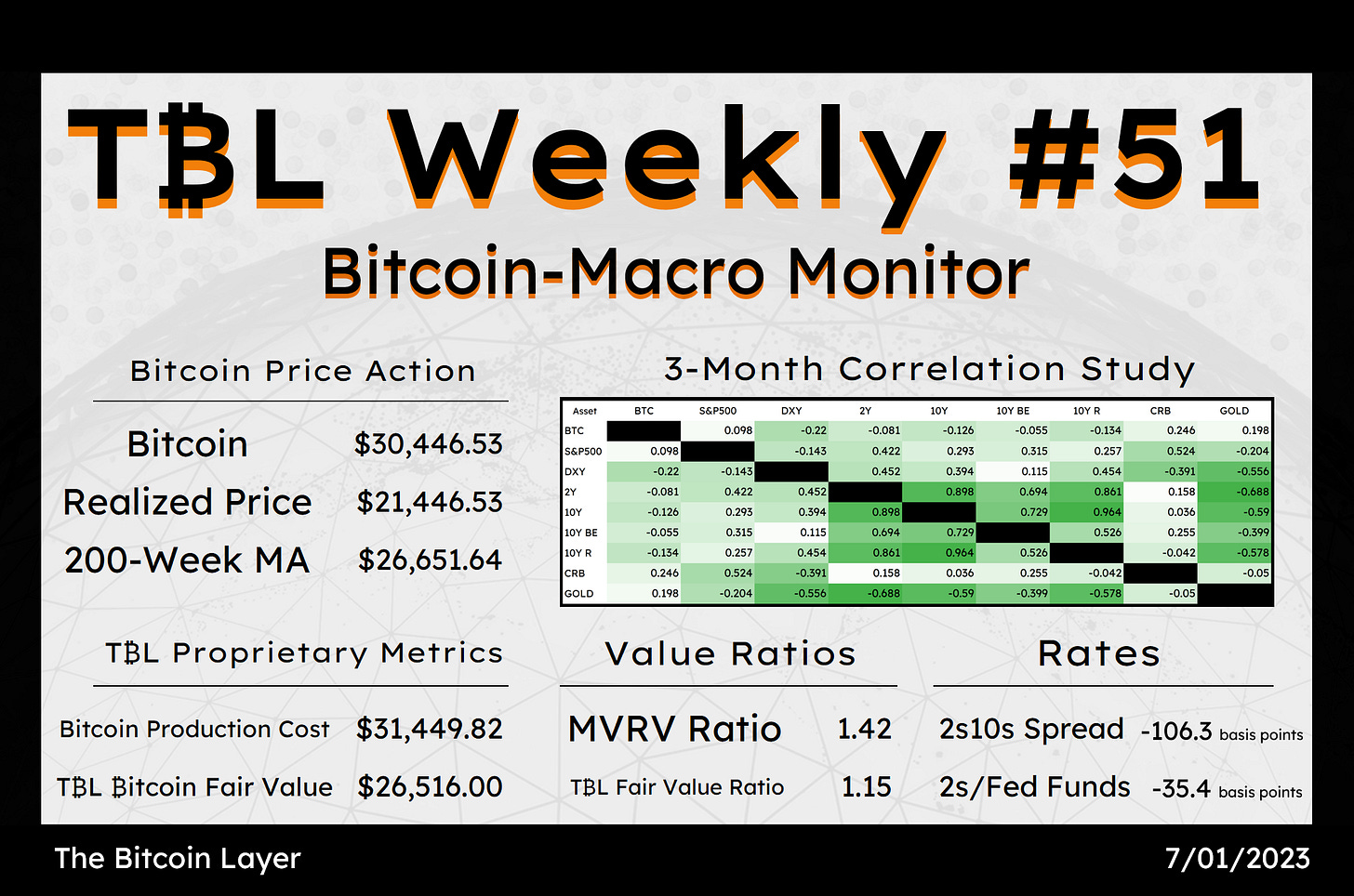

Happy 4th of July! Soft Landing Hopes Abound: TBL Weekly #51

Welcome to TBL Weekly #51—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

Economic data has been strong, surprisingly strong.

In fact, analysts’ expectations about the pace of recession have been consistently beaten over the past 3 months. So much so that the Bloomberg Economic Surprise Index has surged to a 2-year high of 55%—meaning that half of all relevant incoming economic data is beating analyst expectations:

All of your narratives are destroyed.

Is macro investing dead? Not quite, there are a few explanations for the seemingly inexplicable resilience of the US economy in the face of 525 bps of aggregate monetary policy tightening.

First, liquidity has been supported since last October.

Totaling up the Fed’s assets minus its liabilities, its liquidity footprint across its balance sheet and all of its facilities is $6.019 trillion. Despite a maximum of $95 billion worth of QT each month, total liquidity from the Fed is stable and rising slightly since last October, supporting financial markets, risk-taking, and the US economy:

And because of this…

Second—credit spreads have yet to widen out and cause distress for companies.

