevailing in this spot ETF approval will raise the chance that Grayscale’s lawsuit against the SEC to convert its closed-end bitcoin trust into an ETF will succeed too. They’re two completely different products and proposals so this doesn’t make much sense, but hey, when has the market ever behaved like it had perfect information?

Limited-Time Offer

Get 30% off an annual subscription to The Bitcoin Layer—good now through Monday!

And now for a rapid-fire macro rundown.

The week began with CPI inflation falling sharply once again, missing analyst expectations and coming in at 4.0% YoY, with all four components of the basket now decelerating. We’ve been saying this for months: disinflation has inarguably set in across the board, and the question is now one of speed:

That question has been answered by the ISM Services PMI report—where we see Prices Paid by services businesses leading CPI inflation by ~6 months. If the swift disinflation in that print is any indication, headline CPI will return back to the Fed’s 2% yearly target before the year is out with risks of deflation rearing their head:

Note the University of Michigan’s consumer survey of 1-year ahead inflation expectations fell far below analyst expectations to 3.3%, and the fall from 4.2% previously is telling us that the consumer now views disinflation happening materially around them:

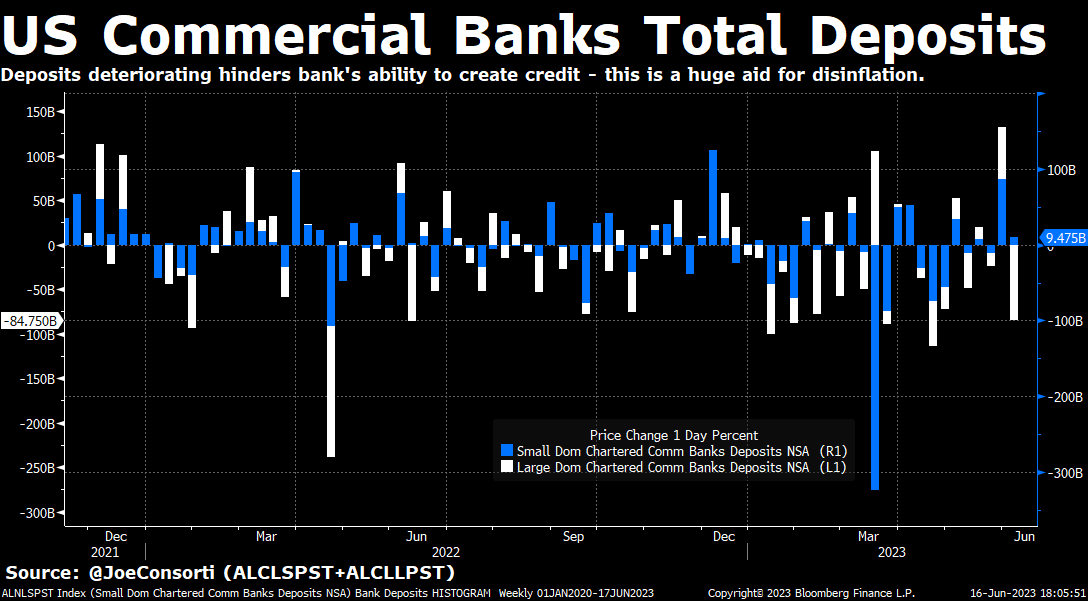

US bank deposits fell by $75.35 billion this week—the largest drop since March's bank runs. This is a huge headwind for credit creation, and given that we live in a credit-based global economy, a huge headwind for global economic activity and growth:

US commercial bank lending fell by $40.6 billion this week—the second-biggest drop since the Great Financial Crisis. Soft landing, eh?

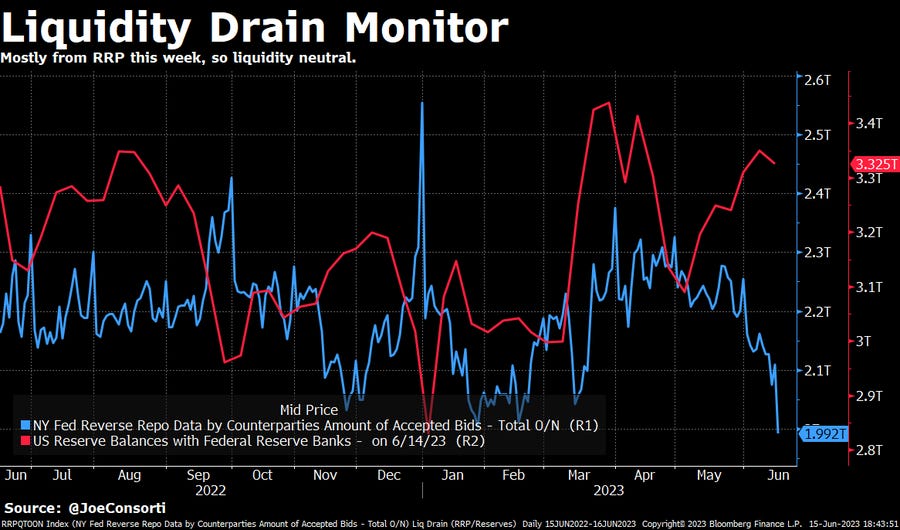

No big liquidity drain this week. The Treasury issued $296 billion of new debt today. Bank reserves, which impact liquidity and risk-taking closely, only fell $25 billion. It was bought mostly with $117 billion from the RRP—a shift of capital from one risk-free institution into a fresh set of new risk-free bills, neutral to market liquidity:

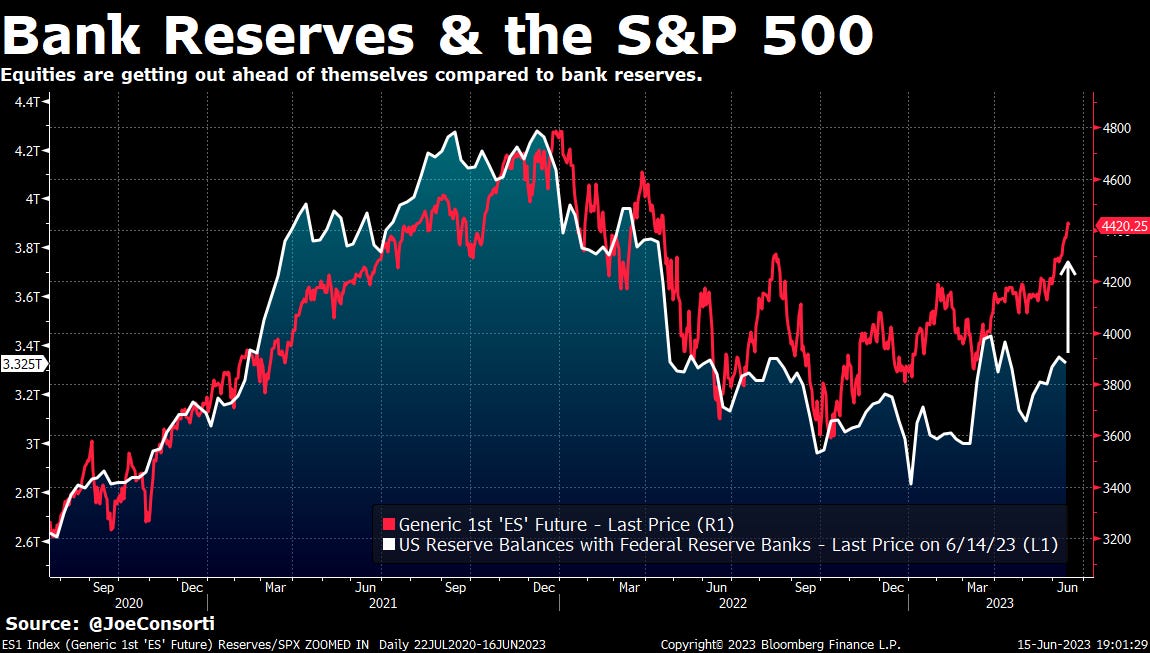

Equities continue to rally and arguably overextend themselves considering market liquidity in the coming months. Liquidity isn’t the only factor impacting asset prices, but soon factors could shift towards risk-off, and equity investors might be caught offside. We anticipated the Fed pause rally months in advance, and now that we see the labor market unwind, disinflation, and economic deterioration, we are looking ahead by many months to when the Fed is forced to cut and equities dump alongside it. Markets don’t top with a whimper, but an exhaustive and unbelievable blow-off top following a rally that generally lasts way longer than market participants think. This is the rally we are experiencing now, and as we said, it can go on much longer than most think:

Despite its usual high sensitivity to the broader market’s moves, bitcoin is far less overextended given its own headwinds with the Coinbase & Binance lawsuits:

It has dipped back below our fair value level for the past three weeks and continues to slide amidst a worsening regulatory backdrop for associated crypto assets:

Emergency bank loans drawn from the Fed’s BTFP facility rose for the 7th consecutive week, swelling to $101.96 billion:

One final note: commercial real estate is a problem, and we are watching regional banks’ balance sheets with unrealized losses on US Treasuries that sparked the creation of BTFP in the first place. A chain of dominoes is teetering on the edge of the table for all CRE lenders and securities holders, but there’s no emergency Fed facility for it… yet.

The Week Ahead

In the week ahead, economic data is on the lighter side, although we’ll get May’s housing data in terms of permits, starts, and sales. All three metrics are in steady decline, indicating an overall weak housing market. While the Fed is likely to send out every single speaker it can find to jawbone the market, participants will look past rhetoric and to jobs and inflation data that will arrive in early July. Treasury will continue its cash build, stocks remain in focus in fresh bull market territory, but The Bitcoin Layer will keep our laser eyes on the front end of the curve and if 2s remain at a premium to Fed Funds—current 2-year yields stand at under 4.75%, with Fed Funds above 5%.

See what a best-in-class Bitcoin mobile wallet feels like with Envoy.

Download it today for free on the iOS App Store or the Google Play Store.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Joe is joined by Jeronimo Ferrer, a bitcoin educator focused on educating the Argentine masses. He discusses life in Argentina under double-digit inflation that is now considered normal, cross-currency markets on the streets, and why citizens treat the US dollar like gold.

Check out—Inflation Is Destroying Argentina | Jeronimo Ferrer

Tuesday

The Fed will pause its rate hikes on Wednesday, yet an otherwise bullish event is partly overshadowed by a looming freeze on Binance’s assets the day beforehand.

Immobilizing many users, US and otherwise, from withdrawing their assets may spark a wave of panicked withdrawals and selling throughout the crypto ecosystem of exchanges and assets, bringing the proverbial bitcoin ship to a halt as the crypto anchor slowly sinks to the ocean floor.

While fund managers on vacation and passive flows have markets firmly in Margaritaville, bitcoin faces battles native to its own ecosystem that could have it wastin’ away for an entirely different reason—it’s liquidity trouble in paradise.

Check out—Liquidity Trouble In Paradise: Bitcoin Update

Wednesday

In this episode, Nik analyzes the latest Fed move to keep rates on hold.

He breaks down why the Fed is relying more on headlines than raw economic data, what rates markets are telling us about Fed policy, and the damage caused to the economy by 5% Fed Funds.

Check out—Fed PAUSES! What Does It Mean?

Thursday

At last, the ears of FOMC members heard the cries of inverted yield curves and decided to play along. After a few months of severe inversion, specifically of 2-year yields to Federal Funds, Jerome Powell adheres to the rates market. We break down the actions and words from Fed day, toy with the idea of $50 trillion in unmonetized national debt, and explain why despite the Fed finally waking up to disinflation, economic damage has already occurred.

Check out—Fed Finally Pauses, Damage Already Done

Friday

In this episode, Joe explains BlackRock's proposal for a spot Bitcoin open-ended trust, why its redemption mechanism makes it functionally an ETF, and the likelihood of approval being much higher than previous SEC rejections thanks to its surveillance agreement with the Nasdaq exchange.

Check out—BlackRock Files For A Spot Bitcoin ETF

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER