Blockspace is highly in demand, a milestone in bitcoin's maturity: TBL Weekly #44

We knew this time would come, and it will only get more common as bitcoin financializes. Like all successful money, bitcoin is scaling in layers.

Welcome to TBL Weekly #44—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

Bitcoin’s financialization is well underway

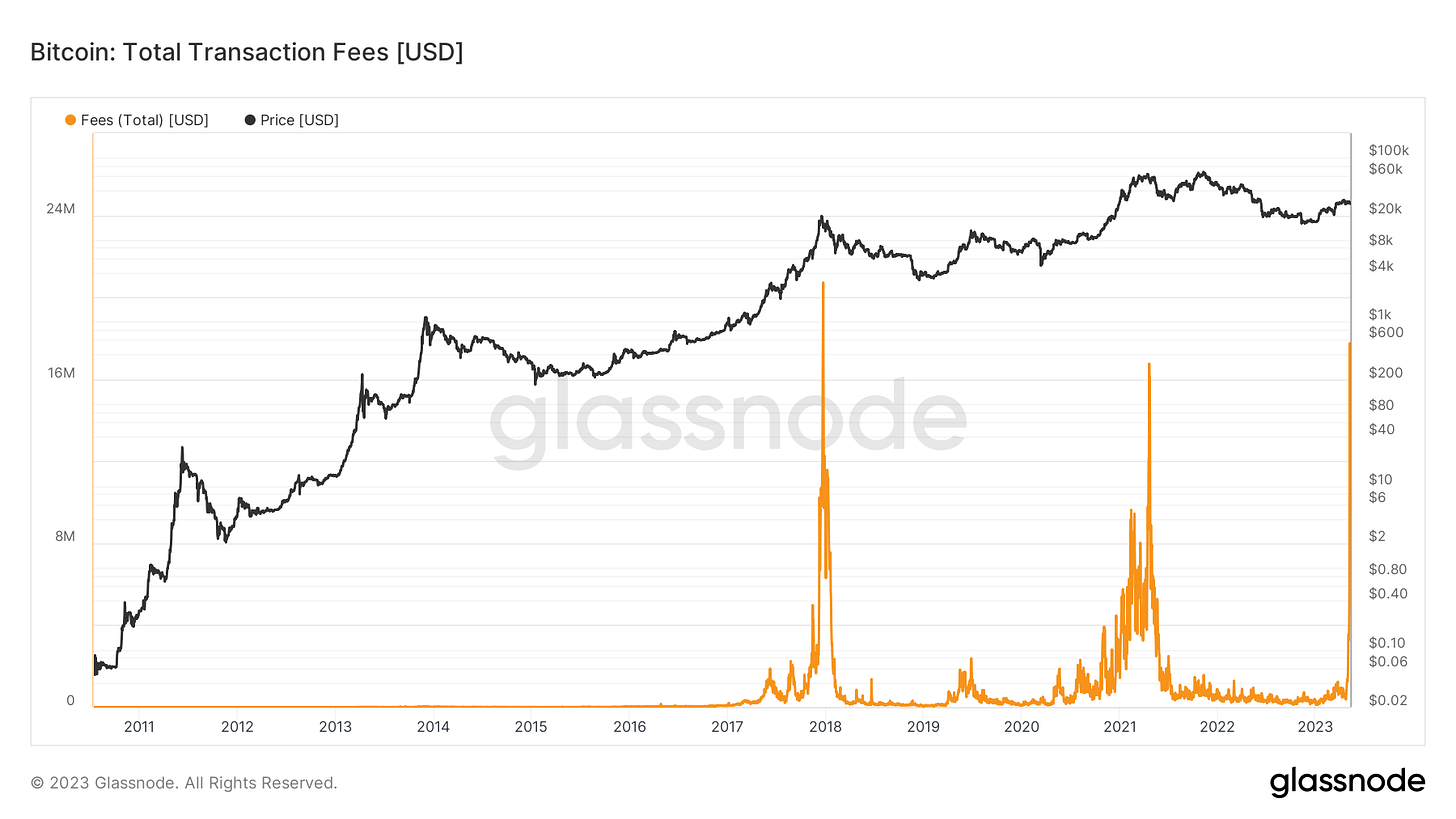

Demand for block space last week rose to a fever pitch thanks to BRC-20 tokens and ordinals, driving transaction fees to levels nary seen. Bitcoin transaction fees surpassed the block subsidy—currently 6.25 bitcoin—for the second time in history on Sunday, May 7th, 2023 at block height 788695. The median fee for inclusion in the block was a whopping 653 sats/vB, or over $26, a staggering departure from the standard fees closer to a single dollar during regular Bitcoin traffic:

The mempool is in the process of clearing closer to its usual transaction throughput, with fees now normalized at ~30 sats/vB, or $1.13:

The reason for this resounding increase in fees that caused them to surpass the amount of new bitcoin issued in each block was a flurry of activity in BRC-20 tokens and ordinals. We’ve discussed ordinals in the past as a social layer for ordering, labeling, and observing satoshis using software to ascribe unique value to individual satoshis—BRC-20 tokens are a similar concept taken a few steps further, allowing users to write information such as text, pictures, videos, and even tokens onto individual satoshis. Ordinals essentially use units of bitcoin as vessels for minting, sending, and receiving unique assets with the use of compatible wallets. The prevalence of BRC-20 and ordinal transactions has risen quickly, briefly usurping regular transactions before falling back below, now sitting at 49.1% of all Bitcoin transactions:

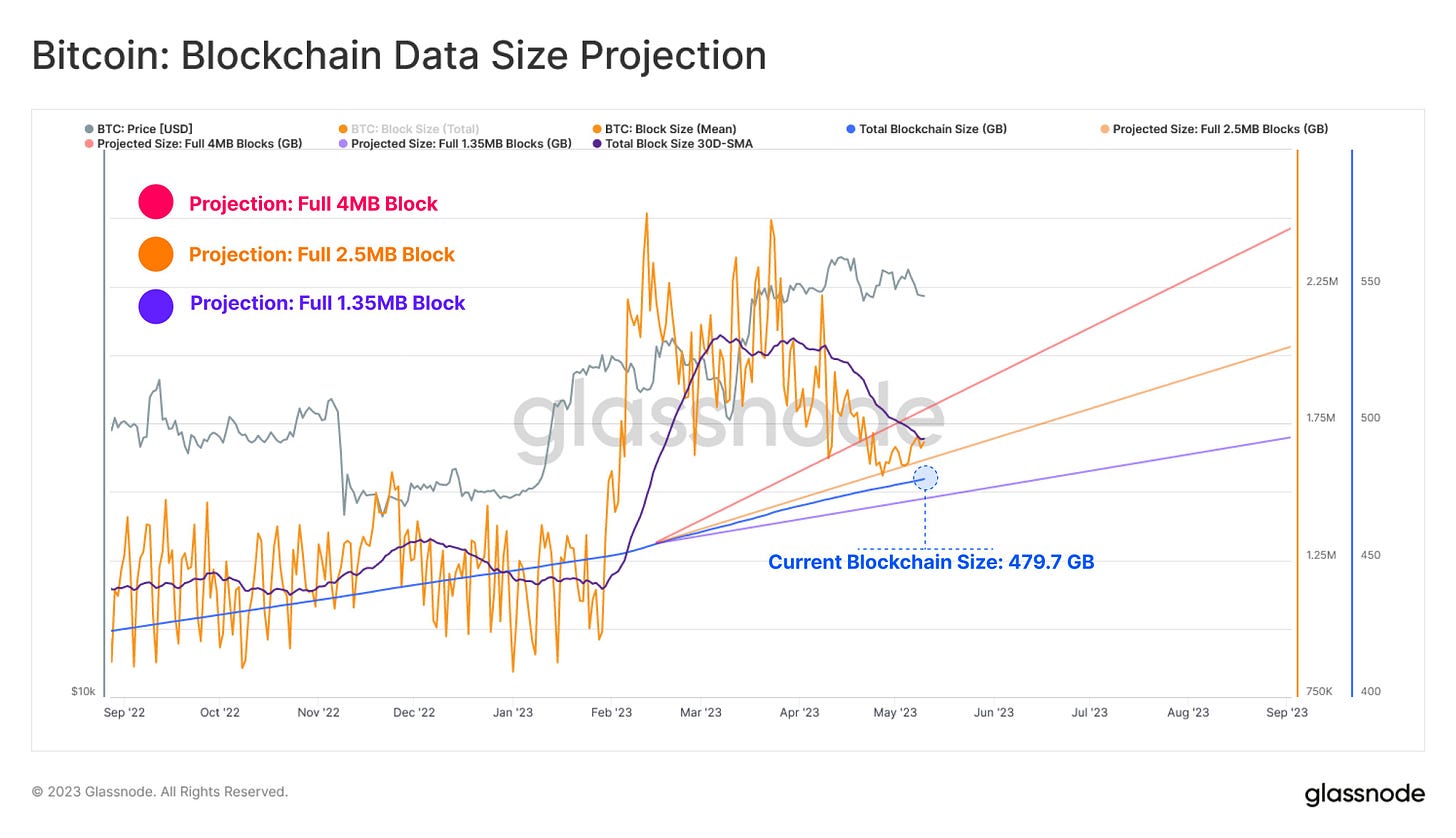

The size of these assets has no bearing on the size of bitcoin’s blockchain, and users can choose to observe these inscriptions or ignore them entirely. However, if use of Bitcoin’s blockchain for the issuance and activity of BRC-20 tokens continues at this pace, it will have an impact on block size, driving the size of each block toward 4MB. Here’s a projection of the size of Blockchain data should blocks be consistently full or follow their current path:

Anything that drives demand for block space is invariably good for bitcoin miners, and unsurprisingly, they have been reaping the rewards and are probably in high spirits. The marginal revenue of additional hashes, or hashprice, doubled in the weeks leading up to this week’s block jam zenith, from $0.06/Th/day to $0.12/Th/day:

Bitcoin also had record-high transaction fees of $17.8 million two days ago, a boon for miners who saw a slump in on-chain activity during last year’s bear market:

See here that this is only the third time in history, after two separate occasions in 2017 and early 2018 when transaction fees have taken a higher percentage of the total reward than the block subsidy of newly minted bitcoin:

Price is truth, and people were paying ridiculous fees for that block space earlier in the week because they demand to use this commodity and its network. This trend could be a transient phenomenon or it could become normalcy over the next several years and decades. If bitcoin is going to monetize into a global, base-layer, reserve asset, demand for block space on Bitcoin’s blockchain will inevitably be taken up by ever larger financial transactions—think the SWIFT cross-continent, interbank settlement network used by the world’s central banks today.

Just like every other money that begins as a commodity, bitcoin is scaling in layers, and everyday, nonfinancial transactions will move to more efficient secondary layers like the Lightning Network. Events such as these that will be more commonplace as bitcoin financializes drive demand and capital towards LN and other scaling solutions that preserve bitcoin while making it layered money.

Regardless of what you think about ordinals, BRC-20 tokens, and all other bitcoin-adjacent tools, there’s nothing you or I can do about it. These inscriptions drive demand for space in blocks, push up fees, bring more efficient miners into the space to capitalize on this thus making the network more robust and resilient, and ultimately bring liquidity onto Bitcoin the network, and its native token, bitcoin the asset.

Ultimately, this is a feather in bitcoin’s cap as it continues to monetize. Recall the lessons from the block size wars of 2017: the block size will stay exactly where it is, preserving bitcoin’s decentralization by ensuring the blockchain is small enough that it is inexpensive to maintain a copy of it. Get used to it. And of course, Bitcoin’s supply schedule will be cut in half every four years until 2140, another unshakeable feature of the protocol:

Bitcoin’s base blockchain is slow and clunky because THAT is the idea of bitcoin. The price we are paying for decentralization is a slow-moving tank that holds an impenetrable, immutable ledger that is small enough to be stored at a low price on hard drives and SSDs across the world—preserving its impenetrability is this decentralization.

To quote our friend Dylan: Your inherent desire for human intervention at every turn is exactly what bitcoin solved, please just shut up.

