Economic Deterioration, Risk Markets, & Liquidity Conditions: TBL Weekly #26

Whether you're in a rush or sitting down for morning coffee, we've got you covered on all the latest in bitcoin and macro.

Welcome to TBL Weekly #26—the free weekly newsletter that keeps you in the know about everything going on in markets. Let’s dive in.

Bitcoin-Macro Monitor

Just quickly grabbing the headlines?

Here’s your rapid-fire recap of the relevant action in bitcoin and macro:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

Bitcoin ends yet another week looking like a life-support EKG, ranging tightly in the $16,500 to $17,000 range. It’s still well below the average network cost basis (MVRV Ratio below 1) and is firmly lower than its production cost which has been purging inefficient miners off of the network and rewarding the most efficient capital allocators. This is painful for bitcoin’s price in the short-term as BTC reserves are often sold and bankruptcies are often declared but maximizes network anti-fragility and efficiency in the long run.

Correlations are normal across asset classes. Bitcoin’s correlation with the S&P 500 has loosened considerably as sell pressure on the BTC side has abated, but companies are about to go through a phase of earnings contraction which will negatively impact equity valuations. When the cost of capital is aggressively rising, it pays to not have a balance sheet: score one for team BTC.

2s10s is flattening once again after a few weeks of attempting to normalize. Investors are piling into the long end of the curve to shield themselves from the anticipated recession and benefit from interest rate cuts that would ostensibly follow. As such, the 10-year yield remains firmly below the 2-year yield, creating this inversion, which is not helped by a hawkish Fed that continues to maintain high policy rate goals.

There are your headlines, now let’s take a look under the hood.

Markets Analysis

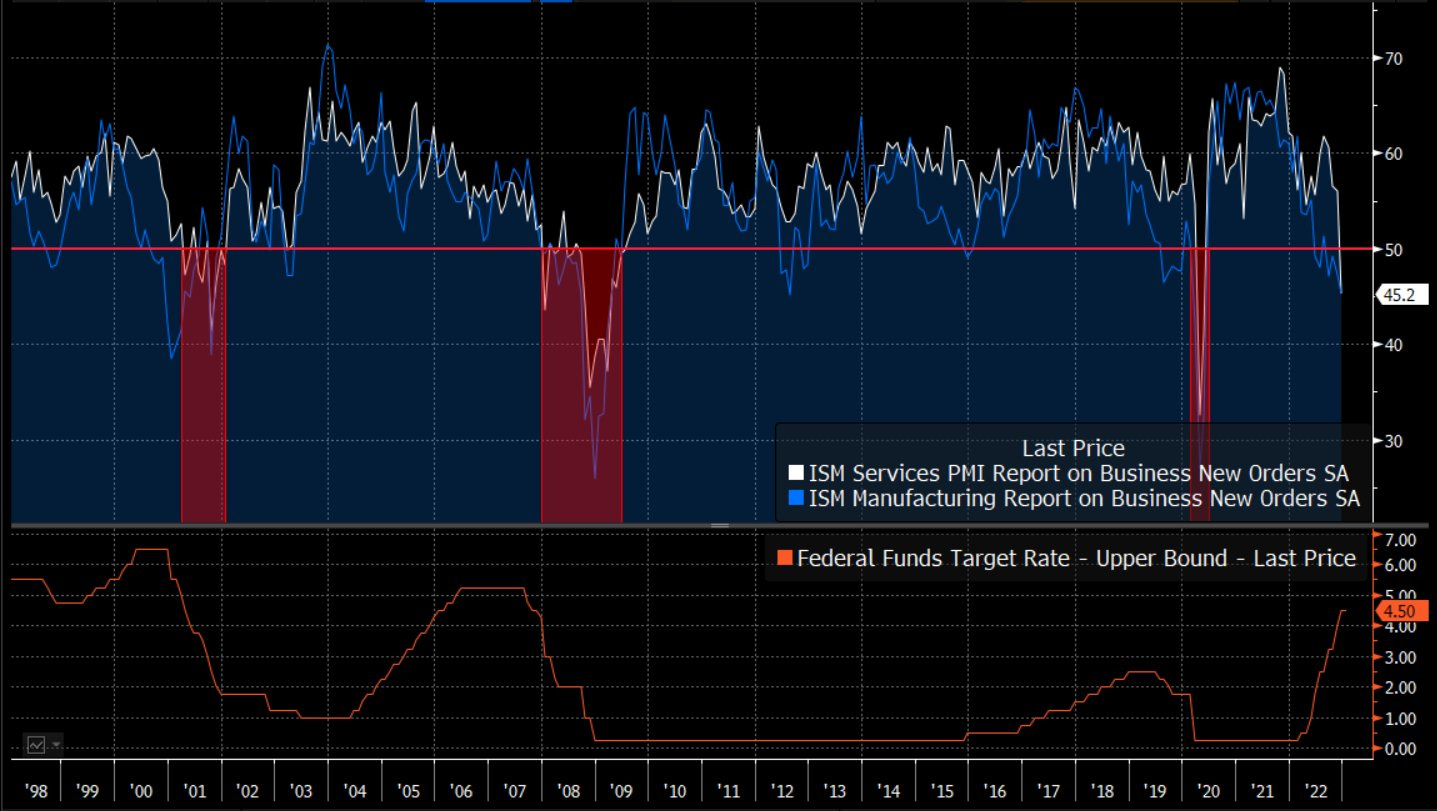

Economic deterioration is upon us. ISM Services PMI for December was released yesterday and with it another basket of indicators of a slowing domestic economy. The index itself missed to the downside: 49.6, down from 56.5, and well below the 55 expectation; this is the first time ISM Services has been in this steep a contraction since the Great Recession (discounting May, 2020). The most jaw-dropping component of the report had to be New Orders, which absolutely fell off of a cliff to 45.2 off of 56 prior. Every time that both ISM Services and ISM Manufacturing New Orders contracted simultaneously, the Fed was already cutting rates to respond to the slowdown:

This time though, the Fed is sterner. It is unwavering. It wags its finger at the bond market as if it has no idea what it’s talking about. We’ve got news for the Fed: your monetary policy toolkit only works when the bond market is agreeing with you. It’s a lot more difficult to communicate where you want front-end rates to be if front-end rates start disobeying you. In other words, the Fed is a slave to the rates market.

From bond trader Jeffrey Gundlach yesterday:

The highest yield on the US Treasury curve is the six-month T-Bill, at 4.8%. There is no way the Fed is going to 5%. The Fed is not in control. The Bond Market is in control.

This is a key dynamic at the core of The Bitcoin Layer’s macro framework. Ultimately, the Fed only has influence over interest rates in the very front end. The longer the duration, the lower the Fed’s ability to guide interest rates where they’d like.

For a time, when it was market consensus that monetary conditions needed to be tightened to cool down inflation and a roaring economy, short rates and the Fed’s policy rate moved in near-perfect harmony:

As the cycle goes along, it becomes apparent to the rates market that sufficient tightening has been achieved. The Fed, however, reaches a willful negligence during peak tightness in monetary policy. It does not pay attention to leading indicators that signal disinflation or deterioration in the economy or labor market, or all three. Its laser-like focus on achieving its mission blinds it from the damage it’s beginning to cause—the fallout of so-called overtightening of monetary policy.

At this phase of the cycle, rates start diverging from the Fed’s prevailing tightening trend. Investors are witnessing falling PMI surveys, wage disinflation, and the first droplet of layoffs, and are signaling that the Fed is committing grave policy error. They bid the US Treasury curve out of growing recessionary fears as contractionary economic data worsens, forcing yields lower and creating an expectation of easing that is out of alignment with the Fed’s goal.

Yesterday was a critical juncture for the path of rates as 2s closed below a year-long uptrend that started in anticipation of the Fed’s first rate hike. Rates give room to hike to the Fed when an overheating market is consensus, and rates take room from the Fed to hike when investors see contractionary leading indicators that the Fed is willfully blind to. Rates are taking away the Fed’s tightening punch bowl:

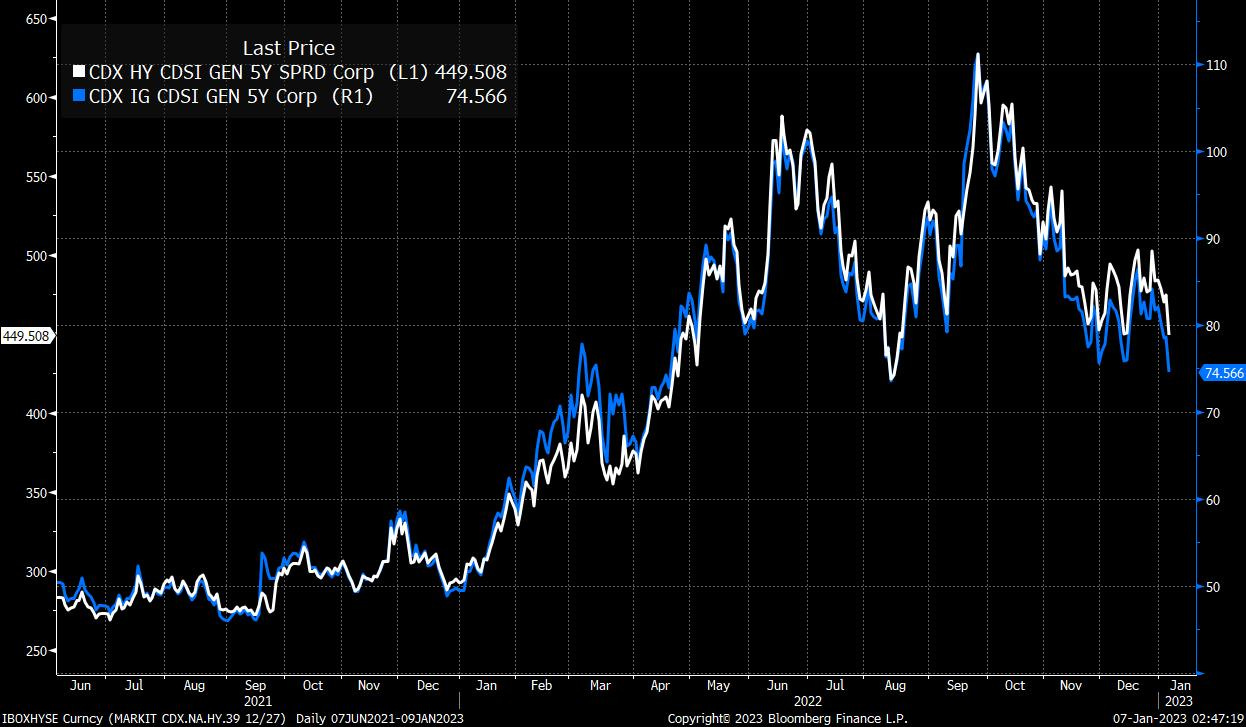

Turning our focus over to risk markets, sentiment is modestly positive and fear is low. A soft landing (shallow 2023 recession or near-recession) is very much in the cards according to investor positioning in credit and volatility premiums.

High Yield and Investment Grade spreads have tightened considerably after widening through 3Q 2022. Credit conditions are mild for now:

VIX remains muted at just 21.13 at market close on Friday—if markets were any less fearful, they may be comatose. As the rates market worries and reacts to each economic release spelling contraction, risk traders are taking the glass-half-full approach to market positioning. Fear is not pervasive, it’s barely present:

Liquidity conditions also remain favorable across markets. See here that prevailing liquidity conditions in the US Treasury market have eased up after rising precipitously during 2021 and 2022:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Now, here are your quick links to all of the TBL content for the week:

Tuesday

Happy New Year! I sincerely wish everyone had at least a few days away from it all—markets, socials, newswires, and all the world’s drama were hopefully paused for friends, family, and a reset.

Time away can lead to fresh hypotheses, and the turn of the calendar also brings an opportunity to make grand predictions for the coming 12 months. But instead of calling the next thousand points on S&P or timing the first rate cut, we settle back to what we are here for: understanding the global macroeconomy and how it affects asset classes, bitcoin most importantly. Studying all that goes on across rates, Fed, China, energy, trade, and banking is indeed daunting, but if you can juggle a dozen or two frameworks, you might just gain that edge—signal amidst the noise.

Check out 2023 Opening Thoughts On Bitcoin, Recession, and Stimulus

Wednesday

We kicked it off on Wednesday with Nik’s 2023 markets lookahead in video form.

Nik delivers an outlook on the uncertain year ahead, highlighting The Fed's Reputation, China, and the US Fiscal & Monetary response to a recession:

Thursday

Between the most aggressive Fed rate hikes in history, bitcoin-adjacent crypto firms collapsing like dominoes, and bitcoin miners burning through reserves or filing for bankruptcy, bitcoin has been locked in an amalgam of market forces that have cultivated the longest bear market in its 14-year history.

As fear sets in that this downtrend will persist forever and Jerome Powell will hike Fed Funds into the stratosphere, we have growing suspicion that risks are now skewed to the upside for bitcoin and other risk-traded assets.

Check out Bitcoin's Longest Bear Market Ever

Friday

Joe sits down with Max Gagliardi, a Partner & Co-founder at Ancova Energy and host of the Talk Energy Podcast.

Max discusses the state of energy markets, unfounded fossil fuel hatred, the idea of renewables, and the intersection of energy and money through bitcoin:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud

Excellent, clearly articulated macro analysis!