Banks usually back away from lending following the Fed hiking its policy interest rates. When the Fed hikes, banks write fewer loans and opt to allocate capital to safer, higher-yielding assets like US Treasuries and risk-free facilities like the Fed’s Overnight Reverse Repo Facility. This makes sense: take risk off the table when rates go higher—why lend to a borrower that may be unable to finance high rates when you could lend to the US government and its central bank who can concoct money out of thin air?

And make no mistake, banks are backing away from lending, just not enough to send shockwaves through corporate credit markets—a precursor to the mass wave of firing that coincides with real economic hardship and recession. Credit spreads for risky and regular corporate borrowers have fallen to historical averages, not ringing any alarm bells of financing stress right now:

With stable liquidity supporting financial institutions’ day-to-day activity, the slowdown in credit creation is steady and measured, engineering a slowdown in the economy that is equally steady and measured as opposed to rapid and devastating to the labor market and business activity. A “soft landing” in the making. The Fed, at least for now, is having its cake and eating it too.

Barring sudden economic collapse between now and the July 26th FOMC rate decision, the market is 86% sold that Fed will hike by 25 bps. A lot can change in 3 weeks, though, so we are keeping our ear to the ground on employment data, and any materially concerning selloff in risk assets:

In the week ahead, we will finally receive a set of tier-1 economic data that should give us a better sense of whether the current soft-landing optimism is for real. On Monday, we’ll receive ISM Manufacturing survey data—although this metric reflects a weak industrial sector, its counterpart, ISM Services remains in expansion. We’ll receive ISM Services on Wednesday, and with the two prints we’ll get a decent sense of how economic activity fared to end the quarter. Job cuts, job openings, payrolls, unemployment claims, wages, and the unemployment rate all hit the tape next week as well—signs of a slowdown in the labor market have been sparse but visible, and hopefully incoming data will help us see a little more clearly. Lastly, on Wednesday, we become privy to the minutes from June’s FOMC meeting. Why did the Fed elect not to hike rates, if only to hike them a few weeks later in July? The sense we got from the Fed’s announcement was a summer pause, but strong stocks and positive economic surprises have bounced expectations for a July hike almost fully. If there are any more specifics to the Fed’s “by-feel” approach to monetary policy, the minutes might give us a whisper:

See what a best-in-class Bitcoin mobile wallet feels like with Envoy.

Download it today for free on the iOS App Store or the Google Play Store.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

On June 22, 2023, volunteers from The Bitcoin Layer, Satoshi Action Fund, and Orange Pill App took to the halls of the Senate and House to distribute bitcoin books, including Nik's Layered Money. Catch highlights of the day in which 700 books were distributed on Capitol Hill.

Check out—700 Bitcoin Books Delivered To Capitol Hill

Tuesday

What happened in Russia over the weekend?

Well, if you were away from your phone, computer, or television set, you’d rightly think that nothing happened—however, a division of Russian troops mutinied against the army, captured a military logistics hub of Rostov-on-don without a fight as citizens cheered them on, and then promptly reached a deal with the Kremlin and stopped their advance, all in the span of 24 hours.

The mutiny came about when a disenchanted head of a group of mercenaries fighting alongside the Russian army became fed up following a multi-month-long battle to capture a city in which some 20,000 of his troops died. He decided, with the support of the Russian people who similarly wanted to end the war, to turn around and march into Moscow seeking a purportedly peaceful end to the conflict that many still find themselves puzzled to find a good reason for.

We are not geopolitical experts; all we can do is unpack the impact that this oddball event and any further escalations will have on global financial markets.

Check out—

Russia's (Short) Mutiny, BRICS Needs Dollars, & Germany Nears Reverse QE

Wednesday

In this episode, Nik breaks down the latest Bank of International Settlements paper that suggests the world move toward CBDCs and tokenized deposits. He discusses the hypocrisy in failing to mention bitcoin, the BIS dream of a unified ledger, and most importantly, why bitcoin is essential for freedom from bank liabilities.

Check out—Bitcoin Will Help You Survive A CBDC Future

Thursday

Every now and again we like to write a markets update without mentioning the policymakers at 33 Liberty Street in New York or the Eccles Building in Washington. The problem with their testimonies, press conferences, and general ramblings is that never once are we able to separate facts from political messaging. It leaves us to fend for ourselves in economic analysis, and today, that’s exactly what we’ll do. Let’s tour the markets, discuss why record-low volatility and solid equity performance don’t paint the full picture, and see the danger looming in FX land.

Check out—Chart Pack: Quiet Fed, Loud Markets

Friday

In this video, Joe takes a break from our regularly scheduled programming to walk through some of his favorite bitcoin-native indicators that add some perspective to where we are at in bitcoin's four-year cycle, and what lies ahead in the next 6-12 months.

Check out—4th of July Bitcoin On-Chain Update

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Happy 4th of July weekend, everybody!

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER