Deflation Cometh & Production Cost Eclipses Bitcoin's Price By $10,000: TBL Weekly #22

Recapping the action in bitcoin and macro.

Welcome to TBL Weekly #22—here are your highlights!

Markets Analysis

Our monitor for the week ending Saturday, December 3rd, 2022:

The spread between the 2-year US Treasury yield and the Federal Funds rate—or 2sFFs—is nearing inversion; a pause in rate hikes from the Fed has followed after every inversion dating back several decades. We’re confident that the inversion of 2sFFs will mark the last hike of the cycle, which will be held “for longer” than usual—roughly 9 months on average—until something pushes the Fed to ease. This will temporarily be supportive of risk assets until earnings for companies begin contracting next year, making another leg down in equities possible during 2023.

Our TBL Glossary is coming very soon, so you will be able to reference it for all of the jargon and financial terms that we use in our analysis—we thank you for your patience.

Nik provided a breakdown of the wider recession signals in yesterday’s post linked below. Let’s hone in on a few of the signs pointing to deflation—a function of the rapid economic slowdown spurred by the Fed tightening policy too aggressively.

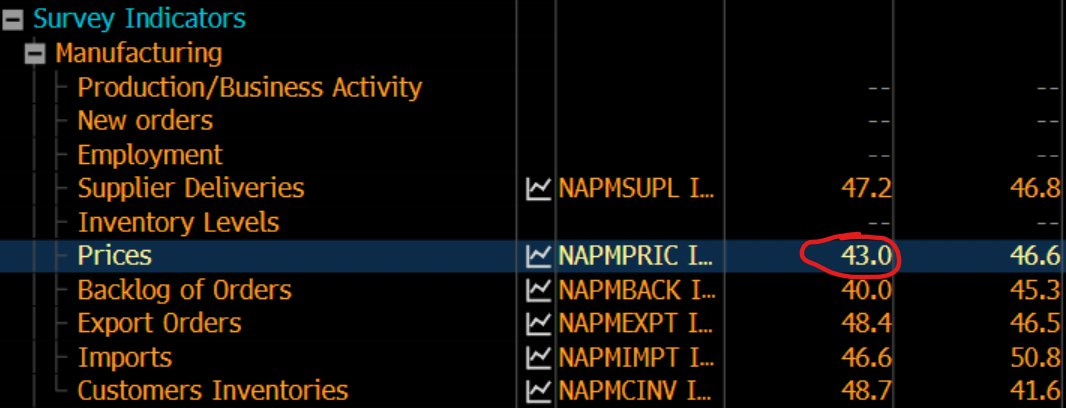

Prices paid by businesses have been trending down but fell dramatically in November, down to 43 from 46.6 last month. It is a part of the ISM Manufacturing survey, which is an accurate bellwether of whether the economy is expanding, stagnating, or contracting. Prices paid falling so quickly leads the CPI basket in signaling not just disinflation—with the increasing likelihood of negative growth as the Fed tightens—but, eventual deflation too:

All of this is unfolding with the backdrop of a rapidly weakening consumer.

Take a look at Backlog of Orders seen above—notice how steeply it dropped too? That means that supply chains are being ameliorated, partly as a result of demand evaporating from the market. When the Fed talks about “demand destruction” in its mission to fight inflation, your livelihood and ability to spend are the demand to which they are referring. Inventories piling up signals that this is no longer a demand issue, but an excess supply issue as customers leave the market amid ever-tightening credit conditions, which they have grown reliant on via record-high credit card balances. Demand is successfully being destroyed, and if consumers are left as destitute as this very-leading data suggests, prices have nowhere to go but down.

On the bitcoin side of things, it’s cheap. Look how the spot price is now $7,000 below our fair valuation metric:

No seriously, it’s so cheap that its average production cost is eclipsing the spot bitcoin price by a mile. This forces poorly-allocated miners (old machines, high electricity cost, high debt servicing cost) to capitulate and scale back their operations.

At our current $27,939 average production cost, and bitcoin’s $17,076 spot price, bitcoin is trading for $10,000 less than it costs to produce(!!!):

We covered the choices that bitcoin miners currently face in Tuesday’s post:

Sell bitcoin reserves to temporarily cover operating expenses

Unplug machines

Take on more debt, despite very wide credit spreads for lower-rated borrowers

Default

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Now, here are your quick links to all of the TBL content for the week:

Tuesday

As the world reels from the collapse of FTX, individuals are learning the important lesson of self-custody, while exposed counterparties such as BlockFi are learning the importance of hiring a good corporate liquidator.

Well, at least we can be thankful that Bitcoin’s hash rate continues its relentless rise! Wait a minute, that’s falling too?

Check out Exchange Outflows, BlockFi Bankruptcy Analysis, & Miner Capitulation

Wednesday

November was a wild month for markets—you may be confused, like untangling your shoelaces or trying to understand why Janet Yellen still has that ridiculous haircut.

Well, we’ve got you covered!

Nik breaks down the current turbulent macro environment—and updates you on all of the current narrative threads across global markets. As bitcoin has drawn down more than 75% for the fifth time in its life, and "crypto" companies fall into insolvency like a chain of dominoes, we're more confident than ever that moving into this global growth slowdown, bitcoin will survive, but all of “crypto” will not:

Friday

A few months ago, we started offering an institutional service of more in-depth charting and market study, but we are discontinuing it. In short, The Bitcoin Layer wasn’t able to tier our research because we didn’t want to shortchange our paying subscribers.

And so here we are, with our best foot forward to bring you a massive global chart pack, covering all the things: rates, risk, bitcoin, and everything else that matters.

As central bankers deny, the hills are alive with the sound of recession.

Check out The Hills Are Alive With The Sound of Recession

Nik sits down for a guest lecture from Lucas Nuzzi, on-chain explorer and Head of Research & Development at CoinMetrics.

Lucas speaks about uncovering the FTX & Alameda relationship using on-chain data, how client funds were commingled with Alameda, and the fallout from this situation both from a regulatory standpoint and an industry perspective. This is a must listen if you’re curious about SBF’s grand fraud:

Holiday Merch Sale!

Can you think of a better Christmas gift for the whole family than some TBL merch?

We can’t.

For a limited time through the end of the holiday season, enjoy 15% off all TBL merchandise!

Use the promo code: XMAS15 for all merch at our store: TBL Merch Store

Keep up with The Bitcoin Layer by following our social media

YouTube — Twitter — LinkedIn — Instagram — TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud

Bitcoin is so cheap