Macro Recap

Emergency lending from the Fed rose again this week after sharply declining last week, excluding the JPMorgan and FDIC deal brokered with the Fed to buy the husk First Republic. We observe that $83.1 billion was borrowed from BTFP, and another $9.3 billion from the discount window. The banking stress is far from abating. Banks are still struggling to fund themselves, which precipitates less credit extended into the economy. In a credit-based economy, that means slowdown and recession:

Continuing jobless claims crossing above their 100-week moving average have 100% accuracy in predicting a recession within 6-12 months. Currently, they are less than 25,000 claims away from crossing above; the magnitude of this increase in joblessness historically all but guarantees a recession shortly afterward—this is simply the result of cyclicality. Once hiring turns to firing, boom has turned to bust:

And finally, on Friday, we got confirmation that consumer sentiment is worsening, but ostensibly for a different reason than in 2022. While the 9.1% inflation burned a hole in consumers' pockets last year, this year consumers are faced with tightening credit. Consumer sentiment hit a record low in 2022 due to inflation, and now it’s nearing that low again as banks tighten their belt and back off from easy lending:

The Week Ahead

In the week ahead, we look to a very important Retail Sales print on Tuesday for any confirmation that April might have been a decent month for the economy. We will also be watching the jobless claims data, which hits every Thursday, for further signs on the trend higher in layoffs. In terms of the bigger macro picture, the 4,200 level on S&P 500 remains something we are watching very closely. Last week, it proved once again as notable resistance. Furthermore, we watch 4% on 2s and 3.5% on 10s as additional levels of resistance. All three of these levels, one in stocks and two in risk, will give us a signal if there is any life left in the growth and/or inflation stories—readers know our bias here is that there isn’t. Our baseline expectation for the remainder of the year continues to be a US economy on very slippery footing, a recession by the end of the year, as well as rate cuts (which are priced into the market to the tune of about 1% by the first quarter of 2024) within that horizon. We all know that the Fed reacts more to the S&P 500 than anything else in the real economy, and so ironically enough, our economic and monetary policy forecast does somewhat depend on weakness in asset prices. A curious conundrum.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

We take a cycle-driven approach when we analyze markets here at The Bitcoin Layer. Fourteen months removed from the Fed’s first policy rate hike, our stage in the cycle is finally shifting into credit contraction, which begets an eventual economic recession.

We hit you with a fresh chart pack that breaks it all down. We look at Monday’s SLOOS report from the Fed which showed tighter lending standards, falling loan demand, and a slowdown in loan creation, confirming the ongoing credit contraction and pinpointing our stage in the credit cycle.

Check out—

Banks report falling loan demand, the Fed's tightening is trickling into the economy

Wednesday

Joe and Nik sat down with Andy Constan, CEO of Damped Spring Advisors. Andy discusses the behavior of UST rates as the debt ceiling deadline approaches, the Fed's ongoing QT campaign, and the state of his higherer for longerer thesis about the Fed's rate hiking. This is a can’t-miss episode.

Check out—Andy Constan: A Recession Is Not Desired, It's Required

Thursday

We sat down with Andy Constan to discuss markets, Fed, and the economy, but Nik was left slightly bewildered by how calmly Andy expressed the simple intent of tightening: a recession is not desired by the Fed to slow inflation, it’s required.

Nik writes a reaction piece to the conversation with Andy, in which we discussed how this recession will impact asset prices and why the Fed is specifically trying to harm bank profitability. Many of the topics are worth an elaboration, and they also elicited increased personal conviction that the sun is setting on this economic cycle. It’s time to start saying goodnight.

Check out—A recession is not desired, it's required

Friday

In this episode, Joe breaks down BRC-20 tokens and ordinal inscriptions. He explains what they are and why they aren't technically sh*tcoins, why they don't impact bitcoin's ruleset including its 21m supply cap, why this was an inevitability as bitcoin matures and block space is reserved for larger financial transactions, and why this drives capital and innovation to second layers so it can scale like every other commodity money.

Essentially, you learn why our company name is The Bitcoin Layer.

Check out—Bitcoin's Blockchain is Full: A Sign of a Maturing Commodity

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.